Weekly Market Pulse: What’s Wrong With T-Bills?

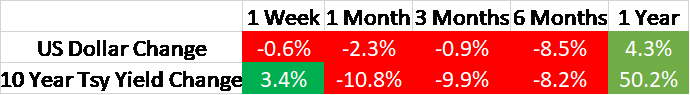

The first quarter has come to a close and things have changed a lot…and not very much at all. Expectations coming into the year were that rates would peak in the spring at around 5% and then fall in the second half of the year to about 4.5%. That was the highest probability outcome according to the futures markets. Of course, what is expected rarely happens and for most of the quarter it looked like those estimates for rates were too low. With Jay Powell doing his best hawk imitation, rate expectations rose right up to the point when Silicon Valley Bank failed. The mini-banking crisis of the last month put a damper on rate expectations and we’re right back to where we started the year.

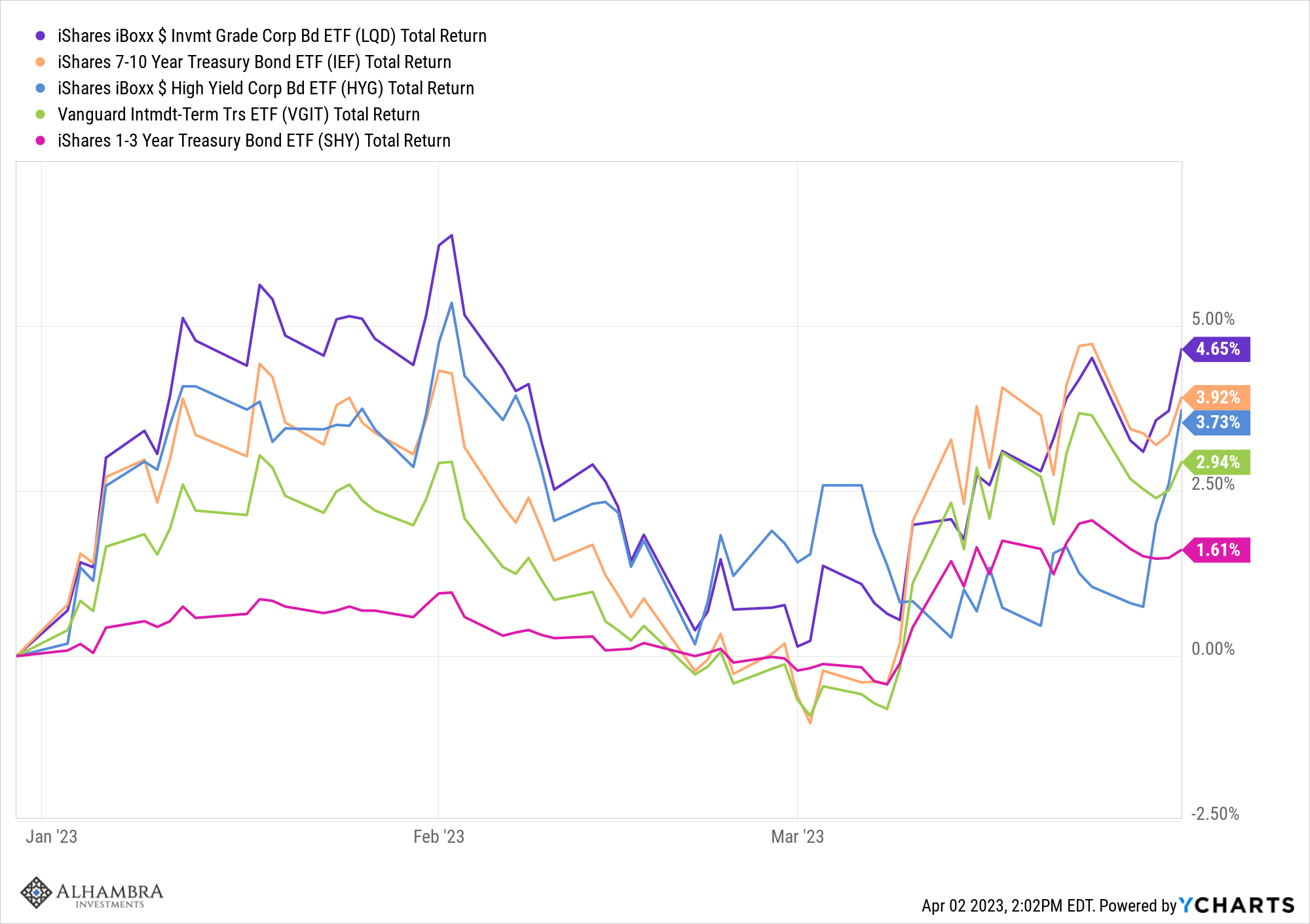

Those changes in the economic outlook were reflected by markets. The 10-year Treasury rate entered the year in a short-term downtrend, turned higher in mid-February, and is now back in a short-term downtrend. Overall, the 10-year yield fell by 39 basis points in the quarter. Bonds prices rise when rates fall so bonds of all kinds had a pretty good quarter with longer maturities doing better than the short end. With everyone crowding into the short end – buy T-bills! – I’d suggest that trend may just have some legs. Another development in the quarter was that the yield curve appears to have put in a bottom. That generally marks a pretty good time to lengthen the duration, as I suggested a few weeks ago. It also means a recession is likely moving closer although it could still be as much as a year before the onset if history is a guide.

(Click on image to enlarge)

