Weekly Market Pulse: Tariffs Aren’t The Answer

Image Source: Pixabay

By the time you read this we’ll have a new President. Well, actually, he’s an old President, but whatever we think we know about him from his first term may not be much help in the second. The group of people about to take over in Washington, D.C. is a lot different than in his first term. About all I can promise for the next four years is a permanent sort of uncertainty. Whatever you believe about Donald Trump, no one can say they know what he’s going to say or do next.

I don’t know what to expect this week when it comes to tariffs or any of the other policies advocated by Mr. Trump on the campaign trail. Will we get an executive order implementing across-the-board tariffs on the entire planet? Or will they be phased in over time? Will tips, overtime, and social security be exempt from tax? I watched the Senate hearing for the new Treasury Secretary last week, hoping to get an inkling of what might be coming, but Scott Bessent’s testimony was about as revealing as a burqa. It was not exactly shocking to hear that he believes the most important item on his punch list is to renew the tax cuts from Trump’s first term – he is a Republican. He apparently believes he can get growth up to 3% with what appears to me to be the same policies that President Trump used in his first term to raise growth by 0.2%/year over Obama’s second term. Since Mr. Bessent is a fellow South Carolinian, I’ll use a phrase he should understand – that dog won’t hunt. We have arrived at this economic juncture through a bipartisan set of screwups. If your goal is to fix it you’re going to have to do something different. And what I’m seeing isn’t in any way different enough to get real trend growth up to 3% or higher unless AI really is the magic wand Silicon Valley wants you to believe it is.

If you believe, as many Americans do, that one of the reasons we are sitting here with $30 trillion+ of national debt and an economy that works great for the top 10% and not so great for everyone else, is that China has been cheating at the trade game, nothing Bessent said last week is going to change that. Tariffs will not solve this problem. Other countries not playing fair isn’t what causes trade deficits. If the politicians in Washington, D.C., of either party, want to meet the architect of our trade and debt problems they need go no further than the closest mirror. Trade deficits are the result of a mismatch between savings and investment, namely that you don’t have enough of the former to fund the latter. Why do we have a lack of savings? Well, we know that individuals save – although not at rates we did in the past – and we know that most companies do too or they’d be bankrupt. So, what entity is responsible for our lack of national savings? The only one left is government, the one running deficits of 6% of GDP.

