Silver, Enjoy The Ride

Image Source: Pixabay

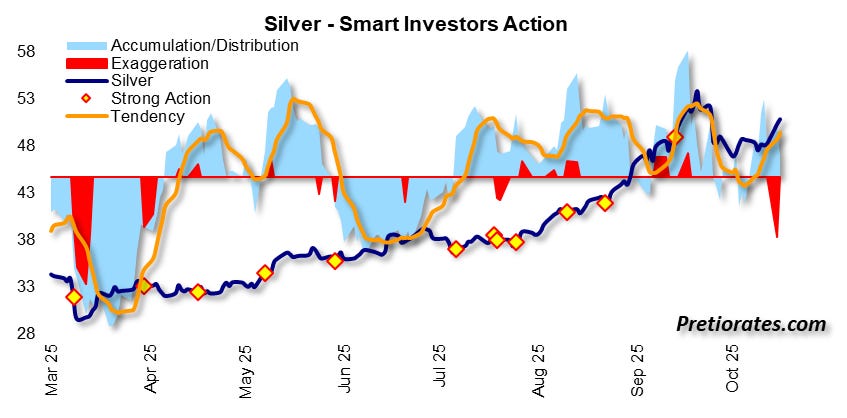

Gold has already recovered noticeably since the beginning of the consolidation. The counter-movement in Silver was even better – and, as expected, significantly more volatile. In recent days in particular, the Silver price has been able to build on the impressive strength we saw in October, when it peaked at USD 54.50.

Interestingly, during the consolidation, there was already a veritable “exaggeration” on the sell side – the red zone. Selling pressure was enormous, even exaggeratedly high according to our indicator. Such exaggerations usually lead to a counter-reaction, i.e., rising prices. And the fact that Silver has hardly fallen despite these massive sales is in itself a clear sign of strength.

(Click on image to enlarge)

Both precious metals have risen in recent years for well-known reasons – excessive government debt, geopolitical tensions, BRICS, currency issues, etc. Gold is primarily bought as insurance. The key point is that Gold is not a consumer good. Almost 100% of the Gold ever mined still exists and can be recycled at any time. This means that every newly mined ounce further inflates the total stock. Every year, around 3,000 tons – approximately 100 million ounces – are added to the estimated 212,000 tons (6.8 billion ounces) that have already been mined in human history. This corresponds to an annual increase of around 1.6%, comparable to average monetary inflation.

The situation is different for Silver. Silver is increasingly becoming an industrial metal. Around 26,800 tons – approximately 860 million ounces – are mined each year. Demand is growing steadily from the solar, battery, and, in the future, nuclear industries, which are set to supply energy to the tech giants’ large data centers. The industry now absorbs almost half of the annual supply – and the trend is rising. At current prices, however, recycling is hardly worthwhile, meaning that a significant proportion of Silver is irretrievably lost.

