Weekly Market Pulse: Fear Itself

Be fearful when others are greedy and greedy when others are fearful.

-Warren Buffett

Buy when there’s blood in the streets, even if the blood is your own.

-Nathan Rothschild

Rothschild is said to have made a fortune buying assets in the wake of the Battle of Waterloo so in his case, he meant this literally. Another quote attributed to Rothschild is to “buy on the cannons, sell on the trumpets” although there is scant evidence he actually said it. Regardless, the Baron knew a thing or two about being a contrarian, as does Warren Buffett. Some of his best long-term investments were made in the bear markets of the 1970s.

At any given time there are always some assets that no one wants, assets that engender that fear Buffett was referring to. If you want big bargains, you aren’t going to find them by looking at the leaderboard; Buffett also once said that “you pay a very high price for a cheery consensus”.

Is there any doubt that the selloff in regional bank stocks last week was driven by fear? Some of it might be legitimate fear but it was fear nonetheless. The days have kind of blurred together recently but it was just last Monday that Republic Bank was ushered into the welcoming arms of JP Morgan and no less than Jamie Dimon himself said this should end the banking crisis. Maybe, but the stocks of regional banks spent the rest of the week trying to make Jamie – and Jerome Powell – look like a fool.

The stocks were fairly stable on Monday but started to sell off on Tuesday on rumors about the health of other west coast banks. Pacwest confirmed late Wednesday that they were “exploring options” which seem limited since JP Morgan probably isn’t going to buy another bank this week. On Thursday, the FT reported that Western Alliance had hired advisors to explore those same “options”. The bank had this to say:

“This story is absolutely false, there is no truth to this,” a Western Alliance spokesperson told CNN in an email.

The bank also said it is exploring legal options in response to the Financial Times’ article.

“There is not a single element of the article that is true. Western Alliance is not exploring a sale, nor has it hired an advisor to explore strategic option. It is shameful and irresponsible that the Financial Times has allowed itself to be used as an instrument of short sellers and as a conduit for spreading false narratives about a financially sound and profitable bank,” a spokesperson told CNN in an email.

The phrase “The lady doth protests too much, methinks” does come to mind but in this case maybe not. The bank has reported on their deposits several times recently and they appear stable for now. As indeed they do in the aggregate. The Fed reported Friday that deposits at US banks – small and large – rose in the last week of April. Borrowing by banks is also down from the highs though still elevated.

So, if there’s fear in the market over the regional banks, isn’t that where we should be looking for bargains? Or maybe the trouble with banks could lead us to another unloved – feared – sector. One of the big macro fears coming out of the banking crisis is the effect on commercial real estate. REITs, especially those focused on office properties, have taken almost as much of a beating as the bank stocks.

SL Green, one of the largest property owners in NYC, has seen its stock drop nearly 48% since February 2nd and 70% since the beginning of 2022. Vornado Realty Trust owns a trifecta of ugly, with properties in NYC, Chicago, and San Francisco. The stock peaked way back in 2017 and is down over 77% since then. These companies were already in triage from COVID and work-from-home before worries about the regional banks hit.

Just to be blazingly clear, I am not in any way recommending that anyone buy these REITs. I don’t know enough about either of them to make that kind of judgment. For all I know they’re both headed for bankruptcy. Neither am I saying you should run out and buy regional bank stocks. And I’m not making any recommendation whatsoever about any of the companies mentioned here. Maybe the regional banks are all headed for heck in a handbasket and you should put all your money in the care of Jamie Dimon.

But this is often how it is when you try to follow Mr. Buffett’s advice. Everything in the bargain bin has a problem, a flaw – or flaws – that everyone knows about and believes can’t be fixed. The regional banks do have some headwinds, to say the least. And short sellers will take advantage of the situation as WAL intimated in their response to the FT article. Office properties have some well-known problems too. Fear feeds on itself until you get an all-out panic. And that’s when you get a chance to buy a high-quality asset on the cheap because the good ones get sold with the bad ones. You just have to figure out which of these companies is the diamond in the rough. To use the punch line from an old joke, you have to find the pony.

