Gold, Silver, And Mining Stocks Leave No Room For Bullish Hopes

Precious metals have probably resumed their medium-term downward trend. Are they ready to hit new lows?

Gold, silver, and miners all declined heavily on Friday, and the medium-term decline appears to be back.

This means that practically everything that I wrote previously has either already become a reality or remains up-to-date as a forecast. Consequently, the technical part of today’s analysis will be rather brief – I have very little new to add to Friday’s big analysis.

(Click on image to enlarge)

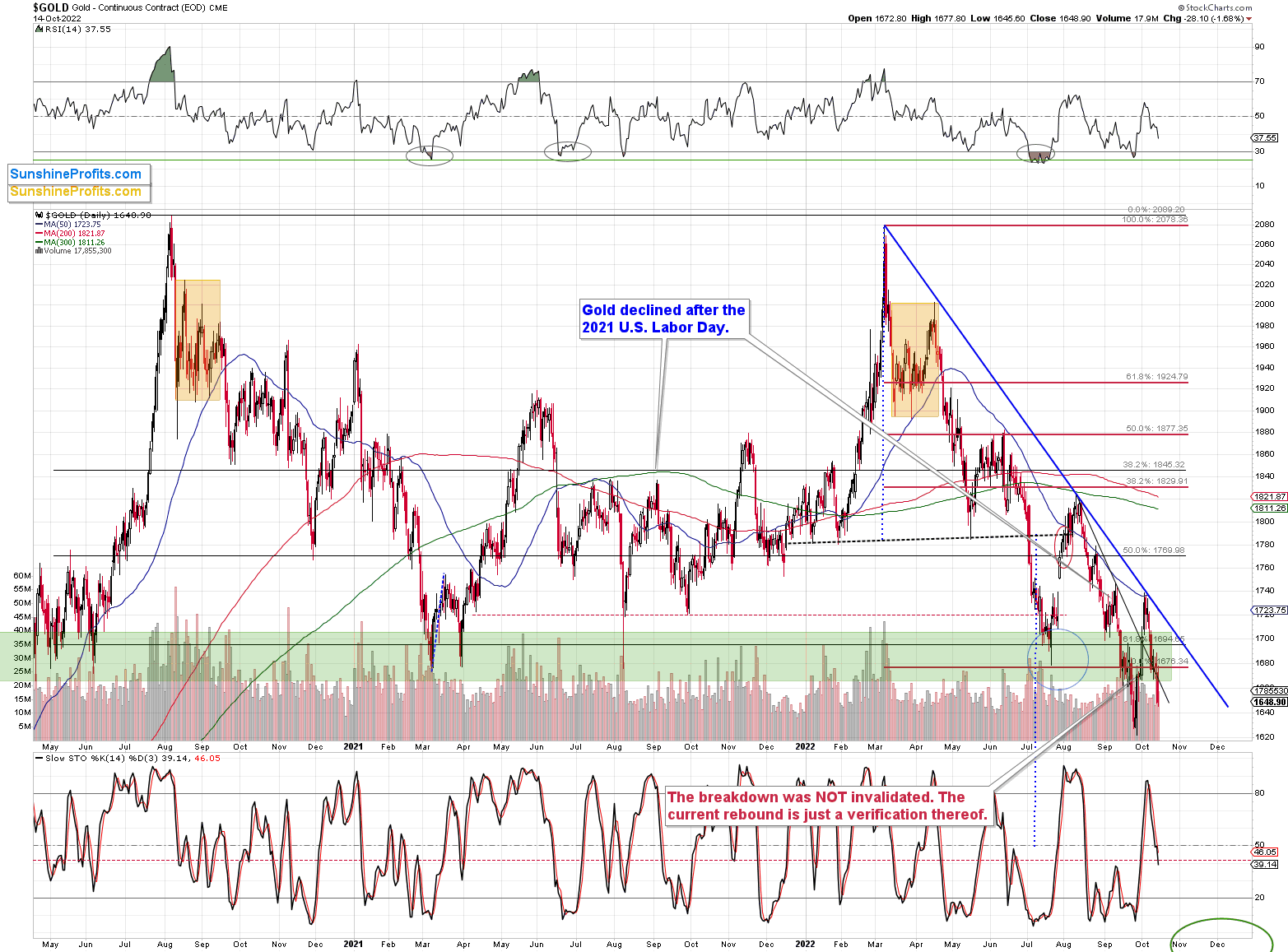

Gold is down, and it’s once again visibly below the green support area. Even though gold moved very briefly above it, one can say that overall, this area worked as resistance.

This means that gold can, and is now likely to fall further.

