How many junior mining investors, management teams, analysts or consultant groups expected US$85/oz near-month silver (“Ag“) futures in January 2026? A year ago I was hoping for $50/oz. It would be nearly impossible to overstate the significance of today’s level.

Of course, many Ag-heavy / primary Ag producers, developers & explorers have seen their share prices soar. Yet, at the same time, valuations have not increased nearly as much as they should have. Ag is +184% in the past year. Let me repeat, +184% since January 2025!

Has the price run too far too fast? No, not in my view. The inflation-adjusted ATH from Jan-1980 is over $200/oz, and that was before globally ubiquitous solar power (uses copious amounts of Ag in panels), before EVs, data centers, cell phones, wireless electronics, etc.

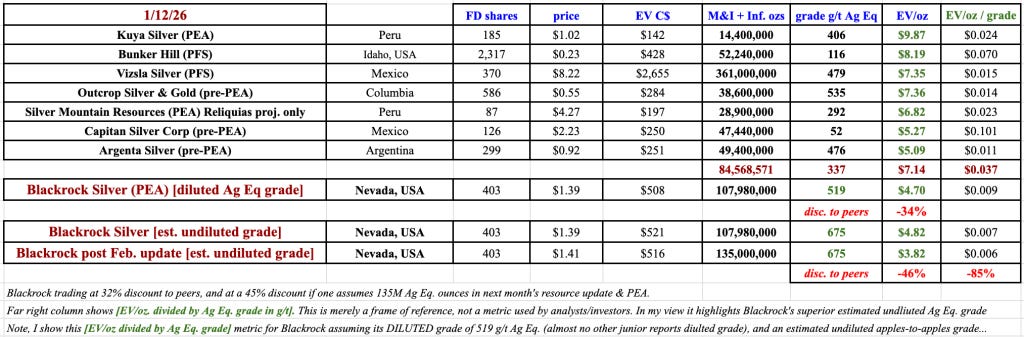

In my view, the top quartile (most promising) juniors should be up 2x-3x as much as the Ag price. The top decile? Up 4x-10x. Valuations, as measured by EV/Ag Eq. oz, average C$7.14/oz. (see table below).

Notice that Blackrock is valued at a 34% discount to high-grade peers despite being more advanced than Outcrop, Argenta & Capitan Silver (lower-grade but a prominent Mexican asset), and more ounces than all but Vizsla.

A 34% discount, even as a premium valuation for U.S. projects could unfold in the coming quarters. All else equal, the Company’s valuation is about to get cheaper. A meaningful upgrade to the 108M Ag Eq. ounces will be out next month along with a new PEA.

World-class primary Ag projects are rare and keenly sought after. High-grade? Even better. In low-risk countries? Better still. Almost every Tier-1 Ag-heavy project is in S. America or Mexico. Investors can easily become overexposed to those regions.

Majors & mid-tier producers are too heavily leveraged to Mexico, Chile, Peru, Columbia, Argentina & Bolivia.

