Weekly Market Pulse: This Too Shall Pass

Image Source: Pixabay

What is the state of the US economy? When will this long-anticipated recession finally arrive? And when it does, what does it mean for investors? Those are the questions everyone is asking and the answers are, well, hard. Despite years – decades, centuries? – of research, there is no accurate way I know of to predict the timing or depth of a recession. We have some general guidelines but nothing that is really definitive. Yield curves and credit spreads are good indicators but the former isn’t particularly timely and the second can provide a lot of false signals. The depth of the yield curve inversion is also often touted as providing information regarding the depth of the recession, the only problem being that there is a severe lack of data to back that assertion.

We can slice and dice the incoming economic data – and we do – but the fact is that much of what the data reveals by looking back at history isn’t what it revealed when it was released. Data is relentlessly revised and what looks perfectly fine on the release date can look perfectly awful when you look back at those charts on FRED 20 years later. All one can really do is take an ensemble approach, a broad view of economic activity and combine it with market observations. We use the Chicago Fed National Activity Index and also monitor the Conference Board’s Leading Economic Indicators for the broad economy. And we use a variety of market-based indicators such as the 10-year Treasury yield and the US dollar index.

Today’s economic situation is, as I’ve said many times over the last couple of years, very unique because of the nature of the last recession due to the COVID shutdowns. The supply chain issues, social distancing, and the unprecedented government response (in dollars and other ways) make for a business cycle that defies all of modern economic history. Rates of change rarely seen, coupled with confusion over nominal and real variables, have produced a plethora of conflicting data and indicators.

We see manufacturing data and sentiment that is recessionary and services data and sentiment that looks great. Just last week, we got an Empire State manufacturing survey that unexpectedly turned positive and a Philly Fed survey that dropped to a new low for this cycle but included improvements in new orders, shipments, unfilled orders, inventories, and prices paid. Later in the week, the S&P Global PMI for services registered a better-than-expected reading of 53.7. It is a strange and confusing economic landscape.

Correctly guessing the future course of the economy isn’t all that valuable in any case, except in the broadest sense. The textbook view of markets is that they anticipate so the market cycle is distinct from the economic one. Stocks, for instance, tend to fall prior to the onset of a recession and bottom before its end. But that isn’t always the case. Stocks didn’t fall until the onset of the recession in 1973 and they fell for another year after the end of the 2001 recession. The S&P 500 never turned negative year-over-year during the 1980 recession. Always remember that markets are just groups of people and they haven’t all read the textbooks.

I’ve said for some time that the US economy would return to its pre-COVID state once all the distortions of COVID are gone. GDP was growing at roughly 2% prior to COVID and we haven’t done anything to change that trajectory over the long term. GDP growth is about workforce growth and productivity growth, neither of which has been changed for the better since March 2020. That could change of course and may be starting to already. We’ve seen an increase in legal – and illegal – immigration over the last two years and that will aid in the expansion of the workforce. And there has been a very noticeable uptick in manufacturing construction in recent years that could raise productivity. I’m a little skeptical of the latter since at least some of it has been driven by government incentives but the impact on GDP in the short term seems likely to be positive.

For now, however, it seems the economy is headed for a slowdown of some sort. The Conference Board’s Leading Economic Indicators point to the onset of a recession in the next few months. Their outlook is for GDP to contract modestly over the next three quarters. The CB’s LEI track record is unusually good and so it seems worthy of our attention. The Economic Cycle Research Institute (ECRI) is another organization with an unusually good track record and they are also calling for a recession. Both of these organizations take a very methodical approach to economic forecasting and have long track records of success. So, a recession sometime this year should probably be your base case.

Whether the recession being forecast has already been discounted by markets is another matter. Stocks and bonds both fell last year but that was about rising interest rates and the impact on bond prices and stock valuations and not really about the recession (except in the sense that the Fed would go too far and cause one). To me, the key question is not whether we will have a recession but how deep it will go and how long it will last. I’ve said before that I think the general health of household and corporate balance sheets makes a deep recession unlikely and I still think that is true. But that falls in the realm of predicting the future, a very uncertain business that I usually avoid, so that isn’t a forecast.

Stock valuations for large US stocks are not cheap though and that has to be considered when thinking about forward portfolio returns. The S&P 500 trades at about 18 times forward earnings estimates which is right about the five-year average. It is well above the long-term average though and way above what we’ve seen at secular bear market bottoms, which tend to be in the single digits. But valuations can fall without a big drop in stock prices if earnings, which are a nominal variable, continue to rise. And we have a precedent for that in the last inflationary period in the 1970s.

