Summary

- U.S. equity markets surged this week, buoyed by positive vaccine data and on renewed hopes of a V-shaped economic recovery as countries around the world begin the reopening process.

- The S&P 500 ended the week higher by 3.1%, closing nearly 35% above its lows in late March despite another slate of ugly unemployment data that looms over the recovery.

- Real estate equities led the gains this week, propelled by a bounce-back in many of the most beaten-down property sectors including retail and hotels that were ravaged by the lockdowns.

- Homebuilders continued their recent resurgence as high-frequency housing data has indicated that the housing industry may indeed be leaders of the post-coronavirus economic rebound.

- Fresh data from Redfin showed a "stunning" rebound in housing market activity over the last month as homebuying demand is now 16.5% above pre-coronavirus levels while home values have seen accelerating growth.

Real Estate Weekly Outlook

U.S. equity markets surged this week, buoyed by news of positive clinical trial results from Moderna (MRNA) and Inovio Pharmaceuticals (INO) and on renewed hopes of a V-shaped economic recovery as most states and countries around the world have begun the post-coronavirus reopening process. Contrary to the predictions of some experts, the virus has remained on the retreat even in states that were among the first to reopen, while emerging evidence - detailed in a report by JPMorgan - suggests that lockdowns may have actually aggravated rather than mitigated the impacts of the disease. Uncertainty remains, however, over how quickly the economic damage can be reversed and the "shape" of the economic recovery in the back half of 2020.

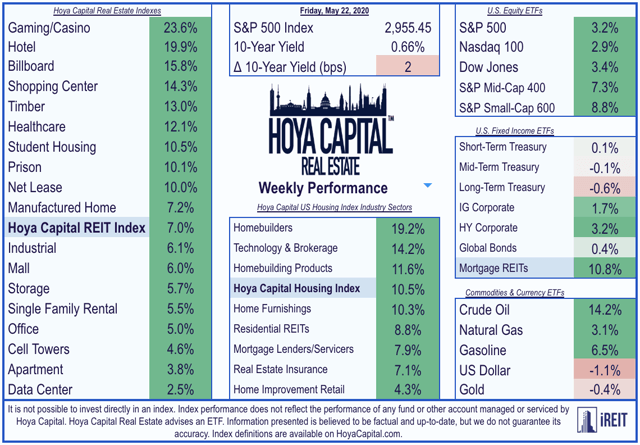

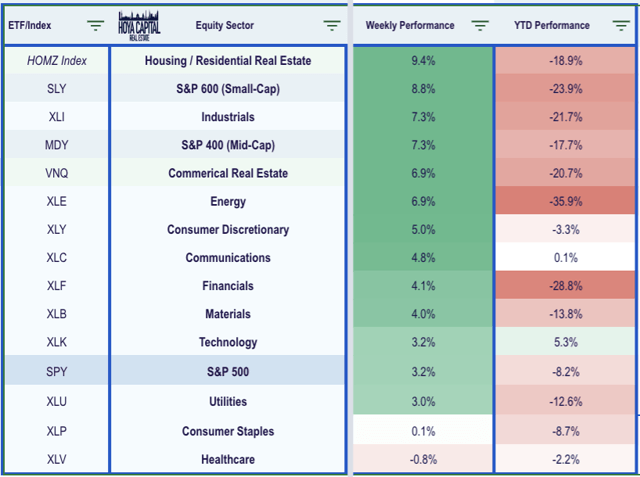

Following a decline of 2.1% last week, the S&P 500 ETF (SPY) ended the week higher by 3.1%, closing nearly 35% above its lows in late March. Real estate equities led the gains this week, reversing almost all of last week's steep declines, propelled by a bounce-back in many of the most beaten-down property sectors that were ravaged by the economic lockdowns. Closing roughly 30% off its lows in March, the broad-based Equity REIT ETFs (VNQ) (SCHH) surged 7.0% with all 18 property sectors in positive territory while Mortgage REITs (REM) jumped 10.8% on the week, closing 55% above its March lows amid clear signs of stabilizing in the mortgage markets.

The more pronounced strength this week was seen in the recently lagging Mid-Cap (MDY) and Small-Cap (SLY) indexes which delivered strong outperformance, surging by 7.3% and 8.8% respectively. The gains this week came despite another round of ugly economic data including Initial Jobless Claims data that showed that another 2.43 million Americans filed for unemployment benefits last week, bringing the eight-week total to over 38 million. However, flashes of strength have become increasingly more evident in recent weeks - particularly in the all-important U.S. housing market - and commentary from corporate earnings reports over the last two weeks indicated that the economic rebound is already beginning to take hold in many segments of the economy. The Industrials (XLI), Energy (XLE), and Consumer Discretionary (XLY) sectors joined the real estate sectors as top-performers on the week while Healthcare (XLV) was the lone sector in the red.

Continue reading on Seeking Alpha.