#Nike is down 30%+ YTD (wiping $60B+). A former Nike branding exec wrote a viral post and blames it on three decisions Nike made in 2020 under incoming CEO John Donahue.

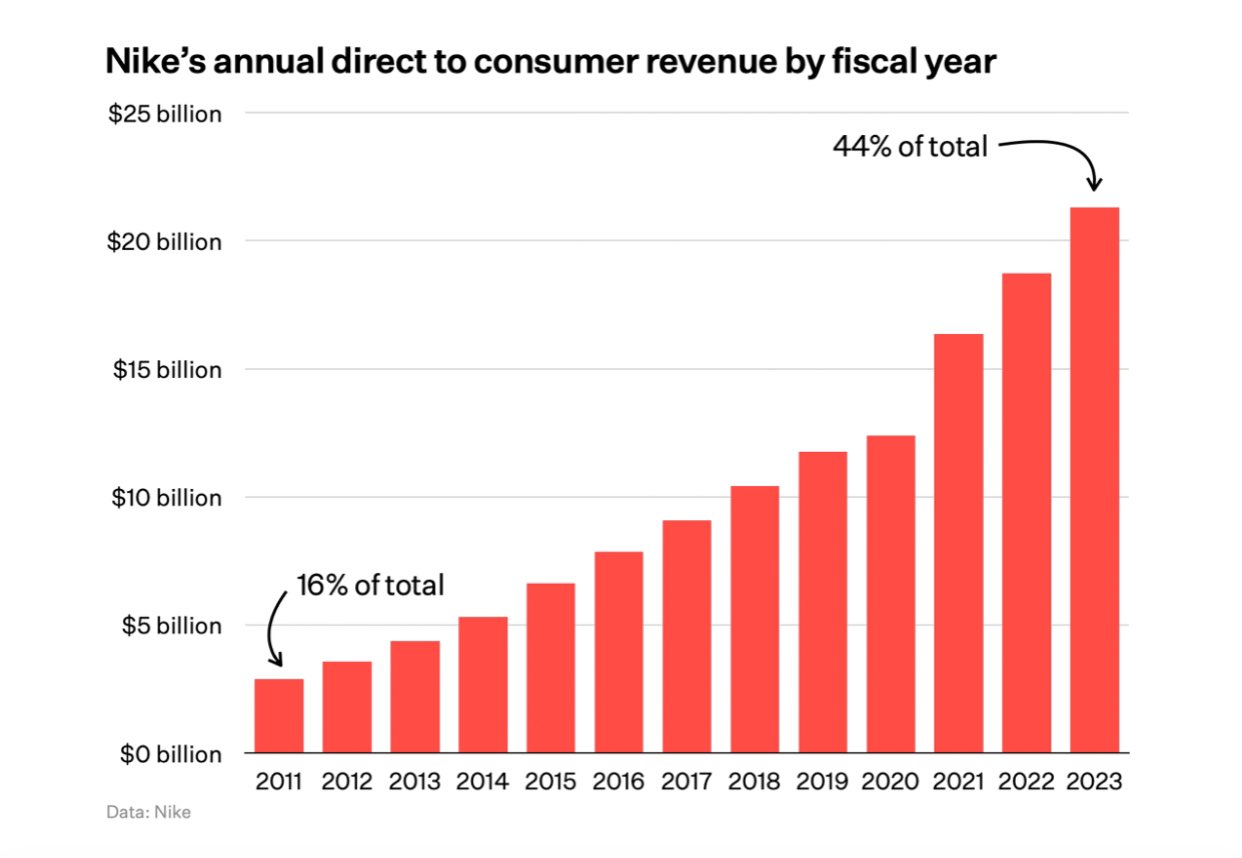

The plan prioritized the direct-to-consumer (DTC) business but backfired:

ELIMINATE CATEGORIES: Mckinsey advised Nike to get rid of categories (running, basketball, soccer) and re-classify everything into “Women”, “Men” and “Kids”.

The logic was that Nike was duplicating resources and a pivot to DTC would provide enough customer data to inform product decisions instead of relying on the category experts (eg. a basketball vet that spent 20+ years at Nike). A lot of these experts were fired and Nike lost their insights.

This was a clear L because Nike quietly brought back categories at end 2023.

END WHOLESALE LEADERSHIP: Nike ended hundreds of relationships with wholesales partners and prioritized Nike website over retail.

The change looked genius during COVID but as customers returned to brick ‘n mortar, Nike’s product were nowhere to be found. It had burnt bridges with partners, who were happy to give shelf space to upstarts (this wasn’t covered but I think On and Hoka took advantage of this for running).

There was also a lack of feedback from retailers, which led to inventory issues (the “data-driven” insights from online sales proved to not be a panacea).

PRIORITIZE DIGITAL MARKETING: Nike changed its marketing budget to focus on driving users to Nike digital properties and membership platforms.

For decades, Nike spent 10% of sales on brand advertising to create an aspirational halo. The prioritization of programmatic ad spend meant Nike went from “create demand” (new customers) to “serve and retain demand” (re-targeting existing ones). The result was a slowdown in sales.

“Because of that,” writes Massimo Giunco (who spent 21 years at the company), “Nike invested a material amount of dollars (billions) into something that was less effective but easier to be measured vs something that was more effective but less easy to be measured. In conclusion: an impressive waste of money.”

***

The focus on DTC is not surprising. Donahue was formerly CEO of B2B SAAS firm ServiceNow.

Nike’s DTC business is now 44% of sales (vs. 30% before the strategy change).

