Gold And The Dollar Went In Opposite Directions Again

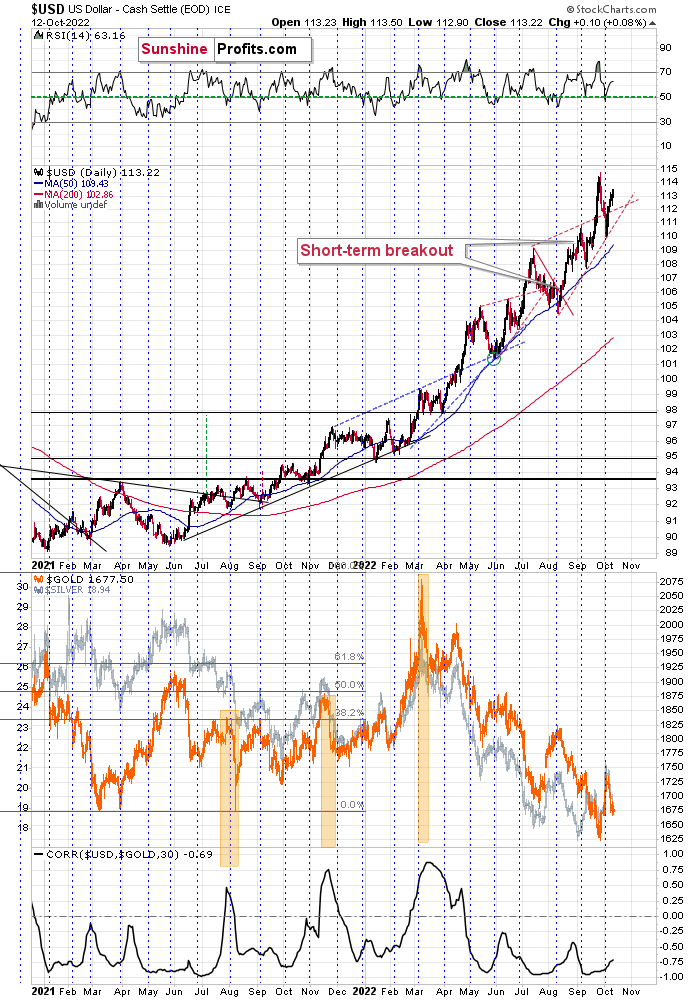

The situation in the precious metals market remains bearish, as expected. In contrast, the dollar index resumed its rally after the breakout was confirmed.

The stock market declined only slightly yesterday, so everything that I wrote about it and about the implications of the situation remains up-to-date [quote is unchanged, but I’m uploading new charts]:

We’re almost there.

We’re almost at the point where stock market investors give up and let the big plunge unfold. I wrote about the link between the general stock market and the precious metals market previously, but as a quick reminder, they are likely to decline together, at least initially, and junior mining stocks are likely to feel the biggest pain.

For broader context, please take a look at the analysis from Oct. 10, if you haven’t had the chance to do so yet.

If you’re familiar with it, let’s take a closer look at the S&P 500 futures.

Even though it might not be clear at first sight, stocks actually made a new yearly low yesterday, which, of course, is something important.

They moved back up in today’s pre-market trading, but the breakdown could really be confirmed this time. We already saw a corrective rally earlier this month, and it failed to ignite a trend reversal. It's no surprise that interest rates are rising and inflation has yet to abate. History shows that rates need to climb much higher for that to happen.

Anyway, if stocks decline further soon – and that appears likely – they will then break below the neck level of the head-and-shoulder formation that started in mid-June. Based on this formation, stocks are likely to move much lower – approximately repeating their August-September decline.

