Bond Market Awaits News On Inflation, Tariffs And The Deficit

Is this the calm before the storm? Or has the danger passed? The bond market is focused on news and data in the days and weeks ahead that will provide context for answering these key questions. Meanwhile, Treasury yields have taken a break from the sharp upswing that’s dominated trading in recent months. In short, a wary calm prevails.

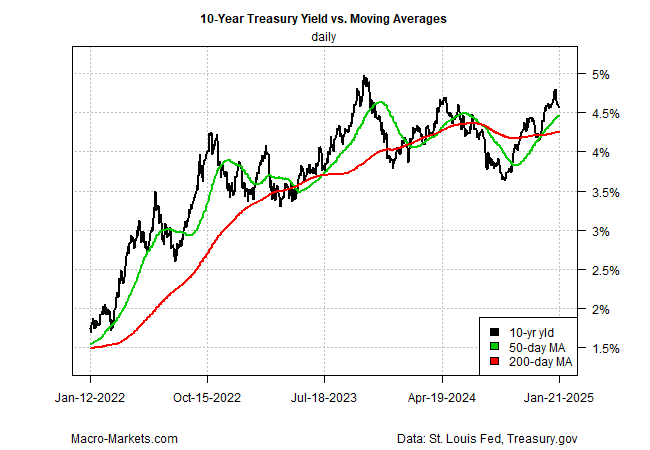

It’s premature to rule out higher levels for the 10-year Treasury yield, which has been rising since September. The recent pullback in recent days has brought relief as the benchmark rate trades moderately below its recent peak of roughly 4.80%. In yesterday’s trading (Jan. 22), the 10-year edged up to 4.62%.

But as the chart below suggests, it’s not obvious that the latest upswing has run its course. One reason to be cautious is the recent rise in the 10-year rate’s 50-day average above its 200-day counterpart, which implies that an upside bias remains intact.

Three key questions are lurking for bonds related to inflation, tariffs and the US government’s growing budget deficit.

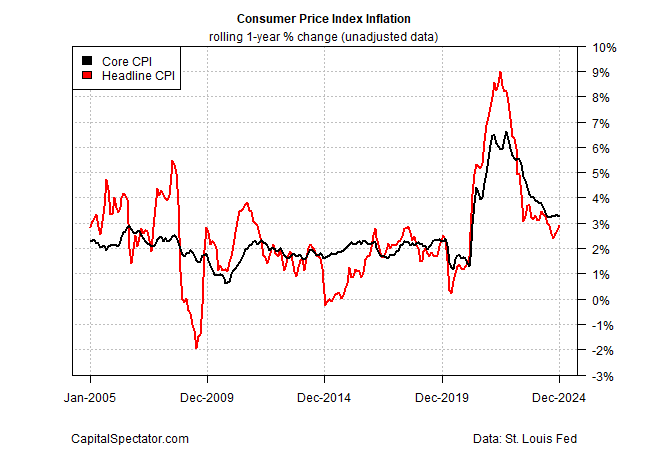

On the inflation front, the bond market has been focused like a laser on the ongoing debate about whether sticky inflation will persist. Although the Federal Reserve can claim a degree of victory in taming the worst of the inflation surge in 2022, disinflation has stalled recently near the 3% mark, or moderately above the Fed’s 2% inflation target.

A complicating factor is President Trump’s plans for raising import tariffs, which some economists predict will be inflationary. One school of thought argues that Trump is using the threat of tariffs as a negotiating tactic and so the risk that new tariffs will drive inflation higher on the margins is less worrisome than some analysts assume.

Perhaps, but economists have recently raised inflation expectations, according to a new survey published by The Wall Street Journal. The outlook for the year-over-year change in the Consumer Price Index (CPI) over the next 12 months rose to 2.7% from 2.3% in the latest quarterly poll. “Only a few of the economists are projecting lower inflation than they did in October.”

Meanwhile, the bond market is warily eyeing the growing US federal budget deficit as a potential factor that could drive interest rates higher. The Congression Budget Office (CBO) recently updated its projections and forecasts that the US government will struggle to keep the deficit steady. Reducing red ink is expected to be a tough political challenge, largely because the politically sensitive spending areas of Social Security and Medicare — major drivers of government spending — are on track to continue rising faster than revenues, thereby widening the budget deficit. By 2035, the CBO projects that the adjusted deficit will be 6.1% of the nation’s economy (GDP), well above the 3.8% average of the past 50 years. The key levers in the government’s toolkit for slowing/reversing the rising tide of red ink: tax hikes and/or reducing spending, neither of which appears to be a political priority for the GOP, which controls both houses of Congress and the White House.

Concerns about rising interest rates are, for now, on hold. Fed funds futures are pricing in a virtual certainty that the central bank will leaves its target rate unchanged at the next FOMC meeting on Jan. 29. A moderate probability (76%) is estimated for no change at the March meeting.

Using the 2-year Treasury yield as a proxy for expectations, however, reminds that sentiment has shifted and the market now assess a relatively neutral stance for the Fed funds rate. The 2-year yield continues to trade roughly in line with the Fed funds rate. The implication: the market sees little, if any, room for rate cuts.

It’s premature to argue that rate hikes are likely. Much depends on the incoming data on inflation and economic growth. Trump’s decisions on tariffs in the days and weeks ahead will be a factor, too. Ditto for political decisions related to government spending and tax cuts, which will be influential for managing expectations on the path ahead for the federal deficit.

“We’re not out of the woods yet from an inflation perspective,” says Dan Ivascyn, chief investment officer at Pimco, the giant bond-fund manager. Rate increases are “certainly possible,” he tells the Financial Times, but aren’t currently his baseline scenario. For the moment, the bond market seems to agree.

More By This Author:

Macro Briefing - Wednesday, Jan. 22

Commodities Take Early Lead For Asset Classes So Far In 2025

Macro Briefing - Tuesday, Jan. 21

Disclosure: None.