Weekly Market Pulse: Not Dead Yet

Bring out your dead!

CUSTOMER: Here’s one.

CART MASTER: Nine pence.

DEAD PERSON: I’m not dead!

CART MASTER: What?

CUSTOMER: Nothing. Here’s your nine pence.

DEAD PERSON: I’m not dead!

CART MASTER: ‘Ere. He says he’s not dead!

CUSTOMER: Yes, he is.

DEAD PERSON: I’m not!

CART MASTER: He isn’t?

CUSTOMER: Well, he will be soon. He’s very ill.

DEAD PERSON: I’m getting better!

CUSTOMER: No, you’re not. You’ll be stone dead in a moment.

– Monty Python and The Holy Grail

Has anyone seen the recession? Last year GDP shrunk ever so slightly in the first two quarters of the year and the chorus of recession calls started to rise, led mostly by political partisans who assured us that the Biden administration was changing the definition of recession to avoid having to admit how bad the economy was with the unemployment rate under 4%. But the definition never changed and the metrics the NBER uses to declare a recession never even approached past recession levels.

Then the 10-year/2-year Treasury yield spread turned negative in June and calls for recession reached a deafening roar. The angst over recession was so great that Google searches for “recession” were twice the level of 2008.

During the summer of 2022, I read many confident predictions that the US would surely enter recession by the end of the year. When Q3 GDP was reported as a gain of 3.2%, the economic pessimists said it was only because of a shrinking trade deficit which they assured us wasn’t really positive. And we were told that recession was still coming if not by the end of the year, then certainly by Q1 of 2023. But Q4 GDP was another surprise, at least to the negative nellies, rising 2.6%. This time the bears said well, yes but that was only because inventories rose and added 1.5% to the total GDP number. That was, of course, negative because no one really wanted to build up inventory.

And last week, the BEA released the first estimate of GDP for Q1 2023 showing +1.1% annualized growth from the previous quarter. And the bears cheered because now it’s obvious, even to all of those doubters out there, that growth is slowing and it’s still only a matter of time before we get that Godot recession, the one everyone is waiting on. I’m sure they all wrote about how inventory affected this report too, right? No? Hmm, well, I guess I have to break the news then and tell you that the drawdown in inventories actually reduced the headline GDP figure by 2.26%, Absent inventories and trade, real final sales to domestic purchasers rose by 3.2%.

The market/economic pundits who have been calling for recession for the last year are mostly the same ones who have been preaching doom and gloom for over a decade, absolutely oblivious to the real world around them. Heck, I can think of one economist who has been bearish my entire career and I started doing this before the advent of online trading. Heck, I started doing this before the advent of online. If the guru you’re listening to hasn’t changed their mind in a decade or more, I’m just going to politely suggest that maybe they aren’t worth listening to. And it doesn’t matter whether they are bullish or bearish. If you know what they’re going to say before they say it, tune them out.

I wrote just last week that a recession at some point this year should probably be our base case. That’s based on a variety of historical facts but still isn’t a sure thing. We know the LEI is pointing to recession within the next year and that has never been wrong, which doesn’t mean it won’t be this time. We know that ECRI is calling for recession and they have had one bad call in the last 5 decades or so. We also have a yield curve that inverted and is now, slowly, starting to steepen again, a change we usually see within about a year of recession. But we don’t have confirmation from some other factors, such as credit spreads and jobless claims, that are more coincident with the onset of recession and so, we still aren’t there yet. I have also pointed out that even if we do enter recession this year, that is no guarantee that markets will do what you think they will. Markets don’t usually make big moves when things turn out as expected and I’m hard-pressed to think of anything more expected right now than a recession.

