Checkout all of my investment ideas at my new Substack Newsletter, Stock Gems

I screen 8,000 stocks to find the True Stock Gems capable of exceptional Returns.

More Here

Overview:

The purpose of these rules is risk management. Pure and simple.

Over thirty years, I’ve learned the hard way what steps are necessary to prevent major losses, while allowing for the largest possible gains.

I’ve come to these rules from reviewing my investing journey. The highs and lows. The purpose of the rules is to avoid large losses while having big gainers. As with everything, it is an evolution.

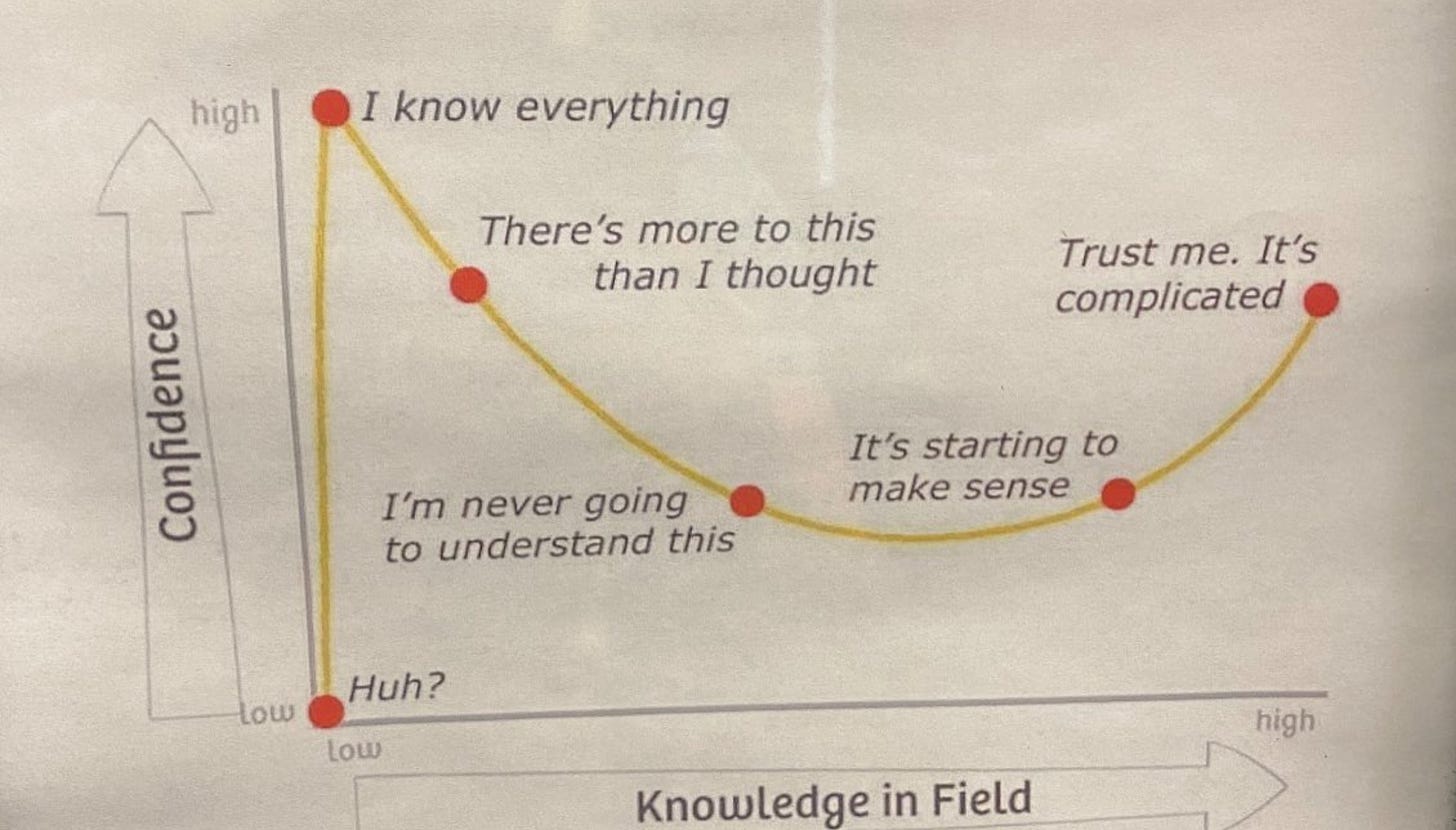

This sums up my journey as an investor. Constantly trying to learn more and battle against overconfidence. (Chart- Dunning Kruger Effect)

I hope these rules speed up your learning curve.

