Will Gold Stocks Manage To Ignore The S&P 500’s Volatility?

Gold, silver, and mining stocks rallied, but with higher interest rates triggering volatility, the outlook for the precious metals market remains bearish.

Introduction

Despite the S&P 500’s 0.80% decline on Oct. 20, gold rallied by 0.16%, silver by 1.80%, the GDX ETF by 1.27%, and the GDXJ ETF by 1.48%. Moreover, the USD Index traded 0.05% lower, while the U.S. 10-Year real yield ended the day flat. Thus, while volatility remains uplifted amid the rise in interest rates, the PMs’ bearish medium-term technical and fundamental outlooks are unchanged.

Rising Rates

While the S&P 500 suffered a sharp intraday reversal on Oct. 20, gold, silver, and mining stocks ended the day in the green. However, with rising interest rates poised to inflict more pain on risk assets, their relative strength should fade in the weeks and months ahead.

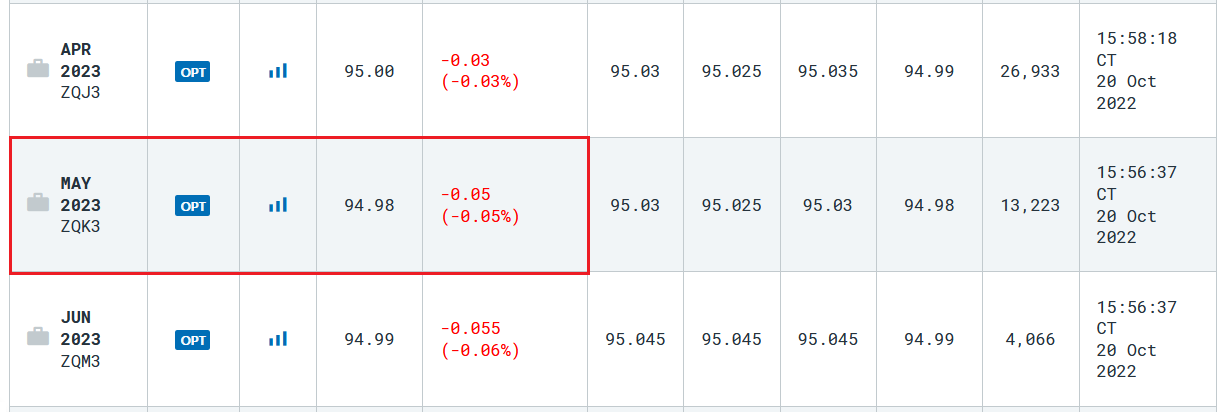

Please see below:

Source: Investing.com

To explain, yields jumped once again, and the U.S. 10-Year Treasury yield closed at another 2022 high. But with the USD Index and the U.S. 10-Year real yield remaining roughly flat, the ramifications were largely neutral for the PMs. Yet, with the real yield benchmark still at a decade-plus high, the USD Index and the U.S. 10-Year real yield should seek higher ground in the months ahead.

