Prepared by Dr Christopher Davis, lead at BAD BEAT Investing

In this weekend's blog, we want to share some thoughts on the market, and give you a peek behind the curtain of some of the recent investments our team and service members made in the last few weeks. And, we just unveiled our latest high conviction name yesterday. So read on for some of our "thoughts on the market", as well as some of the investments we made which are still worthy of your consideration.

Oh, and, not sure if you heard, but Seeking Alpha has chosen to END our (and other service leader's) ability to offer custom discounts to try our very popular and successful investing group, BAD BEAT Investing. In fact, June 10th is the day where Seeking Alpha takes control over all the pricing and any 'sales' will be accross the board. Despite pushback from service leaders, this is the path they are taking. As such, I am offering 3 spots to our service at 35% off. This is a ~$275 discount to our service for the year. And the biggest discount we have offered outside of Black Friday. As of June 10th, we will no longer be able to offer discounts, so if you have any interest, sign up before prices are locked at full price (its really disappointing they are doing this, but we wanted to give you one last chance, if you are interested. We offer a money back gaurantee if you are not happy.

YES, what the hell, why not? I will try it (CLICK HERE)

No thank you but I will continue reading

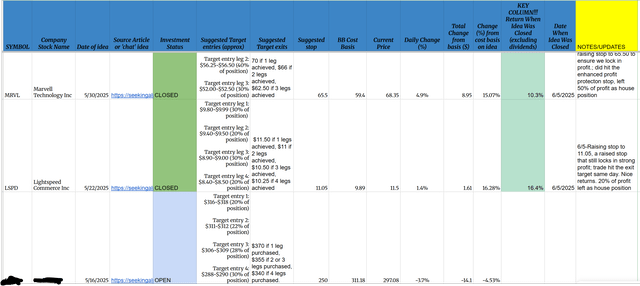

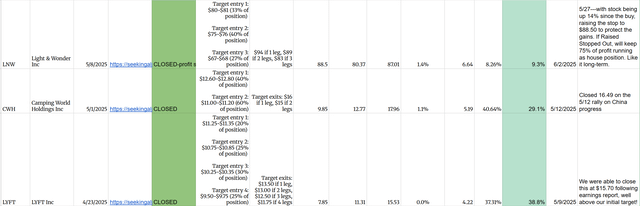

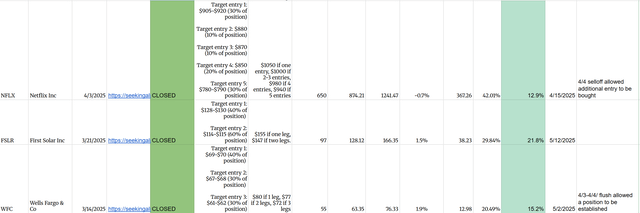

Ok, so, what have we invested in lately. At our service our real world holdings with target entries, exits, stops, links to the research, etc, are all house in an easy to follow Google Sheet. And we have been killing it.

In fact, only one position has not reached its exit it is still pretty new as of 5/16 and we are building the position. On all of these, we left profit in the names to run for a lifetime, so called "house positions." We have all of those going back to 2020 tracked as well. Generational wealth is being created. Here are each of the research pieces tied to this picks for reference.

Of course, the crown jewel of all these is (NFLX) which we now have a 42% return in from the cost basis. And, we think it goes higher But (FSLR) was at almost $200 before pulling back, where we guided members to trim a little more. We think (LNW) and (LSPD) have great futures ahead, while (MRVL) is simply very cheap for its growth. We are pleased with (CWH) and dont mind owning (LYFT) for its future.

Folks, we JUST issued our latest conviction buy, so consider signing up today to access it. We have a lifetime 82% win rate. What does that mean. It means on average, 8.2 of every ten ideas finish with hitting our target profit, for every 1.8 we take a stop on. That is even through the 2025 bear, the 2022 bear, the 2020 covid crash, the 2018 market tantrum, as well as all the mini corrections in between.

