A Short-Term Downtrend Started On Weak Volume

Image Source: Unsplash

A short-term downtrend started on Tuesday, Dec. 6. The previous uptrend lasted a long time, and the market seemed ready to take at least a short break.

The PMO index shown above moved quickly from the top of its range to the bottom of its range, meaning that almost all stocks have lost price momentum, but the SPX shown below hasn't moved lower by very much. This behavior seems more like the kind of short-term downtrend that just pauses and refreshes an uptrend by moving sideways for a period of time.

Volume has been weak so far in December, and with the holiday approaching, it is likely to remain weak. With such low volume, there is very little enthusiasm to buy stocks, but there's also very little interest in selling either. It is the kind of dull market rally where good stock pickers make money, but buying or shorting the major indexes is just frustrating.

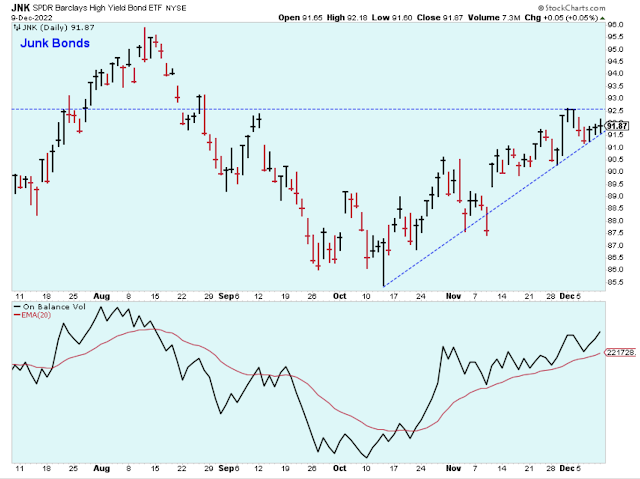

The junk bond ETF is at its downtrend line and is experiencing just a bit of resistance, and the momentum indicator looks likely to turn lower soon. If this were a stock, I wouldn't be a buyer because the larger downtrend is definitely intact, but I wouldn't be a seller either because there isn't a signal to sell.

I'm watching this ETF closely. I'm operating on the assumption that stocks are not going to move sharply lower as long as junk bonds are doing reasonably well. Since this ETF isn't showing weakness, I am expecting the current short-term downtrend in stocks to be relatively harmless for now.

As long as this ETF does reasonably well, I'm not inclined to aggressively short the market.

Here is a closer look at the same junk bond ETF. The chart shows prices under a resistance level but maintaining above its short-term uptrend line, and with a very healthy on-balance volume indicator. This is not a bad-looking chart, and in order to make money shorting the general market, I think you have to see weakness in this chart.

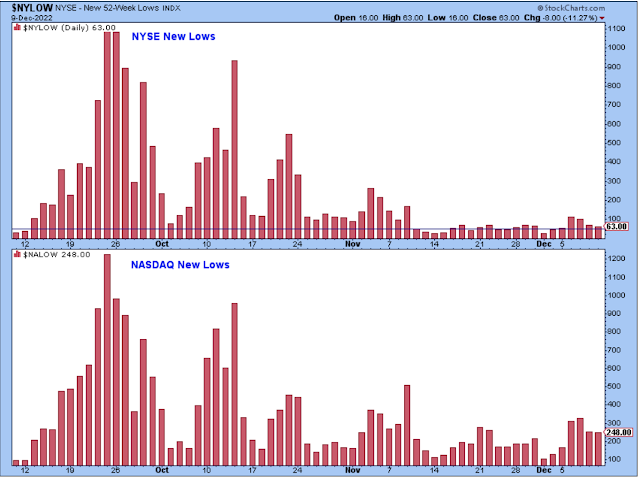

NYSE 52-week new lows have been elevated particularly on Tuesday and Wednesday. This is too many new lows for a healthy market, but at this level of NYSE new lows, the market can grind higher in dull trading.

However, Nasdaq new 52-week lows have been way too elevated, and with this many Nasdaq new lows, I feel confident saying that the stock market has not bottomed out and is not ready to enter a new bull market. I would not be aggressively long stocks with these levels of Nasdaq new 52-week lows.

I hear a lot of recommendations to buy small-caps on CNBC, but when I look at this chart I can only see lower prices. This ETF is in a larger downtrend and under resistance, so it is too early to buy.

Oil prices are trending lower, but there is a decent support level at $62.50.

Bottom line: I don't have any special insights into the market, so I'm sticking to a basic trading strategy. The PMO has moved to the bottom of its trading range which means that most stocks are struggling a bit at the moment, but it is a bit late to be selling.

As we see in a couple of charts, there isn't much to suggest strong selling either (not yet anyway). So, I will give the market a bit of time, and then I will start looking for buying opportunities.

My account has mostly stayed the same over the past two weeks. I have one large short position and several small short positions. I also have a number of very small long positions in companies with the best fundamentals and charts. I'll add to the stock positions showing strong price performance, strong relative strength, and healthy up volume based on the on-balance volume indicator.

Outlook Summary

- The short-term trend is down for stock prices as of Dec. 6.

- The economy is at risk of recession as of March 2022.

- The medium-term trend is higher for Treasury bond prices as of Nov. 19.

More By This Author:

Stock Market Commentary: Headline ChartsThe Best Time To Buy Stocks In The Short-Term Has Passed

The Short-Term Uptrend Continues Despite Uncertainty

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more