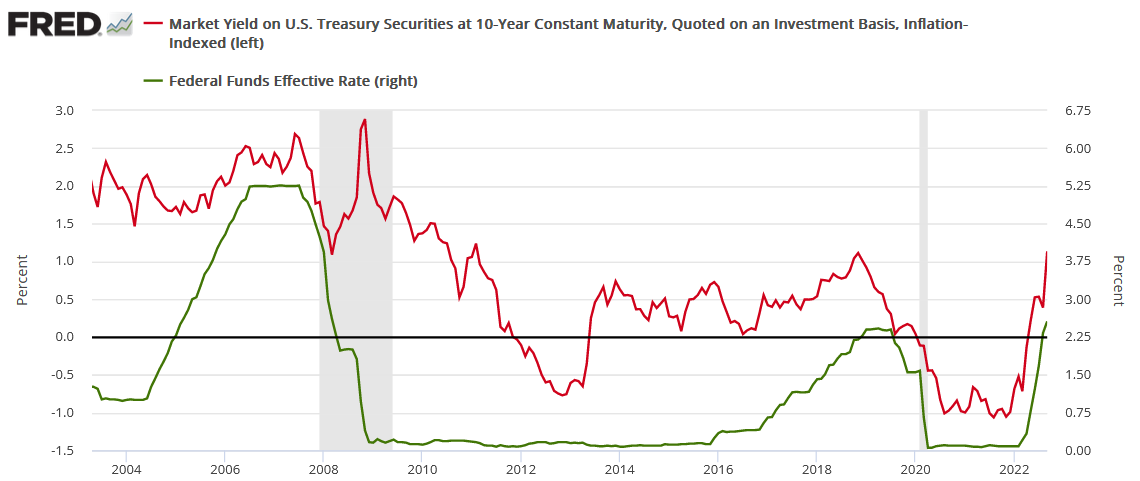

Please see below:

In addition, while the consensus assumed that a ~3% U.S. federal funds rate (FFR) would be enough to curb the highest inflation in 40+ years, I warned throughout 2021 and 2022 that the prospect was extremely unrealistic. Furthermore, with expectations shifting substantially in only a few months, the reality check should pressure the PMs over the medium term. To explain, I wrote on Aug. 1:

While the consensus assumes the Fed is near the end of its rate hike cycle, the Consumer Price Index (CPI) is on the fast track to 2% and a 3% FFR will be enough to capsize inflation, market participants are living in fantasy land.

For example, I’ve warned on numerous occasions that demand is much stronger than the consensus realizes. With Americans’ checking account balances at unprecedented all-time highs and the Atlanta Fed’s wage growth tracker hitting an all-time high in June, the FFR needs to go meaningfully above 3%. To explain, I wrote on Jul. 25:

With more earnings calls showcasing how the situation continues to worsen, market participants don’t realize that the U.S. federal funds rate needs to hit ~4.5% or more for the Fed to materially reduce inflation. For context, the consensus expects a figure in the 2.5% to 3.5% range.

However, a major milestone materialized on Oct. 20, as the dovish pivot crowd suffered a painful death.

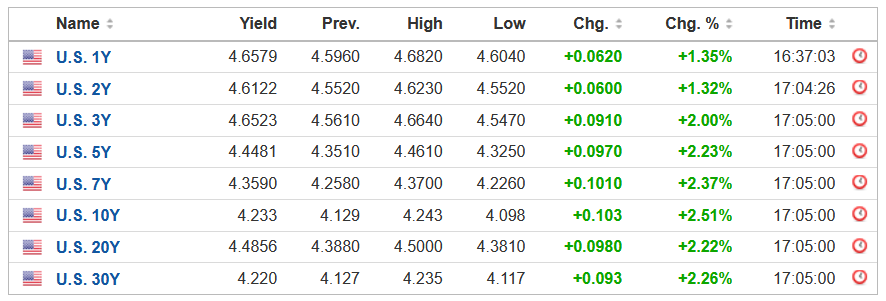

Please see below:

Source: CME Group

To explain, the table above tracks the peak FFR implied by the futures market, and the rate is calculated by subtracting the last price from 100. If you analyze the red rectangle, you can see that futures traders expect a peak FFR of 5.02%. Moreover, it’s the first time in 2022 that rate hike expectations have hit 5% or more, and the crowd is now firmly aligned with our estimate of 4.5% to 5.5% in 2023.

As a result, the fundamentals continue to unfold as expected, and the liquidity drain is profoundly bearish for gold, silver, mining stocks and the S&P 500.

To that point, while stocks were up for most of the morning, Fed officials’ hawkish rhetoric poured cold water on the celebration. For example, Philadelphia Fed President Patrick Harker said on Oct. 20:

“Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work. It will take a while for the higher cost of capital to work its way through the economy. After that, if we have to, we can tighten further, based on the data.”

Thus, with “sometime” still well into the future, the Fed has plenty of room to lift the FFR.

