A New Short-Term Uptrend May Have Started On Friday

Image Source: Unsplash

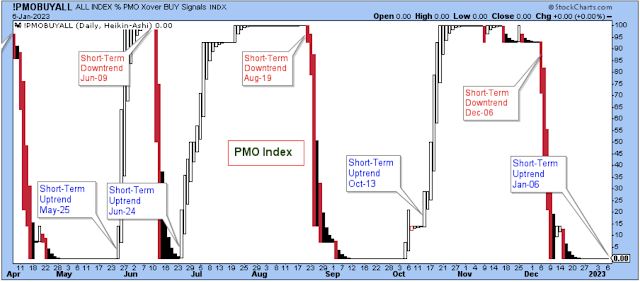

It looks like a new short-term uptrend started on Friday, although the PMO index hasn't turned higher yet. So, we should consider the rally unconfirmed for now.

All three of the major indexes had strong closes well above their 5-day averages.

The bullish percents turned up nicely, giving bullish signals. The Nasdaq bullish percent had already started trending higher, despite a few rocky days in the market providing a decent hint that the market was getting ready to rally.

This junk bond ETF has rallied for the last six days, indicating that the selling pressure has diminished. If the selling pressure is off junk bonds, this says to me that the selling pressure has diminished for stocks as well.

The summation indexes of the three major stock indexes have curled upwards, giving a favorable signal for owning stocks. The SPX summation never even dipped below the zero level, and the small-cap summation didn't dip very far below, and I'm interpreting this as a hint at market strength.

Bottom Line

I closed all my short positions early in the week and went about 40% long during the Wednesday morning rally. On Thursday, that wasn't feeling like the best decision, but it was looking better by Friday afternoon.

I then added about 10% more to the longs by adding to holdings in the stocks with both the best earnings and the best chart patterns. I am now about 50% long in the accounts. I'm still a bear, but I want to take advantage of this short-term stock rally.

This chart next shows that the SPX is still under significant resistance. The 3920-level is a longer-term line in the sand, meaning that when the SPX is underneath this level, it indicates additional caution. It makes sense to have a healthy amount of cash in the accounts with the SPX under this level.

The chart gives the SPX the look of a potential bullish head-and-shoulders price pattern. This will be confirmed if the price breaks above the downtrend line, but until then, as a technician, assume that the downtrend continues.

Outlook Summary

- The short-term trend is up for stock prices as of Jan. 6.

- The economy is at risk of recession as of March of 2022.

- The medium-term trend is higher for Treasury bond prices as of Nov. 19 (prices higher, yields lower).

More By This Author:

Keep Watch For The Next Short-Term UptrendThe Recent Short-Term Downtrend Continues

A Short-Term Downtrend Started On Weak Volume

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more