Last week’s GDP report was not some kind of near miss, something that could be interpreted as negative if you just squint and employ a little confirmation bias. The US economy in Q1 2023 was good and we shouldn’t be shy about saying so:

- Nominal GDP rose by 5.1%, continuing a slowing trend that reflects improving inflation figures and continued steady real growth

- Real GDP rose an annualized 1.1% from Q4 2022

- Real final sales to domestic purchasers rose by 3.2%

- Personal consumption expenditures rose 3.7% with goods up 6.5% and services up 2.3%. Durable goods rose by 16.9%, led by autos

- Non-residential investment rose 0.7% but within that category, structures rose by 11.2% (factory construction is booming). Equipment was down but that comes after big up years in 2021 and 2022

- Residential investment fell 4.2% but that was a huge improvement from the last two quarters which saw drops of over 25%

- Exports and imports were both up

And it isn’t hard to see why:

- Disposable personal income rose 12.5%, an acceleration from last quarter’s still large gain of 8.9%. The gain was a combination of higher incomes (mostly wages) and lower personal taxes

- Real disposable personal income (after inflation) rose 8%, up from 5% last quarter

- The savings rate rose from 4% to 4.8%. Annualized savings in the quarter were nearly a trillion dollars

I don’t see how anyone can look at that report and come up with a negative interpretation. This is not the recession you’re looking for.

Our economy is far from perfect. We have, as they say, issues. Inflation is still stubbornly high (and the dollar is falling now which makes that more significant) and companies are starting to exhibit some reluctance to invest. Core capital goods orders were reported down in March, the 4th negative month out of the last 5. They are, however, still well above the pre-COVID trend. The regional Fed manufacturing surveys and the ISM manufacturing reports have been weak, a function of the inventory correction that has just run through the economy. The good news there is that if consumption holds up, production will have to ramp up to meet demand. We are also about to have a fight about the debt ceiling again, which will get resolved eventually but in the meantime provides a great reminder that our government is a dysfunctional mess.

But, right now, despite all those problems and many more, the US economy is pretty darn good no matter what you read on Twitter.

Environment

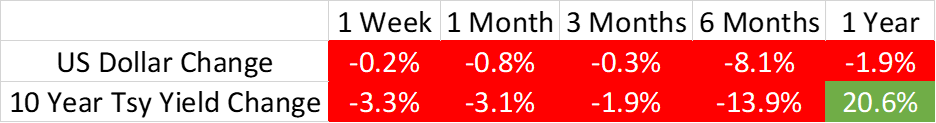

The short-term trends for rates and the dollar are still down. The economic data last week wasn’t really surprising and so we didn’t see much movement in either and certainly nothing that would change the downtrend.

I still think the dollar is due for some kind of rally as sentiment is too negative but even a pretty big drop in the Yen at the end of last week wasn’t enough to juice the buck. There has been widespread anticipation of a Yen rally based on the expectation that the new head of the BOJ would end or at least adjust yield curve control and let interest rates rise. Alas, what everyone expected is not what they got. The bank made no changes to YCC or rates last week and announced a review of their current monetary policy. While that may ultimately mean a phasing out of his predecessor’s policies, the message seemed to be that it wouldn’t be anytime soon.

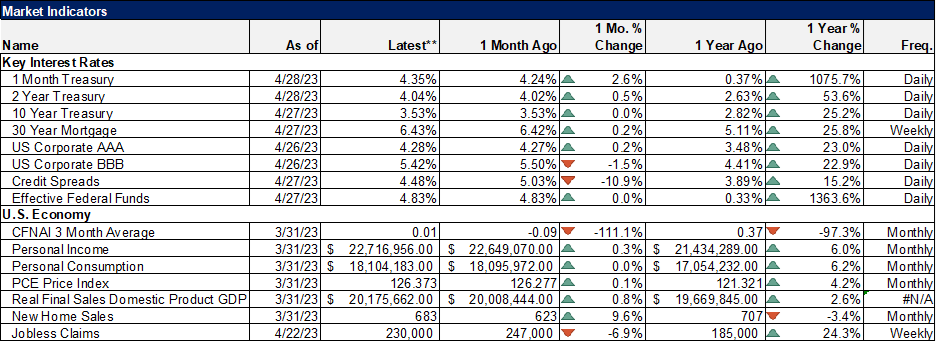

As for rates, another 1/4 point rate hike by the Fed is pretty well baked into the May meeting but the market currently expects that hike to be the last this year. I’m not so sure about that because core inflation is proving pretty sticky but that’s the consensus for now.

