An Exit From The 20% Rule For Buying EWZ (Brazil ETF)

Just over two months ago, I aggressively bought ahead of an official trigger of the 20% rule for buying iShares MSCI Brazil ETF (EWZ). At the time, I explained my decision with three key reasons:

- Rate cuts at the time from the Bank of Canada (BoC) and the European Central Bank (ECB) moved financial markets to sniff out the start of a global rate cut cycle. A rate cut cycle tends to benefit emerging/commodity economies like Brazil’s. The BoC cut rates a second time since then.

- The October lows provided a natural point of support for buying EWZ.

- I learned a lasting lesson from passing over an earlier trades because the stock did not quite trigger a preset rule.

I was also well aware that buying early subjected me to additional risks for the trading rule. Thus, I insisted I would buy at least one more time once EWZ hit the actual point of the 20% decline from the recent highs. I actually ended up buying EWZ two more times after it sliced right past the 20% trigger point. I had my eye on additional buys around the 2023 lows if the selling continued that far (around $25).

(Click on image to enlarge)

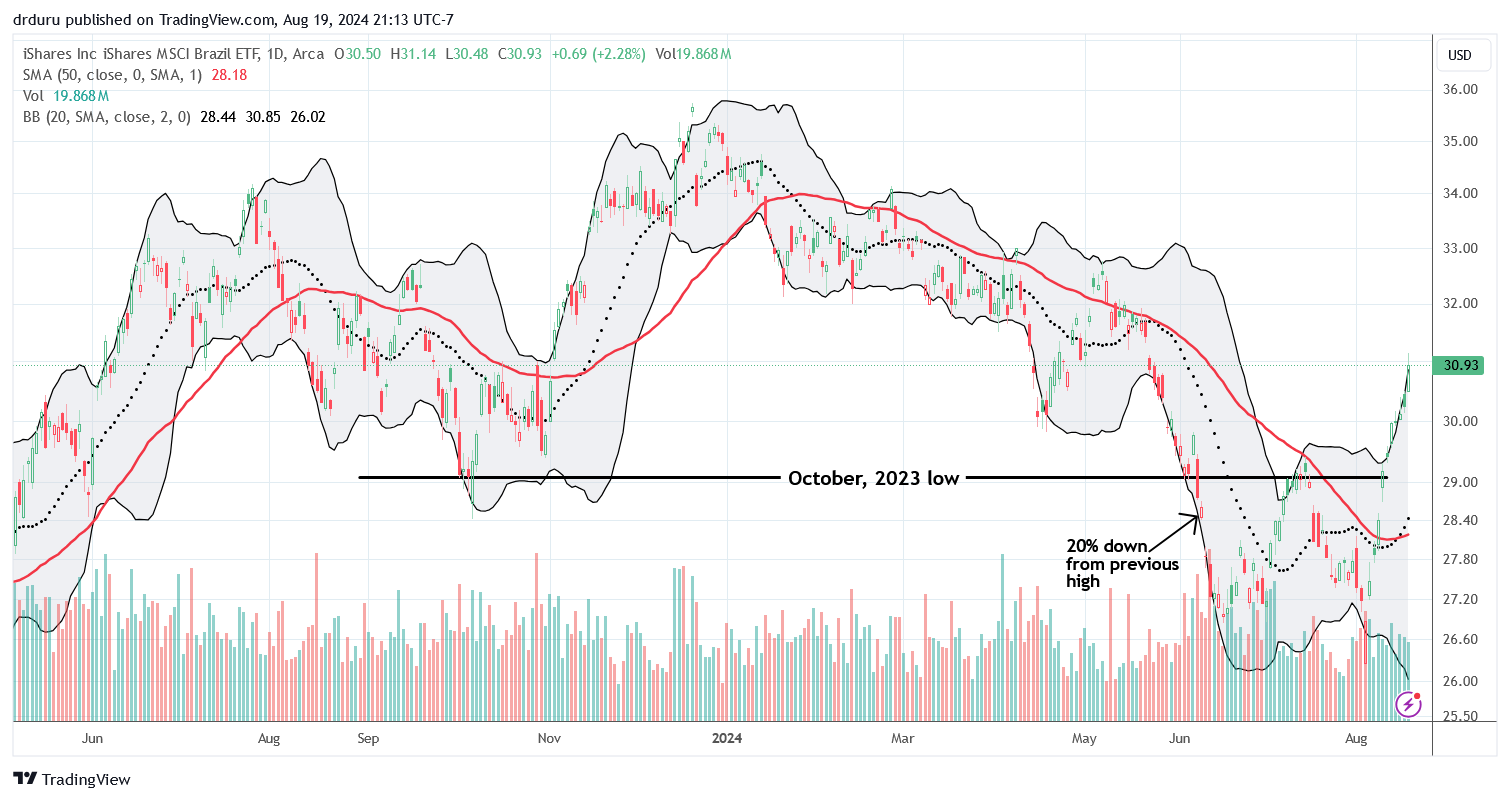

Back in June, the iShares MSCI Brazil ETF (EWZ) failed to hold its October low as support. After the 50DMA held as resistance to the first bounce, this month’s recovery easily took EWZ through several layers of resistance. It now faces 200DMA resistance (not shown).

As the chart above shows, EWZ was a roller coaster at and below its October, 2023 low. The first rebound stopped cold right at resistance from the 50-day moving average (DMA) (the red line). In my previous post, I pointed out how the declining 50DMA could limit upside for this EWZ trade. Yet, I decided to hold in favor of waiting to see what the Fed would bring in its July-ending meeting. EWZ sold straight down from there and into the Fed meeting in what I see now was an early sign of the August calamity. Fortunately, the Brazil ETF never reached the 2023 lows and instead rebounded sharply along with V-shaped recoveries across financial markets. EWZ sliced right through an even lower 50DMA.

EWZ is now within a half point of its 200DMA resistance (not shown). Unlike July, I decided not to wait right at important technical resistance to see what the next Fed action would bring. The Federal Reserve’s confab at the end of this week in Jackson Hole, Wyoming should be anti-climactic given the current market pricing for rate cuts in September. However, the near certainty pricing means that the biggest risk on Friday is a market surprise to the downside. Thus, given the speculative nature of the EWZ trade, I decided to lock in profits.