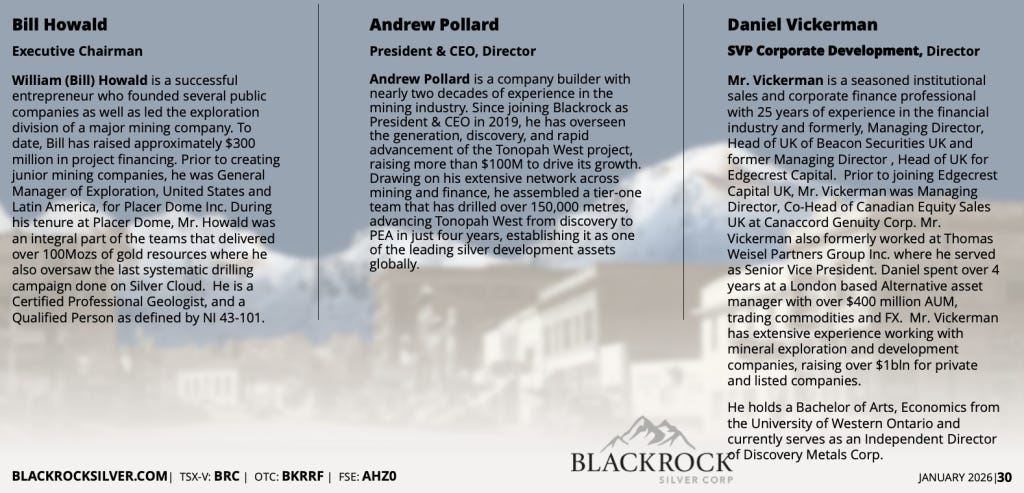

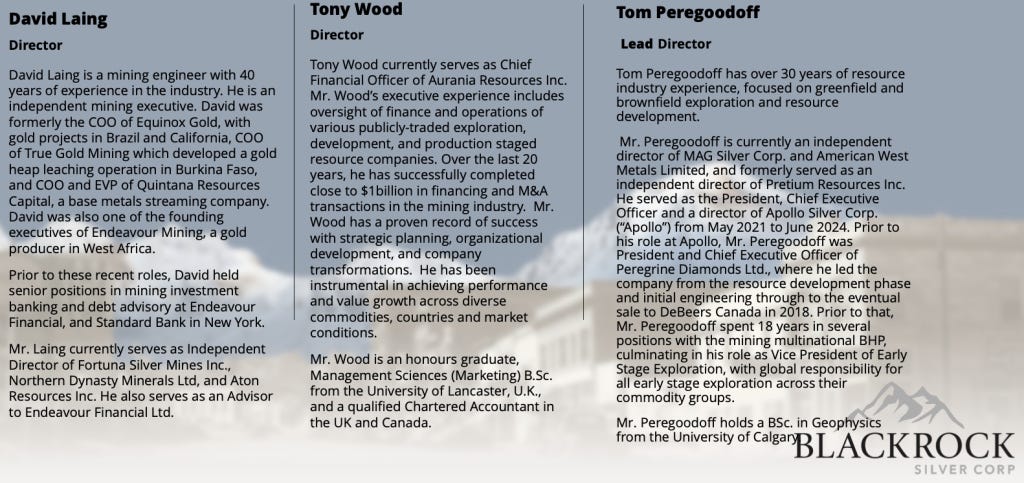

A company I really like for its ultra-high-grade (primary Ag + gold, no other metals) endowment is Blackrock Silver (TSX;v: BRC) / (OTCXB: BKRRF), with its flagship Tonopah West project in the, “Silver State,” Nevada, USA. Blackrock has not just 1 or 2, but 6 world-class senior execs, see bios above and below…