The digital focus seems to have commoditized the product, impacted Nike’s brand perception and created an opening for competitors. But Giunco does think it’s fixable if Nike gets back to its marketing prowess and get off the digital ad drop (obviously take it with the grain of salt that he’s a brand guy).

What was the negative sentiment focused on? I'm bullish on $NKE. I'm very optimistic about Nike's future and you can't beat the brand loyalty its customers have. I won't buy any other brand of sneaker myself. I think the only place to go is up. But I'd like to know what these negative posts were concerned about so I can rebut those concerns.

There was good reason for Nike's stock to drop. It's no secret that the company has had disappointing financial results, driven by weakening consumer demand, and increasing competition. It's not doing well in China which is a major growing market. I don't think we need social media chatter to see that - just research the sticker on any reputable news site like, including right here.

But I do think investors have a right to know if there is an organized attempt to manipulate $NKE's stock price to drive it down.

I agree that this is interesting information, but am not sure what to do with it. It would be more useful if we understood what the chatter actually said. Were most posts in agreement? Did they all take a negative view of the company? Why? What was the news that actually caused $NKE to drop?

Can The Paris Olympics Reignite This Beaten Down Stock?

Lot of good info and insight on $NKE here:

https://talkmarkets.com/content/stocks--equities/correlation-between-social-media-chatter-and-nikes-stock-plunge?post=454229

Correlation Between Social Media Chatter And Nike's Stock Plunge

Saw this and thought it made a lot of sense:

#Nike is down 30%+ YTD (wiping $60B+). A former Nike branding exec wrote a viral post and blames it on three decisions Nike made in 2020 under incoming CEO John Donahue.

The plan prioritized the direct-to-consumer (DTC) business but backfired:

ELIMINATE CATEGORIES: Mckinsey advised Nike to get rid of categories (running, basketball, soccer) and re-classify everything into “Women”, “Men” and “Kids”.

The logic was that Nike was duplicating resources and a pivot to DTC would provide enough customer data to inform product decisions instead of relying on the category experts (eg. a basketball vet that spent 20+ years at Nike). A lot of these experts were fired and Nike lost their insights.

This was a clear L because Nike quietly brought back categories at end 2023.

END WHOLESALE LEADERSHIP: Nike ended hundreds of relationships with wholesales partners and prioritized Nike website over retail.

The change looked genius during COVID but as customers returned to brick ‘n mortar, Nike’s product were nowhere to be found. It had burnt bridges with partners, who were happy to give shelf space to upstarts (this wasn’t covered but I think On and Hoka took advantage of this for running).

There was also a lack of feedback from retailers, which led to inventory issues (the “data-driven” insights from online sales proved to not be a panacea).

PRIORITIZE DIGITAL MARKETING: Nike changed its marketing budget to focus on driving users to Nike digital properties and membership platforms.

For decades, Nike spent 10% of sales on brand advertising to create an aspirational halo. The prioritization of programmatic ad spend meant Nike went from “create demand” (new customers) to “serve and retain demand” (re-targeting existing ones). The result was a slowdown in sales.

“Because of that,” writes Massimo Giunco (who spent 21 years at the company), “Nike invested a material amount of dollars (billions) into something that was less effective but easier to be measured vs something that was more effective but less easy to be measured. In conclusion: an impressive waste of money.”

***

The focus on DTC is not surprising. Donahue was formerly CEO of B2B SAAS firm ServiceNow.

Nike’s DTC business is now 44% of sales (vs. 30% before the strategy change).

The digital focus seems to have commoditized the product, impacted Nike’s brand perception and created an opening for competitors. But Giunco does think it’s fixable if Nike gets back to its marketing prowess and get off the digital ad drop (obviously take it with the grain of salt that he’s a brand guy).

***

Check out the whole piece on $NKE: Nike: An Epic Saga of Value Destruction

The New Consumer chart below: Is Nike actually good at digital? Or is it just lucky to be Nike?

Correlation Between Social Media Chatter And Nike's Stock Plunge

Whatever happened with this? $NKE is still low compared to a month ago.

Correlation Between Social Media Chatter And Nike's Stock Plunge

It doesn't seem suprising that an increase in negative sentiment would cause $NKE's stock price to go down. The only questions I see are:

1. What caused this sudden uptick of negative sentiment and

2. What can the company do about it?

Correlation Between Social Media Chatter And Nike's Stock Plunge

What was the negative sentiment focused on? I'm bullish on $NKE. I'm very optimistic about Nike's future and you can't beat the brand loyalty its customers have. I won't buy any other brand of sneaker myself. I think the only place to go is up. But I'd like to know what these negative posts were concerned about so I can rebut those concerns.

Correlation Between Social Media Chatter And Nike's Stock Plunge

Agreed. Though if that's the case, then it means $NKE is being undervalued and this could be a good buying opportunity.

Correlation Between Social Media Chatter And Nike's Stock Plunge

There was good reason for Nike's stock to drop. It's no secret that the company has had disappointing financial results, driven by weakening consumer demand, and increasing competition. It's not doing well in China which is a major growing market. I don't think we need social media chatter to see that - just research the sticker on any reputable news site like, including right here.

But I do think investors have a right to know if there is an organized attempt to manipulate $NKE's stock price to drive it down.

Correlation Between Social Media Chatter And Nike's Stock Plunge

I agree that this is interesting information, but am not sure what to do with it. It would be more useful if we understood what the chatter actually said. Were most posts in agreement? Did they all take a negative view of the company? Why? What was the news that actually caused $NKE to drop?

Nike Rises After Canaccord Says Buy As 'Battleship Is Turning'

I think $NKE is likely to sink.

3 Reasons Why I Prefer Nike To Under Armour

Great Insight. $NKE