In recent years, the idea of canceling student debt has become a topic of heated debate in the United States. As the nation grapples with over $1.7 trillion in student loan debt, questions arise about the economic implications of such a monumental decision. Proponents argue that canceling debt could provide substantial economic relief and opportunities, while opponents raise concerns about the fairness and long-term economic impact of this move. This article delves into the multifaceted discussion, examining whether canceling all student debt is indeed a beneficial move for the US economy.

Student Debt in the US

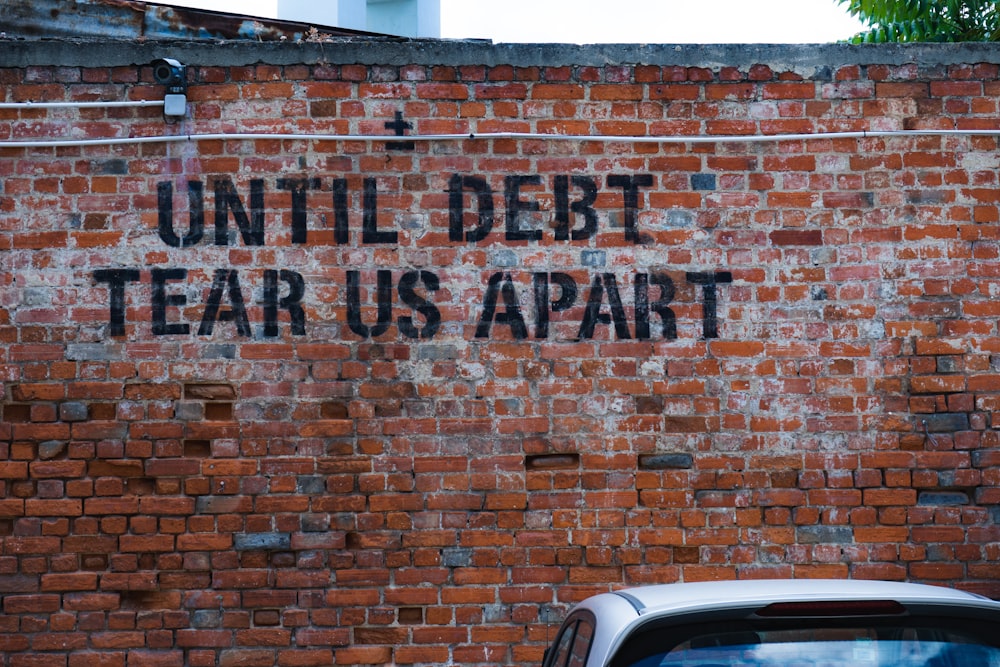

Student debt in the United States has reached staggering levels, with millions of Americans burdened by loans taken out to pursue higher education. This debt not only affects the financial stability of individuals but also has broader economic implications. The average graduate leaves college with tens of thousands of dollars in debt, a figure that has been rising steadily over the years. This situation is often illustrated in various mediums, from news articles to presentations by financial experts. A presentation writer focusing on economic trends would likely highlight that the growth in student debt has outpaced inflation and wage growth, making repayment increasingly challenging for graduates. The rising debt is also reflective of the increasing costs of higher education, making it a systemic issue with deep roots in the country's educational and financial systems.

Arguments for Canceling Student Debt

The argument for canceling student debt centers around several key benefits. Firstly, it is seen as a potential economic stimulus. By freeing up the income currently directed towards loan repayments, individuals would have more spending power, which could boost consumer spending and invigorate the economy. Additionally, there are strong arguments regarding social equity. Canceling student debt could play a significant role in reducing the wealth gap, particularly among marginalized communities that disproportionately bear the burden of student loans. Finally, the educational benefits are also significant. The prospect of a debt-free education could encourage more individuals to pursue higher education, leading to a more educated workforce and potentially driving innovation and economic growth.

Counterarguments Against Canceling Student Debt

Despite these potential benefits, there are significant counterarguments against canceling student debt. From an economic standpoint, the cost and feasibility of such a measure are a major concern. Critics argue that the cancellation of student debt would place a heavy burden on taxpayers and could lead to increased federal deficits. Moreover, there is the issue of moral hazard – the belief that forgiving student debt might encourage future students to take on loans with the expectation of them being forgiven, possibly exacerbating the problem in the long term. There are also fairness concerns to consider. Many people who have either paid off their student loans or chose not to go to college may view debt cancellation as unfair. This aspect of the debate raises questions about the equitable distribution of such a financial benefit.

Looking beyond the United States, various countries have adopted different approaches to managing student debt. For instance, some European countries offer free or low-cost higher education, significantly reducing the need for student loans. In contrast, nations like Australia have implemented income-contingent loan programs, where repayments are based on the borrower's income level. These international examples provide valuable insights into the effectiveness of alternative student debt models. They suggest that while total debt cancellation is rare, there are diverse and potentially more sustainable ways to alleviate the burden of student loans.

Potential Middle Ground Solutions

In light of the complexities surrounding total debt cancellation, exploring middle-ground solutions could be key. Income-driven repayment plans, which adjust monthly payments according to the borrower's income, offer a more individualized approach to debt relief. Another option is partial debt forgiveness, especially for those in public service roles or low-income earners, which could provide targeted relief without the extensive financial implications of total cancellation. These solutions aim to balance the benefits of debt relief with the need for financial sustainability and fairness.

Experts' Opinions and Economic Forecasts

The debate over student debt cancellation is enriched by the perspectives of various experts, including economists, education policy specialists, and financial analysts. While some experts highlight the potential for economic stimulus and increased educational accessibility, others caution against the long-term fiscal impact and potential moral hazards. Economic forecasts modeling the impact of debt cancellation vary widely, with some predicting a boost in economic growth and others warning of inflationary pressures and increased national debt. This divergence in opinion underscores the complexity of the issue and the need for careful economic analysis.

Final Thoughts

In sum, the question of whether canceling all student debt is better for the US economy does not have a straightforward answer. It involves weighing the immediate economic stimulus and social benefits against long-term fiscal sustainability and fairness considerations. As this discussion continues, stakeholders may look toward more nuanced solutions, such as income-driven repayment plans or targeted forgiveness programs. Just like seeking the best essay writing service for a nuanced and well-researched paper, finding an optimal solution to the student debt crisis requires a careful and balanced approach, considering all angles and implications. What remains clear is that the current state of student debt in the US is a pressing issue, requiring thoughtful and effective policy responses.