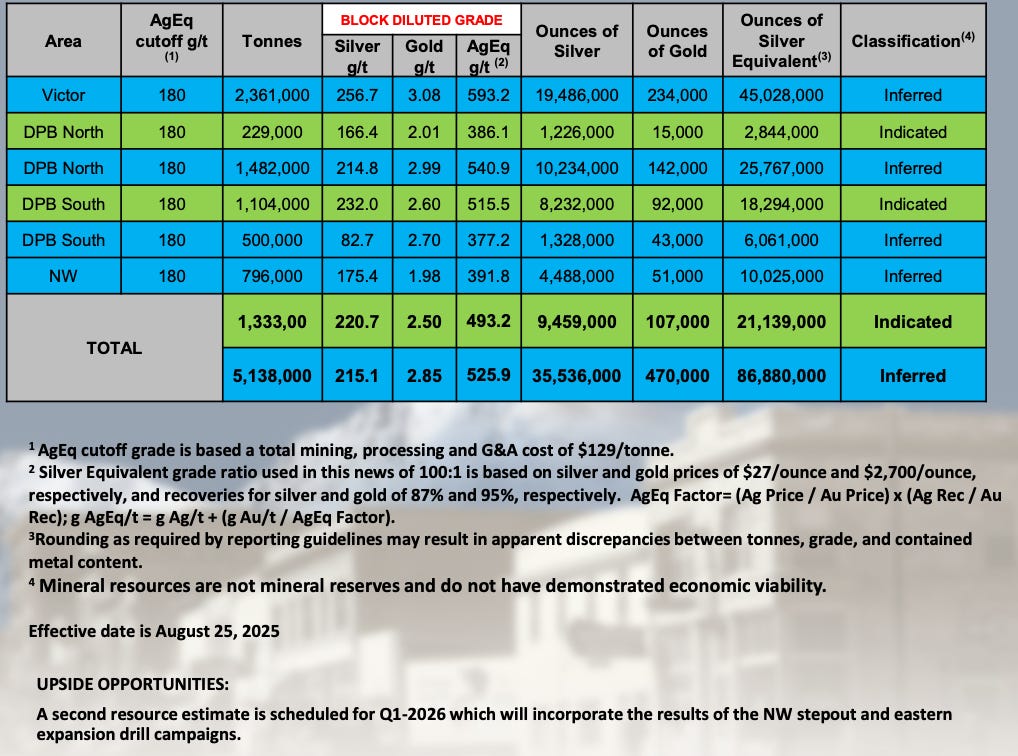

I say ultra-high-grade because on an apples-to-apples undiluted Ag Eq. grade, I estimate Tonopah West could be ~675 g/t Ag Eq. vs its reported block diluted grade of 519 g/t.

Tonopah West, “consolidates the western half of the famed Tonopah Silver District within the Walker Lane trend of Nevada.” This District has produced ~175M Ag ounces + ~1.8M gold (“Au”) ounces from ~7.5M tonnes of material.

Over the past year the Au:Ag ratio has collapsed from a high of over 106:1 to ~54:1. Therefore, calculating the total number of Ag Eq. ounces coming from Tonopah is difficult. Why does it matter? Because the average Ag Eq. grade hangs in the balance.

“Block Diluted” grade of 519 g/t Ag Eq. (I estimate ~675 g/t undiluted)…

I estimate that the District averaged > 1,000 g/t Ag Eq. over many decades, ending in the 1920s due to electricity availability and the Great Depression. The Tonopah District is NOT mined out, not even close.

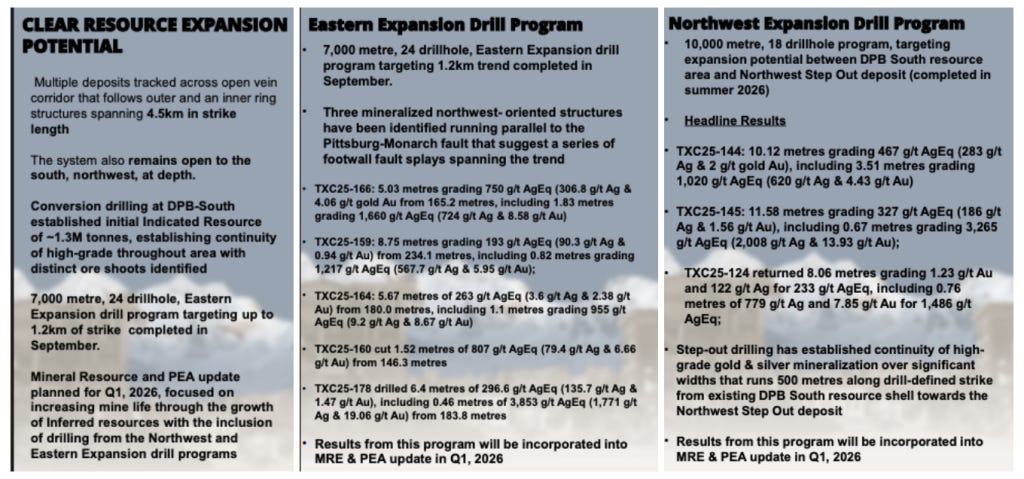

Management thinks exploration upside remains robust. Expansion drilling to the NW has traced more high-grade mineralization 500 m from DPB. Eastern expansion drilling identified several mineralized NW-oriented structures hosting shallow mineralization within a 1,200 m trend.

The newly consolidated land package consists of 25.5 sq. km (6,300 acres). A recent drill program targeted both resource conversion & expansion across multiple vein systems (especially DPB south, and NW step-out) with the goal of increasing resource continuity by linking mineralized zones.

Nevada is a tremendous place to develop precious metal projects. In my view, Nevada and select parts of the U.S. are superior to S. American jurisdictions. Nevada almost always ranks in the Top-3 (often #2) of 80+ mining jurisdictions in the annual Fraser Institute Mining Survey.

