Relatively Dovish Bank Of Canada Depressed The Dollar

The cautious decision of the BoC to raise interest rates helped precious metals rise, worsening the USD’s situation. When will investors’ sentiment change?

While weak earnings from Microsoft and Alphabet (Google) sunk the S&P 500 by 0.74% on Oct. 26, gold rallied by 0.68%, silver by 0.71%, the GDX ETF by 2.95%, and the GDXJ ETF by 3.05%.

In addition, the USD Index fell by 1.15% and the U.S. 10-Year real yield rose by one basis point. As a result, while false narratives helped uplift the PMs and depress the dollar basket, 2022 has been full of countertrend moves that ended in disappointment for the risk-on crowd.

Profitless Narratives

With ZeroHedge known to exaggerate meltdown and melt-up scenarios, concern has arisen over the potential for a sharp rise or fall in U.S. Treasury yields. On the one hand, Mark Cabana, Head of U.S. Rates Strategy at Bank of America, warned that a midterm victory for the Democrats could propel interest rates substantially higher. Moreover, “forced selling” could elicit more “stress” in the bond market.

On the other hand, whispers have grown louder about a potential “intervention” in the U.S. Treasury market, which could elicit and rally in bonds and reduce interest rates. In a nutshell: a Fed pivot is on the horizon.

However, please remember that ZeroHedge is a quasi-news organization whose goal is to increase the number of clicks on its website. Therefore, much of the information on ZeroHedge is spun in a way that generates attention but doesn’t reflect fundamental reality. To explain, I wrote on May 25:

With inflation rivaling the 1970s, still increasing month-over-month (MoM), and U.S consumers still eager to spend, a third category of investors enter the equation: the hyper-inflationists. For context, they resemble permabears, but the idea is that the Fed can't stomach a recession, so officials will let inflation rage.

Please see below:

…. A decade of dovish pivots has a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed pivot crowd should suffer profound disappointment as the drama unfolds.

Thus, while ZeroHedge has been screaming about a pivot for many months, positioning for “Powell capitulation” would have resulted in substantial losses.

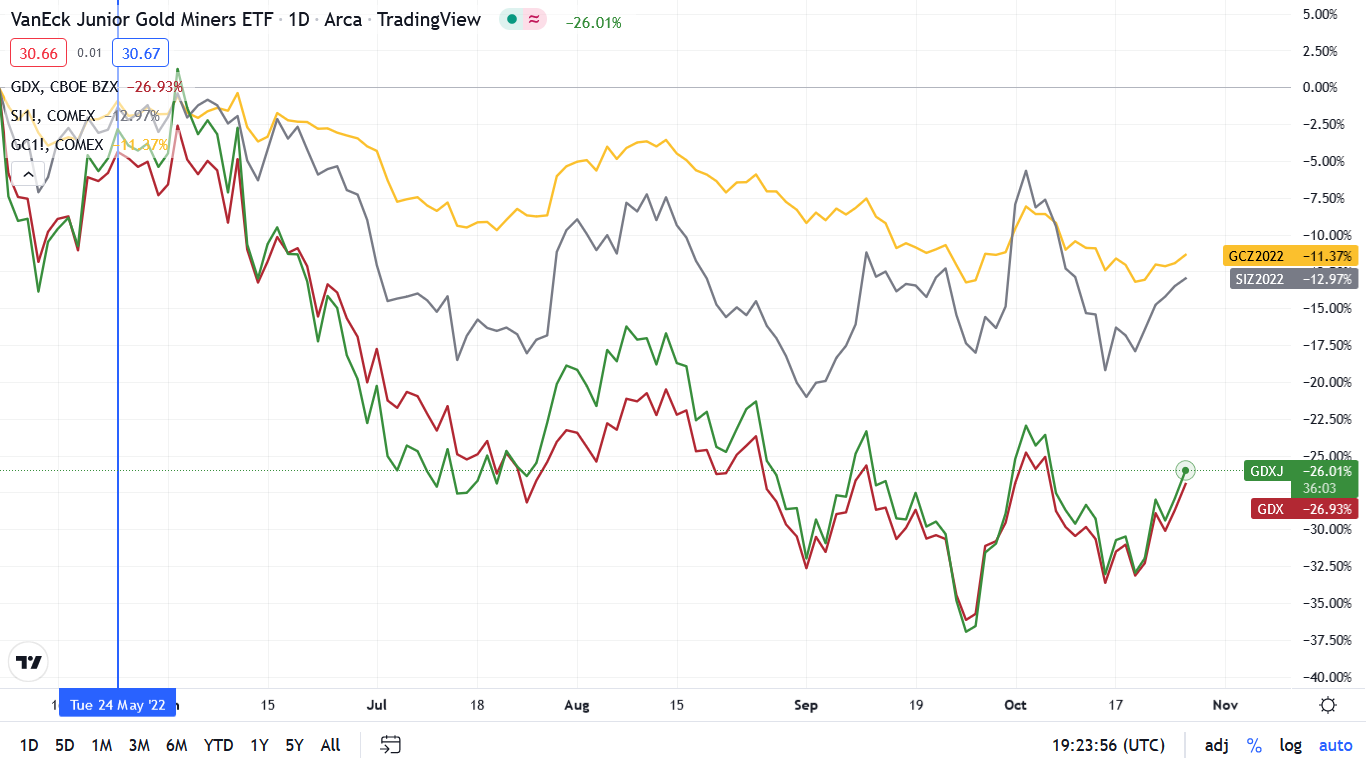

Please see below:

(Click on image to enlarge)

To explain, the gold, silver, red and green lines above track the performance of gold futures, silver futures, the GDX ETF and the GDXJ ETF. As you can see, the PMs have declined materially since ZeroHedge’s May 24th tweet, and mining stocks are down by more than 20%. As a result, please remember that while ZeroHedge’s articles are entertaining, they won’t make you any money.

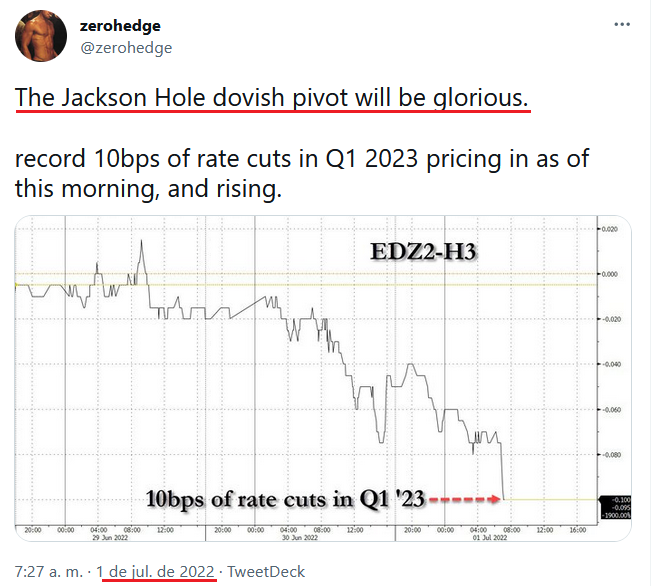

To that point, following ZeroHedge has been the quickest way to the poor house in 2022. For example:

More importantly:

Source: ZeroHedge

So while ZeroHedge has amplified the false pivot narrative for much of 2022, imagine if you had bought the PMs in January. You would have suffered major losses.

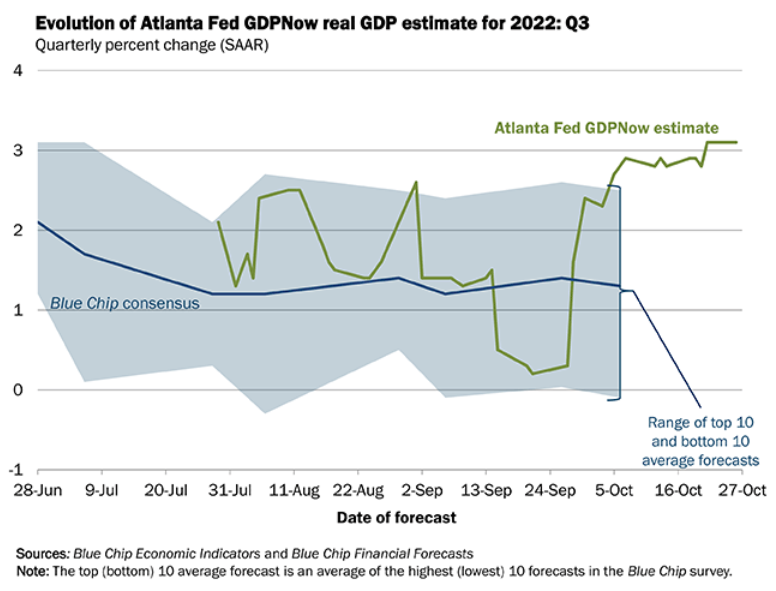

Furthermore, while the site proclaimed that “U.S. GDP growth is now rapidly collapsing” in January, it’s been several months and the Atlanta Fed raised its Q3 real GDP estimate to 3.1% on Oct. 26. Thus, it’s prudent to pay less attention to narratives and more attention to the data

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q3 real GDP growth estimate, while the blue line above tracks the Blue Chip Consensus estimate (investment banks). If you analyze the right side of the chart, you can see that the green line hit a new projection high on Oct. 26. As such, ZeroHedge was, and still is, early in its doomsday prediction.

Turning to Cabana, he also has a history of perpetuating narratives that don’t come to fruition. To explain, I wrote on Oct. 4:

With tales of Treasury market illiquidity resurfacing – which could force the Fed to intervene to avoid a crash in bond prices – it’s important not to assign credibility to individuals that constantly sound the same alarm. Remember, it’s like The Boy Who Cried Wolf. They recycle the same warning, while the wolf only arrives 1% of the time.