Earnings season is just getting started and they don’t look bad so far but neither do they look extraordinary. So far, the decline in earnings is about 6% compared to the same quarter last year so they aren’t up either. But profit margins so far are down just slightly from last quarter and at about 11% are still above the long-term average (about 10% over the last 20 years and mid to high single digits over the very long term). Margins are holding up so far because producer prices are falling faster than consumer prices and because layoffs have been reducing labor costs, especially in the tech industry. It may be significant that technology and communications services (which is tech-heavy) saw big drops in Q4 earnings that likely spurred the recent layoff announcements. If the outlook for those companies’ earnings improves due to layoffs (see Meta), it may improve the outlook for the entire S&P 500.

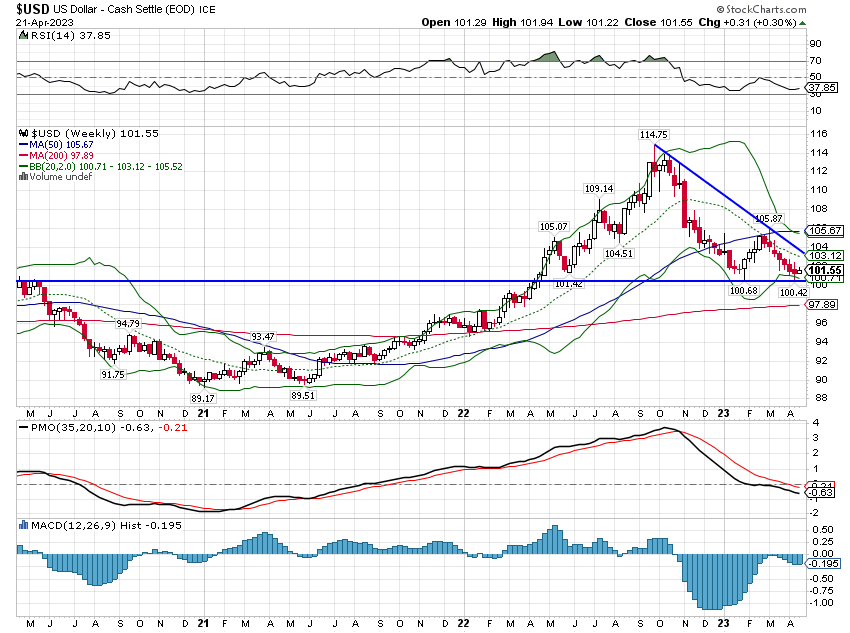

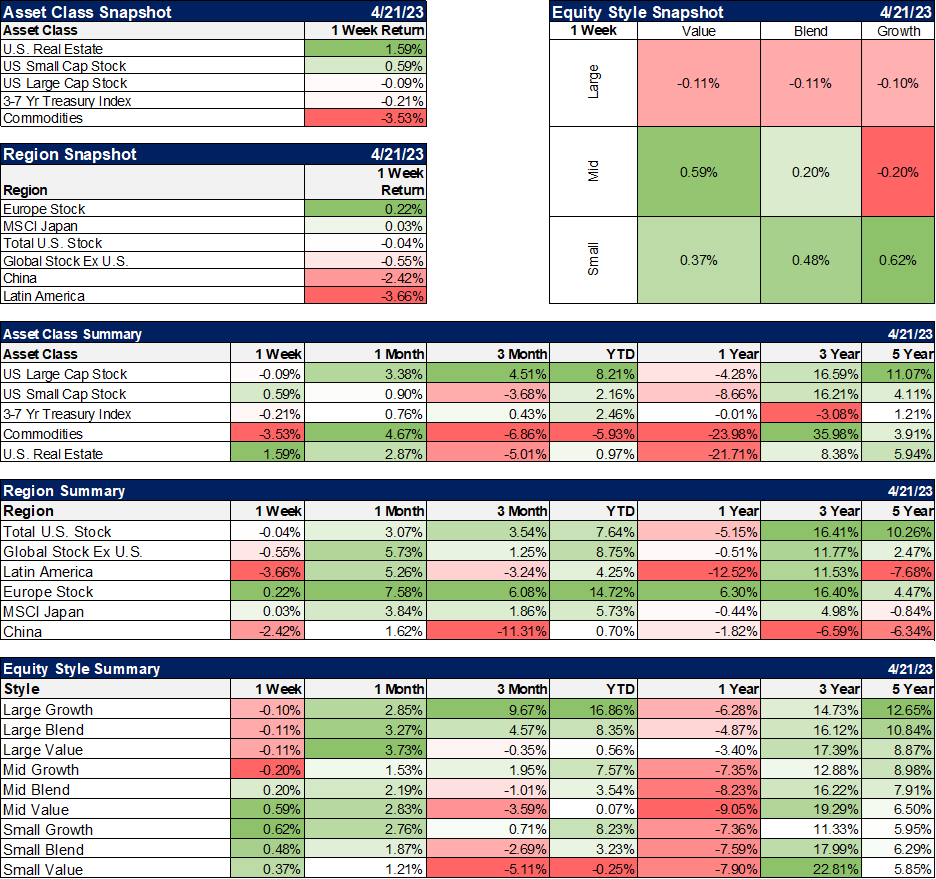

So, valuations aren’t cheap, earnings aren’t rising, and recession is likely on the horizon. That doesn’t sound like a great combination and it isn’t but luckily your potential investment universe isn’t limited to the S&P 500. With interest rates and the dollar in a short-term downtrend, we have favored defensive (high dividend), value, and non-US stocks. The first quarter wasn’t kind to the first two – nothing goes in a straight line – but the latter has done quite well. Earnings growth in Europe beat the US every quarter of last year and seems likely to do so again. Also, in the US, small and mid-cap stocks are a lot cheaper than large caps. Bonds have also performed well this year and even REITs are up on the year. Commodities are down (-3.4%) but gold is up over 8%.

