Rates Spark: Not Much Is Needed For More Dovish ECB Pricing

Image Source: Pexels

Risk assets appreciate the positive headlines on US trade, which seem to be occurring more frequently right now. Having said that, euro markets are still keen to price in more policy rate cuts, and European Central Bank speakers are not offering any pushback; if anything, it's the opposite.

ECB speakers are feeding the already dovish sentiment

Notwithstanding the flip-flopping messages on tariffs, there is a sense that (at least parts of) the US administration is seeing that the situation is unsustainable. On the sidelines of the DC meetings, the outgoing German finance minister, for instance, was positive on reaching a trade deal within the 90-day period while describing the conversations with US Treasury Secretary Scott Bessent as productive. Risk assets at least appear to have found some footing, even if yields are turning somewhat lower again.

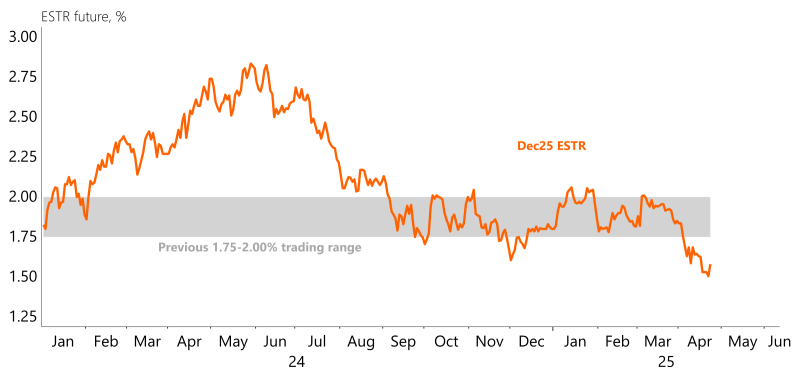

Eurozone data thus far, such as the PMIs and Thursday’s Ifo, has held up relatively well given the bleak prospects on trade. Still, the market is pricing 67bp of ECB easing through early next year, i.e. it is clearly eyeing the 1.5% level as a landing zone for the deposit facility rate. This is in contrast with the 1.75-2% conviction held for many months before.

Comments from ECB officials such as Philip Lane or Olli Rehn on Thursday support such dovish views. While Lane would not pre-commit to any path and said the growth forecast would see only a moderate markdown, he acknowledged the disinflationary forces from the FX developments and energy prices. His colleague Rehn was clearer in his dovish tilt, speaking of materialising downside risks. He called for full freedom of action, including not ruling out a larger cut. The market is not looking in that direction yet, though with a next cut in June fully priced, it would not take much in the data or in terms of headlines to move that market further – and the pushback from the ECB could be limited.

The short end of the curve is no longer supported by a landing zone of 1.75%

Source: ING, Macrobond

Friday’s events and market view

There are very few data releases of note this Friday. The US will release the final University of Michigan consumer sentiment reading and inflation expectations – recall the one-year expectations had risen to 6.8%. There are no scheduled Federal Reserve speakers ahead of the communications blackout period kicking in at the weekend.

No primary market activity from European or US treasuries.

More By This Author:

FX Daily: USD/JPY Dodges The Currency Accord BulletAsia Week Ahead: Japanese Rate Decision And Data From South Korea, China, Taiwan, Australia

Hotter-Than-Expected Tokyo Inflation Supports BoJ’s Case For Rate Hikes

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more