(Click on image to enlarge)

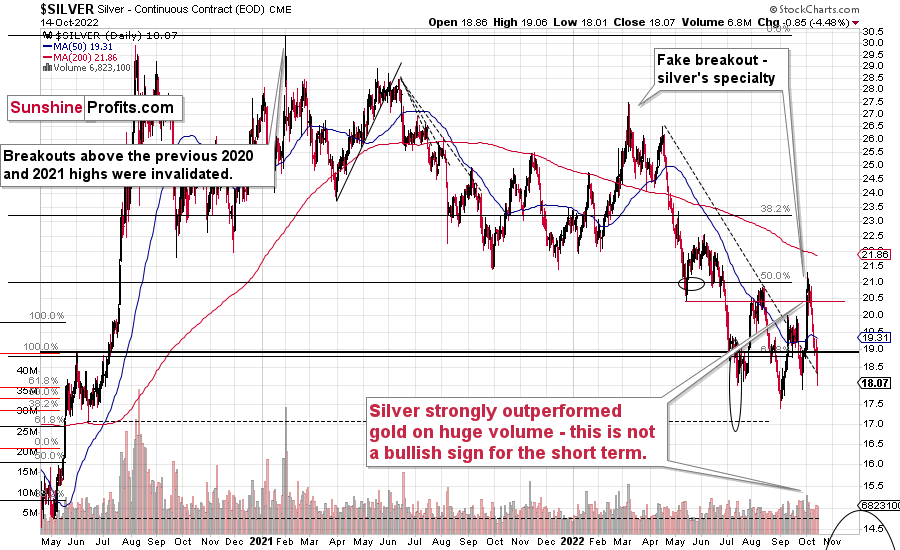

Just like gold, silver declined strongly, and permabulls’ dream of silver’s immediate comeback appears to have been crushed. Last week’s close was the second lowest weekly close that we have seen this year.

The back-and-forth trading pattern that started in July could be viewed as a flag pattern, and the moves that follow flags (which is a continuation pattern on its own) tend to be similar to the moves that preceded them.

In this case, the move that preceded the pattern was a big ~$10 decline, so it seems that silver is about to slide profoundly. It might not be a $10 move lower in this case, as the moves could be similar in percentage terms but not in dollar terms. Still, silver is likely to fall significantly before it bottoms.

(Click on image to enlarge)

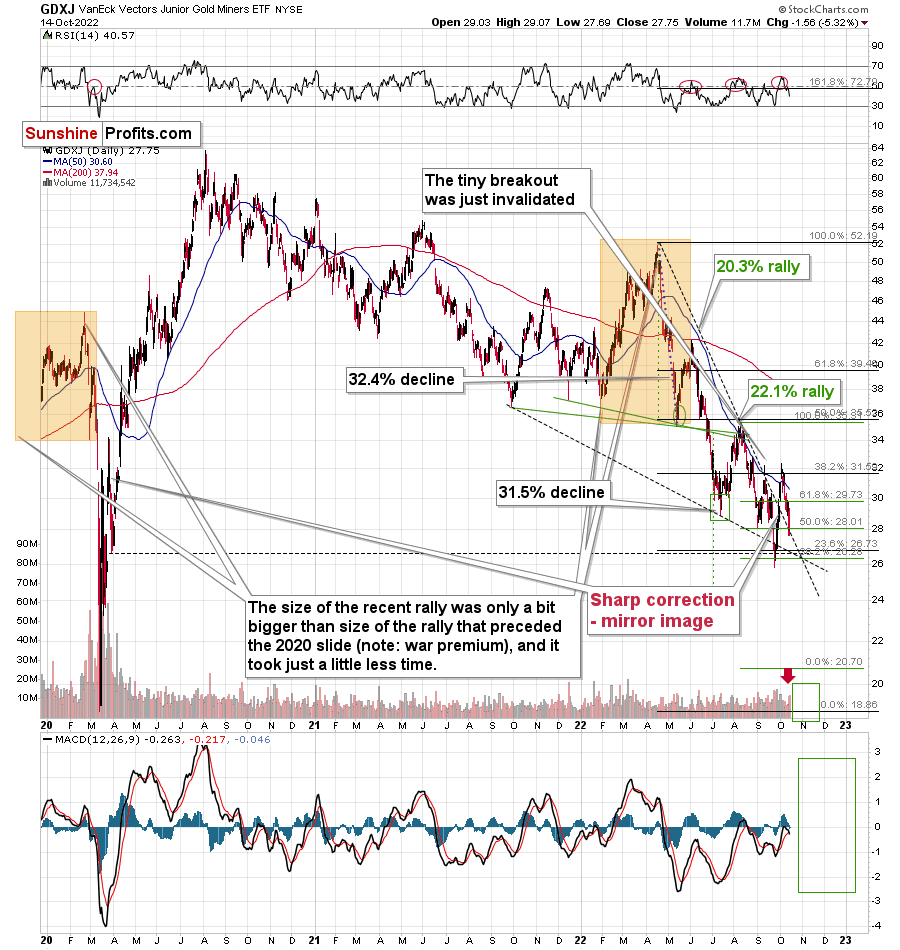

The decline in junior miners is clearly visible as well, and now there’s little doubt about the fake nature of the recent upswing.

