Gold Is Below $1,700 Again; Will It Repeat Its Fall To $1400?

The current situation of gold and its behavior in 2013 share many bearish analogies. Is the yellow metal only halfway through its massive collapse?

A Decade Ago

After we posted last week’s gold price forecast, gold, silver, and mining stocks declined in tune with the analysis. Is the rally over?

Let’s start by taking a closer look at gold.

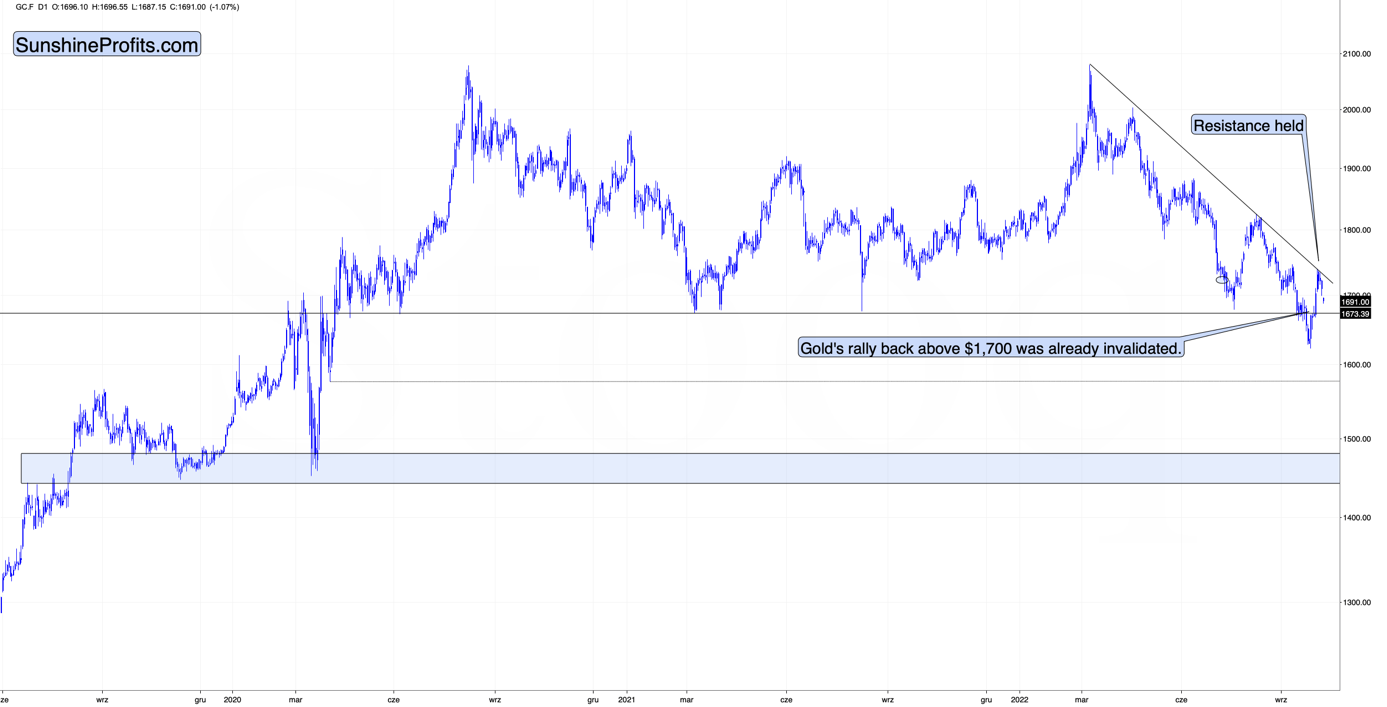

(Click on image to enlarge)

Gold declined after touching its declining, medium-term resistance line, and at the moment of writing these words it’s trading at about $1,690 – visibly below the important $1,700 level.

This means that the attempt to break above this level failed.

It’s bearish on its own, but it’s much more so when you compare the current situation to what happened in April 2013 at the analogous moment.