The good news is that you probably don’t have to rush. When assets crash like these have, sentiment takes time to recover. Take your time, do your research, and find the gems, the best of the worst, the baby that’s been thrown out with the bathwater. Maybe instead of buying a REIT focused on NYC or San Francisco, you can find one focused on the sun belt or the Midwest where vacancy rates aren’t as high. Or maybe you can find a regional bank that acted conservatively and didn’t load up on low-yielding assets.

Investing as a contrarian is hard. It requires that you do what few are willing to do, to stand outside the crowd, to be the optimist when everyone else is focused on the negative. John Archibald Wheeler, a theoretical physicist and contemporary said this about Einstein:

There were three additional rules of Einstein’s work that stand out for use in our science, our problems, and our times. First, out of clutter find simplicity. Second, from discord make harmony. Third, in the middle of difficulty lies opportunity.

All of these are good rules for investors. They are also very easy to recite and very hard to implement. But if you want to get results that are better than average you have to do things that the average investor isn’t doing; you have to be different. And that is what acting contrarian is all about.

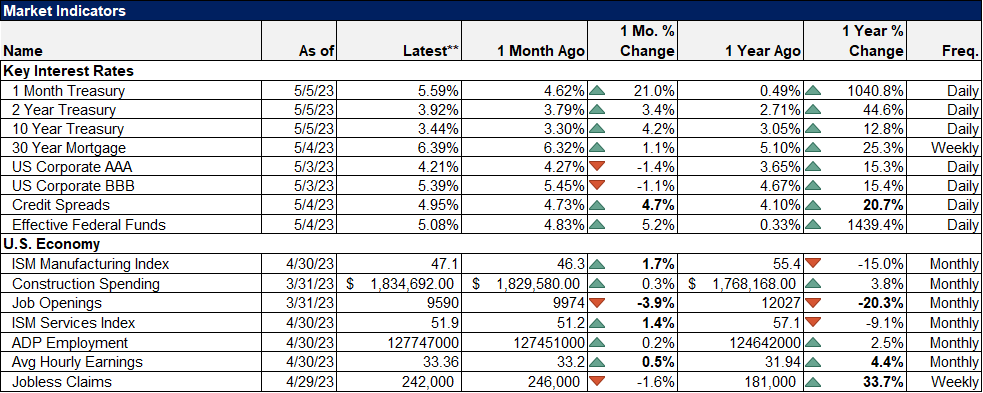

Environment

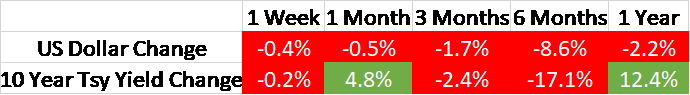

The short-term downtrends in the 10-year Treasury yield and the US dollar are intact although both feel a little long in the tooth. A near-term countertrend move in either or both wouldn’t be a surprise. The economic data released last week was better than expected and if that is the start of a trend – for however long – then a rebound in rates and the dollar would seem logical. There were also hints in some of the data that inflation isn’t exactly on its deathbed. Both ISM reports showed a rise in the prices component, although the rise for services was small.

Unit labor costs were reported up 6.3%, a big jump from last quarter. The latest jobs report was pretty good but average hourly earnings were up more than expected and 4.4% over the last year. It seems that most companies have been able to pass along the rise in wages so far but that may get tougher if the economy slows.

But will the economy slow? That is certainly expected as the market is currently anticipating rate cuts before the end of the year. But the ISM reports last week were both improved from the previous month and could be pointing to a near-term rebound in activity. Last year’s inventory correction appears to be about complete (see Q1 GDP Report). The ISM manufacturing survey showed an improvement in new orders (but still below 50) and employment (50.2 vs 46.9 last month) and a rise in prices. The ISM Services index showed a big jump in new orders as well (56.1 vs 52.2).

Total vehicle sales were also reported last week but didn’t get much attention. Annualized sales jumped to 15.9 million in April from 14.8 million in March. Average annual sales of light vehicles since 1985 are 15.25 million so the current pace is just a bit above average. Best levels in expansions get to around 17.5 million annualized so this isn’t best by far but it is in a rising trend too. Personally, I don’t know how anyone can afford a new car but somebody’s buying them.

