Student Loan Forgiveness: A Boost For The Middle And Upper Classes Which Costs $300BN And Raises GDP Only 0.1%

While it is all too obvious that the Biden admin is rushing to buy as many votes as it can with its latest $10,000 student debt loan forgiveness scheme just two months left until the midterms...

Unlike draining the SPR- everyone consumes energy- the student loan relief as a vote buying tool is a waste bc the Dems already have 99% of the double-Masters/cat owner demo.

— Barbarian Capital (@BarbarianCap) August 23, 2022

... and thus the move makes sense if only from a political point of view, one wonders if the White House has evaluated every aspect of this latest mini-stimulus meant to benefit the middle and upper classes and push the US much deeper in debt in exchange for a fractional GDP boost? Here's why:

Back in 2021 when Biden's plan to forgive anywhere between $10K and $50K in student debt first emerged, Goldman quickly calculated that the proposed debt forgiveness would not benefit the lower class - i.e., those who at least, in theory, benefit the most from Democrat policies - but the middle and upper classes.

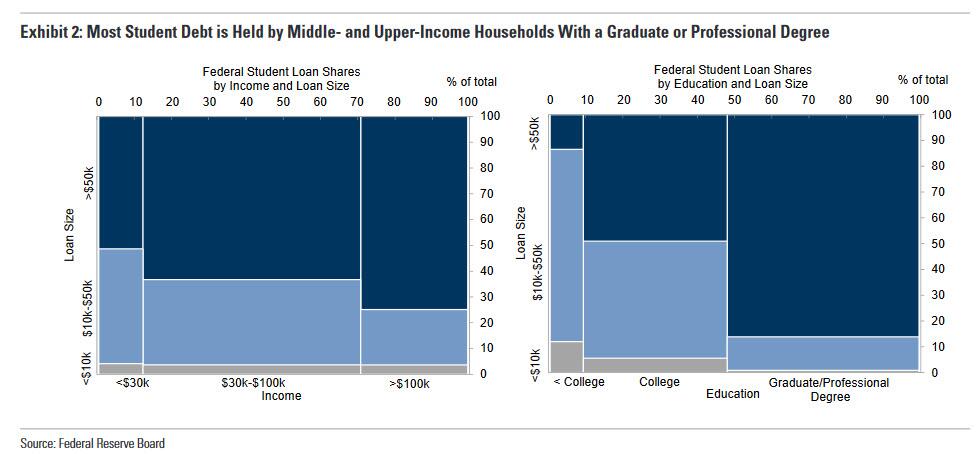

As Goldman's Jan Hatzius wrote then, "although over 43 million individuals have federal student loans totaling almost $1.6tn, most federal student debt is held by middle- and upper-income households, and over half—including the vast majority of large debt balances—is held by highly-educated households with a graduate or professional degree (Exhibit 2)."

(Click on image to enlarge)

According to Goldman - and frankly anyone with half a brain - these households likely have significant earning potential (we do not adjust for pervasive laziness or a predisposition to sit on your ass and ruminate rather than actually doing something useful with your life) and are less likely to be resource constrained, so eliminating their loan payments i) might not generate a large spending response and ii) once the peasants realize that their progressive heroes are once again bailing out the rich, the outcry would be a sight to behold.

In any case, soon after it became abundantly clear that Biden's latest boondoggle would only benefit those who actually can afford to repay debt on their own, the debt forgiveness ploy was quietly shelved... until now, when Democrats are badly lagging in the polls and will pay anything for a vote, certainly $300 billion in new debt... because that's how much this particular debt forgiveness will cost.

Fast forwarding to today, Goldman economist Alec Phillips reruns his cost-benefit analysis and finds a whole lost of costs and virtually no benefit for the broader economy (but certainly benefits to the middle and upper-class individuals whose student debt is about to be trimmed materially). Below we excerpt from Goldman's note:

Various press reports suggest President Biden will announce a plan to forgive up to $10k in federal student debt for borrowers with incomes of up to $125k. This comes ahead shortly before the current student loan payment pause expires August 31, which the White House also looks likely to extend. While we expected the White House to extend payment deferral, it has been unclear what or when President Biden would decide on student debt. For the last several weeks, prediction markets implied roughly even odds the White House would announce student debt relief this year.

While we have not yet estimated the effects of the plan that the White House looks likely to announce, it appears similar to a potential policy we wrote about shortly after the 2020 election. In that analysis, we found that debt forgiveness of $10k per borrower would discharge around $300bn (1.2% of GDP) of debt but would boost consumption by less than by less than 0.1% of GDP over the year following implementation.

Two policies have changed since that prior analysis:

- (1) the American Rescue Plan Act of 2021 (ARPA) exempted most discharged student debt from tax (discharged debt normally counts as income), which slightly increases the near-term growth effects of student debt relief.

- (2) The Biden Administration has extended the student loan payment pause several times and appears likely to extend it again, which reduces the near-term impact of debt forgiveness as borrowers' monthly payments would not change (they would be zero with or without debt forgiveness).

However, neither issue is likely to meaningfully change our estimate that forgiving $10k in student debt per borrower would have a very modest economic effect.

There you have it: virtually no economic benefits, but lots of new debt, and contrary to lies from the White House, only the middle/upper classes benefits.

More By This Author:

Ugly, Tailing 2Y Auction Spooks Bonds Ahead Of Jackson HawkanoTwitter Whistleblower Reveals Company Hid "Extreme, Egregious, Deficiencies"; Musk Subpoenas Dorsey & Ex-Security Chief

Euro Area Flash PMI Paints A Grim Picture

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more