These rules are in no particular order. Because they are all important. Some rules are technical like don’t buy a stock in a downtrend. Others are fundamental such as avoid companies that are losing money or carry high levels of debt.

Every one of these rules increases the odds of success.

The New Rules of Value Investing

Never buy a stock in a downtrend.

Set a sell stop of 10%

Avoid Large Losses:

Avoid Debt:

Avoid Companies Losing Money:

Look for cash rich companies:

Avoid Lower price stocks:

Optimize Position Sizing:

Be a contrarian:

Follow the General Market Trend

1. Never buy a stock in a downtrend. Never

Valuation is only the beginning. Undervalued stocks can and will continue to go lower.

Stocks are ruled by supply and demand.

A stock in a downtrend will continue lower even if it has become extremely undervalued.

Value traps are real and they can significantly reduce returns.

The following chart is from Stan Weinstein’s excellent book, Secrets for Profiting in Bull and Bear Markets. Its a quick read and well worth it.

This chart is the framework for every stocks’ evolution. We only want to own stocks entering stage 2 after a base.

It is the ideal entry point, especially for value stocks.

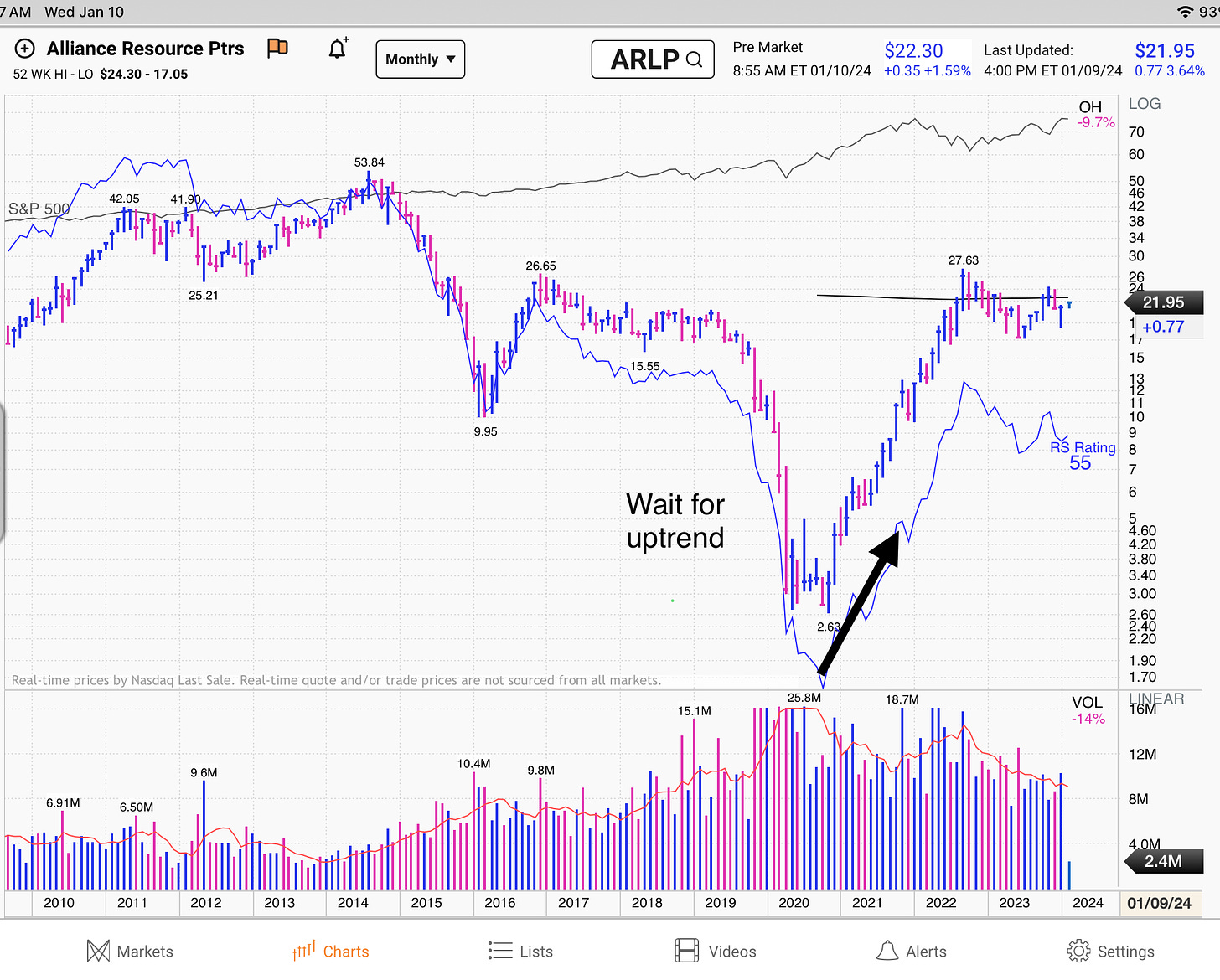

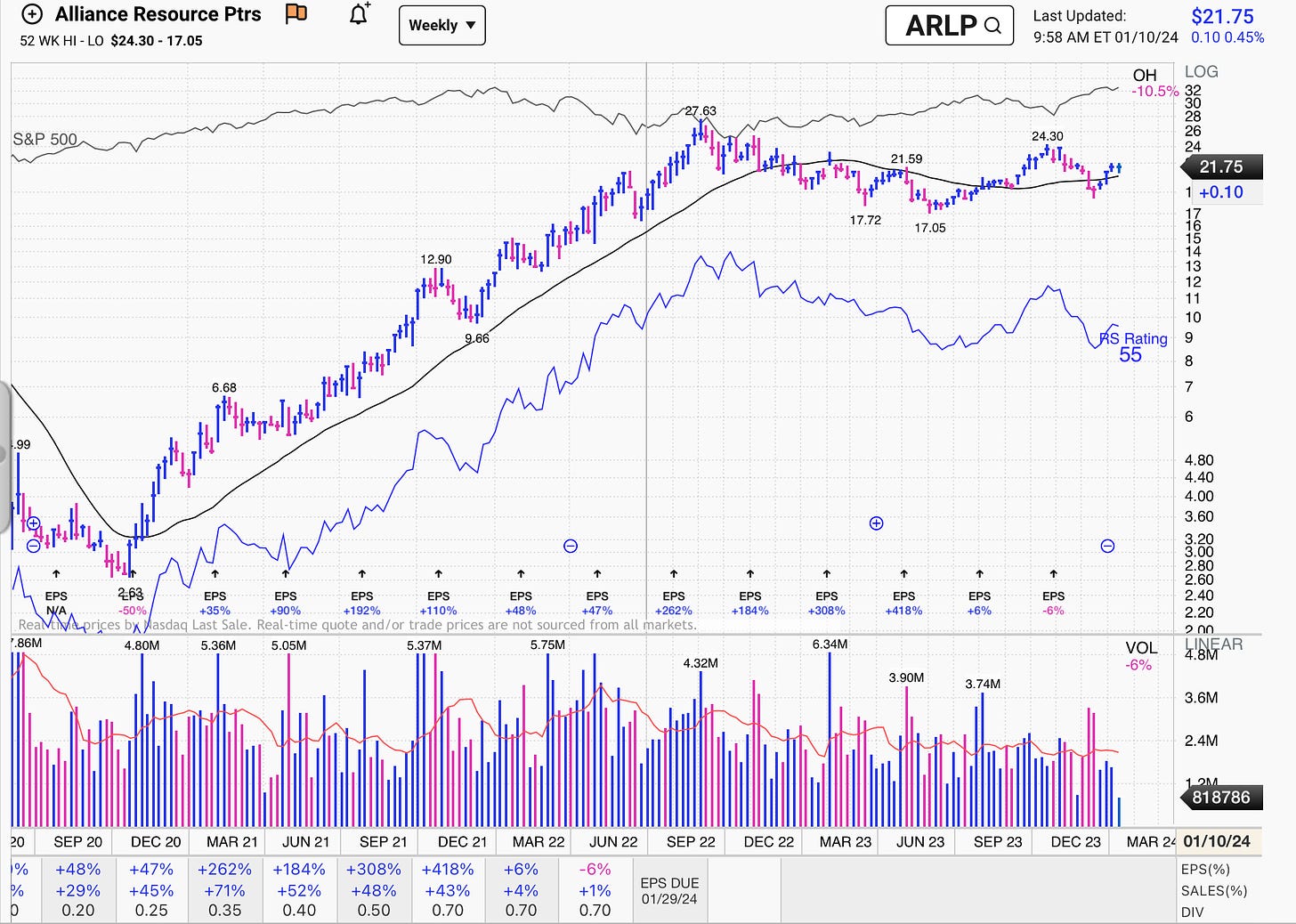

A recent example is Alliance Resources $ ARLP from 2020

Based on valuation, the shares were quite undervalued at $10 per share. However, sellers were in control and the proper buy point was much lower. The buy point was ~ $3.5 Buying the shares at the first buy point would be a costly mistake. (see below)

This is why my rule is to wait for a base and then a new uptrend before entering a position, no matter how undervalued the stock is.