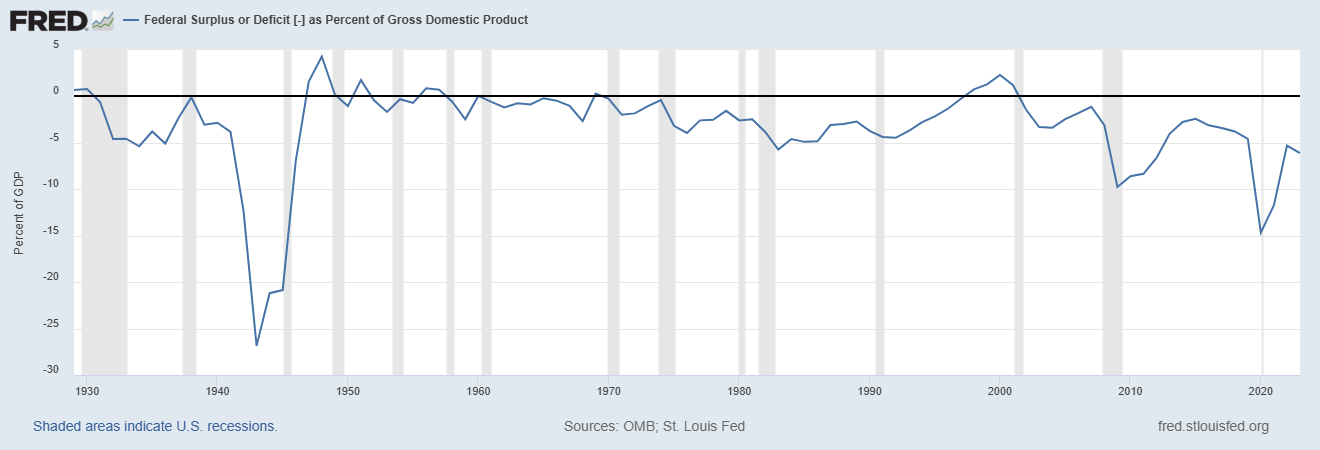

I know all Republicans believe that this is because of Democrats but the truth is that Republicans talk a lot about fiscal responsibility but haven’t actually acted that way. From the late 1940s to 1974, the US budget was mostly in balance but starting with Gerald Ford the budget balance shows a predictable pattern. Ford inherited a (mostly) balanced budget from Nixon and it was -4.6% of GDP by the time he left. The deficit improved steadily under Carter and ended at -2.5% of GDP. By 1983, the deficit under Reagan deteriorated again to -5.7%. Through the rest of the Reagan’s two terms and Bush’s one, the best annual deficit was still worse than it was when Jimmy Carter left office. Bill Clinton took over a deficit of -4.5% of GDP and by the time he left it was a surplus of 2.3% of GDP. It fell into deficit again under GW Bush, improved during Obama’s run, worsened during Trump and improved during Biden. Before you start accusing me of being a Democrat apologist, realize that I voted for all of those Republicans, starting with Reagan, except Trump. I finally gave up waiting on a Republican to actually act like a fiscal conservative during the GW Bush administration and went independent. Now, like a lot of Americans, I’m in the political wilderness, wondering when an adult will emerge from either party.

(Click on image to enlarge)

Now there were, as they say, extenuating circumstances along the way (recessions for Ford, Reagan and both Bushes, COVID for Trump, economic recoveries for Carter, Obama, and Biden) and no President or party is fully responsible for the debt we’ve run up on the national credit card over the last 50 years. The fact that the deficit improved under Carter does not make him a good president any more than its deterioration under Reagan proves him a bad one. I would also hasten to add that the deficit, in and of itself, is not the real problem. To paraphrase James Carville, it’s the spending, stupid. The trade deficit and the debt that produced it is caused by our continued failure to live within our means, to consume and invest less than we earn. If we want to reduce our reliance on the kindness of foreigners, that has to change. And if we want to avoid a recession – or something worse – while we do that, it can’t be done quickly.

Economic growth can be reduced to just two elements – workforce growth and productivity growth. That’s the whole equation and since we seem intent on limiting the first, the only path to higher growth is through the latter. And productivity growth comes from investment, which we, as a country, don’t save enough to fund, which is why we run a trade deficit. Our options are:

- Continue to run large budget deficits and rely on foreigners to fund our investment.

- Eliminate the deficit, spend less, save more, and fund our own investment.

Since we don’t want to do the first and the second one is painful, at least in the short term, maybe we should consider a third way. The trade deficit isn’t really a problem by itself. We’ve been running large trade deficits since the early 80s and real GDP today is 2.2 times what it was in 1982. We don’t know the counterfactual – how much would we have grown without the big budget deficits – but we have managed to grow nearly 3% a year while doing so. Further, if the dollar continues to be the world’s reserve currency – as President Trump wants – it is going to be hard to balance our trade book because the rest of the world needs dollars too and trade is how they get them. The real problem we have here is that one of the countries we’re running a large deficit with isn’t friendly – China. The third way is to continue cutting our ties to China, increase trade with more friendly countries, and cut our budget deficit over time.

It has taken us 50 years to get into this mess and there is no quick fix that will get us out of it. We can’t tariff our way to prosperity and every country that runs a surplus with the US isn’t the enemy. If we want economic growth, we need investment from the rest of the world and that isn’t going to change by next week or next year and probably not in the next decade. The investment we need has to come from somewhere and the only way to get it with continued budget deficits is to run a trade deficit with someone. If it isn’t China – and there are good reasons it shouldn’t be in my opinion – it will be another country. And if you cut off trade with the entire rest of the world to prevent that, we’re going to get the mother of all recessions. The only real option, if you really think we need to fund our own investments for growth, is to cut the budget deficit. The new administration seems to believe they can do that through spending cuts alone but cutting $1 trillion from the budget right now would only get the deficit down to 3% of GDP – and that assumes they can do that without causing a recession. Since you can draw a straight line from government spending to corporate profits, that seems unlikely.

I applaud Trump – and Biden after him – for confronting China about their cheating on trade. That cheating goes all the way back to the mid-90s when they devalued the Yuan and kept it undervalued for over a decade. It took 20 years and three Presidents before Trump finally said the quiet part out loud – China isn’t our friend. Cheap goods from China were part of the reason most Americans were able to maintain their lifestyle and continue consuming more than we produced for the last 40 years. But they also produced the current populist political backlash and led us to rely too heavily on China for goods critical to national defense.

