Is The US Treasury Market In The Right Boat?

On October 20, 2025, Sanae Takaichi took office as Japan’s new prime minister. Her outspoken admiration for Margaret Thatcher earned her the nickname «Japan’s Iron Lady» early on. And she got straight down to business: one of her first projects was a gigantic investment package worth 17.7 trillion yen – around 114 billion US dollars. Her main aim is to boost the domestic economy and strengthen the military.

The economic hopes promptly led to rising stock prices. At the same time, the yen and government bonds came under pressure, which in turn drove up interest rates. From the investors’ point of view, the additional debt also increased inflation and fiscal risks. Although a weaker yen supports Japan’s export-oriented economy, it also fuels inflation through more expensive imports.

Many investors in America and Europe may wonder why we are dealing with a topic today that seems so geographically distant. But Japan is a heavyweight in the global financial system – not least because of the famous «carry trade». For new readers, here is a brief explanation: The yen carry trade is a strategy in which investors

• borrow money cheaply in Japan (thanks to the formerly extremely low interest rates),

• exchange the borrowed yen amount into another currency

• and then invest the capital in higher-yielding investments abroad, such as US bonds or stocks.

As long as the yen does not suddenly appreciate sharply, the investor earns money on the interest rate differential – but if the yen strengthens, repayment becomes more expensive and profits can quickly turn into losses.

No one knows exactly how large carry trade portfolios have become after two decades. The only thing that is certain is that we are talking about trillions rather than billions.

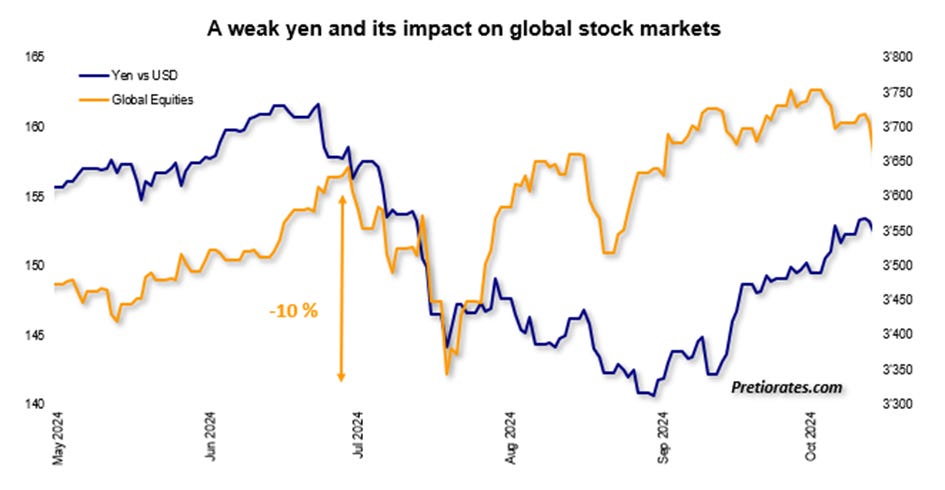

Over the past year or two, professional investors have already begun to gradually reduce these yen loans. The repayments led to a temporary rise in the yen – with noticeable effects, not only for Japan’s export industry. When BoJ Governor Ueda intervened in July 2024, global stock markets slumped by around 10% within a month. Investors sold positions they had financed with yen loans.

As the chart shows, the markets recovered quickly, but there is no guarantee that this will happen again.