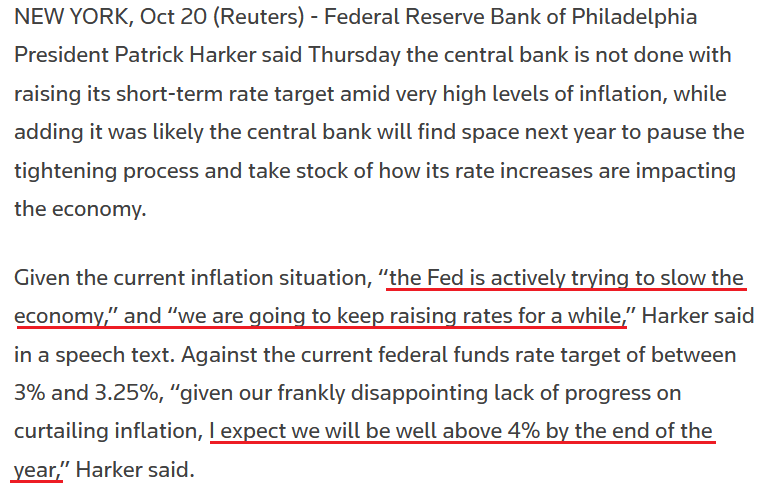

Please see below:

Source: Reuters

Similarly, Fed Governor Lisa Cook said on Oct. 20:

“Inflation is too high; it must come down and we will keep at it until the job is done. This likely will require ongoing rate hikes and then keeping policy restrictive for some time (…). Policy must be based on whether we see inflation actually falling in the data, rather than just in forecasts. Policy should remain focused on restoring price stability, which will also set the foundation for a sustainably strong labor market.”

So with Fed officials reiterating their commitment to normalizing inflation, I warned on Apr. 6 that the bulls were fighting a losing battle. I wrote:

Please remember that the Fed needs to slow the U.S. economy to calm inflation, and rising asset prices are mutually exclusive to this goal. Therefore, officials should keep hammering the financial markets until investors finally get the message.

Moreover, with the Fed in inflation-fighting mode and reformed doves warning that the U.S. economy “could teeter” as the drama unfolds, the reality is that there is no easy solution to the Fed’s problem. To calm inflation, it has to kill demand. As that occurs, investors should suffer a severe crisis of confidence.

Furthermore, with Harker making the point for me when he said, “the Fed is actively trying to slow the economy,” there is no more confusion; and while the S&P 500 and the PMs have declined substantially since Apr. 6, their medium-term lows are likely still on the horizon.

To explain, I wrote on Oct. 7:

The U.S. 10-Year real yield often peaks alongside the FFR (or near it). As a result, with the Fed poised to raise the FFR by at least another 1.25% (to reach 4.5%), the U.S. 10-Year real yield should have more room to run, which is bullish for the USD Index.

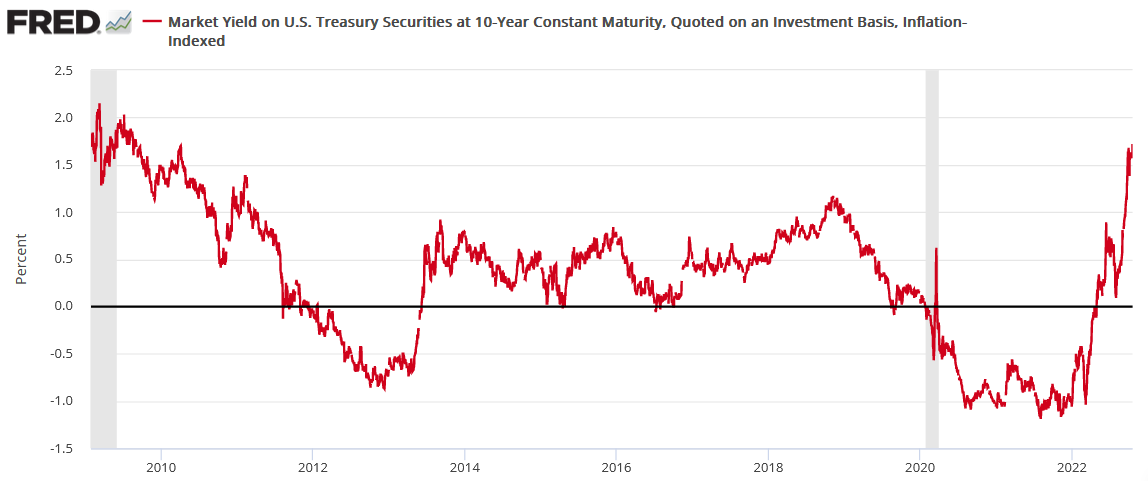

Please see below:

To explain, the red line above tracks the U.S. 10-Year real yield, while the green line above tracks the FFR. As you can see, a higher FFR supports higher real interest rates. Also, when the FFR hit ~4.5% in February 2006, the U.S. 10-Year real yield reached a monthly high of 2.14%, and it occurred with a YoY CPI at roughly half the current rate.

