Good Things Come In Threes: Muni Bonds Appear Ripe For 2023

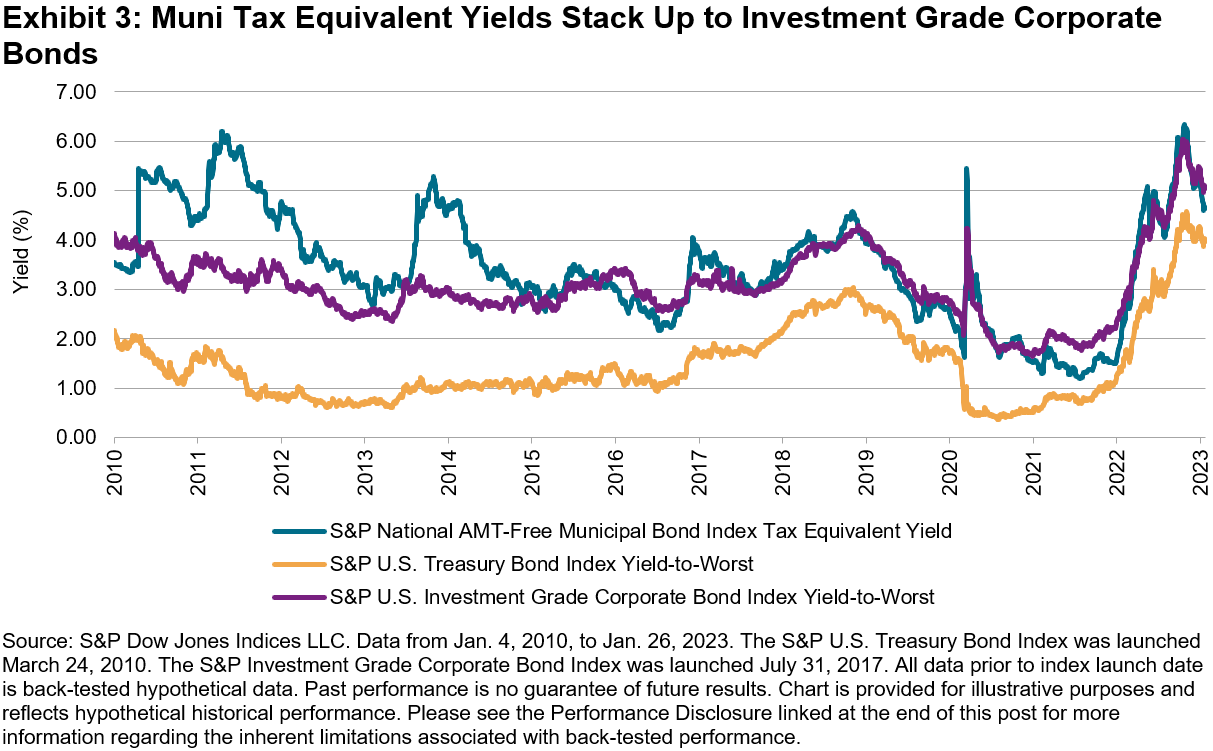

With one month down in 2023, let’s track the performance of municipal bonds so far: as of Jan. 31, 2023, the yield for the S&P National AMT-Free Municipal Bond Index was at roughly 3% (3.02% to be exact). The total return was up about 3% for January (2.87% to be exact), putting a dent in last year’s sell-off to provide a one-year return of “only” -3% (-2.97%). With rates rising, new opportunities are being uncovered and investors are seeking new ways to access the municipal bond market.

