What Factors Do Not Support The Fed’s Dovish Pivot?

Wishful thinking pushed gold stocks up again. Meanwhile, visualizing the dovish Fed may obscure what’s important for the medium term: fundamentals.

No Pivot

With short squeezes abound on Oct. 3, gold, silver, mining stocks, and the S&P 500 rose sharply. However, while oversold conditions and one-sided positioning can lead to violent short-covering rallies, the ‘here we go again’ narrative is destined to fail.

To explain, after the Bank of England (BoE) resumed QE to help offset a liquidity crunch in the U.K. bond market, the post-GFC crowd hoped the Fed would be next. Then, with Credit Suisse’s credit default swap (CDS) rate soaring in recent days, rumors of insolvency poured gasoline on the pivot fire. In a nutshell: “if things blow up, the Fed will turn dovish”.

However, while market participants like to turn whispers into shouts, the new narrative contrasts fundamental reality. One, Sarah Cha, Financial Sector Specialist at Goldman Sachs, noted how colleague Jonathan Weetman described the Credit Suisse drama as “unwarranted.” She wrote:

“CS off 7% following online/social media speculation and multiple press articles over the weekend around what appears to be a risk-off market fueled negative feedback loop around capital position. Weetman calls the weakness in the stock unwarranted and walks through some of the considerations in his note this morning which includes:

- The liquid balance sheet

- No Equities Prime business

- Levered loans a very well covered bear point but that the composition & timing of a potential recap (he thinks consensus forming around CHF 4-5b) alongside IB restructuring the key question from investors.”

Thus, while one cannot be sure of Credit Suisse's financial health, Goldman Sachs has little incentive to support the bank. In fact, amplifying the panic, then purchasing the stock and waiting for a reversal would be more profitable for Goldman Sachs. Therefore, the rumors are likely more semblance than substance.

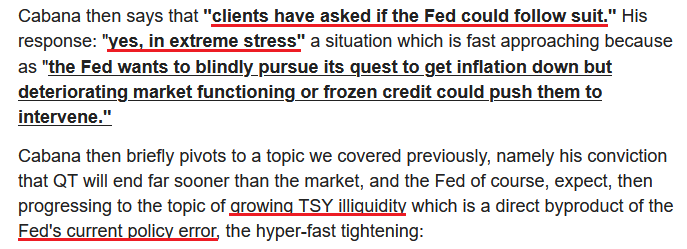

In addition, with the Fed holding an emergency meeting on Oct. 3, speculation has arisen that the central bank may attempt to lower U.S. Treasury yields and weaken the USD Index. For example, Mark Cabana, Head of U.S. Rates Strategy at Bank of America, compared the BoE to the Fed on Oct. 3. He wrote:

Source: ZeroHedge

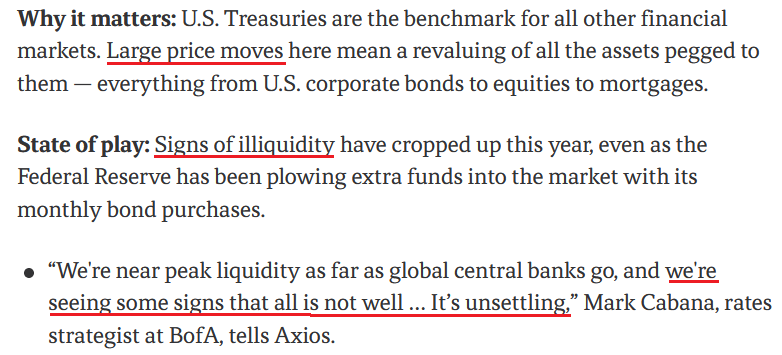

Yet, with tales of Treasury market illiquidity resurfacing – which could force the Fed to intervene to avoid a crash in bond prices – it’s important not to assign credibility to individuals that constantly sound the same alarm. Remember, it’s like The Boy Who Cried Wolf. They recycle the same warning, while the wolf only arrives 1% of the time.

Please see below:

Source: Axios

To explain, the screenshot above is from an article written on Nov. 17, 2021. Here is the link if you want to read it: https://www.axios.com/2021/11/17/treasury-market-stress-signs-regulators

As you can see, Cabana said the same thing nearly a year ago. Moreover, the U.S. 10-Year Treasury yield ended the Nov. 17, 2021 session at 1.59%, while the GDXJ ETF closed at $47.38. So, if you had positioned for Cabana's warning back then, you would have lost a lot of money buying the U.S. 10-Year Treasury Note and the junior miners' index.

As a result, more important than the information you're digesting is where the information comes from. Many 'analysts' lack objectivity and don't disclose how wrong they've been. Therefore, while Cabana awaits the Treasury market's implosion, his warning hasn't made his clients any money over the last ~11 months.