These reports are just for one month and both are volatile. Either or both of these metrics could turn south in next month’s reading. But right now, all we know is that both improved last month which is interesting considering the consensus view on the economy. I was told a long time ago that markets will act to frustrate the maximum number of people and that has proven true more often than not in the 30+ years I’ve been doing this. So, is anyone positive about the dollar or expecting higher rates right now? Anyone? Bueller?

Markets

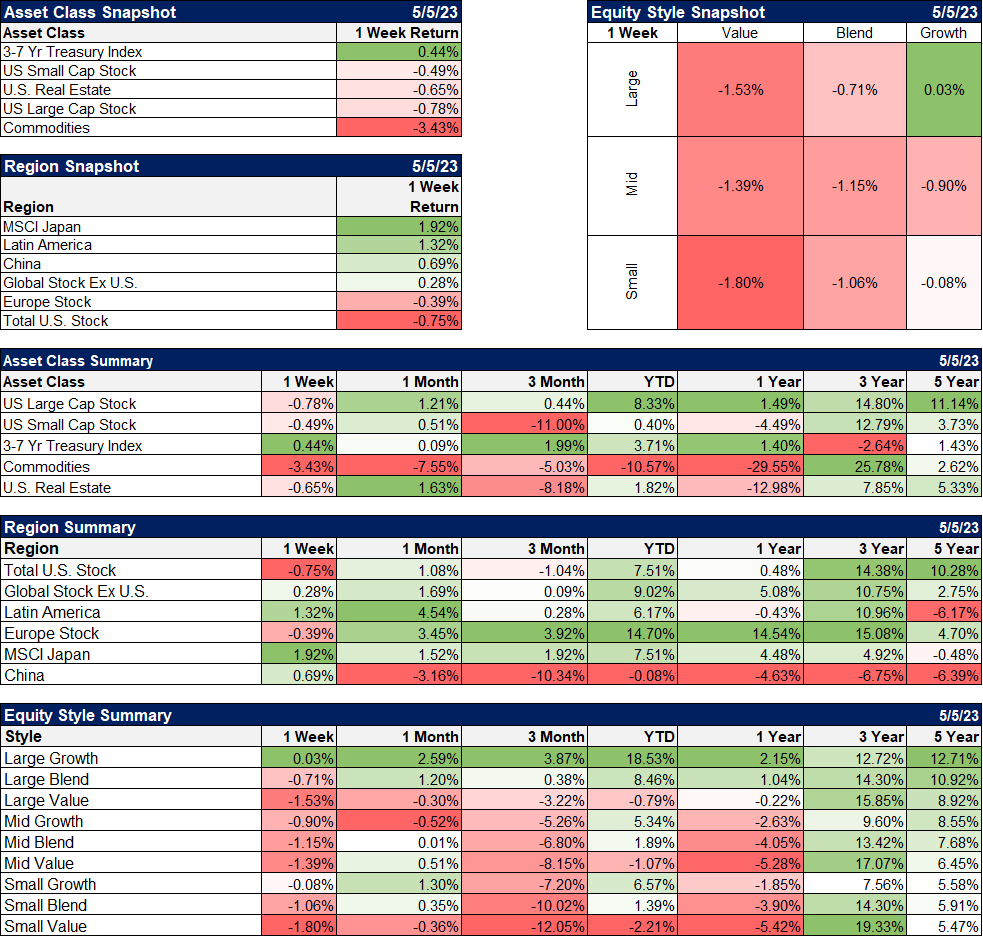

Stocks, real estate, and commodities were all down last week while bonds were generally higher. The yield curve twisted last week with Tbill rates rising, 1 to 10-year notes rallying and the long end selling off. Some of the short-end movement is about the debt ceiling drama and we’ll probably get more distortions the closer we get to….whatever happens.

International continues to outperform with Japan leading last week. Japan has outperformed the S&P 500 over the last year (6.7% vs 1.4%) and that is in the face of a 4% decline in the Yen. The Yen is, however, up 10% since October last year but still down 15% since the end of 2021 and 24% since the end of 2020. Just a little sushi for thought.