Resource growth potential is significant, see below…

Many of the world’s premier projects are in S. America, like flagship assets owned by Vizsla Silver, New Pacific Metals, Outcrop Silver & Gold, Argenta Silver, Andean Silver, and Silver Mountain. These companies, like Blackrock, are very well positioned and are prime takeover targets.

Still, high-quality, high-grade, precious metal only projects in Nevada/the U.S. are especially attractive given tariffs enacted by the Trump Administration. And, now that Ag is a strategic metal in the U.S., it’s eligible for Section 45x tax credits and/or Department of Energy (DOE) grants/loans.

In fact, other U.S. gov’t agencies could come into play with low-cost loans or free-money grants (see following image). Moreover, many (but not all) S. American mining projects face water scarcity in very dry regions, ultra-high elevations (>3,500 meters) and/or serious local opposition.

To reiterate, these top projects are world-beaters, but in my opinion Blackrock’s Tonopah West is possibly the most desirable. Who might care to acquire or partner with Blackrock instead of a S. American play? As mentioned, Majors & mid-tiers can be overexposed to select regions.

Prospective acquirers of Blackrock include; Nevada Gold Mines (a JV between Newmont/Barrick), AngloGold Ashanti, Pan American Silver, Fresnillo plc, Coeur Mining, Hecla, Kinross, Equinox Gold, First Majestic, Hycroft Mining, I-80 Gold, SSR Mining, Americas Gold & Silver, and Perpetua Resources.

If one adds Cu-heavy names that dabble on the precious side, one cannot rule out Freeport, BHP, RIO, Glencore, and the combined Grupo México/Southern Copper/ASARCO conglomerate.

Astute readers might note that several companies named are probably too big to care about tiny Blackrock, but mid-tiers looking to be taken out by Majors would benefit by beefing up with projects like Tonopah West. There are numerous companies valued under C$6.0B not listed above.

Blackrock is updating its resource estimate and delivering a new, enhanced PEA with a longer mine-life and stronger economics, in large part due to soaring Au/Ag prices. The existing PEA used just $1,900 Au & $23 Ag! At spot prices I estimate the post-tax NPV would be ~C$2.8B.

The new PEA coming next month will be an eye-opener. At spot pricing, might the post-tax NPV approach C$4.0B?!? Compare that to Blackrock’s fully-diluted enterprise value of C$508M (Jan. 12th). Also noteworthy is the post-tax NPV/cap-ex ratio. At spot pricing the new PEA could show a 10 to 1 ratio!

Importantly, the upcoming PEA will still have ample room for annual throughput expansions with a larger mill and a longer mine life than just 10-12 years. The payback period on incremental cap-ex to build a larger operation is under a year.

Earlier I declared S. American projects to be less desirable to Blackrock’s Nevada location, but there’s a lot more to be said about the Tonopah West project in particular. It’s on private/patented land, meaning it bypasses the lengthy NEPA/federal permitting process.

