Gold: Unique In Every Way

Gold is a special asset. It is simultaneously a commodity and a foreign exchange instrument. It is cyclical and defensive at the same time. It has been used as a store of value and a medium for exchange for millennia. With references to the metal in the Torah, Bible, Qur’an and Bhagavad Gita, its historical allure to humans verges on empyrean.

Different and Resilient

In the financial world, its unique behavioral traits make it a perfect diversifier to a portfolio:

- It behaves differently to equities, bonds, commodities and crypto currencies

- It is a great inflation hedging instrument

- It is a great geopolitical shock hedging instrument

- It is a great financial shock hedging instrument

- It performs well in both recessions and strong expansions

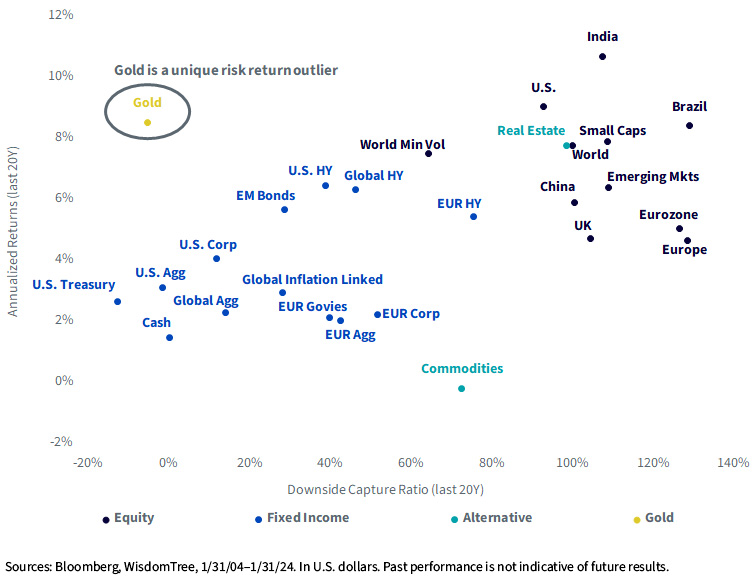

This balance between downside protection and capacity to generate positive return over the long-term is unique to gold. As illustrated in figure 1, returns for most assets are broadly proportional to risk. Assets with high equity-like returns over the last 20 years have exhibited downside capture (vs. equity markets) of around 100%. Assets with lower downside capture, like fixed income, tend to have lower returns, too.

Gold bucks these trends: it has exhibited equity-like returns of 8.5% per annum over the last 20 years with very minimal downside capture. Gold, therefore, is a uniquely suited asset to increase diversification and reduce risk in a portfolio without weighing on long-term performance.

Figure 1: Long-Term Performance and Downside Risk for Different Assets over the Last 20 Years

The Perfect Diversification Tool

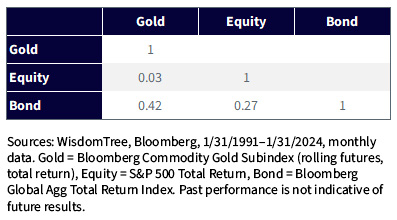

As the late Markovitz said, the only free lunch in the world of investing is diversification. That diversification is enhanced by low correlations. As figure 2 illustrates, gold’s correlations to equities and bonds are low.

Figure 2: Asset Correlation Matrix

The Perfect Tool Shunned by Many Investors Today

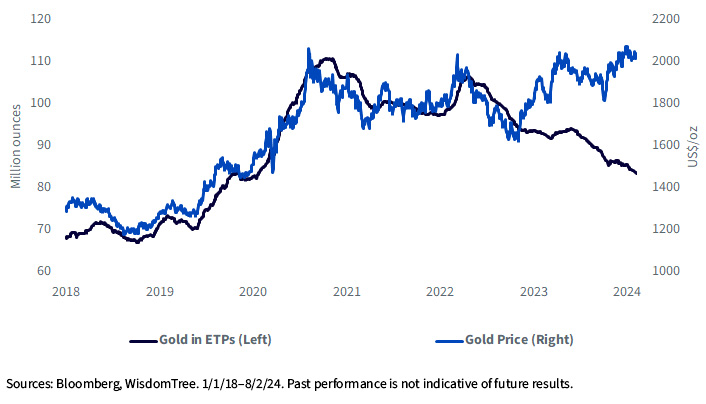

Judging by flows out of physical gold exchange-traded funds (ETFs) over the past three years, professional gold investors appear to have turned their backs on the metal (figure 3). With repeated attempts to break above the $2,050 per ounce mark, there has been no tailwind from the ETF market. If gold successfully gets above that level, we could see ETF investors return -- and that could fuel a stronger rally.

Figure 3: Gold Price and ETF Holdings

Gold Poised to Reach a New High

Although soft landings have historically not provided the best setting for gold to shine, in this rate cycle we have seen gold hit a fresh high in December 2023, when markets were expecting a decisive Federal Reserve pivot in 2024.

Some of those gains have been given back as markets reassessed the Fed’s urgency, but our gold model points to gold rising to a higher high by the end of this year, on account of bond yields declining and the U.S. dollar depreciating.

Gold could reach $2,210 per ounce, close to 10% higher at the time of writing. Achieving the lauded soft landing is easier said than done (and that is why we have so few observations to look at). We could face a bumpy road in 2024, with the Fed and markets clearly having a different view of the rate path ahead of us. Gold’s hedging capabilities may once again prove to be the antidote to volatility elsewhere.

More By This Author:

Magnificent Seven Earnings (Mostly) ImpressFocus On The Fed Series: Taking Stock Of Fixed Income

Groundhog Day For The Bond Market

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more