Recession is probably coming to the US this year, but we aren’t there yet so getting aggressive right now is probably not a great idea but that doesn’t mean you have to put your investments on hold. In fact, even if we get a recession this year that doesn’t mean stocks will fall. In half the years with recession since WWII, the S&P 500 posted a positive return and the average return in the year of a recession is actually positive. So, pay attention to the economic situation by all means, but stick to your investment plan.

Environment

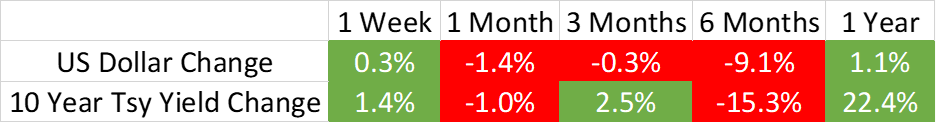

Interest rates rose last week but the short-term trend for the 10-year Treasury yield is still down. Shorter-term rates are still responding to the debt ceiling drama and anticipating another rate hike by the Fed. The 2-year Treasury note yield has risen since the banking..er…issues, from 3.76% to 4.17% which is still quite a ways below the peak of 5.05%, pre-SVB. That high was driven by Jerome Powell’s hawkish testimony to Congress and not actual economic data so I’d take it with a large grain of salt. A better approximation of the peak rate is around 4.75% (the current bottom end of the Fed Funds target band).

Meanwhile, shorter maturities are all over the map responding to different things. The 3-month TBill has risen an even more impressive 70 basis points from its low but is still trading below the Fed Funds rate, which tells me the market doesn’t believe the Fed will be able to stay “higher for longer” as they claim they want to do. The even shorter 1-month TBill has the entire bear side of the Twittersphere up in arms because it has fallen off a cliff recently, down from 4.74% to just 3.36% at the end of last week. Why? I will be the first to offer an honest answer and say that I don’t know for sure. It could be the debt ceiling and it might indicate bigger problems in the repo market but I will only be able to tell you that with certainty with the benefit of hindsight. I don’t know exactly how the debt ceiling drama will play out but I am pretty darn certain of this: the US will not default on 3-month Tbills.

It is more important to just acknowledge that rates appear to have peaked for now. Is that good or bad? Right now it is Schrodinger’s rate.