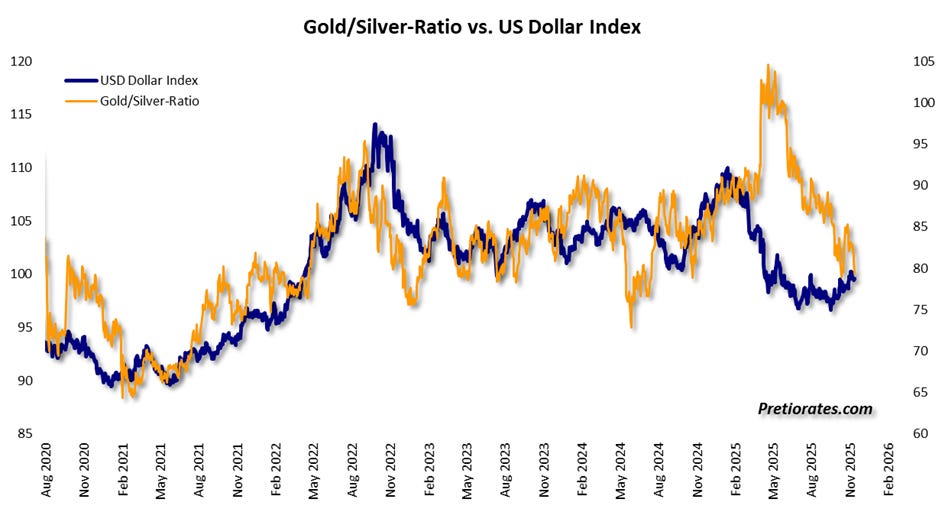

The Gold-to-Silver production ratio is therefore around 8.7:1. Does this justify the current Gold/Silver ratio of 79:1? Certainly not. Considering that Silver, unlike Gold, is actually consumed, this ratio seems even more absurd.

(Click on image to enlarge)

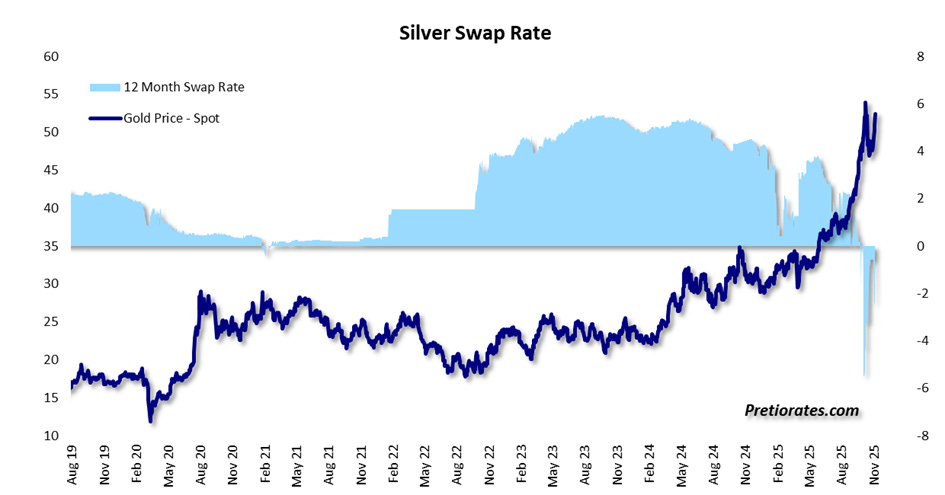

There is said to be a lot of Silver in global warehouses, but the figures are unclear. Estimates range from one to five billion ounces – however, a large portion of this is deposited for ETFs and therefore not freely available. The recent price increase has also fueled speculation about actual physical availability. We have previously pointed out the highly volatile lease rate, which recently exploded to 35% and has since settled down to around 5% – still a very high level historically.

(Click on image to enlarge)