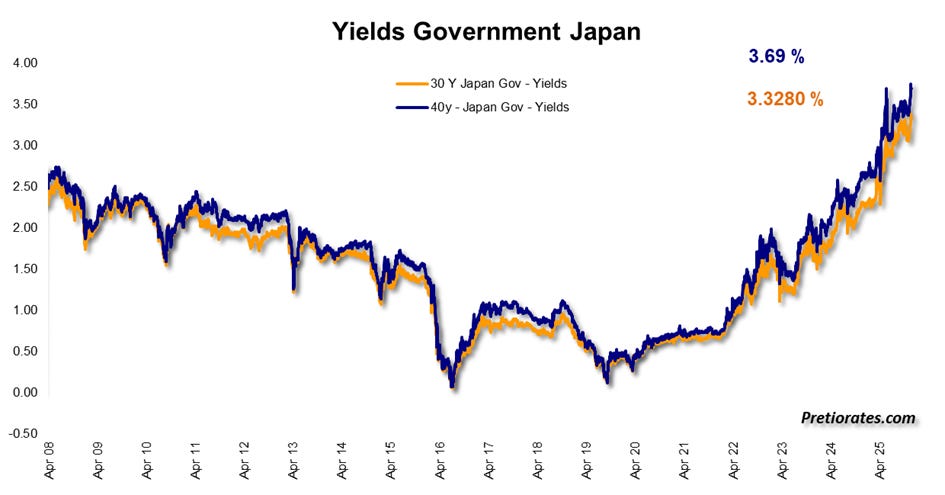

No one knows the current extent of carry trades, but they are most likely smaller today than they were a year ago. Nevertheless, the stock markets persistently ignore the increasing risk. Japan as a source of money is increasingly drying up – a trend that is reflected in the slow but steady rise in long-term interest rates.

And it is precisely this source of money that explains why the Japanese yen and the yield on US Treasuries – shown inverted – are so closely correlated. And current developments show that the market continues to ignore the danger. A falling yen actually signals rising market yields in the US. But the orange line – the inverted US Treasury yield – has so far refused to acknowledge this signal.

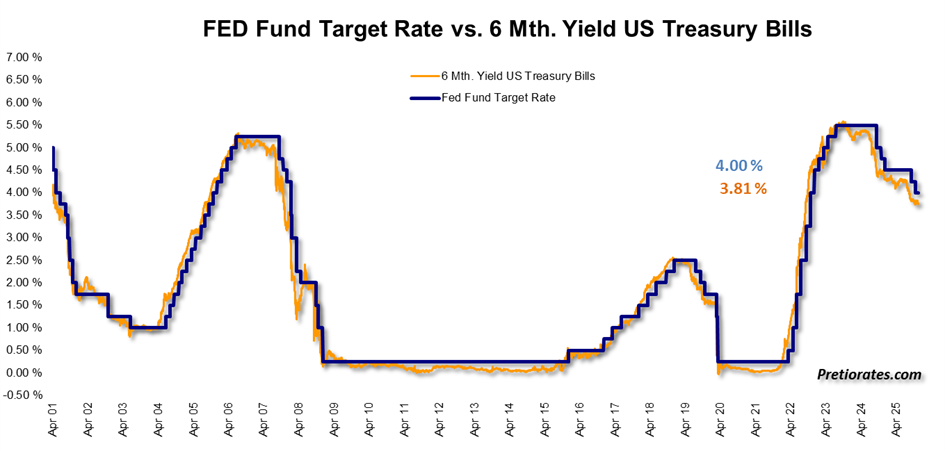

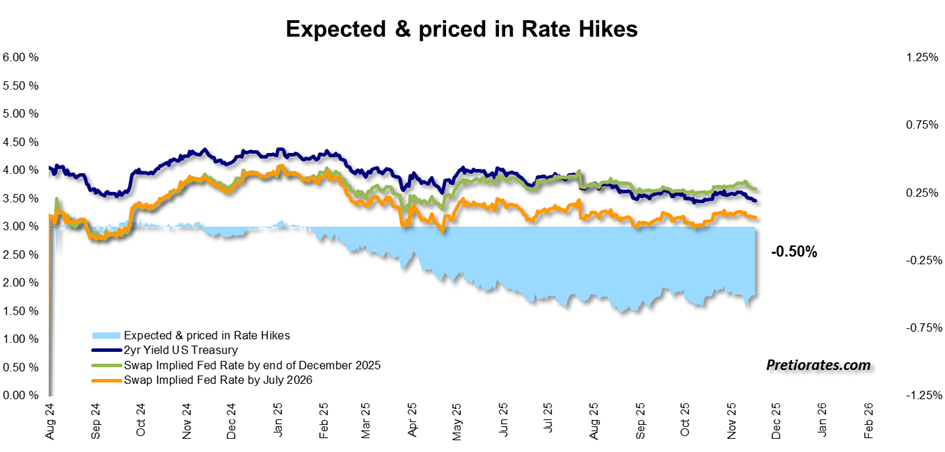

The US Treasury market for maturities of ten years and less in particular is not playing along: it continues to price in falling yields. Although important economic data is missing and being published late due to the government shutdown, a further interest rate cut is almost completely priced in – around 19 basis points below the Fed Funds Target.

