Is Gold Setting Up A Bull Trap?

Photo by Anna Valieva/iStock via Getty Images

Fundamentals

U.S. weekly jobless claims fell significantly last week. The number of Americans filing new claims fell more than expected last week. Experts attribute this decline in part to the easing of pandemic restrictions with the increasing number of Americans now vaccinated. The relief packages are also contributing to a tight labor market, as some Americans prefer to stay home with government support than to return to work even as businesses reopen and clamor to hire new employees. Twenty-three states have announced they will end the Federally supported $300 subsidy to the unemployed starting next month, which some say discourage the unemployed from seeking work.

The 10-year note is slightly higher this week at 1.611. We may be establishing a trading range between 1.46 and about 1.52 to about 1.77. Interest rates are going to play a critical role in the next few months as we accelerate into the third and fourth quarters of this year when we will see a lot more volatility.

Most experts believe that higher interest rates will be bearish for gold. In this case, with interest rates where they are, basically in negative territory if you factor in inflation, we believe that higher rates may be bullish for gold and precious metals. We are already seeing price inflation in commodity futures. More money is coming into the economy and there are shortages of plastics, computer chips, and many other products. We will probably see a spike in prices as the summer arrives. Real estate prices are also spiking, as is the stock market. Only gold and silver are not making new highs. It is frustrating for precious metals traders. We will see an adjustment, but right now there are too many bulls out there. The sentiment is extremely bullish and the fundamentals are also extremely bullish. The massive printing of US dollars and other currencies should drive the price of precious metals up as the purchasing power of fiat currencies declines.

Coinbase and Bitcoin

Courtesy: TDAmeritrade

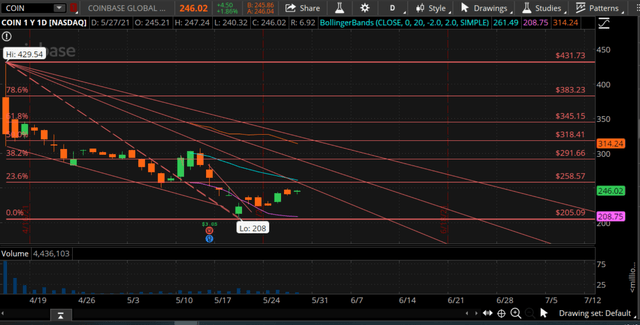

The leader in volatility is Coinbase COIN. We have been recommending it, but it is extremely volatile given the rhetoric that is out there. It is setting up the standard for the rest of the markets, such as for equities and metals in terms of what volatility can do. The fact that we are seeing such volatility in virtual currency markets, means that it is pulling in the other markets to also be extremely volatile.

Coinbase has been falling from 429.54 to 208 just since April. This appears to be a perfect confirmation of a weekly reversal. The demand in virtual currencies is not going away. Many people do not want to hold dollars; they would rather hold Bitcoin or Coin. Coin appears to be moving back up, so continue to hold it, if you have it.

Courtesy: TDAmeritrade

We trade the Grayscale Bitcoin Investment Trust (OTC: GBTC). If you want to hold it, you have to be willing to take a 50 percent correction. We do not believe that is the way to create wealth. We trade GBTC aggressively to take advantage of the volatility, but we do not hold it long term. It has become a more tradable market. The volume has increased, but it is still very small compared to the gold market.

Precious Metals

Courtesy: TDAmeritrade

In silver, we are below the weekly VC PMI average of $27.94 and daily average of $27.93. This is a critical harmonic relationship to identify the price momentum of the market. We focus on mean reversion trading to identify when the market is at its mean, which is when we do not trade the market. At the mean, markets can go up or down. We trade when markets reach extremes above or below the mean. When a market is at an extreme, there is a much higher probability that the market will revert back to the mean.

Courtesy: TDAmeritrade

For gold, we have a weekly bullish trigger with the target of $1871, which is the weekly average.

NUGT is down about 96, JNUG down about 1.11. GDX is slightly down, so gold and its derivatives are a slightly bearish market. At the end of the month, there will be selling pressure as options contracts expire. It will be interesting to see what happens after the holiday. We recommend maintaining your long-term long core position in precious metals. The markets are building solid bases that are attracting new buyers at higher levels. Gold especially should revert back to its real mean. The 360-day cycle for gold, which we published back in September on Seeking Alpha, predicted a target of $2164, which is the VC PMI's Sell 1 level. The cycles indicate that this target could be completed sometime in August. That is the time frame based on the VC PMI's annual analysis. Gold is breaking out of its Fibonacci fan line resistance

We are breaking out of a 50% correction based on Fibonacci analysis. The market should revert back up to even the $2023 level, which is a 78.6% retracement. The previous target was $2112.70 and the target would be $2164. We appear to be building a pattern in gold. Use corrections to add to your long-term position in gold.

Disclosure: I am/we are long GDX.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on more