Conversely, all we had this year were profitable transactions: both long and short.

Likewise, while we've had several GDXJ ETF short squeezes and pivot prognostications in 2022, the junior miners have continued to hit new lows. Thus, we view the current move as a countertrend rally within a medium-term downswing. In contrast, uninformed assessments of the fundamentals highlight why narratives seem so powerful in the short term.

Please see below:

To explain, extremely impressionable investors flock to narratives like a snowball rolling down a hill. The more ground it covers, the larger it becomes. However, if you bought the GDXJ ETF every time one of these false narratives emerged, your portfolio would have suffered substantial losses.

Remember, none of these supposed pivot-worthy issues solve inflation. In reality, the recent deceleration in month-over-month (MoM) inflation has occurred because the Fed maintained a hawkish stance. If that reverses, the small amount of realized progress will evaporate, and the Fed will confront the same problem again.

Follow the Data

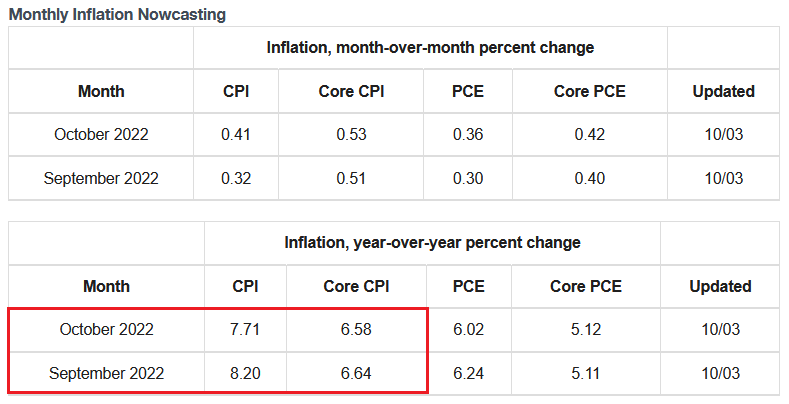

The Cleveland Fed projects that the headline and core Consumer Price Indexes (CPI) will hit 8.20% and 6.64% year-over-year (YoY) in September and 7.71% and 6.58% YoY in October; and while lower commodity prices help slow the headline CPI, resilient consumer demand should keep the core CPI uplifted.

Please see below:

Source: Cleveland Fed

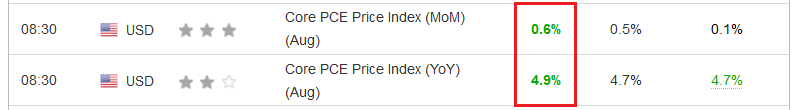

In addition, it was only one day ago that the core Personal Consumption Expenditures (PCE) Index re-accelerated YoY and outperformed expectations. For context, I wrote on Oct. 3:

With the core PCE Index – the Fed’s preferred inflation gauge – outperforming expectations on Sep. 30, inflation is nowhere near the levels that support a dovish pivot.

Please see below:

Source: Investing.com

To explain, the core PCE Index came in at 4.9% year-over-year (YoY), which exceeded economists' consensus estimate of 4.7% YoY. Also, August's print exceeded the 4.7% YoY realized in July. As such, inflation remains highly problematic.

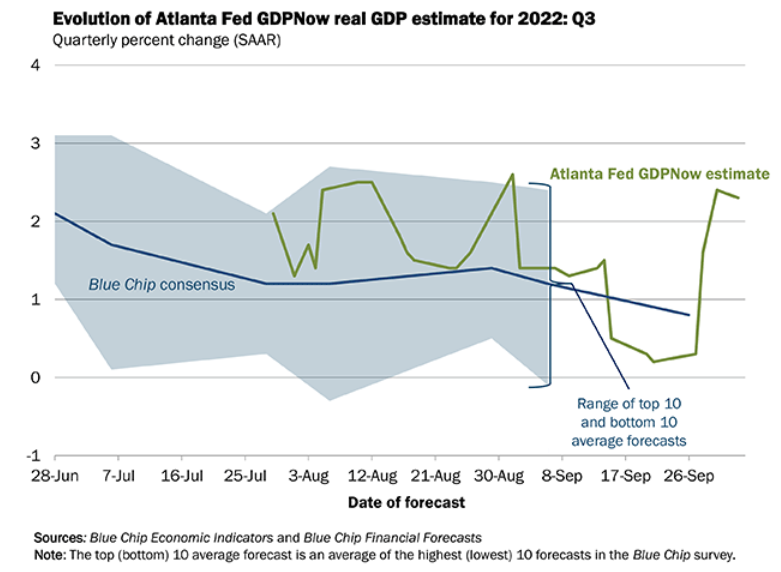

On top of that, the Atlanta Fed’s third-quarter real GDP estimate (updated on Oct. 3) stands at 2.3%, which is near the highs set in August.