Remember how last week all the bears were worried about the drop in the 1-month TBill yield? Yeah, never mind. I don’t know what was depressing the rate but whatever it was it got better last week. The 1-month bill yield jumped nearly a full percent last week, back above 4%. That may be because tax receipts were pretty strong so the drop-dead debt ceiling date probably got pushed out to the end of the summer. Having witnessed more than a few of these debt ceiling debates in my career, I have a hard time getting too worked up about this one. As someone once said:

You can always count on Americans to do the right thing after they’ve tried everything else.

Probably not Winston Churchill but it should have been.

Markets

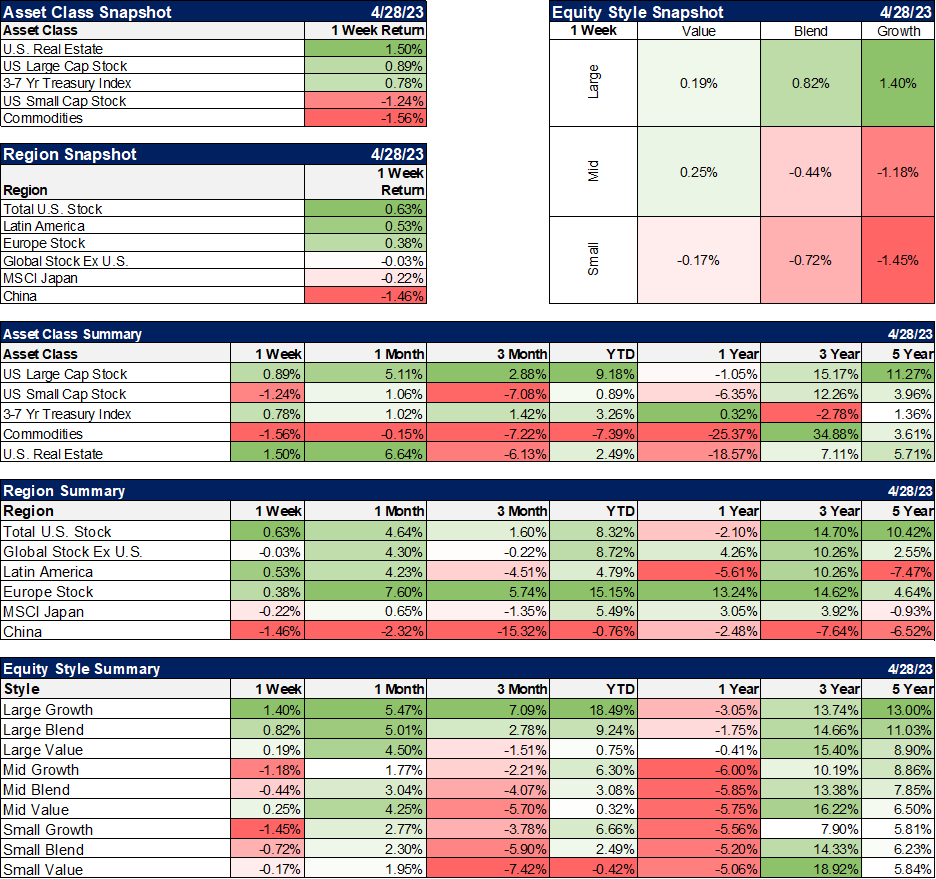

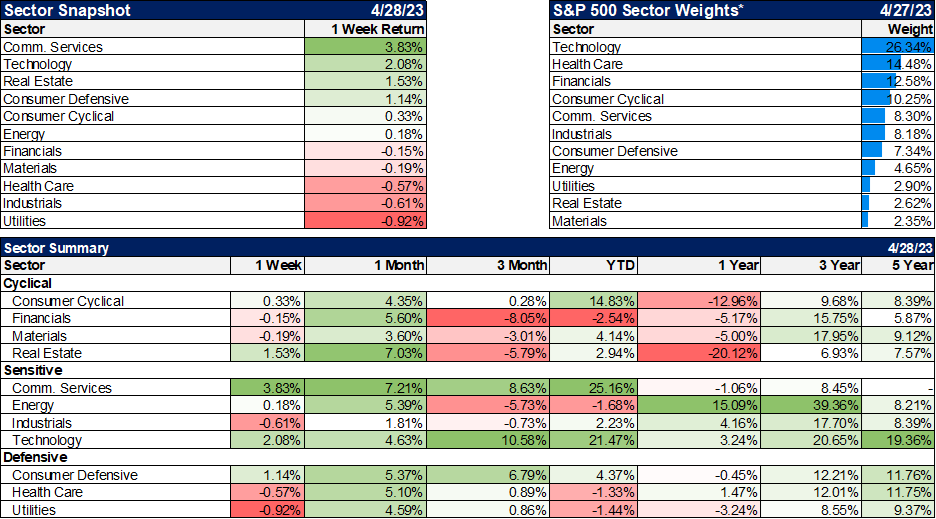

Real estate had another up week and continues its recovery. There are certainly some problems in the commercial real estate space but the selloff in REITs was probably overdone. Yes, there are problems in some office markets but office is a small part of the publicly traded REIT market.

Large-cap stocks were higher but with small-cap down it was a mixed week for equities. Europe and other international markets continue to lead in a weak dollar environment. While I think that may continue to be a good long-term bet, I’d be wary in the short term. As I said above, the dollar looks ready for some kind of rally and a rising dollar is a headwind for non-US dollar investments.

Large-cap growth had another good week and continues to trounce value YTD. Value still leads over the last 1 and 3-year periods. The outperformance of growth appears to be a function of better-than-expected earnings, particularly in tech and communication services (which is tech-heavy). Earnings for the S&P 500 are coming in a lot better than expected so far although they are still down 3.7% from last year (with just over half of companies reporting). Growth still isn’t cheap by any stretch of the imagination but better earnings sure don’t hurt. Earnings for value-oriented sectors are doing well too, though, and so the relative value equation continues to favor value.

Good earnings from Meta buoyed the Communication Services sector and the sector is now up by a quarter this year. Even after that impressive rally, the sector is still down over the last year. REITs continue to lag the field over the last year but have rallied 7% in the last month. If interest rates continue their gentle downtrend, I’d expect that to continue.