What I heard from our new Treasury Secretary last week wasn’t bad, it was just too conventional and milquetoast. Keeping taxes low is a good thing but it isn’t the only thing. Reducing the regulatory burden is generally good although relying solely on the good intentions of individuals with a magnet stuck to their moral compass, as seems to be the plan for crypto markets, isn’t good enough. Getting rid of government waste and making it more efficient, as is envisioned with DOGE, is a fine idea and one every American ought to support. Government is a cost to our society and we should get good value for our tax dollars. But you can’t balance the budget, or even get close, with that approach.

It is long past time for us to get our fiscal house in order and nothing should be off the table in that regard. It is a matter of national security and we should take that seriously. That means some sacred cows are going to have to get gored. Specifically, any attempt to bring the budget back to near balance is going to require a serious effort to reform our healthcare system. Medicare and Medicaid amount to nearly a quarter of federal spending and total health expenditures are nearly 18% of GDP. You can’t balance the budget without going through healthcare and I have heard nothing from anyone in the new administration – or the last one – that is serious in that regard.

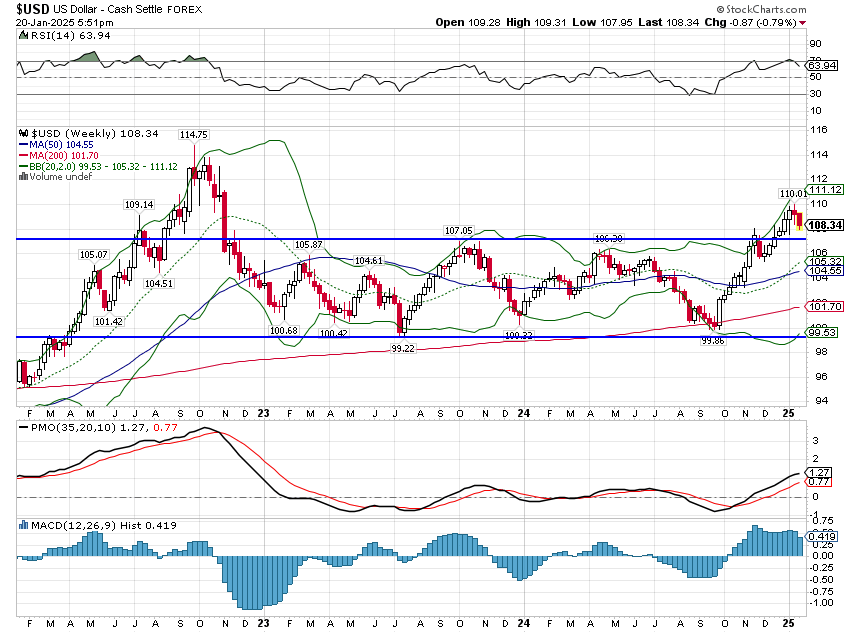

One last thing to note is that the dollar’s reaction to Trump’s election makes clear why tariffs are the wrong remedy. The dollar index is up 9% since bottoming on September 27th (markets anticipate), a response to the tariffs expected from the new administration. Meanwhile, the Chinese Yuan is down 4.3% against the dollar and that is with the Chinese government actively trying to support it. The Euro, which trades more freely, is down 8%, almost exactly matching the rise in the dollar index. That is exactly the response one would expect – currencies adjust to offset the tariffs. Tariffs make imports more expensive and a stronger dollar makes them cheaper again. You can’t get there from here.

I don’t normally write much about politics because we’re investment advisers, not political consultants or policy wonks and the impact of politics on markets is generally overstated. It is our job to see the economy and markets clearly, as they are today, with an eye on the future but the humility to know we can’t predict it. Most of the policies imposed by our political masters are neither the panacea promised by their backers nor the disaster assured by their opponents. But as we talked about before the election, a sweep of the House, Senate, and White House by one party is the worst possible outcome because it introduces an extreme amount of uncertainty. Political parties with complete control try to do “big things” which take time and a lot of haggling. While the politicians haggle, most businesses and individuals sit and wait to see what the new rules will be rather than take actions in anticipation of policies that never materialize. I am also reminded of a quote from Mark Twain:

To lodge all power in one party and keep it there is to insure bad government and the sure and gradual deterioration of the public morals.