Please see below:

To explain, the green line above tracks the Atlanta Fed’s Q3 real GDP estimate, while the blue line above tracks the Blue Chip consensus estimate (investment banks). If you analyze the sharp rise in the green line on the right side of the chart, you can see that expected economic growth is far from crisis levels. Therefore, the data does not support a dovish pivot.

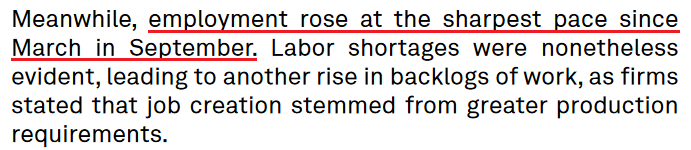

As further evidence, S&P Global released its U.S. Manufacturing PMI on Oct. 3. The headline index increased from 51.5 in August to 52.0 in September. The report revealed:

“On the price front, input costs rose at a slower pace in September. The rate of inflation was still historically elevated.”

In addition:

“Manufacturers registered a softer increase in selling prices compared to earlier in the year. That said, the pace of charge inflation ticked up from August as firms sought to pass through higher cost burdens to clients.”

So while inflation has slowed (which it should after 12 25 basis point rate hikes in 2022), U.S. manufacturers increased their selling prices at a faster pace in September versus August. As such, the pivot crowd is buying hope and selling reality.

More importantly:

Source: S&P Global

With employment (one-half of the Fed’s dual mandate) going strong, the U.S. labor market remains on solid footing. Moreover, with increased hiring poised to uplift wages, the inflationary headwind will only be exacerbated if the Fed turns dovish.

Furthermore, with real GDP growth relatively strong (if the Atlanta Fed’s projection holds) and realized inflation still outperforming, the three metrics signal a higher, not lower, U.S. federal funds rate (FFR). Thus, the post-GFC crowd is repeating the same mistakes they made throughout 2021 and 2022.

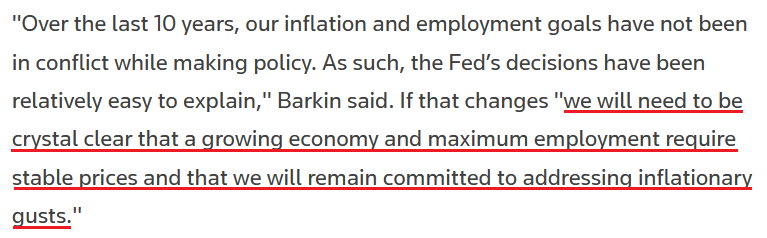

Finally, Richmond Fed President Thomas Barkin said on Oct. 3 that inflation uncertainties “could make looking through short-term shocks more difficult. They could make gradual rate increase paths less effective. They could make market functioning interventions somewhat trickier.”

He added:

“Our efforts to stabilize inflation expectations could require periods where we tighten monetary policy more than has been our recent pattern.”

As a result, Barkin is the latest Fed official to reiterate that inflation is the top priority; and he understands that without “stable prices,” employment and growth are living on borrowed time.

Source: Reuters

The Bottom Line

While it’s hard to count how many times investors have predicted a dovish pivot in 2022, each iteration has been incorrect. Moreover, with realized inflation, projected real GDP growth, and the U.S. labor market still resilient, investors are in la-la land if they think these metrics support a dovish 180.

Likewise, the alarmists citing Treasury illiquidity, market functioning, and financial stability as reasons for a pivot tell the same stories over and over. Therefore, while the Fed will pivot at some point, timing matters, and their timing has been way off. As such, it’s important not to overthink short-term moves: assets become oversold, narratives create doubt, and short-covering sparks decent rallies. However, those gains are unlikely to hold since the medium-term technicals and fundamentals don’t support the moves.

What are the voters concerned about the most at this time?

Inflation.

Period.

In conclusion, the PMs rallied on Oct. 3, as hope uplifted risk assets. Also, the USD Index and U.S. real yields declined, which often occurs when risk-on sentiment dominates. Despite that, the optimism should evaporate in the months ahead, as all of the GDXJ ETFs 2022 rallies have failed, and this one should be no different.

More By This Author:

Gold’s Rally - A Whole Lot Of Nothing

Gold Rallies In The Face Of The BoE’s Quantitative Easing

The U.S. 10-Year Real Yield Hits Its Highest In Over A Decade

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more