The Bond Market Fears Something Worse Than Inflation Is Coming

The bond market is signaling something “BAD” is coming.

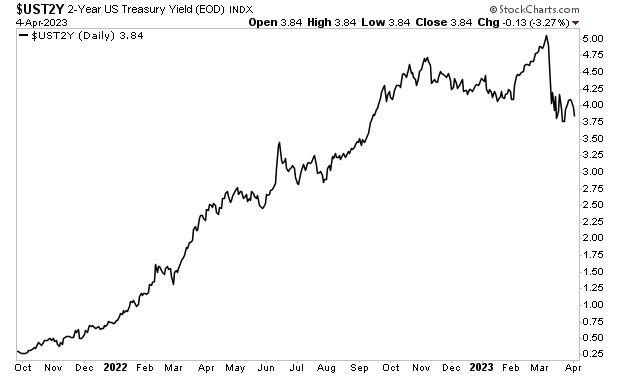

Bond yields rose throughout late 2021-early 2023 on fears of inflation. But once Silicon Valley Bank imploded, yields dropped rapidly: historically investors pile into Treasuries as a “safety trade” whenever things get hairy in the financial system. The regional banking crisis in mid-March was no exception with yields collapsing at their fastest rate since the 1987 crash.

When this happened, I began to wonder… would yields begin to rise again as things normalized following the regional banking bailouts… or would the economy roll over and yields finally start to plunge as a recession took hold?

We now have our answer…

The yield on the 2-Year U.S. Treasury is NOT rising anymore. If anything it’s rolling over and approaching the “Silicon Valley Bank” lows.

This is a signal that something “BAD” is brewing in the economy/ financial system. If everything was fine, yields would be rising again based on hopes of growth and fears of inflation.

Put simply, the fact yields are falling like this tells us that the bond market fears something far worse than inflation is coming…

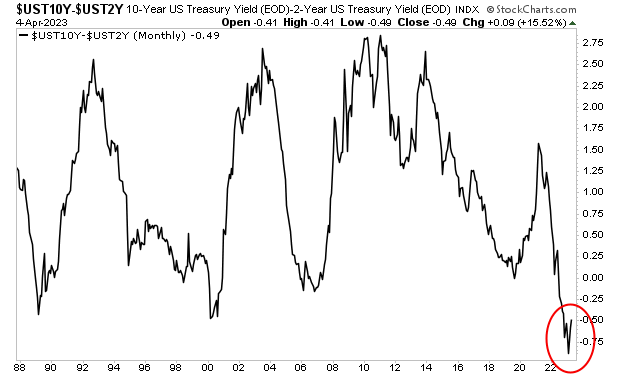

Indeed, the 2s10s are now beginning to invert. Historically, this has been the signal that a recession is about to hit.

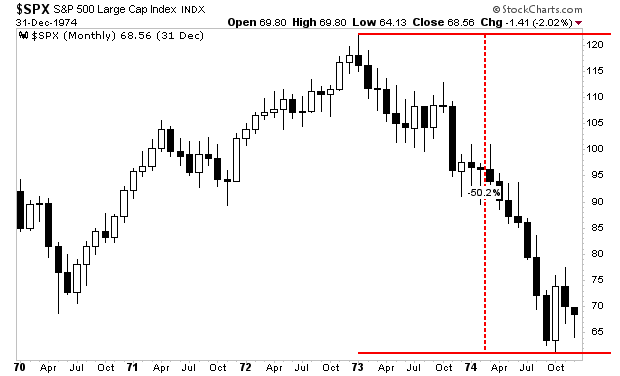

What happens to stocks when a recession hits while inflation is still at 6%?

The 70s showed us…

More By This Author:

What Happens When $400 Billion Isn’t Enough?

Why The Credit Suisse Collapse Is A Big Deal For Banks Going Forward

The Fed Is Back To Printing Money… With Inflation At 6%