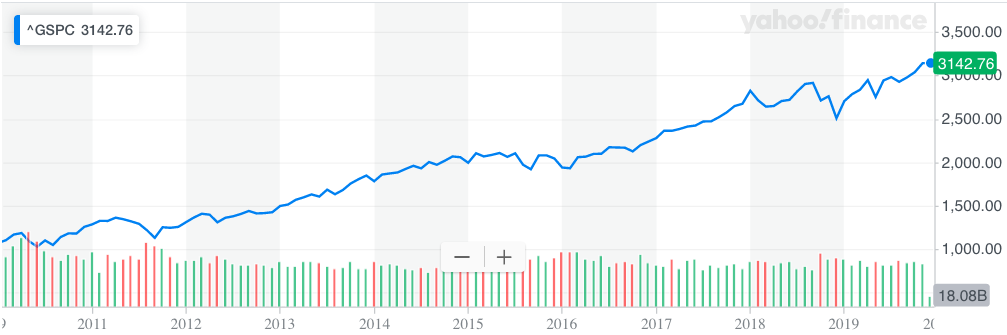

The S&P 500 has had an incredible run in the 2010s, with a return of 182.12% so far this decade; supported by ultra-loose monetary policy conditions, profit margin expansions and share buybacks. Looking ahead, market participants are still very optimistic for equities going into next year and the new decade, which tends to be ominous for stocks performance going forward. Both macro developments and astrological patterns reflect trouble ahead for the economy and equity markets.

Source: Yahoo Finance

Investor optimism likely to end in severe disappointment

While certain investors are wisely skeptical of the prospects of this current bull continuing over the next decade, many still complacently believe that as long as the Fed maintains loose monetary policy conditions, the uptrend will persist. The concept of ‘paradigm shifts’ implies that the performance of asset classes in a new decade is influenced by investors’ expectations and attitudes at the turn of the decade, and that performances turn out to be the opposite of what investors were expecting. For example, amid the bull-run in stocks in the late 1990s, investors entered the next decade with high optimism, and were ultimately confronted with the bursting of the dotcom bubble, 9/11 and the financial crisis later in the decade. While valuations are nowhere near the levels witnessed at the end of the 1990s/ beginning of 2000s during the infamous tech bubble, they are not necessarily cheap either, with the S&P 500 currently reflecting a P/E multiple of 24.36x and a forward multiple of 19.18x, and valuations do not necessarily need to be as expensive in order to witness a significant decline in stocks.

In fact, Vedic astrological patterns are currently signalling a black swan event ahead that is likely to occur any time between Christmas 2019 and end- January 2020. In a previous article, details of the type of black swan event that could occur were provided, including an attack on a country similar to 9/11 or an event concerning a world leader that would devastate markets. As per Vedic astrology, this is due to 7 planets coming into conjunction and all facing towards a malicious planet on the opposing side, which tends to flare up trouble in the world. Whatever the event may be, one thing is certain, it will shake the global markets. Hence holding positions in risky assets (such as equities) is not advisable.

Given that we are already in the late stages of this cycle and are facing a slowing global economy, this black swan event is very likely to increase the odds of a recession, which contradicts with market participants’ current optimism that a recession will be avoided. This makes markets extremely sensitive to even the slightest piece of bad news, hence the mere increase in the odds of a recession occurring would be enough to induce stocks to dive significantly lower. It is recommendable to wait until the full implications of the black swan event are understood and priced in before buying into the big drop in risky assets.

Political Landscape

Another interesting astrological pattern will be also be forming from January 2020, whereby planet Saturn will be transiting through its own Zodiac signs from 24th January 2020 to 29th March 2025 (including retrograde planetary movements in between). This planetary position tends to restore discipline in the world, particularly when Saturn is transiting through Capricorn. In the past, when this astrological positioning has occurred, it has resulted in disciplinary budget reform and/or increased government regulation in the US. For example, during the 1990s when this astrological positioning had taken place, the Clinton administration had taken significant disciplinary measures regarding budget reform, specifically the Omnibus Budget Reconciliation Act 1993, which included increased taxes for the wealthy and spending cuts for welfare and defense. It is interesting to note that the infamous Gramm-Leach-Bliley Act (financial deregulation), one of the culprits for causing the financial crisis, was only signed into law in 1999 (by which time the disciplinary planet Saturn was no longer in its own zodiac signs anymore).

This astrological positioning returns every 30 years. Hence before the 1990s, Saturn returned to its own Zodiac signs during early 1960s under the Lyndon B. Johnson administration, during which time America witnessed increased regulations and initiatives to reduce poverty. Furthermore, this planetary positioning also happened during the 1930s under the presidency of Franklin D. Roosevelt, during which time Americans witnessed significant regulatory reform and measures to pull the nation out of the Great Depression, including the Glass-Steagall Act 1933 to restore discipline in the financial sector.

What can we expect going ahead when this astrological position returns during the 2020s? There is a good probability that at some point during the first half of the new decade, a Democrat will come to power and reverse the tax cuts and the de-regulations enacted by the Trump administration. Higher corporate tax rates and regulations will certainly undermine equity market performance during the 2020s. Furthermore, following the widening wealth gap over the past several decades, presidential candidates like Elizabeth Warren and Bernie Sanders have been gaining popularity. Their potential election could incur radical measures (dependent on their level of control over the House and Senate) against Corporate America, such as limiting share buybacks and increasing labor costs, during which time stocks could struggle to rally the way they did during the 2010s.

This of course does not mean that every stock/ industry will perform poorly during the next decade. Instead of making passive bets on the overall market, investors should seek to actively pick out specific stocks that are well positioned to benefit from promising secular trends and are likely to face low political risks in the foreseeable future. Such areas include companies engaged in 5G deployments (e.g. semiconductors) and the space economy.

Bottom Line

Market participants seem to be eager to price stocks for perfection and hope everything turns out fine going into the new decade, which in itself sets the market up for trouble ahead. With a current Forward PE multiple of 19.13x, equities are not pricing in the upcoming black swan event and the potential for business-unfriendly policy shifts over the next decade. Investors should not naively expect the type of equity returns witnessed over the past decade to continue into the 2020s, as paradigm shifts are inevitable amid a widening wealth gap and the fact that loose monetary policy conditions will prove insufficient to tackle all obstacles faced by the economy on its own. It is advisable to wait until the black swan event has materialized and been priced into asset prices, after which investors should adopt a more active approach to selecting stocks that have sustainable growth potential and the ability to weather any economic hardships ahead (at a reasonable price).

I never understood the connection between astrology and stock trading. Isn't that like trying to decide which stocks to buy with a tarot deck instead of using proper financials?

Some people are really into that. I am not one of them personally. I don't believe in crystal balls or tarot cards either. But hey, whatever floats your boat.