So with the latter ending the Oct. 6 session at 1.54%, there is still plenty of potential upside over the medium term. As such, the outlook is bullish for the U.S. 10-Year real yield and the USD Index, and the PMs should suffer as interest rates normalize to more appropriate levels.

To that point, the U.S. 10-Year real yield ended the Oct. 20 session at 1.74%, and there is still room to run; and if the FFR exceeds the February 2006 reading of ~4.5% (remember, 5.02% is now priced in), the U.S. 10-Year real yield could surpass its February 2006 high of 2.14%.

Thus, risk assets remain in a precarious position, and the PMs shouldn’t bottom until the medium-term technicals turn bullish, the Fed turns dovish, and the USD Index and the U.S. 10-Year real yield show weakness.

Hawkish PMIs

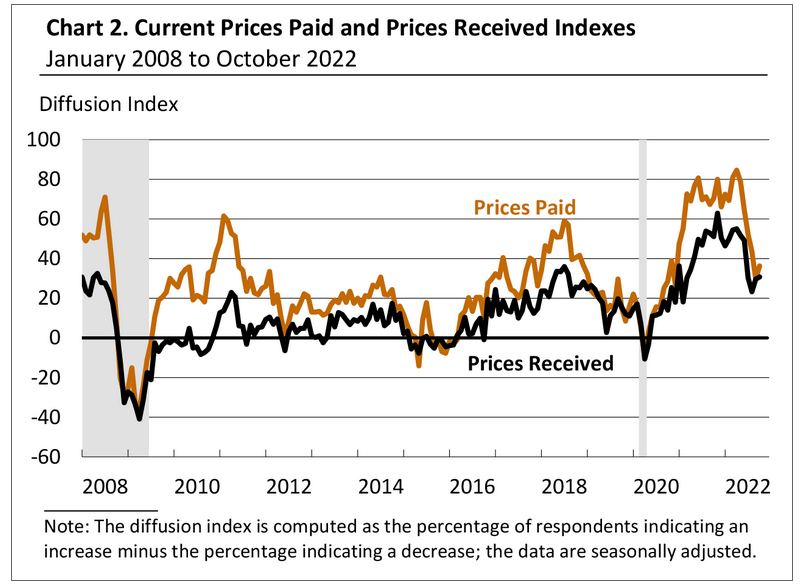

The Philadelphia Fed released its Manufacturing Business Outlook Survey on Oct. 20; and while the headline index increased from -9.7 to -8.7, it remains relatively weak. However, the report stated:

“The indicators for prices paid and prices received rose modestly this month following steady declines through the summer. The prices paid index – which had fallen 55 points between April and September of this year – rose 7 points to 36.3. The current prices received index edged up 1 point to 30.8.”

Therefore, while some progress is present, the price indexes increased again in October.

Please see below:

Source: Philadelphia Fed

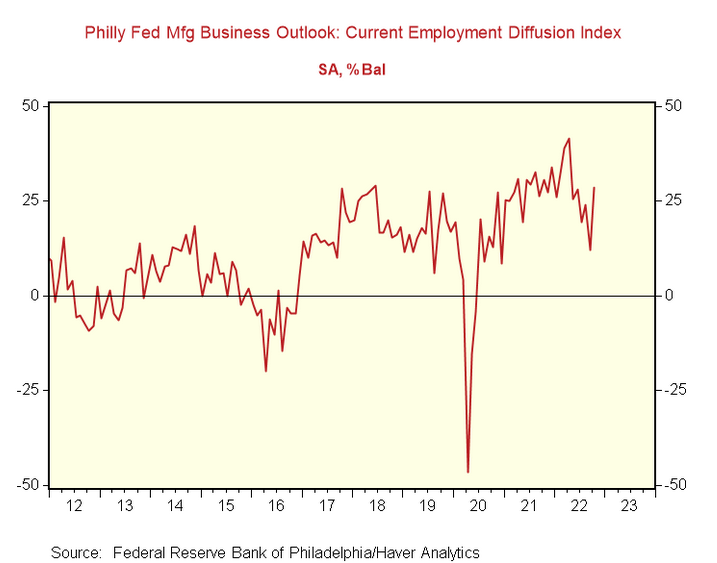

More importantly, I’ve noted recently how the U.S. labor market has become the most important fundamental variable. In a nutshell: even if inflation has peaked, it’s too high for the Fed to relax. As a result, unless employment collapses, the Fed should keep its foot on the hawkish accelerator.

Likewise, with the Philadelphia Fed’s report highlighting further job gains, the Fed has the green light to hammer inflation. An excerpt read:

“Firms continued to report increases in employment on balance. The employment index rose from 12.0 to 28.5 this month, more than offsetting its decline from last month. The average workweek index returned to positive territory, rising 14 points to 10.4.”

Please see below:

To explain, the red line above tracks the Philadelphia Fed’s employment index. If you analyze the right side of the chart, you can see that the metric is nowhere near crisis levels, and a higher FFR should materialize as the U.S. labor market remains on solid footing.

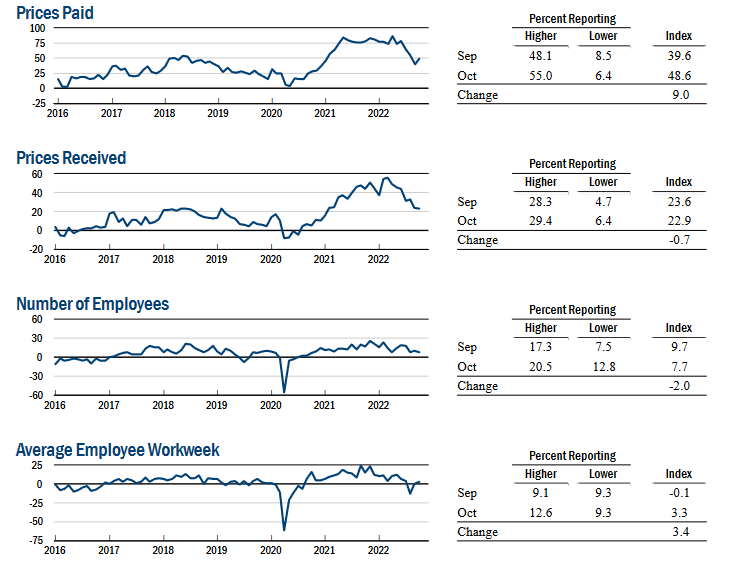

Finally, the New York Fed released its Empire State Manufacturing Survey on Oct. 17. The headline index declined from -1.1 to -9.1. However, the report revealed:

“After falling significantly over the prior three months, the prices paid index rose nine points to 48.6. The prices received index held steady at 22.9.”

In addition:

“The index for number of employees was little changed at 7.7, pointing to a modest increase in employment levels, and the average workweek index climbed to 3.3, signaling a slight increase in hours worked.”

Thus, with inflation and employment still moving in hawkish directions, a higher FFR, higher real yields, and a stronger USD Index are profoundly bearish for the PMs.

Source: New York Fed

The Bottom Line

With higher interest rates stifling the S&P 500, even bullish seasonality coupled with contrarian positioning and sentiment metrics couldn’t help the index hold its daily gain. Therefore, while its performance is more of a wild card in the weeks ahead, the GDXJ ETF should remain a relative underperformer as the months progress.

In conclusion, the PMs rallied on Oct. 20, as they sidestepped the S&P 500’s volatility. However, while their daily optimism was aided by a flat USD Index and U.S. 10-Year real yield, both should hit new highs over the medium term. As such, the PMs will likely confront more downside before long-term buying opportunities emerge.

More By This Author:

Gold Didn’t Need Any Special Boost To Reach The New Low

Despite The Rally, Is The Future Of Gold Only Bearish?

Gold, Silver, And Mining Stocks Leave No Room For Bullish Hopes

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more