The US economy continues to grow at trend with the 3-month average of the CFNAI at 0.01.

In an essay published in 1924, John Maynard Keynes said:

The inactive investor who takes up an obstinate attitude about his holdings and refuses to change his opinion merely because facts and circumstances have changed is the one who in the long run comes to grievous loss.

Successful investing requires, more than anything, an open mind and a good healthy dose of humility. We can’t predict the future and neither can that Twitter guru who sounds so smart. All we can really do is observe and interpret the present. Which isn’t as easy as it sounds and is darn near impossible if you’ve already made up your mind about where things are headed.

The problem with trying to predict is that it locks you into a position where it becomes hard to change your mind. The irony is that being right about the future economy isn’t as much help to an investor as it seems it should. Even if you knew the exact date the next recession would start, it may not help you navigate the market. Sometimes stocks fall well in advance of recession and sometimes they peak right before recession. Sometimes they bottom and start to rise before the end of the recession and sometimes they keep falling well after the end.

Investing, like golf, is not a game of perfect. And trying to be perfect in either usually leads to big mistakes. I played golf with an older gentleman one time who never hit a ball further than about 150 yards but always hit it straight. I was younger, stronger, could hit it farther, and lost by 10 strokes. You have to decide what’s important. Winning in golf, as in investing, is best accomplished by minimizing your mistakes. You probably aren’t going to make that 230-yard shot over the water to that par-five green. And you probably aren’t going to predict when the next recession will start. And you’ll almost certainly be worse off if you try.

It’s better to be approximately right than exactly wrong.

More By This Author:

Weekly Market Pulse: This Too Shall PassWeekly Market Pulse: Much Ado About Not Much

Weekly Market Pulse: History Lessons

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more