You know what? I WILL try it (CLICK HERE FOR 35% off)

No thank you

Some thoughts on the market

Well, that was a week. We had a winning week. The Dow was ahead 1.2% this week, the S&P 500 was up by 1.5%, and the Nasdaq climbed over 2.2%. Some swings, but higher on the whole. 6,000 is back. President Trump and Elon Musk had a very public falling out. Oil bounced back some following escalations of Ukraine and Russia's war. China and US seemingly getting along despite snags along the way. Market is pricing in 10% tariffs and 30% on China as base case (plus the sector specific stuff). If this changes, then all bets are off and we are back under 5,500 quickly. Is it worth having some insurance hedges? Yes, I think so. Especially at this valuation. We also have the Fed question, on when rates will be cut. It is getting less likely given the data. And then the tax cut bill, if it can get passed or not, and what it looks like when passed. A lot of happenings this week. Oh and we closed a number of trades, locking in more wins. Crushing the averages, helping you make money but also learn and grow. Now, I want to talk about this jobs report. What was considered a strong job report, to me, was not as strong as we all think.

Jobs report was more mixed than most people think

Markets cheered the upside surprise yesterday (I am actually writing this at 4pm on Friday EST just an fyi, in case something wild happens overnight that is not covered, just putting it out there). Stocks rallied from the report on the May jobs count, but traders will want to keep their eyes and ears open in coming months for significant signs of weakness that also appeared in the report. From a headline view, the 139,000 gain in nonfarm payrolls provided a nice bit of relief for a market on edge over the direction of the economy and the impact that President Donald Trump’s tariffs might bring. However, several factors in the report bear watching, if not as a signal of impending doom than at least cautionary flags that the labor market is a bit more fragile than what appears on the surface.

Here is what you may have missed or just did not consider with the jobs

While the monthly number looked good, it was in keeping with a year that has seen job growth slow considerably. Through five months, the average gain is just 124,000, compared to 180,000 for the same period a year ago — a 31% slide. What appeared to be solid growth in previous months isn’t as good as it looked. Revisions took down the March and April estimates by a combined 95,000, or 26% below the prior counts. Hiring breadth was terrible. Combined, health care, leisure and hospitality and social assistance — essentially a subcategory of health care that the Bureau of Labor Statistics nonetheless parses out — accounted for 126,000 of the jobs, or nearly all of the hiring for May. Health care benefits greatly from government assistance, which may or may not be drying up depending on how President Trump’s “big beautiful” spending bill ends up. So if you worked in a medical facility, restaurant or bar, jobs were plentiful. Otherwise, you were out of luck. Wages rose more than expected. While that’s a good thing if you’re employed, it could work against hopes for lower interest rates if Federal Reserve officials change their thinking and consider the labor market could, in fact, be a source of inflation. Government jobs, a prior significant source of employment gains, fell by 22,000 at the federal level. With cuts from the Department of Government Efficiency approaching 300,000, per Challenger, Gray & Christmas, this will be a space to watch closely as unemployment benefits and severance pay run out. The May jobs report was mediocre guys. Not horrible, but not very good. The headlines were decent, but the details were considerably worse. Tariffs were a headwind to private job growth, with losses in manufacturing, retail, and professional services. Job gains in other cyclical private industries were anemic, reflecting the drag from policy uncertainty.” Still, markets liked the report, even if they bet more heavily against significant Fed easing this year. Traders now see zero chance of a rate cut when the central bank meets again in less than two weeks, with odds diminishing of further decreases. Instead, investors were relieved that despite an array of headwinds and uncertainty, the labor market is still standing. It is a good thing that the American economy is so resilient and dynamic because it has been able to endure the headwinds caused by an ever-changing trade policy and higher tariffs. That resilience, though, has its limits, as the May employment report started to show on Friday.

We get inflation data next week folks

Next week’s inflation data could be the first to show the impact of higher tariffs. Economists expect that the May readings for the consumer and producer price index, both inputs for the Federal Reserve’s favorite inflation gauge later this month, could start to show a rise in goods inflation, which is sensitive to the higher levies imposed by the Trump administration on imports. The consumer price index, or CPI, for example, is expected to have held steady in May, up 0.2% from April. Excluding volatile food and energy prices, however, CPI is set to have risen 0.3% from 0.2% on a monthly basis, and to 2.9% from 2.8% year over year. So, I look at this and think, well right here now is really the time when we should start to see the tariff impact. I mean, obviously, it was too soon in February and in March and even in April, but May and onwards, we should definitely start to see the impact on goods prices, you would think.

Finally, I want to mention, at BAD BEAT, you get one highly likely successful investment idea a week (on average). We do growth, value, income, dividend stocks, and cover nearly every sector. Our goal is to teach you how to invest in quality that offers rapid-returns, plus long-term wealth building. We have tons of education pieces, an options training course, options education columns, trading and investing approaches, weekly weekend game plan articles for the week ahead, and daily market commentary, PLUS analysts available all day during market hours fielding inquiries. Get in the game!