"It's Not Enough": A Deeper Look Inside China's Latest 1 Trillion Yuan Stimulus

A few days ago we mocked the relentless China newsmill, saying that "Every day there are 5 stories about some new imminent stimulus out of China and every day nothing at all happens."

Every day there are 5 stories about some new imminent stimulus out of China and every day nothing at all happens.

— zerohedge (@zerohedge) August 17, 2022

Well, it appears that someone in Beijing heard us because just days later we got not one but two major "stimmy" developments:

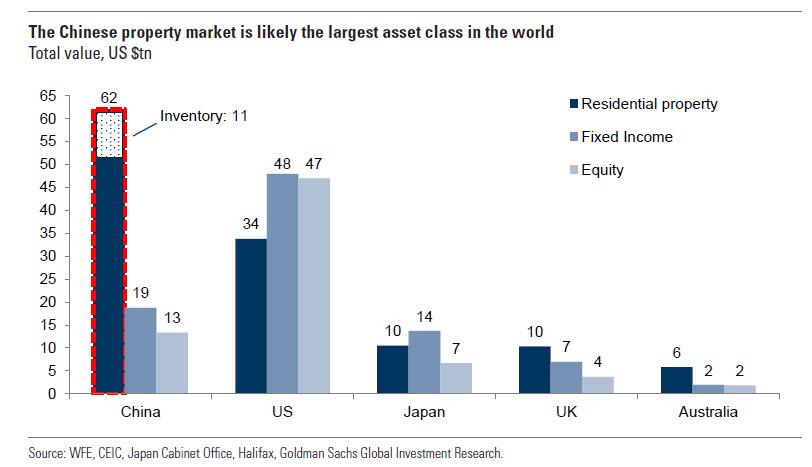

The first one hit early on Monday when we learned that to contain the collapse of China's critical housing sector, which at $62 trillion is the world's largest asset class...

(Click on image to enlarge)

... Beijing would offer 200 billion yuan ($29.3 billion) in "special loans" to ensure stalled housing projects are delivered to buyers. This new lending program "would make it the biggest financial commitment yet from Beijing to contain a property crisis that’s seen home prices slump and real estate sales plummet, at a time when growing housing market instability also means a growing threat to political stability during the sensitive run-up to the Communist Party’s leadership transition later this year.

The second stimulus hit overnight when China unexpectedly stepped up its economic stimulus with a further 1 trillion yuan ($146 billion) of funding focused on infrastructure spending, support which analysts quickly calculated won’t go nearly far enough to either counter the damage from repeated Covid lockdowns and a property market slump or to reboot the struggling Chinese economy which has is on the verge of contraction.

On Wednesday, the State Council - China’s Cabinet - outlined a 19-point policy package on Wednesday, including another 300 billion yuan that state policy banks can invest in infrastructure projects, on top of 300 billion yuan already announced at the end of June. Local governments will be allocated 500 billion yuan of special bonds from previously unused quotas.

At a meeting chaired by Premier Li Keqiang, the State Council vowed to make use of “tools available in the toolbox” to maintain a reasonable policy scale in a timely and decisive manner and announced a series of growth supportive measures, including an additional 300bn yuan credit support by policy banks and RMB 200bn bond issuance by power generating central SOEs. Li also pledged to accelerate infrastructure investment project approvals and urged local governments to better utilize the RMB500bn local government bond issuance allowance accumulated from previous years’ unused quota.

The Chinese Premier also urged local governments to distribute RMB10bn subsidies to the agricultural sector, and further urged relevant government institutions to announce detailed implementation plans for these measures, and stated that policymakers would approve a batch of infrastructure investment projects (though he also required policymakers to ensure the quality of these projects).

The 19 measures came on top of several recent stimulus steps: policy banks have been allocated a total of 1.1 trillion yuan of financing for infrastructure projects since June; the central bank delivered a surprise 10 basis-point interest rate cut last week; and in May, Beijing announced about 1.9 trillion yuan of support measures in a 33-point policy package, including targeting small businesses. The State Council on Wednesday also pledged to approve a batch of infrastructure projects. Local authorities are encouraged to use city-specific credit policies to support reasonable housing demand, it said.

However, to counter speculation that Beijing is finally turning the tide on years of fiscal frugality, the State Council also said the economy won’t be flooded with excessive stimulus, and that China won’t “overdraw” on the room it has to take more policy action to protect longer-term growth - reiterating the cautious stance officials have taken toward stimulus in recent years.

The meeting sent a signal: “Don’t expect massive additional stimulus,” according to Bruce Pang, head of research and chief economist for Greater China at Jones Lang LaSalle Inc. He added that the language used in the announcement suggested “the possibility of adopting extraordinary tools such as special sovereign bonds or increasing official budget deficit has decreased.”

Commenting on the stimulus, Goldman said that in its view, the RMB300bn credit support (equivalent to around 0.3% of GDP) is a new supportive measure, while the RMB 500bn potential local government special bond issuance echoes the statement in the July Politburo meeting, but was significantly smaller than the RMB 1.5tn difference between the allowed total LGSB outstanding (RMB 21.8tn) and the actual outstanding (RMB 20.4tn). Whether the RMB200bn bond issuance by power-generating central SOEs represents incremental policy support remains to be seen.

The bank also believes that these measures could help offset the sharp contraction in government revenue and support infrastructure investment growth to some degree in coming months. However, with a very weak property sector, and headwinds to activity growth from local Covid outbreaks and related control measures, barring major policy easing measures, we think overall growth would remain sluggish during the rest of this year (Goldman recently downgraded its 2022 full-year GDP growth to 3.0% yoy).

“We’re getting easing, but it’s not quickly enough to keep up with the pace of deterioration in the broader economy,” said Andrew Tilton, chief economist for the Asia Pacific at Goldman Sachs, in an interview on Bloomberg TV. “More domestic policy easing and improved growth and domestic demand is going to be key as we get into 2023.”

Others agreed: Bloomberg economists Chang Shu and David Qu wrote that "China’s latest package isn’t enough to turn the economy around. It will create more public demand that will partially fill a growing hole left by a retreating private sector -- giving some support to growth. What it won’t do is deliver a confidence boost that’s needed to prompt households to spend more and companies to invest more."

The 500 billion yuan in additional local government special bonds this year is smaller than what some analysts had expected, given the estimated amount of unused quota could be as high as 1.5 trillion yuan. Local authorities have accelerated their issuance of the bonds -- a major source for infrastructure investment -- this year compared with previous years, and have used up most of the 3.65 trillion yuan in official quota set early this year.

Nomura economists led by Lu Ting said Thursday the measures aren’t “game-changers.” That’s partially because the property sector is still in deep trouble, they wrote in a research note, pointing out that in previous easing cycles, real estate played a major role in pumping up credit demand among households, companies and local governments.

Indeed, despite the surprise one-two stimulus punch out of China this week, economists were downbeat on the measures, while financial markets were muted. The yield on 10-year government bonds rose 2 basis points to 2.65%. China’s CSI 300 Index of stocks rose as much as 0.6% before paring gains to trade up 0.3%.

More By This Author:

Grain Traders See Record Profits Amid Food Crisis, Prompting Calls For Windfall Tax

Home Price Drops In Pandemic Boomtowns Could Be First Sign Of Coming Real Estate Turmoil

Could Poor Coffee Harvests Send Prices Even Higher?

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more