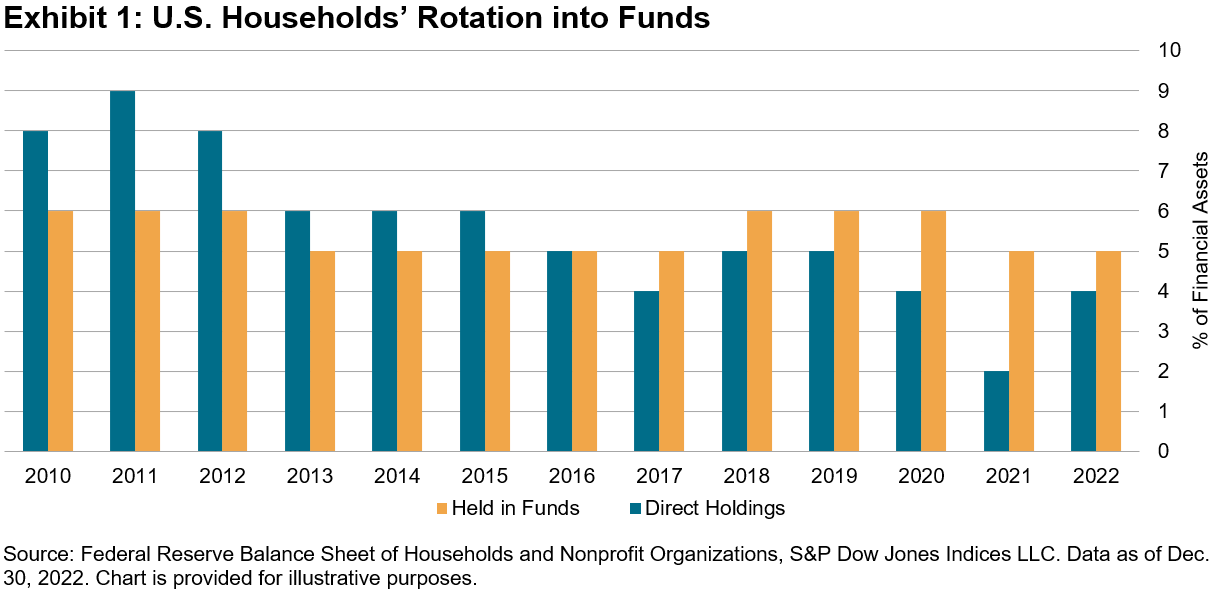

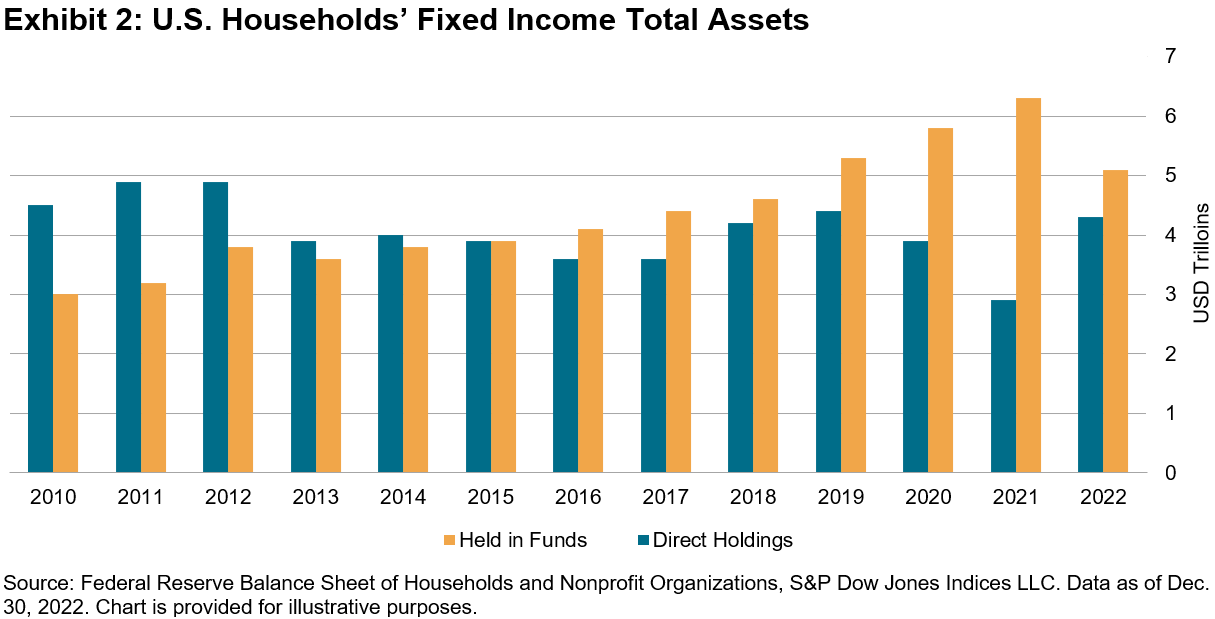

Increasingly, investors are looking for income through index-tracking funds. In January alone, more than USD 25 billion flowed into U.S.-listed fixed income ETFs. While large institutions have traditionally allocated to bonds, retail investors have changed how they allocate to fixed income, with an increasing preference for funds. Focusing on U.S. households, both the share (see Exhibit 1) and total value of assets held in fixed income funds (see Exhibit 2) are larger than individual bond purchases. As a larger percentage of the population enters retirement age, the need for a fixed stream of income would appear to be greater. Federal Reserve data has shown that this has not been the case. Baby Boomers started to enter retirement age in the last decade and are expected to continue through this decade. During that time, U.S. households’ total share of fixed income (both direct bond purchases and purchases through funds) shrank. This contrasts with the equity market, where the total share of equities held has risen from 28% to 35% since 2010.

(Click on image to enlarge)

Over the past five years, individual investors have shown an increasing preference for accessing the bond market through index-tracking ETFs. When comparing fund flows of mutual funds and ETFs, a stark contrast emerged in 2022. Fixed income mutual funds had USD 546 billion in outflows in 2022 due to rising rates and price underperformance. Despite that market backdrop, fixed income ETFs saw USD 199 billion in inflows. This trend also played out in the municipal market. While taxable bond ETF asset flows kept AUM levels relatively flat, municipal bond flows grew by USD 29 billion, pushing municipal bond ETFs assets to over USD 100 billion, a 26% increase