(Click on image to enlarge)

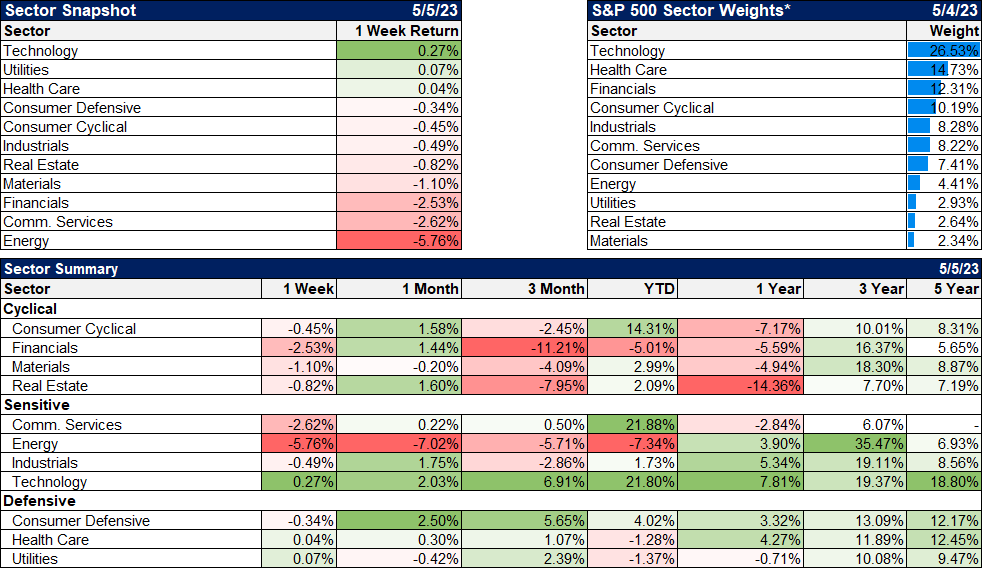

Good earnings out of Apple led the tech sector higher while lower crude prices hammered the energy stocks again. Energy stocks are only up 3.9% over the last year, 4th best, with technology, industrials, and health care all doing better. I wouldn’t exactly call them hated yet but sentiment is certainly more cautious now than last year when everyone claimed to be overweight energy.

Communication services, the sector leader for most of the year, took a beating last week as Paramount reported a lousy quarter and all the streaming stocks fell in sympathy. Streaming has been very good for viewers but not so great for content producers.

(Click on image to enlarge)

Credit spreads widened last week but are still below the long-term average.