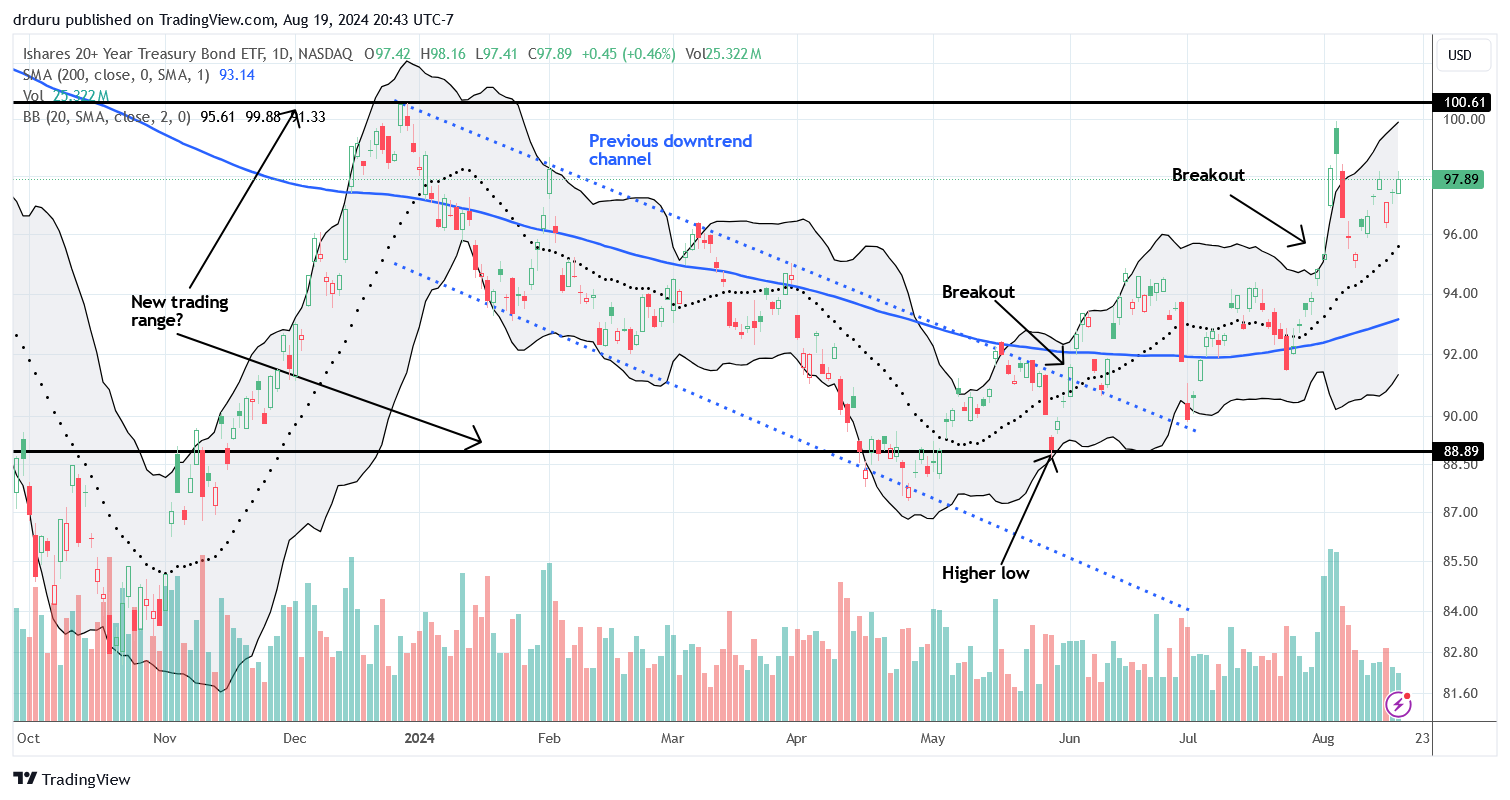

The chart below shows how the bond market has moved dramatically in the past two months. The previous downtrend channel for the iShares 20+ Year Treasury Bond ETF (TLT) is ancient history. TLT has carved out a new, presumed horizontal trading range. TLT has swung wildly with the volatile sentiment around poor and good economic data. I see short-term downside risk to TLT, an observation which further motivated me take profits on EWZ here.

(Click on image to enlarge)

The iShares 20+ Year Treasury Bond ETF (TLT) fully anticipates imminent rate cuts and widened its presumed trading range.

Trade School

EWZ underperformed the S&P 500 from the start of the trade to now. EWZ gained 3.9% versus the S&P 500’s 4.8% gain. Adjusting for risk, EWZ under-performed even more. Yet, I am still happy with the trade. I did not and could not forecast the potential performance differences. The trading thesis rested on a rule that I followed, implemented, and saw through. I prefer using discipline over relying on crystal balls. Moreover, the trading rule worked yet again ( with a turbo boost from additional purchases at lower prices of course). Finally, along the way, the EWZ trading thesis helped to carry me through the August calamity without panicking with the rest of the “deleveragers”. That sentiment helped my focus on other trades as well.

Having said that, if the market responds positively to whenever the Fed finally stops teasing about rate cuts, I expect EWZ to outrace the S&P 500 higher. EWZ has a lot of room to fill just back to its 2024 high whereas the S&P 500 is already near its all-time high. Such an EWZ trade will be a whole different thesis (and much more discretionary).

Be careful out there!

More By This Author:

Consumers No Longer Accept The Blame For Inflation

The Carry Trade Sweeps The Sahm Rule Aside

The New Recession Obsession: The Sahm Rule