One possible reason for the rising popularity of fixed income ETFs could be investor preference for index-based products with increased transparency and liquidity. Another reason could be the ease of access and low cost. Evidence that retail transaction costs to trade municipal bonds can be as much as 66 bps more than institutional trades provides a good reason for this one-sided flow.1 Transaction costs could potentially be reduced by accessing bonds through mutual funds or ETFs. These ETFs have a distinct advantage in that shares of the fund can be exchanged without the need to incur any transactions in the institutional market.

The current tax equivalent yield on the S&P National AMT-Free Municipal Bond Index is 4.63%. Taking tax benefits into account puts municipal bonds on equal footing with other taxable fixed income sectors like treasuries and corporate bonds. U.S. Treasury yields fall short of that, at 4%, while corporate bonds currently exceed 5% (see Exhibit 3). Those incremental 37 bps do come with credit risk, however, as the average rating for the municipal index is AA, compared with A- for the corporate index.

(Click on image to enlarge)

Rising yields have drawn increased attention to the bond market. As investors readjust to a world where fixed income could actually offer income, they face an unprecedented array of ways to access targeted exposures to states and duration. More than ever before, municipal bond investors are choosing index-based products, making their preferences clear and changing the fund landscape. With hundreds of municipal bond indices tracking the broad market, you can measure the national market, drill down to state-level performance and seek out targeted interest rate exposures down to a single maturity year.

1 Giordano, Jason. “The Hidden Costs of Retail Purchases in Municipal Bonds.” S&P Dow Jones Indices LLC. July 2022.

More By This Author:

Commodities Flat In January After Second-Best Yearly Performance In Two Decades

Net-Zero Targets And Temperature Alignment: Two Sides Of The Same Coin?

What Performance Reversals Suggest

Disclaimer: See the full disclaimer for S&P Dow Jones Indices here.