Please see below:

Source: Axios

To explain, the screenshot above is from an article written on Nov. 17, 2021. Here is the link if you want to read it: https://www.axios.com/2021/11/17/treasury-market-stress-signs-regulators

As you can see, Cabana said the same thing nearly a year ago. Moreover, the U.S. 10-Year Treasury yield ended the Nov. 17, 2021 session at 1.59%, while the GDXJ ETF closed at $47.38. So if you positioned for Cabana's warning back then, you would have lost a lot of money buying the U.S. 10-Year Treasury Note and the junior miners' index.

All in all, the moral of the story is to scrutinize where the information comes from; and while ZeroHedge has useful data, its analysis is biased. Therefore, if you take its conclusions at face value, you may be disappointed with the results.

What’s Wrong With the USD Index?

With the USD Index declining sharply on Oct. 26, the dollar basket has suffered in recent days. Furthermore, with risk-on currencies like the EUR, the GBP, and the CAD rallying, the greenback has hit a rough patch.

But while the weakness is bullish for gold, silver, and mining stocks, the underperformance is unlikely to last. For example, the Bank of Canada (BoC) raised its overnight lending rate by 50 basis points on Oct. 26. Now, the move was relatively dovish, as market participants largely expected a 75 basis point rate hike.

Likewise, with the BoC and the Fed often following in each other’s footsteps, the odds of a 75 basis point rate hike by the latter in December retreated on Oct. 26:

Please see below:

Source: Bloomberg/ZeroHedge

However, the BoC’s official statement read:

“Given elevated inflation and inflation expectations, as well as ongoing demand pressures in the economy, the Governing Council expects that the policy interest rate will need to rise further.”

Yet, BoC Governor Tiff Macklem (Canada’s Jerome Powell) said during his press conference:

“If we don’t do enough, Canadians will continue to endure the hardship of high inflation; and they will come to expect persistently high inflation, which will require much higher interest rates and potentially a severe recession to control inflation. Nobody wants that.

“If we do too much, we could slow the economy more than needed; and we know that has harmful consequences for people’s ability to service their debts, for their jobs and for their businesses.

“This tightening phase will draw to a close. We are getting closer, but we are not there yet.”

Thus, the last statement was music to the bulls' ears. With Macklem hinting that the BoC is "getting closer" to the end of its rate hike cycle, the crowd surmised that the Fed could be on a similar path. As a result, the buy bonds, sell the dollar trade materialized on Oct. 26, as pivot hopes intensified.

However, the BoC made a mistake. With the central bank essentially green-lighting a risk rally, the error will only cause more inflationary problems in the months ahead. As such, the BoC wants to rein in inflation without slowing the Canadian economy "more than needed."

In reality, the prospect is unrealistic and is doomed to fail. To quell inflation, the BoC needs to commit to higher interest rates, as a half-hearted attempt will lead the central bank to fail at both initiatives. So while the Fed may attempt a similar feat, it will only lead to more problems down the road. Overall, the BoC essentially performed a "transitory" part two on Oct. 26.

To that point, while the developments were bearish for the USD Index, support could be around the corner.

Please see below:

(Click on image to enlarge)

To explain, the candlestick chart above tracks the USD Index, while the black line at the top tracks its 75-day moving average. If you analyze the relationship, you can see that the 75-day MA has provided material support for the last ~16 months. Likewise, it roughly marked the bottom during the July/August pullback.

As a result, with the level fast approaching, it should help the greenback regain its footing. In addition, the USD Index’s daily RSI (the red line at the bottom) is near the levels that coincided with reversals over the last ~16 months. Thus, we may witness a comeback sooner rather than later.

Also noteworthy, Europe and Britain face worse growth-inflation dynamics than the U.S., so while sentiment has shifted, the fundamentals support a weaker EUR/USD and GBP/USD; and with Japan still implementing QE to suppress interest rates, the USD/JPY should have more upside. Therefore, the fundamentals support a stronger USD Index in the months ahead.

The Bottom Line

While gold, silver, and mining stocks rallied on Oct. 26, investors are following the same losing playbook that has plagued them throughout 2022. Each time a dovish pivot is anticipated, the crowd believes the worst is in the rearview. However, you can’t reverse engineer a stable economy. With inflation still unanchored, a deceleration in rate hikes only makes a bad situation worse. So while investors may assume that cautious central banks are bullish, they’ll realize later that the policy stances create more problems than they solve.

Remember, when the Fed and the BoC called inflation “transitory” in 2021, investors happily bought into the narrative. Yet, that decision wasn’t so wise when the bear market arrived in 2022. As such, we see this as another iteration of the same mistake and expect gold, silver, and mining stocks to hit lower lows before long-term buying opportunities emerge.

In conclusion, the PMs rallied on Oct. 26, as the BoC helped uplift sentiment. However, while the USD Index often suffers when false narratives occur, it has pulled back and then ascended to new highs several times in 2022. As a result, a similar outcome should occur over the medium term.

More By This Author:

Will Gold Stocks Manage To Ignore The S&P 500’s Volatility?

Gold Didn’t Need Any Special Boost To Reach The New Low

Despite The Rally, Is The Future Of Gold Only Bearish?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more