Mark Twain

The re-election of President Trump and the Republican sweep means politics will have a bigger impact than usual and I will have to pay more attention to it than I normally do. It isn’t something I relish; I don’t like politics, politicians, or political parties. Unfortunately, that’s the world we live in, one where politics has taken center stage even though most of us long ago tired of the play. I’ll leave you with one more quote from Mencken that neatly sums up my feelings about politics and politicians (and it doesn’t matter which party is in power):

Every decent man is ashamed of the government he lives under.

H.L. Mencken

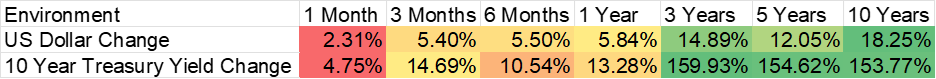

Environment

(Click on image to enlarge)

I’ve been thinking about the dollar a lot recently as it adjusts to the idea of increased tariffs in Trump’s second term. The dollar appears to be overvalued and I wonder if tariffs are sufficient reason for that to persist. What do I mean when I say it is overvalued? Mostly anecdotal evidence that shows the stark difference in dollar incomes across countries. I saw a recent statistic ( and confirmed it; you can’t just trust what you find in the press) that Mississippi, the poorest state in the union, has a higher per capita income than the UK, France, Italy, and Japan and just below Germany. Arkansas and West Virginia actually rank ahead of Germany. If you’ve been to Jackson, MS, Little Rock, AR or Morgantown, WV and to Tokyo, London, Paris and Rome you have to know that doesn’t make a lot of sense. And by the way, no knock on MS, AR or WV; I’ve been to all those states – spent part of my childhood in AR and still have family there – and love them all. It also makes little sense that you can make more than the per capita income of Japan working at a fast food restaurant in California. Or that the median salary for a gas station manager in the US is higher than for a doctor in Italy or Spain.

This is also why we find ourselves in an uncompetitive situation in manufacturing. It costs, on average, $52/hour to manufacture in the US but only $21 in Japan and $10 in China. The inflation of the last few years has, obviously, made this situation much worse as salaries have risen much more here than Asia or even Europe. Does anyone think we can raise tariffs sufficiently to offset that widening gap in costs? And if we could, does anyone really think prices aren’t going to rise? Seems unlikely to me. Currency markets usually don’t allow disparities like this to persist; the currency of the country with uncompetitive wages will fall to balance things out. That hasn’t happened to the dollar yet but if tariffs can’t fix this, currency markets will.

In any case, the dollar did pull back a tad last week but remains near the highs of the year.

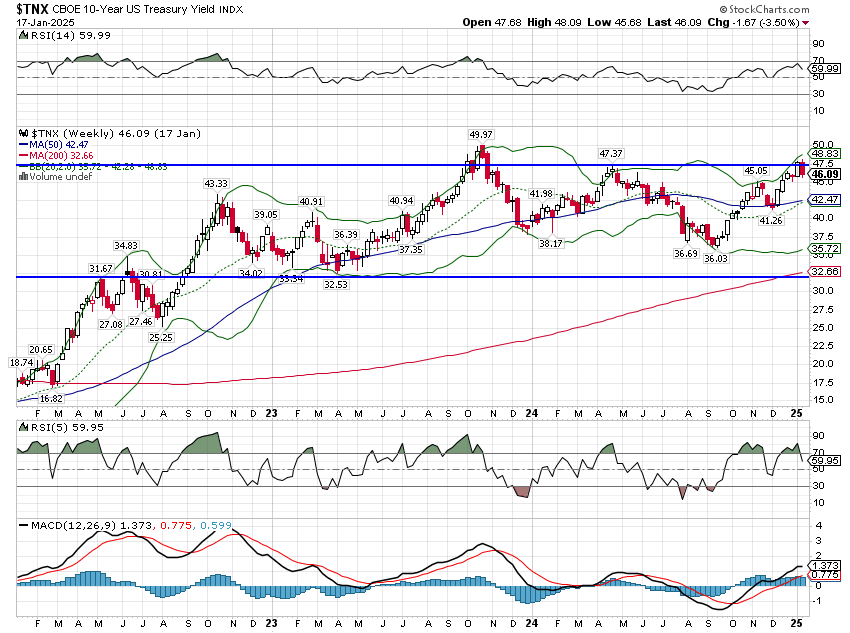

(Click on image to enlarge)