The GDXJ ETF is not yet at new yearly lows, but it seems likely that when it moves to new lows (which means a breakdown below the support at about $26), it will decline very fast.

The reason is the lack of strong support between $26 and the 2020 low that’s just below $20.

(Click on image to enlarge)

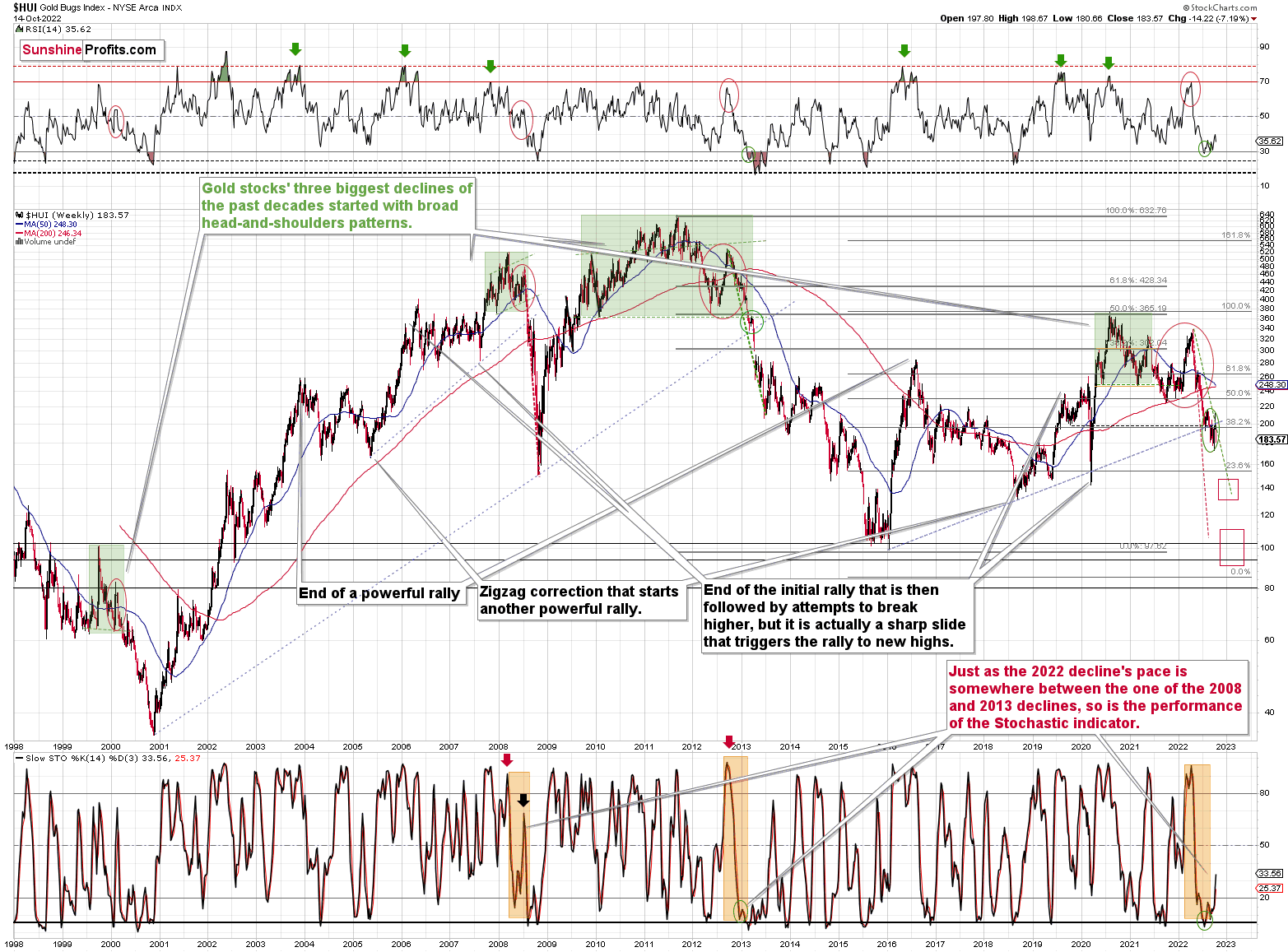

From the long-term point of view, it’s crystal-clear that gold stocks broke below the rising medium-term support line and they verified this breakdown.

After the same thing happened in 2008 and 2013, a huge decline followed.

The implications are extremely bearish, and while I can’t promise anything regarding performance, it seems that profits on our short position in junior miners will increase substantially.

More By This Author:

Gold And The Dollar Went In Opposite Directions Again

Gold Is Below $1,700 Again; Will It Repeat Its Fall To $1400?

With The USDX Rallying Again, Are Lower Gold Prices In Sight?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

So we are going lot lower..??? gold at 1500s.