DLF continues its bullish trajectory as it progresses through the last stages of a multi-year Elliott Wave impulse, with higher highs still expected in the coming months.

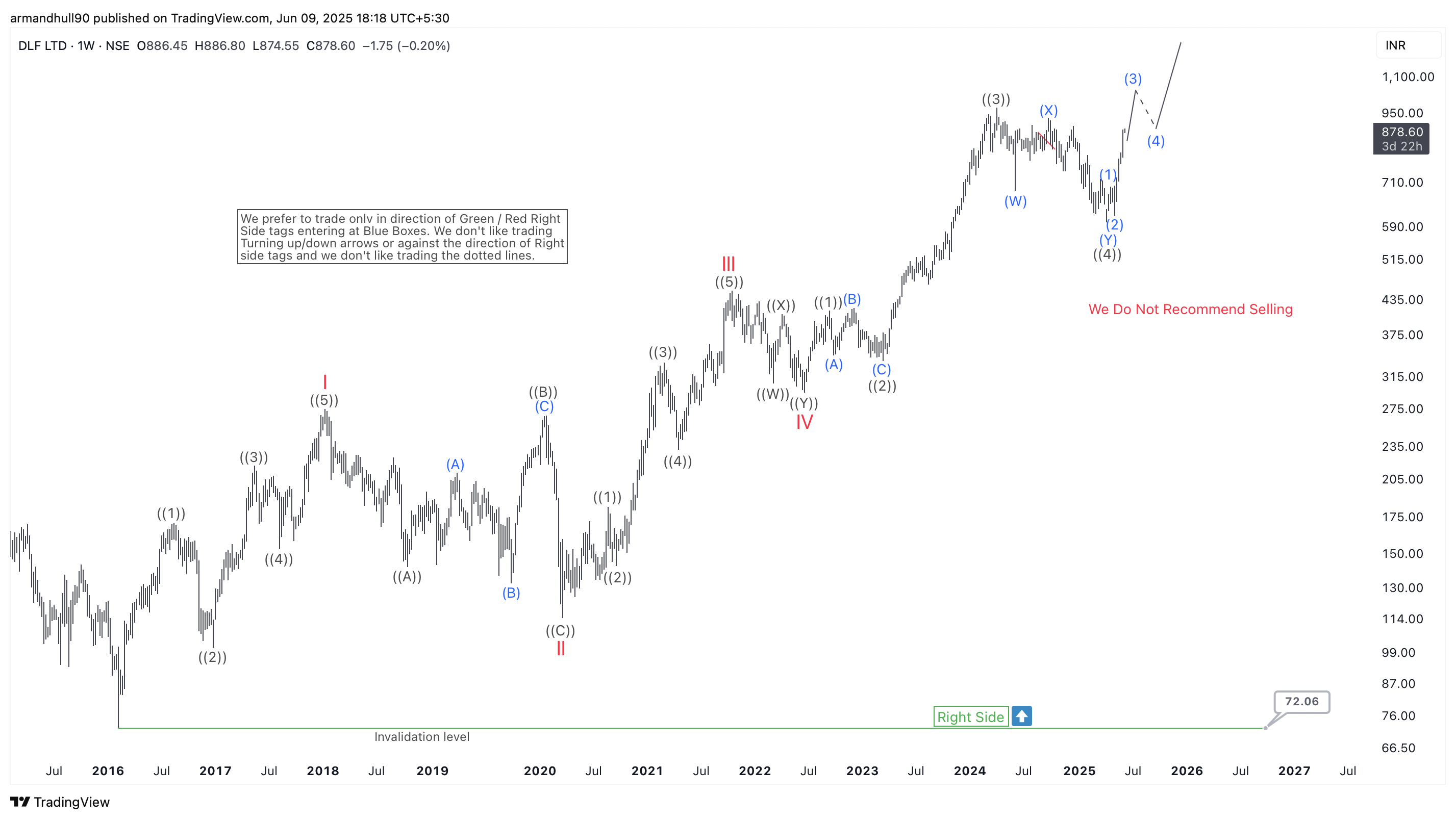

DLF Ltd (NSE: DLF) continues to show strong bullish momentum. The stock appears to be unfolding the final leg of a long-term Elliott Wave impulse. Based on the weekly chart, it is currently progressing through the last set of 5-wave advances. This rally began from the March 2016 low near ₹72.06.

Since then, DLF has followed a clear impulsive structure. Multiple degrees of Elliott Waves have formed, pushing the price steadily higher. Wave counts suggest that major waves I, II, and III are complete. Wave IV ended around mid-2022, setting the stage for the ongoing wave V.

The current wave V shows clear signs of internal development. Subwaves ((1)) to ((4)) are already visible, and wave ((5)) is now in progress. Within this wave, we can see smaller subdivisions, suggesting that the market is respecting the Elliott Wave structure.

The analysis remains valid as long as price stays well above the invalidation level of ₹72.06, which sits far below current market levels, providing strong bullish conviction. The “Right Side” tag at the bottom of the chart confirms that we prefer to trade in the direction of the higher probability path – which is up.

The note “We Do Not Recommend Selling” further supports the bullish bias, as the chart advises against counter-trend positions. Until the 5-wave move from the 2016 low completes fully, long opportunities remain favorable on dips, especially when price reaches corrective blue boxes or completes internal corrective structures.

Summary:

In summary, DLF appears to be unfolding its final impulsive leg within a larger 5-wave Elliott Wave structure. As long as the invalidation level holds, the trend remains bullish with scope for higher highs before a significant correction begins.