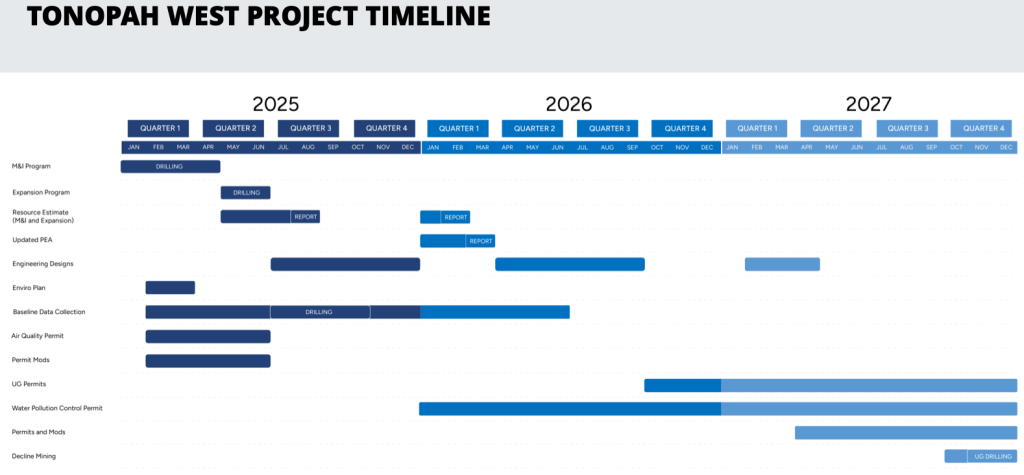

CEO Andrew Pollard believes Tonopah might be the next U.S. based primary Ag project to enter production as it could be permitted & construction-ready by mid-2027. Logistically, it doesn’t get much easier, the Project is directly off a highway near power, workers, services & equipment.

Another critically important factor is Tonopah’s metallurgy. The Project boasts simple, high-grade, narrow-vein ores. Processing should be straightforward –> crush only, no flotation or gravity separation, allowing for a low-cost operation. Recoveries are coming in @ 96.1% Au / 88.9% Ag.

While a resource upgrade and new PEA are near‑term catalysts, CEO Pollard highlights that significant permitting work (baseline studies, hydrology, engineering design) is ongoing in parallel, pointing to an upcoming exploration decline and a 100,000-tonne bulk sample mining pilot program.

Finally, unlike some projects, Tonopah will only produce Ag/Au (no zinc, lead, or copper and associated deleterious materials) in a clean, high-grade ore that should be in very high demand. Unlike many peer projects, Tonopah is a brownfields site, there are historic mines on the property.

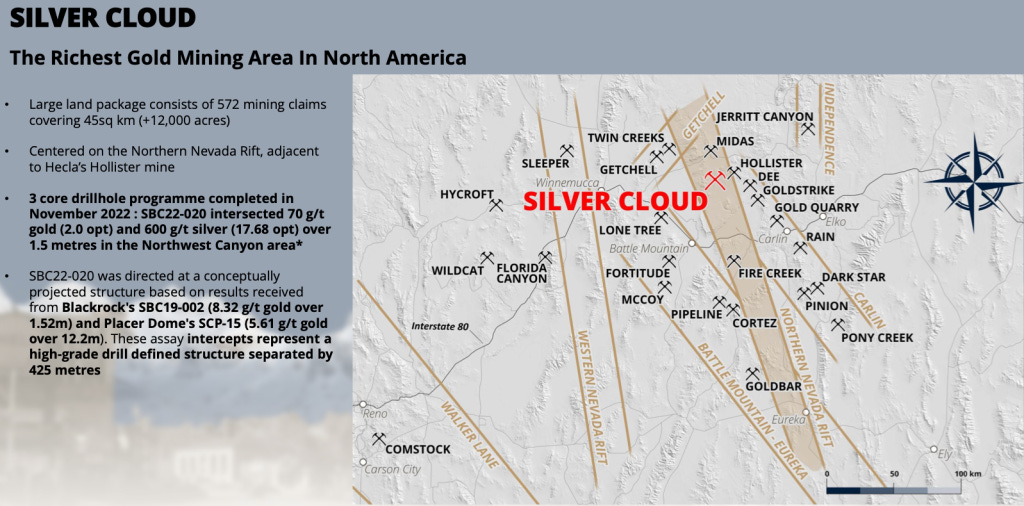

Although not the current focus, another promising project is 45 sg. km Silver Cloud, which has been described as the donut hole in Hecla’s Nevada land package (Midas & Hollister, see map). Grades at Silver Cloud are even higher than Tonopah West. For instance, 70 g/t Au + 600 g/t Ag over 1.5 meters.

Circling back to Tonopah West, I believe that speed to market, low regulatory/permitting risks, in one of the best jurisdictions on earth, with fewer mine planning & technical risks, boosts Tonopah West to must-own status by larger players. Instead of a discount, it might rise to a premium valuation.

Disclosures/Disclaimers

Blackrock Silver has expressed interest in retaining Epstein Research to write investment articles like this one, but has not officially signed on as a client. Given that ER expects that Blackrock will soon become a paying advertiser, one should consider ER to be biased in favor of the Company. Peter Epstein of ER does not own shares in Blackrock Silver, but he might buy some in the near future.

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Blackrock Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Blackrock Silver are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.