Had I used this rule for Alliance, I would’ve made 300% returns instead of making 100% returns. Big difference.

2. Set a sell stop of 10%.

Even if a stock is undervalued, it will go much lower if the market begins a correction. Or a bear market. Or if the company reports weaker than expected earnings.

Truthfully, there are many reasons an undervalued stock can go lower. Having a sell stop gives you the chance to protect yourself from further losses and reassess the situation.

This is an important part of risk management. An undervalued stock beginning an uptrend should continue to move higher. If it doesn’t, there is something wrong. It’s possible that the market is beginning a correction.

Whatever the reason, the stock should be sold.

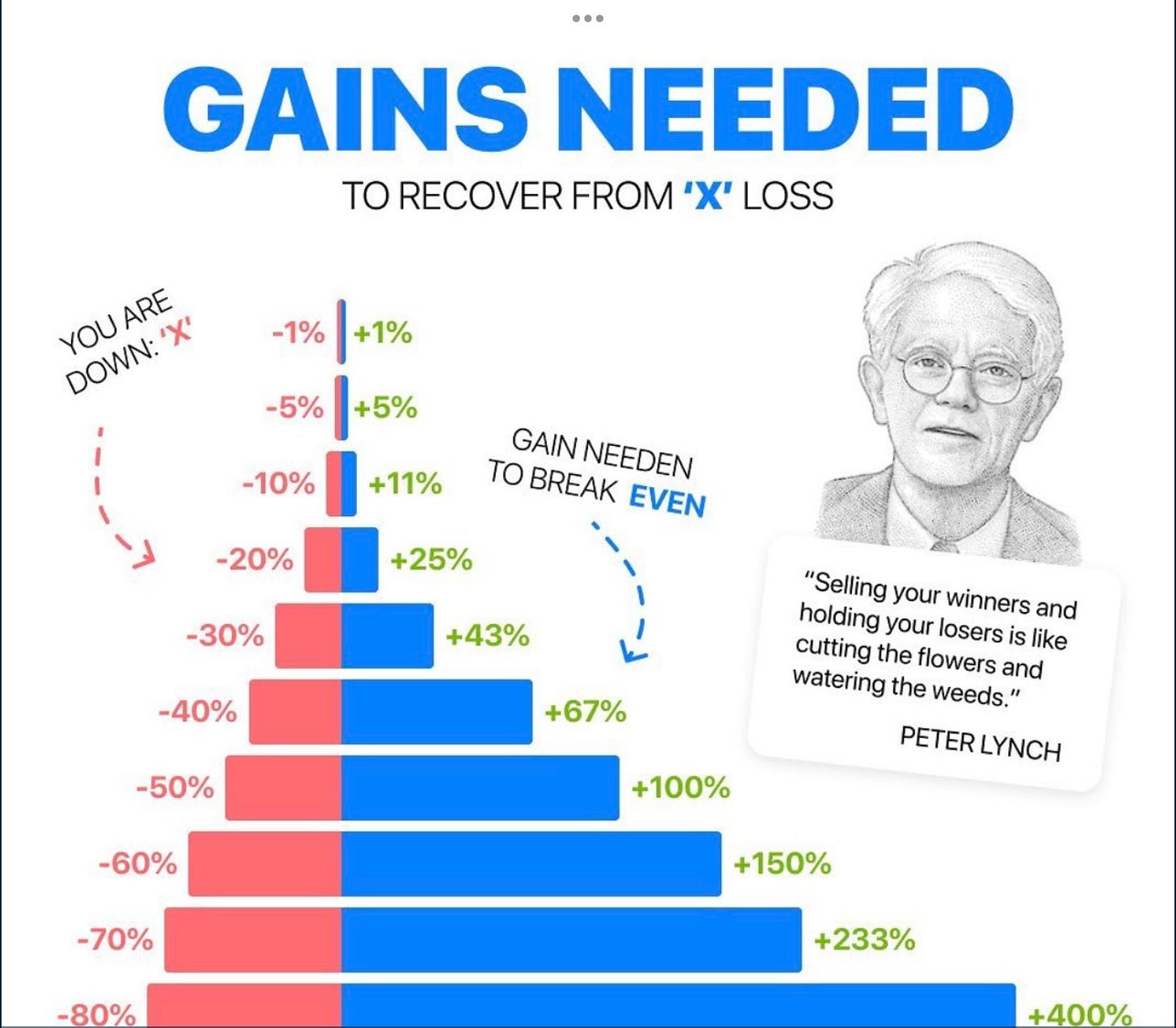

The larger goal is to have winners that double and triple in value, with losers cut at a 10% loss or less.

Figs ($FIGS) wasn’t an attractive stock based on earnings or valuation, but it was an attractive product story. They were going to be the Lululemon of hospital scrubs.

If you bought at $10 thinking it had begun a new uptrend, you quickly got stopped out at 10% for a loss. Fine.

Look at what happened if you didn’t sell- the shares kept going down all the way to $4.60, so the stop prevented a much more serious loss. What the stop also does is give you a chance to re-evaluate the position.

In retrospect, the stock shouldn’t have been bought because it wasn’t it an uptrend. Also, earnings were deteriorating and sellers didn’t want to own the shares.

It was a loser. The stop loss protected you from a much larger loss. Best to take a quick loss and focus on the winners.

3. Avoid Large Losses:

My goal is to find stocks capable of doubling or tripling in value. In order to achieve results like that, it requires taking some risk. To mitigate the risk, many of my rules are designed to avoid large losses. Sell stop, wait for an uptrend, and buy at low valuation.

This graphic sums up how devastating it is to recover from large losses.

4. Avoid Debt:

Avoid companies with large amounts of debt. The more debt, the higher the likelihood of a bankruptcy.

In a turnaround situation, a higher debt load means the turnaround must happen quickly or the company will be forced into bankruptcy.

Here’s something they will never tell you in business school: some companies and CEO’s want to declare bankruptcy. It doesn’t hurt them at all. Their stock options get re-priced. The company is easier to manage with less debt. Don’t assume management wants to “save” the company.

