The Price/Earnings ratio is 6.85, which indicates a rather cheap valuation of AAP.

Compared to the rest of the industry, the Price/Earnings ratio of AAP indicates a rather cheap valuation: AAP is cheaper than 89.39% of the companies listed in the same industry.

The average S&P500 Price/Earnings ratio is at 25.50. AAP is valued rather cheaply when compared to this.

With a Price/Forward Earnings ratio of 9.59, the valuation of AAP can be described as very reasonable.

AAP's Price/Forward Earnings ratio is a bit cheaper when compared to the industry. AAP is cheaper than 69.70% of the companies in the same industry.

When comparing the Price/Forward Earnings ratio of AAP to the average of the S&P500 Index (18.66), we can say AAP is valued slightly cheaper.

Margins

AAP has a Profit Margin of 3.08%. This is in the better half of the industry: AAP outperforms 62.88% of its industry peers.

AAP's Profit Margin has declined in the last couple of years.

The Operating Margin of AAP (4.90%) is comparable to the rest of the industry.

AAP's Operating Margin has improved in the last couple of years.

AAP has a better Gross Margin (43.58%) than 73.48% of its industry peers.

In the last couple of years the Gross Margin of AAP has remained more or less at the same level.

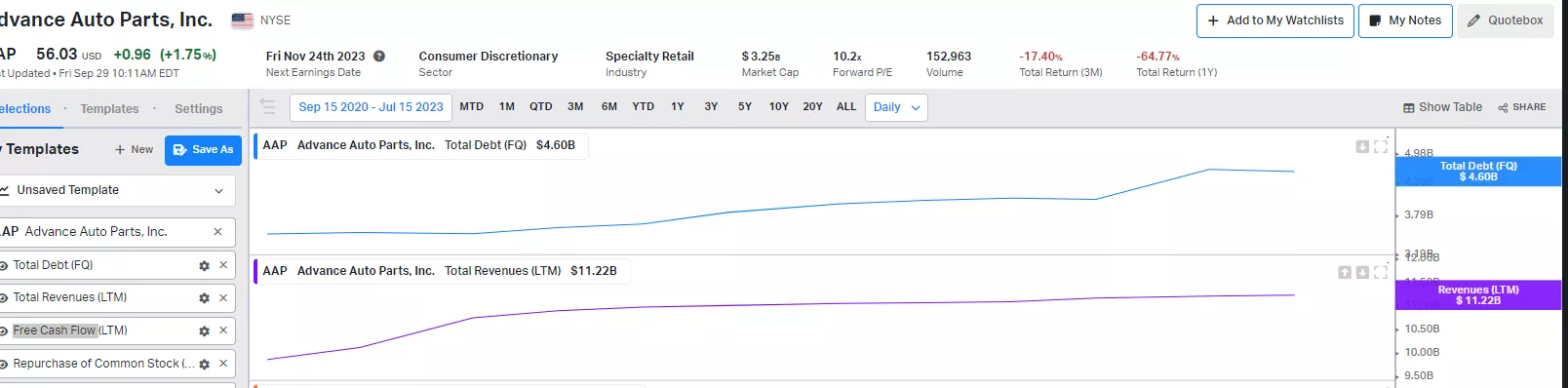

The company has revenues of 11 billion dollars against a debt of 4 billion. Last week the stock made a weekly reversal candle on an upward trend line from the first day of the stock. If it goes down from here, it's generally the company's competitors who try to buy it at a cheaper price

Latest Comments

Bear Of The Day: Advance Auto Parts

its time to buy aap

The Price/Earnings ratio is 6.85, which indicates a rather cheap valuation of AAP.

Compared to the rest of the industry, the Price/Earnings ratio of AAP indicates a rather cheap valuation: AAP is cheaper than 89.39% of the companies listed in the same industry.

The average S&P500 Price/Earnings ratio is at 25.50. AAP is valued rather cheaply when compared to this.

With a Price/Forward Earnings ratio of 9.59, the valuation of AAP can be described as very reasonable.

AAP's Price/Forward Earnings ratio is a bit cheaper when compared to the industry. AAP is cheaper than 69.70% of the companies in the same industry.

When comparing the Price/Forward Earnings ratio of AAP to the average of the S&P500 Index (18.66), we can say AAP is valued slightly cheaper.

Margins

AAP has a Profit Margin of 3.08%. This is in the better half of the industry: AAP outperforms 62.88% of its industry peers.

AAP's Profit Margin has declined in the last couple of years.

The Operating Margin of AAP (4.90%) is comparable to the rest of the industry.

AAP's Operating Margin has improved in the last couple of years.

AAP has a better Gross Margin (43.58%) than 73.48% of its industry peers.

In the last couple of years the Gross Margin of AAP has remained more or less at the same level.

https://www.chartmill.com/stock/quote/AAP/fundamental-analysis?utm_source=PROFITABILITY&utm_medium=stocktwits&utm_campaign=FA&utm_content=AAP

Bear Of The Day: Advance Auto Parts

Their competitors paid bribes to lower their ranking.

There is no reason why the shares should not return to at least $100

Bear Of The Day: Advance Auto Parts

This is not true .

The company has revenues of 11 billion dollars against a debt of 4 billion.

Last week the stock made a weekly reversal candle on an upward trend line from the first day of the stock.

If it goes down from here, it's generally the company's competitors who try to buy it at a cheaper price