Morgan Stanley Sees S&P Tumbling As Low As 3,400: "That's Where Valuation And Technical Support Lie"

In the latest Morgan Stanley Sunday Start note published over the weekend, which this time featured the bank's chief US equity strategist, Michael Wilson (who after BofA's Michael Hartnett, is easily the street's second most bearish strategist), the bank's strategist elevated his bearish view up another notch, writing that this bear market will not be over until one of two things happens: "either valuations fall to levels (14-15x) that discount the kind of earnings cuts we envision, or earnings estimates get cut."

Writing after the torrid Friday bear-market dead-cat bounce, it is no surprise that Wilson said that "with valuations now more attractive, equity markets so oversold and rates potentially stabilizing below 3%, stocks appear to have begun another material bear market rally." However, returning to his favorite bearish place, he adds that "after that, we remain confident that lower prices are still ahead."

How much lower? Wilson's answer: "in S&P 500 terms, we think that level is close to 3,400, which is where both valuation and technical support lie."

(Click on image to enlarge)

We'll get to how Hartnett gets to that number soon, but first a quick summary on why Hartnett thinks that it's all about growth from this point, published earlier today in his latest Mid-Year Outlook note titled "More of the Same."

Picking up where he left off yesterday, which for those who missed it was to explain that the rates market fully reflects the "fire" part of Wilson's narrative (adding that rates could have even overshot to the upside by incorporating more hikes than the Fed may be able to deliver in this cycle, based on the significant damage to financial asset prices and the approaching slowdown that looks much worse than just a few months ago), the strategist writes that with the 'Fire' portion of our narrative (higher inflation and tighter Fed policy) now more reflected in asset prices, he expects interest rates to stabilize from here: "In other words, we think the bond market has now done enough of the Fed's work to slow the economy. Therefore, the key question for equity investors at this point is how much will the economy slow and how much are earnings over-stated."

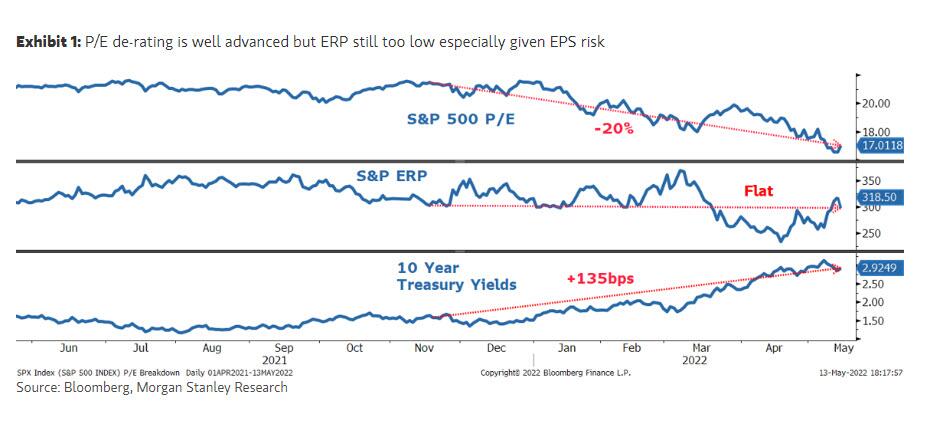

Wilson's own view is that multiples generally fall ahead of the bulk of earnings cuts so part of the de-rating this year has been about the market anticipating these earnings cuts as much as higher rates. However, given the very modest equity risk premium (300bps) currently embedded in the P/E, Wilson doesn't think much of an earnings cut has been discounted yet:

In our experience, the market will want to see NTM EPS start to fall before it discounts the eventual cuts fully. Then, as estimates come down, the multiple will bottom and turn higher because you don't pay trough multiple on trough earnings.

As such, Wilson's 3400 tactical target assumes the P/E troughs near 14-15x before NTM EPS finishes its downside move.

To be sure, Wilson's baseline is for the S&P to close at 3,900 12 months from now, so it's not quite the "fire and brimstone" that BofA's Michael Hartnett predicted when he said the S&P would drop to 3,000 by October if it follows the path of other bear markets.

Even so, based on his fair value framework, the S&P 500 is still mispriced for the current growth environment; picking up what he said last Monday, Wilson leverages the strong relationship of PMIs versus equity risk premium over time to project fair value ERP based on the current level of the US ISM Composite PMI. Based on this approach, fair value ERP is 340-350bps. Applying today's 10-year yield to the fair value risk premium indicates a forward multiple of ~16x and an S&P 500 price level of 3,700-3,800.

(Click on image to enlarge)

Weaving that tactical set-up in with Wilson's forward 12-month price target of 3,900 implies that he expects to overshoot our target to the downside in the near term before working back toward 3,900 by next spring.

In keeping with that forecast, the strategist expects equity volatility to remain elevated over the next 12 months, especially when one adds the elevated geopolitical uncertainty that has arisen over the past several months amid the Russia/Ukraine conflict. Wilson also expects elevated performance dispersion in this type of environment and favors companies that can deliver on cash flow and operational efficiency. He is sticking with his defensive bias given a broadly risk-off view and remains overweight Health Care, Utilities, and Real Estate.