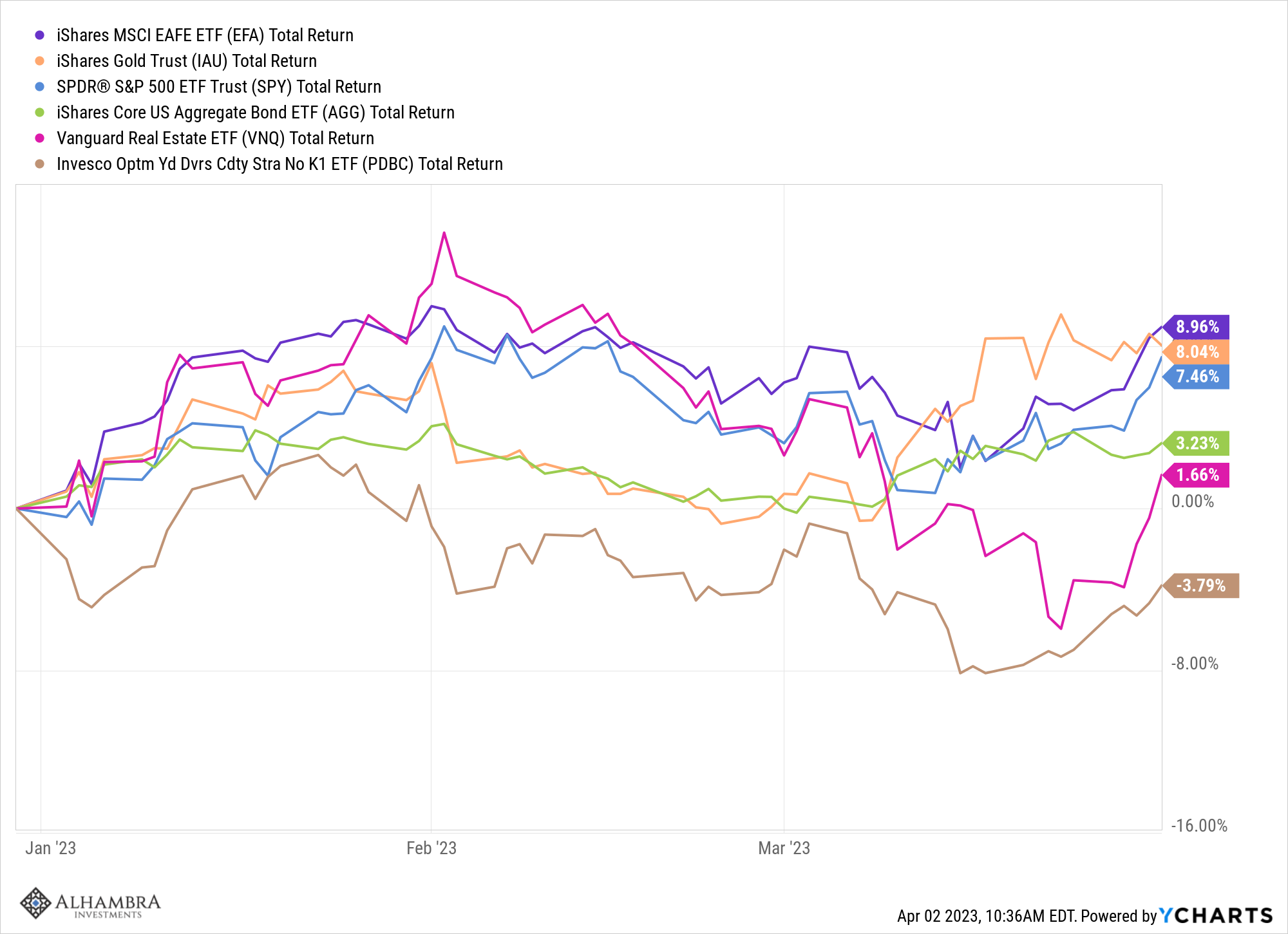

Stocks also did well despite renewed growth concerns. Investors seem to believe that rates falling signals a return to the pre-Fed tightening markets where growth stocks can be marked up to higher valuations based on a lower discount rate. QQQ put on an impressive 20%+ gain in the quarter. While the magnitude of the gain was an outlier, there was any number of ways to make money in stocks during the quarter. With the dollar continuing to fall, international stocks outperformed their US counterparts. Value stocks, real estate, and small-cap stocks were all victims of the financial sector fallout but still managed to make gains. Maybe most surprising was gold, up 8% for the quarter as real rates fell and economic growth prospects faded a little. Commodities fell despite the lower dollar as crude oil fell nearly 6% and natural gas a whopping 50.5%.

(Click on image to enlarge)

The falling rate, falling dollar environment we currently find ourselves in has markets performing pretty much as expected. There are exceptions but if the dollar and rate trends persist – not a guarantee at all by the way – I would expect the exceptions list to dwindle. Leading that list today are the growth stocks and while valuation is a bad timing tool, it does tell us about risk. In late 2021 I warned about the overvaluation of the S&P 500 and specifically the growth stocks within it. The overall index valuation has improved since then but the growth part is still very highly valued. The S&P 500 growth index ETF (IVW) trades for 20 times expected earnings, 2.7 times sales, and 11 times cash flow while long-term earnings growth is around 15%. In addition, 43% of its assets are in the top 10 holdings, with Apple and Microsoft representing just over 20% of total assets.

There are still plenty of cheaper alternatives, especially in foreign markets which will likely continue to perform well if the dollar stays in its current downtrend. The EAFE index ETF (EFA) trades for just 13 times expected earnings and 1.1 times sales. European stocks are even cheaper at 12 times earnings, 1 times sales, and 6 times cash flow with expected earnings growth of 12%.

Markets have come a long way since the October lows, a wide variety of assets are in uptrends and yet, sentiment remains quite dire. The rush for cash alternatives isn’t, by itself, evidence of anything other than the low regard banks have for their customers. Bank deposit rates have not come close to keeping up with T-bills and other short-term rate products. I do have a rough indicator I like to call the Grandma indicator though and it is flashing red right now. When grandmothers are calling asking you about a particular investment you know its time is coming to an end. For example, I was getting Grandma calls about crypto in 2021. And today, I’m getting Grandma calls about T-bills.

