Home Price Drops In Pandemic Boomtowns Could Be First Sign Of Coming Real Estate Turmoil

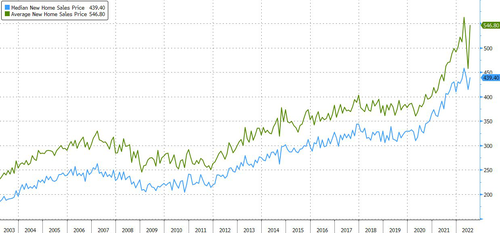

While new home sales plunged in July, inventory continues to build, and median prices for new homes are back near record levels, some of the frothiest real estate markets, i.e., pandemic boomtowns, are rapidly cooling.

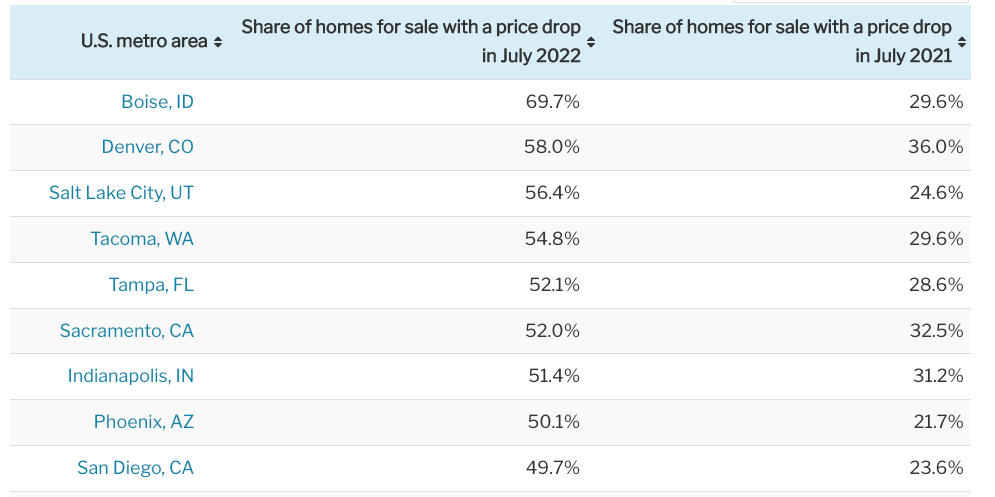

New data from online brokerage Redfin shows 70% of homes for sale in Boise, Idaho, had price drops in July, the highest share of price drops out of 97 metros in the report. Next was Denver, where 58% of homes for sale had a price drop, Salt Lake City (56.4%), and Tacoma, Washington (54.8%).

"Individual home sellers and builders were both quick to drop their prices early this summer, mostly because they had unrealistic expectations of both price and timelines," said Boise Redfin agent Shauna Pendleton.

Pendleton added: "They priced too high because their neighbor's home sold for an exorbitant price a few months ago, and expected to receive multiple offers the first weekend because they heard stories about that happening."

As the winds in the pandemic boomtown shifted this summer, she advised sellers to "price their home correctly" to market conditions and understand things are slowing.

(Click on image to enlarge)

The common denominator in all of these cities is that an influx of demand during the early days of the pandemic sent home prices quite literally 'through the roof' because city-dwellers figured out they could remote work to low-cost areas.

Now the boom is ending in the frothiest of markets because the Federal Reserve's most aggressive interest rate hikes in years to quell the highest inflation in four decades has sent mortgage rates north of 5% in such a short period, sparking what we've been warning about for months of an emerging affordability crisis.

So how could the housing downturn play out? Well, pandemic boomtowns could be the first domino to fall.

Meanwhile, the overall US housing market seems to be stalling as sales in July plunged.

What's troubling is inventory across the country is soaring back to 2008 levels.

... at a time when US home prices are at near record highs (what could go wrong?).

Pay attention to price drops in pandemic boomtowns because they could signal what's to come for the rest of the housing market.

More By This Author:

Could Poor Coffee Harvests Send Prices Even Higher?

Fed Balance Sheet Shrinkage Kicks Into High Gear In September

Student Loan Forgiveness: A Boost For The Middle And Upper Classes Which Costs $300BN And Raises GDP Only 0.1%

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more