Bowflex BFX (Formerly Nautilus) went from $3/ share in earnings to consecutive years of losses. It was mentioned favorably right at the top and now teeters towards possible bankruptcy.

5. Avoid Companies Losing Money:

Earnings drive stock prices. If a company has no earnings, there is little reason for shares to go higher. Even a company with minimal debt and cash on the balance sheet will eventually use up the cash to run the business. In some instances, a dramatic change in the industry could force temporary losses for a quarter or two. The key word here is temporary. Losses over more than two quarters is a big red flag.

6. Look for cash rich companies:

Cash is king. It allows a company to return capital to investors via stock buybacks as well as dividends. It attracts potential buyouts and activist investors.

Typically, the way to measure cash is to use the current ratio. Benjamin Graham, the iconic value investor looked for a current ratio greater than 2.

*The current ratio is a financial metric that measures a company's ability to cover its short-term liabilities with its short-term assets. It is calculated by dividing a company's current assets by its current liabilities.

Current assets include cash, accounts receivable, and inventory, while current liabilities encompass obligations that are due within one year, such as short-term debt and accounts payable.

6. Avoid Lower price stocks:

What makes stock prices go up? Institutions. Many institutions are not allowed to own stocks below $5 and definitely below $2.

Avoid lower priced shares.

7. Position Sizing:

I look to have a portfolio of positions. I try not to have a concentrated equity position in any one individual name unless I am convinced it is a special situation.

If I want to have a large position, I’ll consider using options. This controls my risk. I know that many of the companies I identify can double or triple in price. And I’ll cut my losses at 10% if I’m wrong.

8. Be a contrarian:

You can’t take the same actions as everybody else and expect to outperform

- Howard Marks

It’s rare that the whole market goes down 50% as we saw in 2008. However, there are always sectors that are experiencing extreme pessimism. Investors sell first and ask questions later.

Extreme pessimism can lead to outsized returns.

Being a contrarian is always a prudent move. Avoid the herd.

Right now I’m looking at ideas in some of the most beaten down sectors like Real Estate and China. Stay tuned.

9. Follow the General Market Trend

80% of the time stocks will follow the overall market. If the market experiences more than 6 higher volume down days of 1%, it is time to lighten positions, stop new purchases, and consider selling calls on open positions.