What exactly that means is hard to say other than that maybe we ought to be looking for something to invest in other than T-bills. Whether that is stocks or longer-term bonds is the question one must answer and right now the answer appears to be yes; both are rising. In addition, negative sentiment has fund managers sitting on a lot of cash – just like Grandma – with fears of recession rising based on expectations for a credit crunch in the wake of the bank problems. So, if that’s your base case you should be quite comfortable in the crowd.

Even with bank rates still low, the outflow of deposits from small banks has moderated for now (down about $1 billion last week) and as I’ve said before, I question the credit crunch thesis. Sitting on a bunch of low-yielding assets just ensures a slow earnings burn for banks. With rates now falling and the value of their current holdings rising again, banks might see this as an opportunity to lend while rates are still higher and sell their Treasuries and MBS into the bond market rally. What will all the T-bill holders do when their 3 months (or 6 or 9 or 12) is up and rates are lower?

Environment

The 10-year yield rose last week but the short-term downtrend is intact. Since the recent lows on March 17th, a week after the SVB failure, the 10-year rate is up about 9 basis points. Interestingly, the yield on the 10-year TIPS is down 13 basis points over the same time frame. That means that in the aftermath of the banking troubles, real growth expectations have fallen and inflation expectations have risen. Of course, these are small changes and not big enough to be meaningful yet but it is interesting. Are market participants trying to anticipate stagflation?

The dollar is still in a short-term downtrend but I’d start to look for a rally attempt. The enthusiasm for gold and the remarkable number of articles and TV spots dedicated to the demise of the dollar seem way overdone. The talk of the dollar losing its global reserve currency status is way too early at best. And maybe just wrong. Yes, I’m well aware of the machinations of the Saudis and the Chinese. But the Saudi currency is still pegged to the dollar and they don’t seem likely to aim their foot. And yet it probably isn’t a coincidence that OPEC+ just announced an oil production cut this weekend. As I said last week, an alliance between the Saudis, Russians, and Chinese could attempt to push up energy prices for the west while keeping them low for their partners. We’ll see how successful they are.

