Summary

- The approval of the T-Mobile/Sprint merger is a negative for the major wireless players.

- A strong T-Mobile and a viable fourth wireless carrier in DISH Network was the worst outcome for AT&T.

- Investors should not expect AT&T to reach minimal revenue growth targets of 1% to 2%.

- The stock is only good for the 5.5% dividend yield from here.

Judge Victor Marrero's surprise decision to approve the T-Mobile US (NASDAQ:TMUS) acquisition of Sprint (NYSE:S) is a very negative development for AT&T (NYSE:T). The new T-Mobile has the force and market position to drive towards aggressive customer acquisition in 5G. Long term, the wireless market faces a stronger entrant in DISH Network (NASDAQ:DISH) likely to prevent a cozy oligopoly with limited desire to compete on prices.

Unfortunately, AT&T isn't likely to see any benefit from consolidation in the sector while trying to execute on a strategy of returning to revenue growth. For these reasons, my investment thesis remains very tepid on the wireless and media giant.

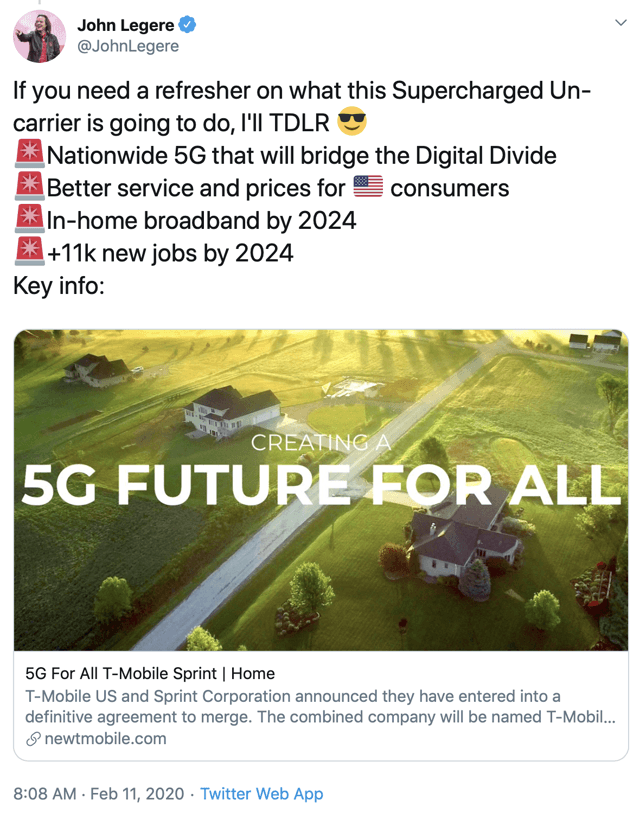

Image Source: T-Mobile website

Bigger Threat

On Tuesday morning, the judge in the T-Mobile/Sprint merger case in the U.S. District Court made a surprise ruling to approve the merger. Sprint was trading at 52-week lows near $4, as the market didn't expect the merger to obtain approval. Sprint ended the day up 77.5% on the surprise dictions by Judge Victor Marrero of US District Court for the Southern District of New York.

The company hasn't closed all the steps needed to complete the merger, with the potential appeal of the 13 state attorney generals originally suing to block the merger and the California Public Utilities Commission still needing to sign off on the merger. Regardless, the new T-Mobile expects to close the deal by April 1 with limited risk of the deal not closing now.

The problem for AT&T is that the new T-Mobile is a bigger threat in the wireless space. John Legere took to Twitter to remind the market of their aggressive push into 5G and in-home broadband over the next few years.

The new T-Mobile is going to be aggressive in the wireless space in the next few years. The agreement with the FCC requires the company to reach 97% 5G coverage within three years and 99% 5G coverage in six years, with 85% of rural America covered.

Continue reading on Seeking Alpha.

Good read on Seeking Alpha.