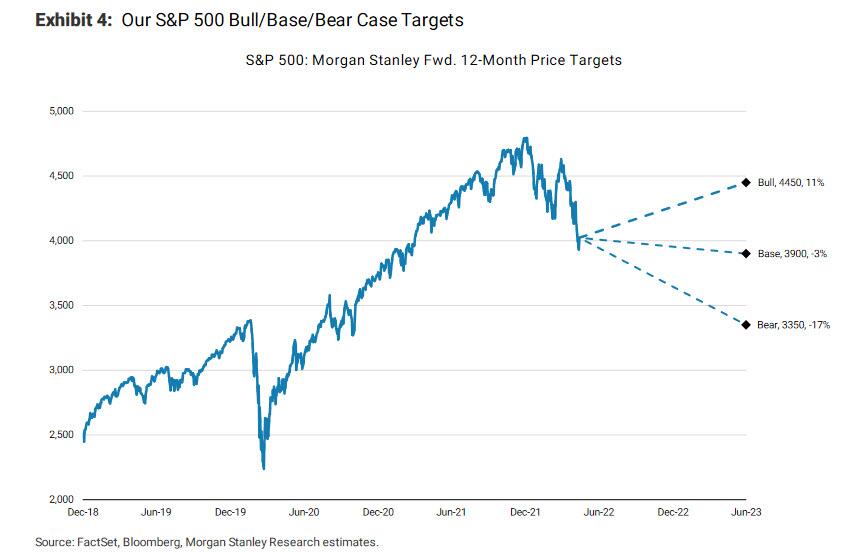

Finally, here is a rundown of Wilson's three price targets for 2022:

(Click on image to enlarge)

Base Case Price Target for 2Q23: 3,900

In our 3,900 base case, the market puts a 16.5x P/E multiple on forward (June 2024) EPS of $236. We expect the market multiple to de-rate further from current levels over the next 12 months driven by a higher equity risk premium (~325 bps) as earnings, economic, policy and geopolitical uncertainty remain high. While the multiple compression we embed in our base case is fairly modest given the recent drawdown we have experienced in equities, we think the risk is elevated that the market multiple overshoots our base case to the downside in the near term (see Weekly Warm-Up: That Escalated Quickly As News Always Follows Stocks). On the earnings front, we take down our estimates as cost pressures continue to ramp up, top line growth slows and output from our leading earnings model points to a further deceleration in EPS growth. Our earnings estimates are now well below consensus out to 2024. Specifically, we see 8% growth in '22 (consensus is at 10%), 5% growth in '23 (consensus is at 10%) and 0% growth in '24 (consensus is at 9%). In short, the over-earning that took place post the covid recession is worked off as demand slows and cost pressures eat into margins. In the absence of a recession (our economists' base case view), this dynamic happens less abruptly atthe overall index level, but we continue to believe it may feel like a recession for certain areas of the equity market over the next twelve months (specifically those areas tied to the consumer goods and technology overconsumption that transpired in 2H '20 and '21). Bottom line: 'fire' AND 'ice' persist as the Fed continues to tighten policy into a slowing growth environment. Expect decelerating earnings growth, a lower multiple and elevated volatility. An overshoot to the downside of our next twelve month multiple and price targets is likely tactically as the market discounts (in advance) the consolidation in earnings expectations we expect to transpire over the coming months.

Bull Case Price Target for 2Q23: 4,450

In our 4,450 bull case, the market puts a 17.9x P/E multiple on forward (June 2024) EPS of $249. A soft landing is achieved in our bull case. The Fed's hawkish path is not a risk to the US growth backdrop, consumer confidence rebounds as inflation fades, cost pressures ease along with inflation as supply chains reopen in an orderly manner, corporates maintain pricing power, and any excess inventory build in consumer goods is absorbed by household demand. As noted in the Global Strategy Mid-Year Outlook, this scenario could also involve changes to China’s covid policy and a more positive geopolitical situation in Europe. Amid this backdrop, multiples expand to 17.9x, and the equity risk premium remains around post-GFC lows (~280 bps). On the earnings front, growth is modest but still positive out to 2024 as margin pressures are less significant than in our base case. Bottom line: earnings growth slows but is still positive, cost pressures ease as inflation is curbed, consumer confidence rebounds, and excess inventory in consumer goods is absorbed—a soft landing where multiples have room to expand.

Bear Case Price Target for 2Q23: 3,350

In our 3,350 bear case, the market puts a 15.9x P/E multiple on forward (June 2024) EPS of $212. This scenario assumes a recession. We have earnings growth decelerating in 2022 and then outright negative in 2023 (-10%) from a calendar year standpoint. We then see 2024 EPS growth rebounding off of recession comps, finishing the year +17%. In this scenario, margin contraction is more severe in 2022 and 2023, and nominal top line growth nearly contracts on a year-over-year basis by 2023, only kept modestly positive by inflation. Bottom line: sticky input/labor cost inflation drives sustained margin pressure. Payback in demand is a dominant theme, leading to a broad deceleration in sales growth. That combination takes EPS growth negative in 2023. At the same time, stickier inflation keeps the Fed on a hawkish path despite decelerating growth and tightening financial conditions.

In summary, in the base case, Wilson's 'fire' AND 'ice' persist as the Fed continues to tighten policy into a slowing growth environment. Expect decelerating earnings growth, a lower multiple, and elevated volatility. In the bull case, earnings growth slows but is still positive, cost pressures ease as inflation is curbed, consumer confidence rebounds, and excess inventory in consumer goods is absorbed—a soft landing where multiples have room to expand. The bear case assumes a recession—sticky input/labor cost inflation drives sustained margin pressure. Payback in demand is a dominant theme, leading to a broad deceleration in sales growth. That combination takes EPS growth negative in 2023.

For more details on Wilson's forecast as well as his sector preferences, read his full Mid-Year Outlook available to professional ...

more