Markets

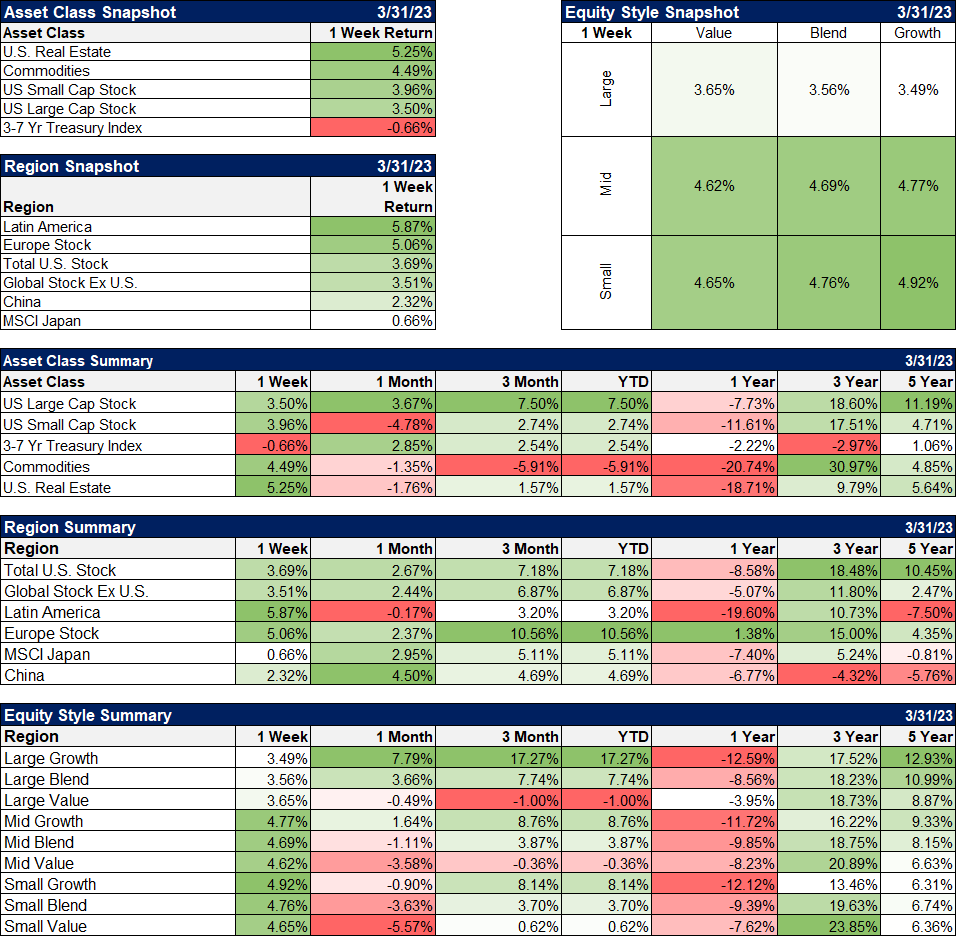

Real estate stocks rebounded last week to cut their losses for the month to less than 2%. The asset class has been under stress over concerns about a credit crunch since the start of the banking issues a few weeks ago. Large-cap stocks had another great quarter, up 7.5% YTD.

Bonds were down some last week as the banking fears have eased. The deposit outflow from small banks all but stopped last week according to figures released after the close Friday.

Commodities also had a good week as crude oil rebounded by over 9% from its recent lows. Natural gas was down again on the week but had a big rebound Friday, up over 5%.

There was little difference in performance between growth and value last week but large-cap growth is the clear leader YTD, up over 17% while large value was down 1% for the quarter. Value still leads over the last year by a good margin.

Latin America rebounded last week with commodity prices and more positive news about China’s reopening. Europe continues to lead YTD over the last 6 months, is up an astounding 41.6%.

Last week saw small and midcap stocks lead as the banking fears subsided. Small-cap value stocks have outperformed over the last three years by a wide margin.