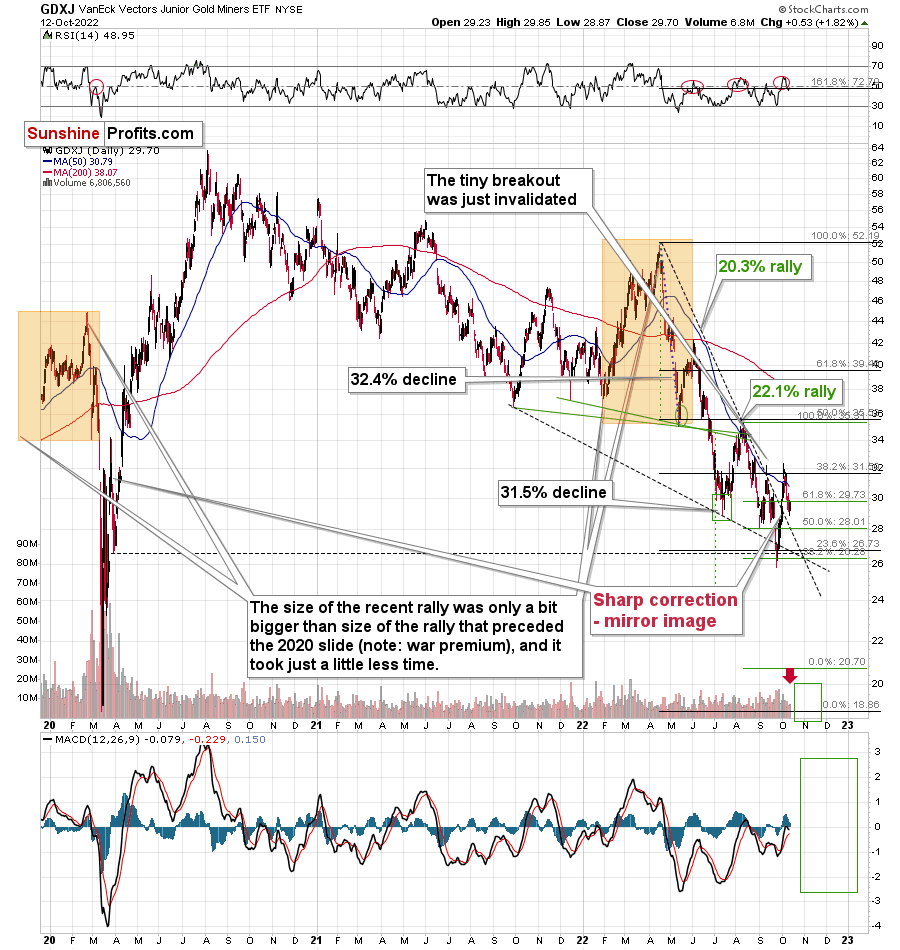

What if junior mining stocks also repeat their August-September decline?

Well, then they would be likely to fall significantly – to $22-24.

However, based on the link to 2013, and based on where the strong support levels are (there aren’t any really strong support levels between ~$26 and the 2020 lows), the GDXJ is likely to decline even more.

The GDXJ ETF ended yesterday’s session slightly higher, but please note that this move up materialized on low volume. This tells us that it’s just a pause within the decline.

So, all in all, my previous bearish comments on gold, silver, and mining stocks remain up-to-date, and there’s little new that I can add today that I haven’t already written about in recent days. Before moving to the fundamentals, I’d like you to take a look at the below USD Index chart, and appreciate how perfectly the monthly turning point worked recently.

On Oct. 3, I wrote the following:

Nothing changed in the USD Index – it just verified the breakout above its rising support/resistance line. It declined close to the turn of the month, which is when it tends to reverse its course.

As the breakout held, the outlook for the U.S. dollar remains bullish, and given the above-mentioned monthly seasonality for the dollar, it seems that the rally is likely to resume any day now.

Indeed, the USD Index’s rally resumed just a few days later.

More By This Author:

Gold Is Below $1,700 Again; Will It Repeat Its Fall To $1400?With The USDX Rallying Again, Are Lower Gold Prices In Sight?

Gold Continues To Rise, Fueled By Bullish Sentiment

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

Excellent analysis as usual.