A look at the swap rates until July 2026 also clearly shows that the market expects an interest rate cut of exactly half a percent by mid-2026.

These interest rate expectations are based on the assumption that the US economy will lose momentum in the coming months. Many are relying on weak labor market data and received further confirmation this week with the announcement of a seven-month low in US consumer confidence. In addition, some believe that certain FOMC members could still fulfill Trump’s desire for lower interest rates.

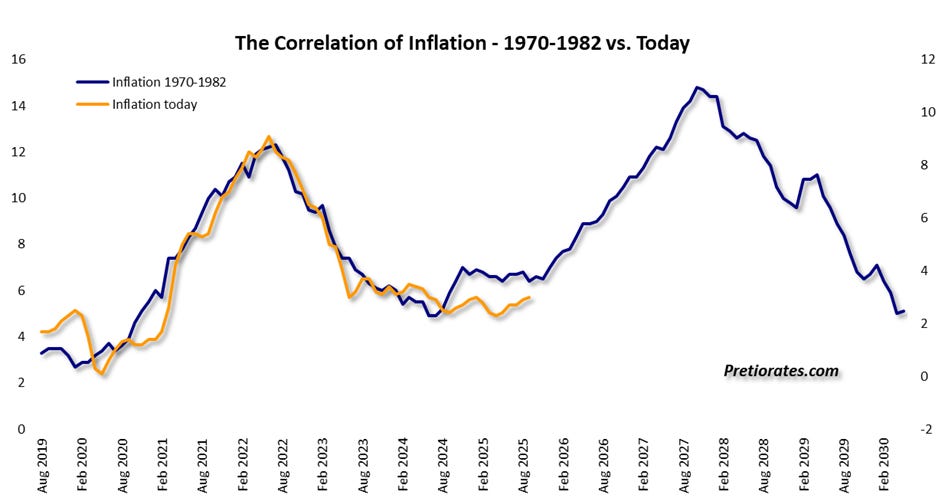

One might expect US Treasury yields to have long since fallen below the 4% mark, where they are currently trading. However, other forces are pushing in the opposite direction: rising government debt is increasingly worrying investors. And persistently high inflation offers little reassurance. A look back at the 1970s reveals parallels that suggest inflation could pick up again. There are plenty of reasons for this...

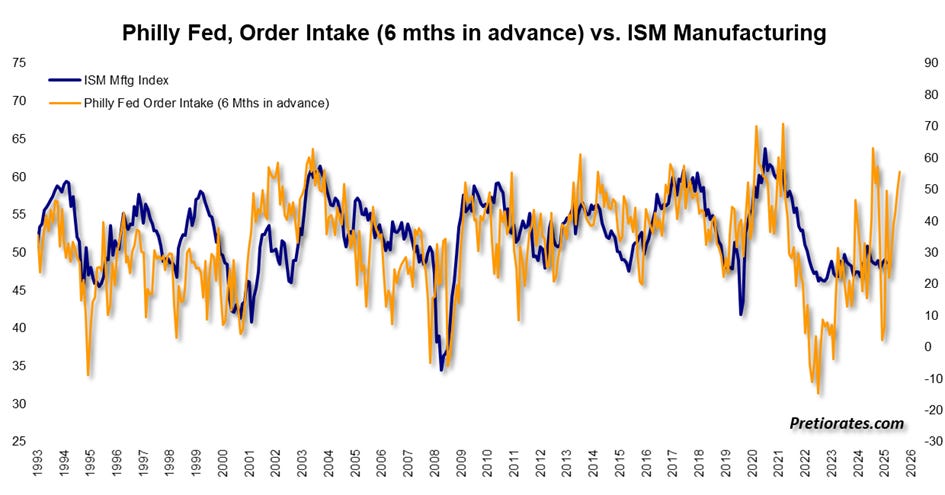

But perhaps the US economy is not as weak as many currently assume. Due to the shutdown, crucial data that would provide a clearer picture is missing. Once this data is released, there could be a significant surprise: The Philly Fed’s new orders index is a reliable leading indicator for the most important macro data set – the ISM. The trend so far points to an increase in the ISM Manufacturing Index.