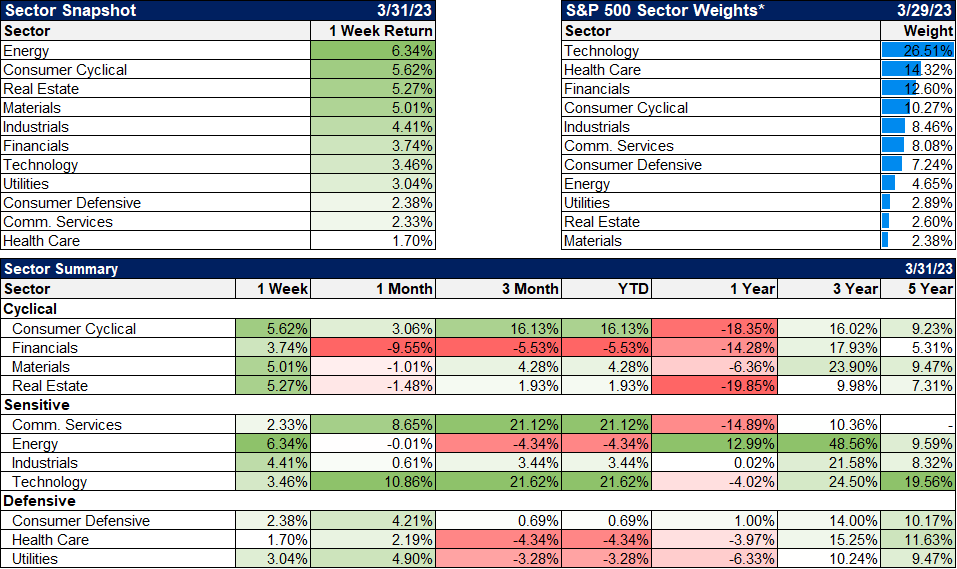

(Click on image to enlarge)

All 11 sectors were positive for the week with more cyclical sectors leading. The economic data last week wasn’t particularly good but inflation data continued to moderate, raising hopes the Fed’s rate hiking cycle is nearing its end. Energy stocks rebounded with crude oil while financials also recovered.

(Click on image to enlarge)

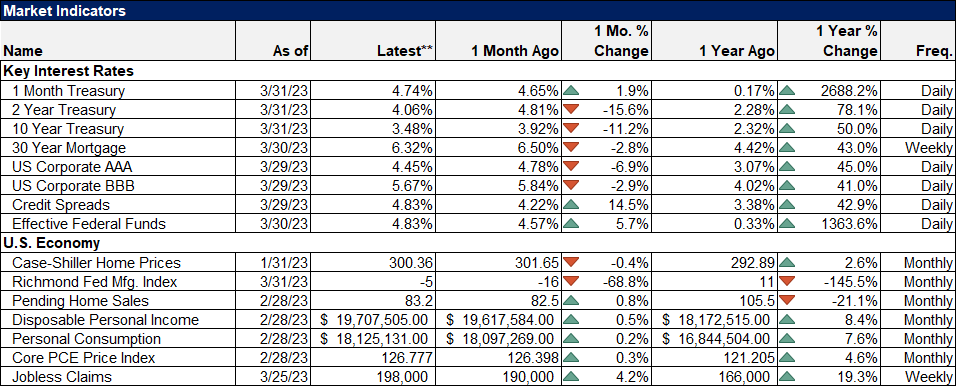

House prices continued to fall in January as the Case-Shiller index fell 0.4%. Year-over-year prices are up just 2.6%. Pending home sales were up slightly in February. Disposable personal income continued to rise in February as current taxes continue to fall. Consumption also rose but less than income so the savings rate also rose, to 4.6%. Real consumption, after inflation, fell by 0.1%. Jobless claims are up year-over-year but from very low levels and still under 200k.

Credit spreads are narrowing again and back under 5%. After all that has happened over the last year, spreads are still below the long-term average.

(Click on image to enlarge)

We’ve had two good quarters back to back now but the S&P 500 is still down a little over 8% in the last year. But if you widen your lens just a little, there are better performers out there. European stocks are up over 6% in the last year. EAFE, a broad non-US index, is down just a bit over 1%. Parts of the S&P 500 are doing better than the whole too with the value part down less than 1% (we own IVE). Gold is up 2.3% (we own IAU and GLD). The last year hasn’t been pleasant but if you owned some of these, it wasn’t a disaster either. Diversification works.

I don’t know what the future holds but I’m certain it will hold surprises that are contrary to today’s consensus. You can do what everyone else is doing and buy T-bills and you won’t get hurt. But crowded trades rarely work the way you think they will; the easy trades are almost always wrong. With everyone piling into cash, it is time to start looking for why that might be the wrong thing to do.

More By This Author:

Weekly Market Pulse: Perspective

Weekly Market Pulse: Been There, Done That

Weekly Market Pulse: It Isn’t A Bailout

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more