ASML Holding N.V., (ASML) provides lithography solutions for the development, production, marketing, sales, upgrading & servicing semiconductor equipment systems. It also offers hardware, software & services to chipmakers to produce the patterns of integrated circuits. It comes under Technology sector & trades as ‘ASML’ ticker at Nasdaq.

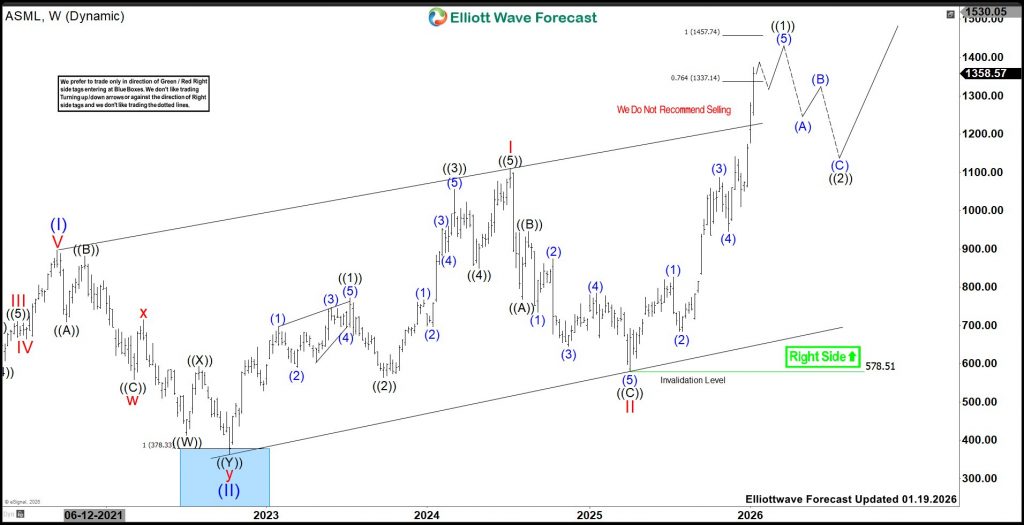

ASML trading at ATH, broke the price channel in weekly, favoring rally against April-2025 low. It favors upside in (5) of ((1)) & expect further upside towards $1457.74 before correcting next.

In weekly, it ended (I) at $895.93 in September-2021 & (II) at $363.15 low in October-2022. Above there, it is showing nest structure & favors rally to continue against April-2025 low. Above October-2022 low, it ended I of (III) at $1110.09 high & II at $578.51 low. Within I, it placed ((1)) at $771.98 high, ((2)) at $564 low, ((3)) at $1056.34 high, ((4)) at $849.14 low & ((5)) at $1110.09 high. Within ((2)), it ended ((A)) at $767.41 low, ((B)) at $945.05 high & ((C)) at $578.51 low in zigzag correction.

ASML - Elliott Wave Latest Weekly View:

Above II low, it favors rally in ((1)) of III. It ended (1) at $826.56 high, (2) at 684.24 low, (3) at $1086.11 high, (4) at $946.11 low & favors upside in (5). Within (5), it ended 1 at $1141.72 high, 2 at $1010.01 low & favors upside in 3. It expects soon to end 3 of (5) and pullback in 4 against 12.15.2025 low before final push to end ((1)). It should extend rally towards $1334.14 - $1457.74 area to end ((1)) before correcting next. Buyers can look to buy the next pullback in 3, 7 or 11 swings in ((2)) against April-2025 low in daily. It already broke channel, indicates bullish bias. The rally within III already extend above $1327.3 level as equal leg area of I, indicates more upside is likely.

Source: https://elliottwave-forecast.com/stock-market/asml-holding-favors-rally-1457-74/