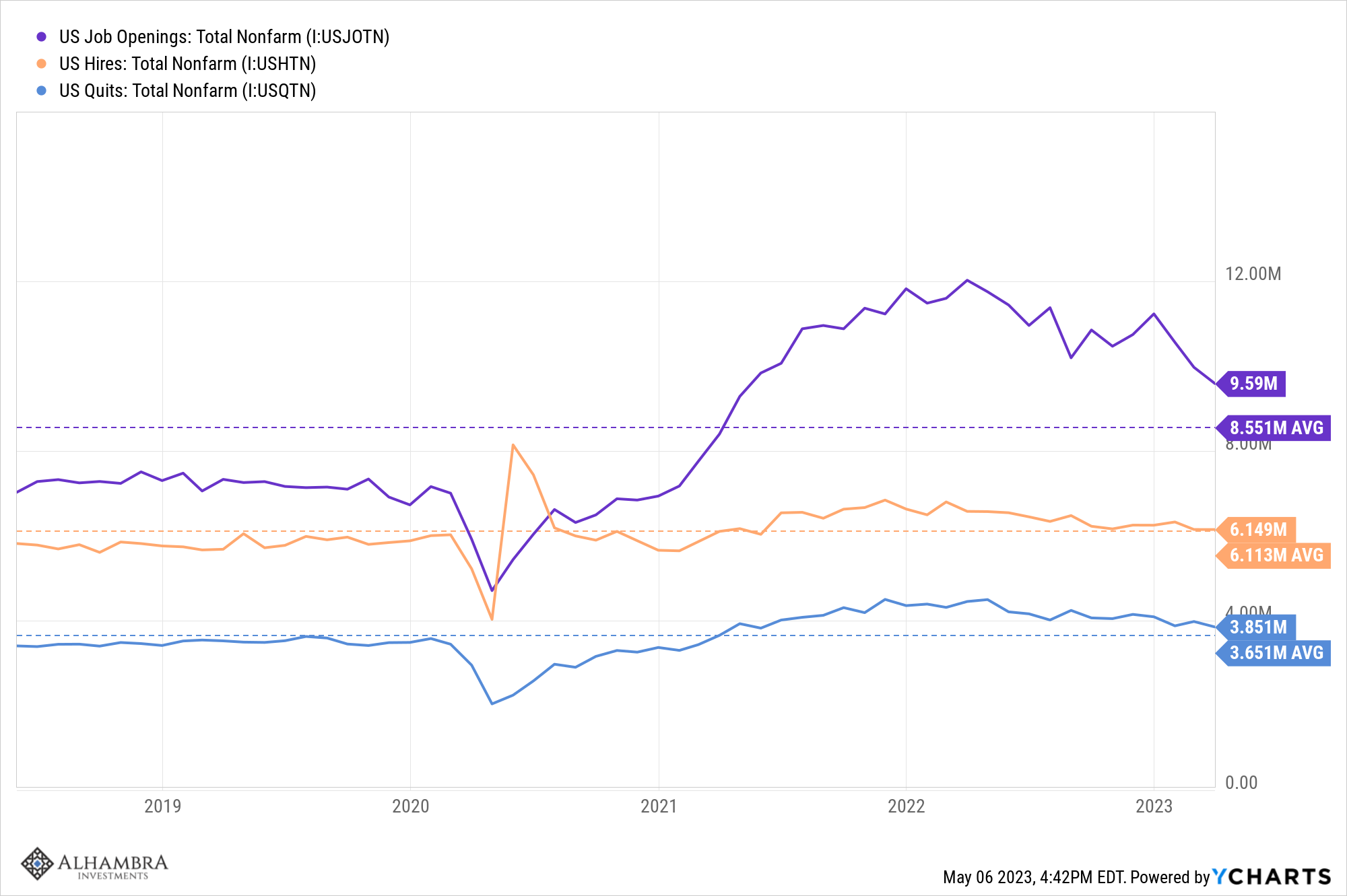

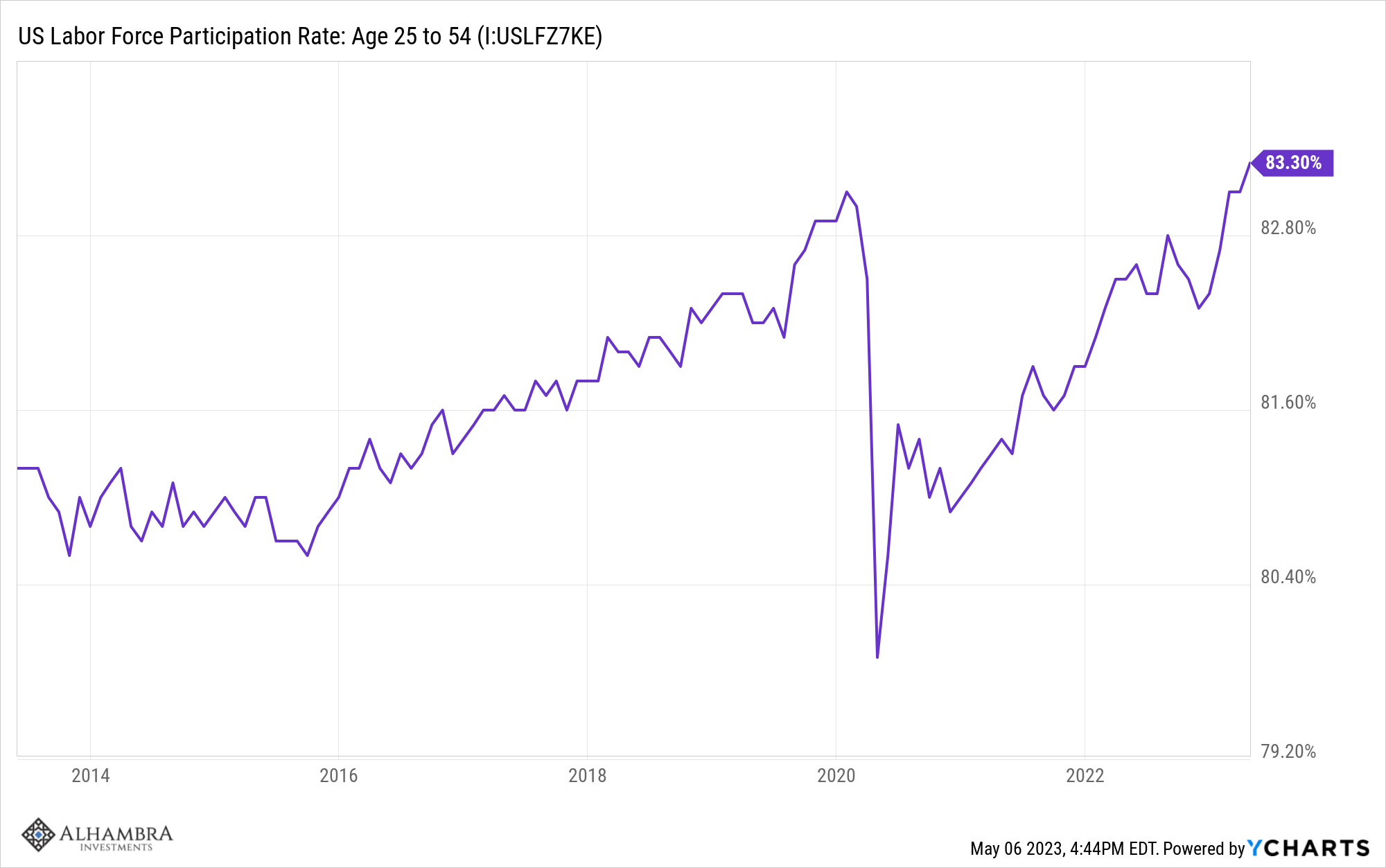

Job openings fell last month but at 9.6 million are still about 1 million above the 5-year average. Hires and quits are just above their 5-year averages. Do we still have a labor shortage? Did we ever? I’d say that wages weren’t at the clearing price but maybe we’re closer now. But the prime age labor force participation rate is now back above the pre-COVID level and resuming a rising trend that started back in 2015. With participation at 83.3%, there isn’t a lot of upside but the peak was 84.6% in 1999.

(Click on image to enlarge)

There are a lot of investors who claim to be contrarians but when the time comes, when fear hits the market, most can’t live up to the moniker. That’s because the fear that often envelops markets or parts of the markets is driven by real concerns. We’ve already had several bank failures this year and the conditions that brought them down are shared, in some ways, by almost all banks, large and small. The fear that other banks will succumb to the same fate as Silicon Valley Bank or First Republic Bank is real.

But all regional/small banks are not the same. The poor management of the banks that failed is probably not unique but neither is it universal. There are well-run banks out there and their stocks have been sold with all the poorly-run ones. The same is true of REITs, even ones that specialize in office properties. Vacancy rates in the office sector are far from uniform geographically. There are many markets, especially in the south, where vacancy rates are actually lower now than pre-COVID.

Most of your investments should adhere to Einstein’s first rule – out of clutter, find simplicity – but small investments in contrarian ideas can pay large dividends over time. It is hard to say when fear has hit its peak when the shunned asset has hit bottom, so you are unlikely to pick the exact bottom, so be patient, do your research, and diversify, diversify, diversify. But be contrarian. It is the very essence of investing.

More By This Author:

Weekly Market Pulse: Not Dead Yet

Weekly Market Pulse: This Too Shall Pass

Weekly Market Pulse: Much Ado About Not Much

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more