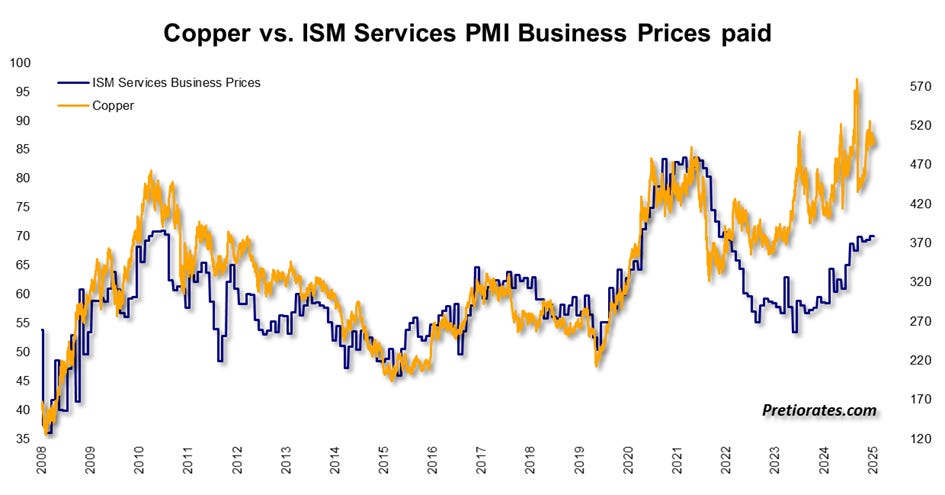

The price of copper is also closely linked to the ISM Services Index, which in turn is an important factor influencing inflation. The current situation suggests that either the price of copper is too high or the economic index is too low...

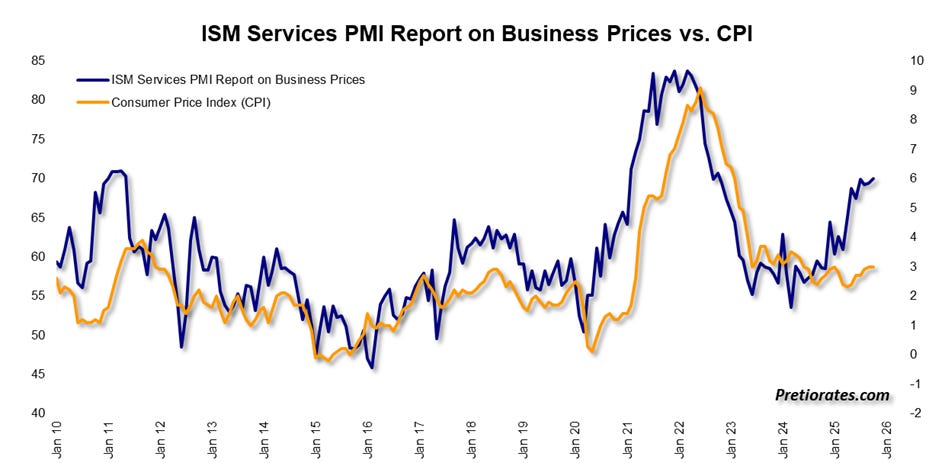

And yes, the ISM index suggests that the consumer price index should indeed rise again soon...

Betting on falling interest rates could actually be the riskier bet at the moment. That is why we maintain that the other boat may be the safer option. The problem of government debt, the crowded trade of investments with hopes of interest rate cuts, a potential rise in inflation, and, last but not least, the situation surrounding the yen carry trade. In addition, the yield differential between Japan and the US is narrowing, which means that the strong Japanese US Treasury investor will probably prefer to invest his money back home soon...

If the market realizes that it may be in the wrong boat, this could trigger a significant trend reversal—not only in the bond market, but also in all other financial markets.

We wish you successful investments!

More By This Author:

Nvidia Is Just A Gust Of Wind, The Autumn Storm Is Likely Not Over Yet

Silver, Enjoy The Ride

There Is No Need To Toss The Coin

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more