(Click on image to enlarge)

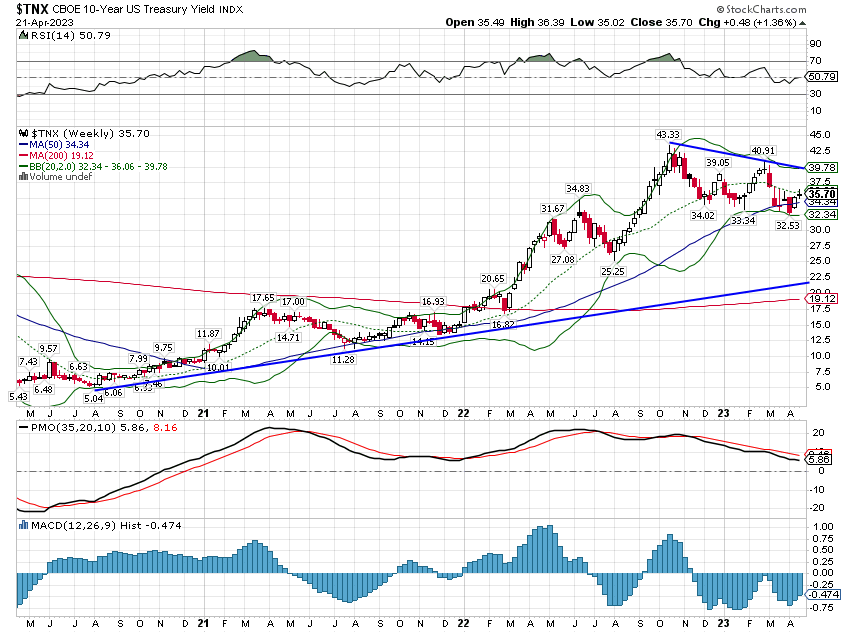

The dollar also rose a tad on the week but the short-term downtrend is intact. There is a perception out there that this move in the dollar index is all about the Euro and it is certainly true that the Euro area economy has performed a lot better than expected. But the rise in the Euro (+14.9% since late September) has been almost matched by the Yen (+13.3% since mid-October). Isn’t it interesting that you haven’t heard anything about how the Japanese economy is doing? All the talk is about the change at the BOJ and whether yield curve control will continue. I guess monetary policy in Europe plays a role too in pricing the Euro but there is also a decent economic story. Japan’s economy certainly isn’t doing badly and we’ve had an investment there for some time but I don’t know of anyone who is pounding the table on Japan except some guy named Warren Buffett. Maybe he knows something.

Having said that, I continue to expect some kind of bounce in the buck because the European economy isn’t really all that great and the sentiment on the dollar is turning quite sour. In addition, large specs are still pretty long at the Euro. It is interesting though that the Euro is the only major currency where we see that. Speculators are still short the Yen, Canadian$, and Aussie$. That might be a recipe for a long sideways move in the dollar index.

(Click on image to enlarge)

Markets

We finally got some relief in the real estate stocks last week but commodities were a big drag, mostly due to crude oil. Interestingly, the biggest moves in commodities last week were to the upside. Platinum has gone nowhere for 8 years and is down 42% from its 2011 peak. But it was up 8% last week to near the top of its long trading range. Of more interest may be its close substitute palladium which was also up big last week (+7.4%) and has the benefit of a pretty large spec short position in the futures market.

Europe led gains last week again but as I said above, the long Euro trade is getting long in the tooth. Overall, there wasn’t much gain in stocks for the week on a global basis. Emerging markets were down with Latin America continuing its recent rollercoaster ride. The big news was Chile talking about nationalizing lithium mines but it was the Brazilian Real that really took a hit. Why? Who knows but with a steadily rising trade surplus, the Brazilian currency has pretty good fundamental support.

Value vs growth was a mixed bag last week with neither doing a lot. Value continues to lead over the 1 and 3-year periods.

(Click on image to enlarge)

Sector leaders were all defensive last week while energy and communication services were the laggards. Communications stocks were brought down by a weak earnings report for AT&T but the sector remains the best performer YTD.

(Click on image to enlarge)

Credit spreads widened a few basis points last week but remain very well-behaved. The economic news was pretty uniformly negative but none of it was especially noteworthy. Changes were negative but small.

(Click on image to enlarge)

Recessions are inevitable and important for investors but not in the way most people think. Stocks may fall before recession – they usually do – but stocks go through corrections frequently that are not connected to recession. Trying to figure out whether this drop is The One is a useless exercise. If you invest regularly, you want to be buying almost all the dips and no one can tell you which one to skip.

But once you are in recession is a different story. If you have enough evidence to make a recession call – most of them are pretty obvious – stocks are probably already falling. But they aren’t going to fall forever. Every recession and bear market in history has been followed by economic expansion and higher stock prices. If anything, you want to be more aggressive when the economy is in recession. It is when things look their bleakest that the best investments get made.

More By This Author:

Weekly Market Pulse: Much Ado About Not MuchWeekly Market Pulse: History Lessons

Weekly Market Pulse: What’s Wrong With T-Bills?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more