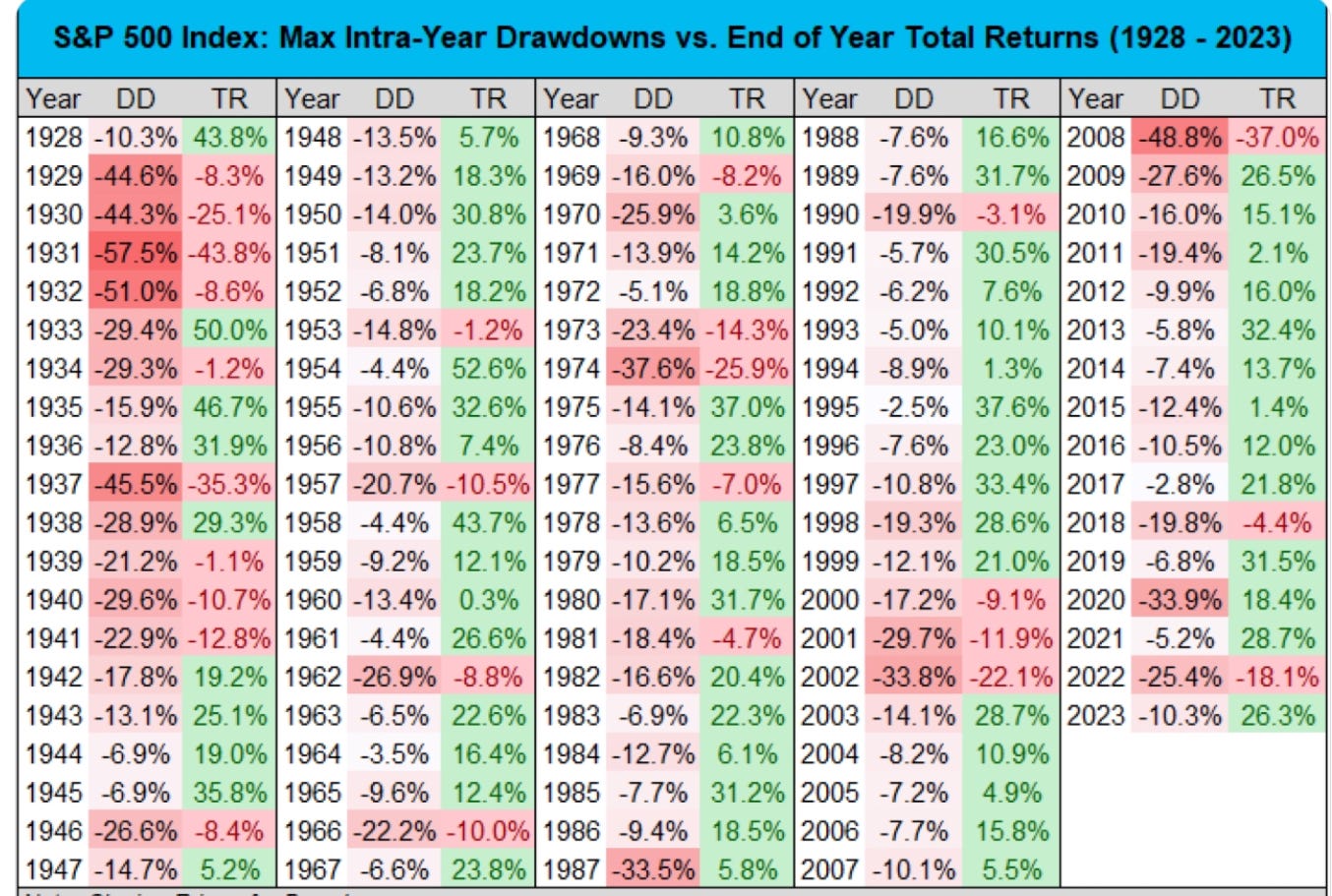

Expect two corrections per year.

This is the historical average even in Bull markets.

Conclusion:

These rules are extremely important.

Everything I do is based off of these rules. They will allow for exceptional returns when the time is right. And they will reduce your risk when you’ve made a mistake or the timing is wrong.

Every one of these rules increases the odds of success.

Here they are again.

Never buy a stock in a downtrend.

Set a sell stop of 10%

Avoid Large Losses:

Avoid Debt:

Avoid Companies Losing Money:

Look for cash rich companies:

Avoid Lower price stocks:

Optimize Position Sizing:

Be a contrarian:

Follow the General Market Trend

Good read, thanks.