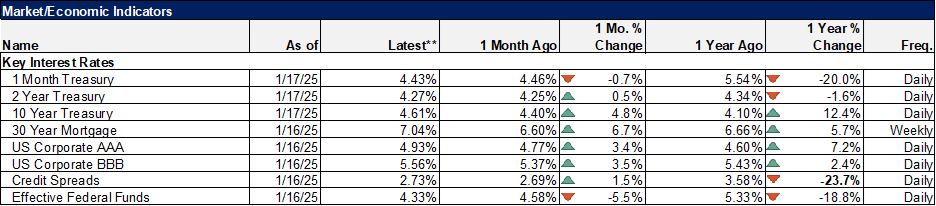

Interest rates fell across the board last week as the inflation figures, for some reason, were interpreted as benign. I don’t see it that way with headline and core CPI up 2.9% and 3.2% year-over-year respectively. That isn’t, last I checked, 2% but maybe the Fed has a new calculator. Or maybe interest rates were down for some other reason although I have a hard time figuring out what it might be. The 10-year Treasury note yield is right at the top of the range it has inhabited since late 2022. Nothing has changed.

(Click on image to enlarge)

Markets

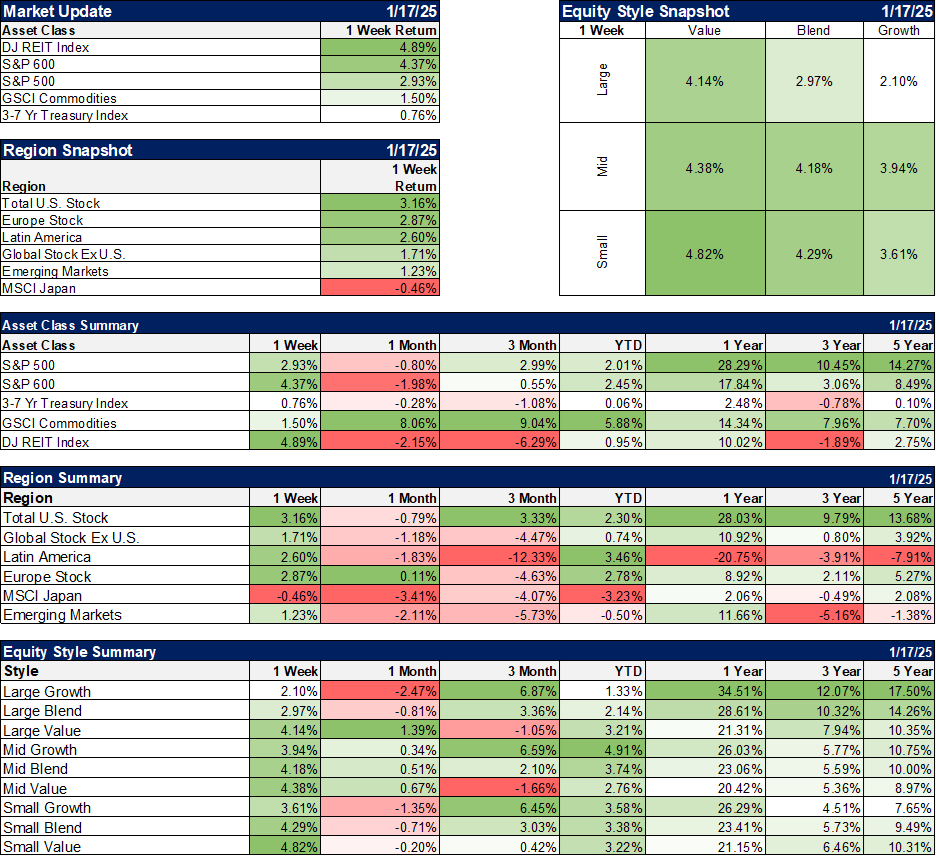

The drop in yields had big impact on REITs last week, up nearly 5%. Small cap stocks also liked the lower rates. For the week and YTD, large value stocks are outperforming large growth stocks, a reversal of last year’s trend. Growth and value in mid and small caps have performed about the same and have outperformed large cap YTD as well. Commodities still lead for the year, up nearly 6% so far.

The pullback in the dollar aided international markets with Europe and Latin America leading the way. Still, they lagged US stocks for the week and for YTD as well but not as much as one might think given the incoming administration.