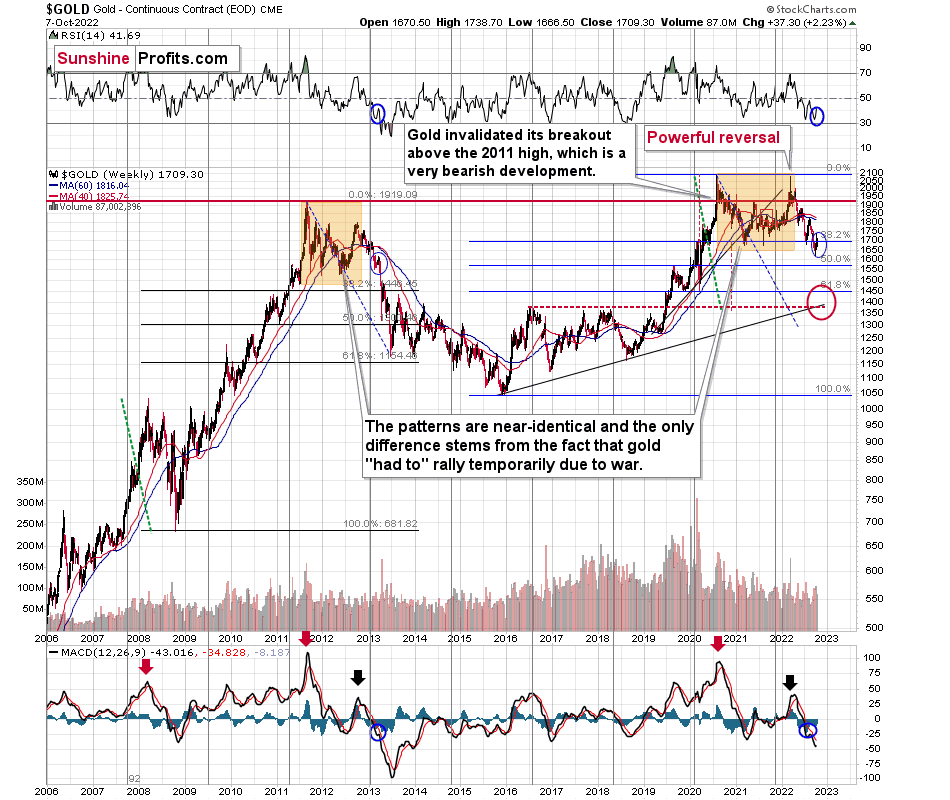

(Click on image to enlarge)

I’ve been writing about this important analogy for months, but if you haven’t read my previous analyses, please focus on the orange rectangles on the above chart – how the price behaved and what happened in the RSI and MACD indicators. The situations are near-perfectly aligned.

If you were monitoring the gold market back in April 2013, you might remember the overall feeling among gold investors and traders when gold rallied from the 2012 lows. Practically everyone and their brother were convinced that the bottom in gold is really in, and that it was about to soar to new highs.

Sort of like what we experienced recently.

However, it wasn’t the bottom. It wasn’t even the mid-point of the entire medium-term decline.

Sure, history doesn’t have to repeat itself to the letter, and the geopolitical and monetary situation now is different than it was back in 2013, but… Fear and greed work in the same way, and when people try to forecast the future by looking at previous price patterns (very few people look at the big picture; most just focus on the last year or so), they ultimately follow a similar emotional process. This leads them to repeat their past behaviors and, as a result, the price patterns continue to be similar.

Where Is the Line?

Actually, the situation regarding monetary policy now supports even a more profound slide than it did back in 2013. Still, due to geopolitics, the decline could be “only” similar to what we saw back then.

There’s very strong support just a bit below $1,400, and the decline to this level (approximately) would be in tune with the size of the 2011-2013 decline.

Can gold really slide that low? Absolutely.

Will it slide there immediately? There’s a good chance we’ll have some sort of correction in the meantime, and one of them might be tradable. The rebound from the 2020 lows seems quite likely at the moment, but I’ll keep monitoring the situation and report to my subscribers accordingly. I’ll also describe which part of the precious metals sector is likely to benefit the most from this decline. At this time, it seems that junior mining stocks are likely to decline the most (as they have so far this year), but this might change as prices move lower.

Either way, the short- and medium-term outlooks for gold are bearish.

More By This Author:

With The USDX Rallying Again, Are Lower Gold Prices In Sight?Gold Continues To Rise, Fueled By Bullish Sentiment

What Factors Do Not Support The Fed’s Dovish Pivot?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

The vorrection on gold is not always for the same reason.

In 2013, it was a correction because it wrnt too high, and quick.

We got the same level 10 years layer, right?

So the correction is not because of too quick high but the investment mentality of getting away from gold when int. rates go up, right?

What is not yet considered is that inflation is about 3 times int. rates.

Meaning, a bunch of people are just loosing 5 to 7 percent in rider to be on tb or whatever.

Till they will realize that only hard asset not real estate that will collapse a bit, bank as well,...gold will be the must have asset...

But government DOES not want you to make the move.

They want to sell you tb.

Interesting.