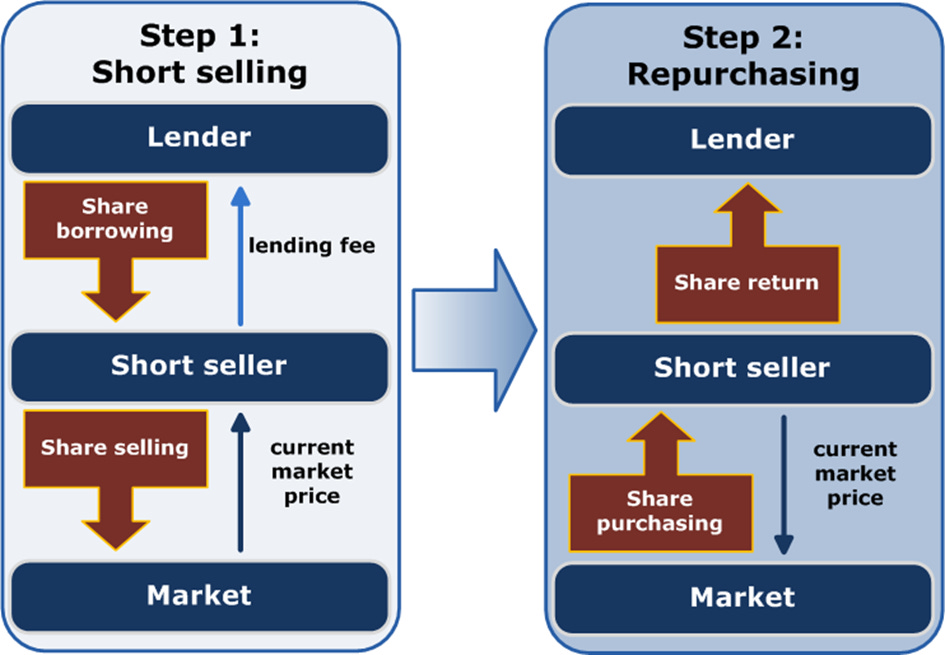

The lease rate is ultimately the price of borrowing physical Silver – for example, to speculate on falling prices in the spot market. Anyone who sells short must already deliver Silver when they sell – which they borrow beforehand.

Source: Wikipedia

Another way to bet on falling prices is the futures market. As a reminder, London’s LBMA is the center of physical trading, while COMEX in New York dominates futures trading – the realm of “paper Gold.” Because physical delivery is usually not required there, COMEX is the preferred playground for short speculators. The trading volume is correspondingly huge – according to estimates, ten times the physical London volume changes hands there every day.

After purchasing a Silver futures contract, an investor has three options: he can sell it again, remain invested until the expiration date – and then decide between a cash settlement or physical delivery. The latter was long a marginal phenomenon; in most cases, investors simply “rolled” into a longer-term contract. However, there are now increasing signs that physical Silver is becoming scarce. As a result, many investors no longer want to lend their holdings, which is why the lease rate has exploded.

(Click on image to enlarge)

Now things are getting exciting: all investors who are currently engaged in futures with an expiry date of December 2025 must decide by November 28, 2025 how they want to proceed with their positions. Options include selling, cash settlement, or rolling into longer maturities. However, the market is increasingly speculating that this time around, many investors will actually demand physical delivery. Because real Silver in hand is now the game in the City.

On November 28, the “First Notice Day” (FND), long investors will receive their “Notice of Intention to Deliver.” If many decide to take delivery, things could get tight – because the trading volume on COMEX is about ten times greater than that on the LBMA.

This would be a real problem for the short side: if the buyer opts for physical delivery, the seller of the futures contract must deliver. A futures contract covers 5,000 ounces of Silver – around 155 kilograms. This is no problem for mining companies, but it can be a nightmare for pure financial investors: they must either find the metal or, if necessary, buy back their short contracts at any price.

SWAP transactions were introduced to avoid physical transport between London (physical trading) and New York (paper trading). They are a central element of global precious metal trading because they connect the markets without the need to actually move bars. Normally, SWAP rates are positive – storage costs money, after all. However, if they fall into negative territory, this signals physical scarcity: traders then pay premiums to get their hands on Silver immediately. The rate slips even further into negative territory when short positions are closed in a panic – a classic short squeeze.

Since the introduction of Silver swap rates, there has hardly ever been such a sharp decline. A slight decline of 0.5% has occurred repeatedly – but in recent days, the rate has fallen to –5.5% at times. This suggests that numerous investors are rushing to cover their December futures.

(Click on image to enlarge)

Bottom line: In contrast to the rally of recent months, current demand appears to be less driven by traditional investors. Rather, all signs indicate that short positions in the December contract have come under massive pressure. They must abandon their bets on falling prices before November 28, 2025 – and that is driving the market. The price of Silver could continue to rise sharply in the coming days; movements of 5% per day are entirely possible. As nervousness increases, so does the risk of default – and with it, the upside price potential. There is only one moment in an investor’s life when they have to buy: when they are still short shortly before expiration. Volatility is likely to remain extreme – new commitments are risky. But for those who are already in Silver, there is only one thing to do: Enjoy the ride!

More By This Author:

There Is No Need To Toss The Coin

Cheap Gold Mines And A New Chapter In The Silver Market

Don’t Be Emotional With Emotional Assets

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more