(Click on image to enlarge)

Sectors

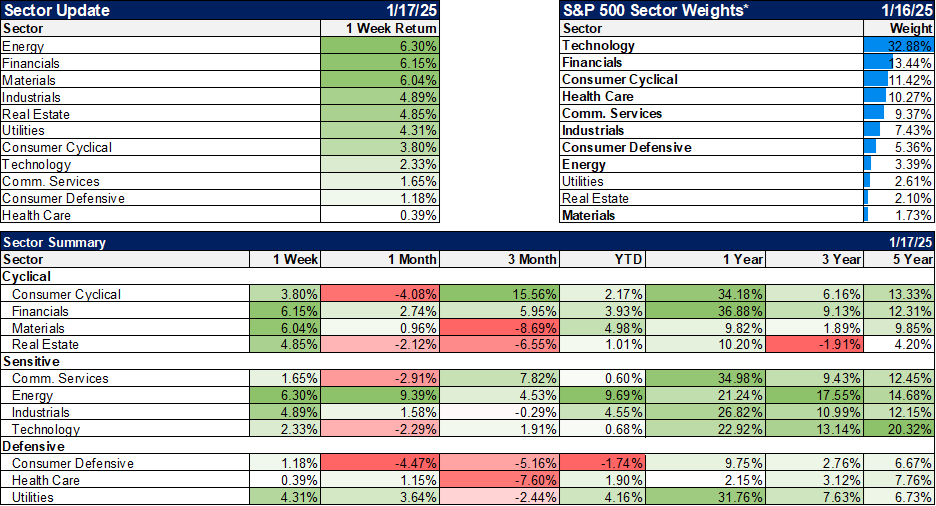

Energy stocks are leading the market this year as crude oil (+7.9%) and natural gas (+8.7%) are both up big. Some of the enthusiasm probably has to do with hoped for changes in government policy but I have my doubts about the potential of the government to make oil companies more profitable, mostly because they’re doing pretty well right now. Maybe I’m missing something but higher energy company profits and lower prices at the pump don’t sound compatible.

Financials also had a good week as earnings have generally come in better than expected.

(Click on image to enlarge)

Economy/Market Indicators

Credit spreads are back near their lows and mortgage rates are back above 7%. We’ll see if that lasts.

(Click on image to enlarge)

Economy/Economic Data

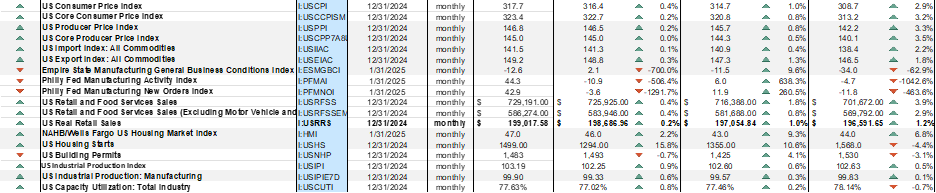

While everyone was focused on the inflation data, the real surprise of the week was the Philly Fed Manufacturing index which rose from -10.9 to 44.3, the highest reading since April of 2021 and largest monthly increase since June of 2020, just as the economy was starting to recover from the initial COVID hit. New orders and shipments also hit multi-year highs and employment also rose. We’ve been talking about a rebound in manufacturing for months but this is not just a ramp up based on inventory rebuilding. My guess – and that’s all it is – is that companies are ordering product in advance of potential tariffs. US manufacturers will be affected by tariffs too as the cost of imported inputs rises. Their end customers may be getting ahead of expected price increases. From a bigger picture though, this series has been signaling a rebound for some time – 9 of the last 12 months have been positive after being negative for 18 of the previous 20 months.

If this is from ordering in advance of expected tariffs, it won’t be sustained. I’ve seen reports recently that the Trump team was talking about having the new tariffs rise on a schedule, up say 2%/month until they reach their desired level. My first thought was “these people don’t know how markets work”. If you are an importer of anything and you know tariffs are going to rise on a schedule, are you going to just wait for prices to rise? Any business that stupid shouldn’t survive.

(Click on image to enlarge)

More By This Author:

Weekly Market Pulse: Good News Is Good NewsWeekly Market Pulse: The Times Are Still A-Changin’

Weekly Market Pulse: Questions For The New Year

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more