Prepared by Christopher Davis, PhD

To our valued followers. Below we have a trade outlined for you for reading, as well as our weekly 'thoughts on the market' series that is offered to our investing group members each weekend. But first, I wanted to say that we recently had a Labor Day special for Seeking Alpha's premier investing group, BAD BEAT Investing, before prices rise October 1st. We had 15 open spots. There is one left, and if YOU take it, we will knock 33% off the annual price (or 75% off the price monthly members are paying), and you will be getting a better price than others who took advantage of the Labor Day Sale. We want to fill the spot. If you are interested in taking true control of your trading and investing, we invite you to join and take this last spot.

Take a look at our most recent review:

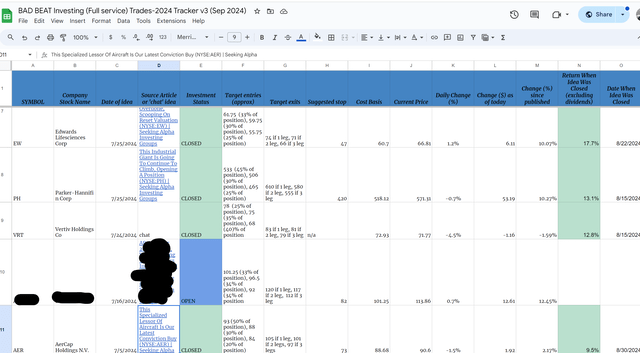

You will have wish you started sooner. You will get our highest conviction ideas (one per week on average) and direct one-on-one attention daily during market hours. We invest in all of our ideas. And have the receipts to prove it, as we provide two trackers, one in a simple article style table that lists all the ideas and another google tracker that tracks returns, a redacted snapshot version is shown below where open trades in the view are closed. Oh and if you don't love it, there is a MONEY BACK GUARANTEE!

YES I will take the spot! (Get started now and take the last spot at this fantastic price)

Currently we have a number of open trades, and our most recent idea with 25% upside was released yesterday. Try us now to access this high conviction idea! Here is a snap shot of that tracker, an over time our average returns are 24%, and most ideas close within 3 months. Our win rate still remains above 85%!

The tracker also has a second page listing our "house positions" that were established this year. These are trades where we take a chunk of the profit and let it ride for a life time, collecting ALL future gains, spinoffs, dividends etc. This is how you build generational wealth.

Get in the game now! (click to get started at the Full Service)

We just came off one of the worst weeks in nearly two years. Sometimes I feel like a broken records on repeat, but I had for weeks and weeks been telegraphing in this weekend pieces that we would see volatility and weakness in this time period, and suggested having long dated puts that you could offload for profit when things got ugly. Well, things are less than beautiful. The question on everyone’s minds is when will things bottom out. That is impossible to answer, but my personal hunch is that we have some green days sprinkled in in over the next few weeks, but I do not think this is over. I do think we can test the 200 day which is SP 500 ~5200. Still, with the directional move and the vix spike again, if you held on to some puts after the August 5th gift, you have a chance to shave for some gains. I would hang on to a few, I think we likely bottom out in October. Sometimes in election years, the volatility lasts until November. It is impossible to know, but all we can do is buy stocks when opportunity arrives, protect downside with insurance puts or inverse funds, and wait it out. This is also where diversifying into different sectors and ideas comes into play. You will note that many of our ideas are in different sectors. Of course, there will be duds no matter how much fundamental and technical work goes into my modelling, it does happen, the key is to keep having our winning percentage outpace the losers, and those who have been with us nearly 7 years know that over time the system continues to work wonders. YES…you will have a bad quarter sometimes, particularly if you hold a loser too long, or only pick a subset of trades and catch a few negative ones. At the same time, you have to have a time frame. If you are investing long-term, that means long-term. 6 months barely touches medium term. If you are trading short-term, embrace the stops. As always, we suggest a blend of both. Your investments largely should be In the highest quality companies, well rounded, and further bolstered by long-term lifelong house positions in winning trades. You talk to members who have been here 5+ years, they have changed their future and are setup for life. So, don’t sweat a tough week, month, or quarter. With all of that said on this Saturday morning, where the cooler fall air is starting to descend on the New York nights, Wall Street appears to be grappling with what exactly the mixed August jobs data from Friday means for markets. At first stocks were green following the report, but shortly after the bell, stocks started selling off.

Stocks dropped Friday, with the S&P 500 posting its worst week of the year after the nonfarm payrolls report came in with both good and bad news. On one hand, the unemployment number eased slightly. On the other, the headline jobs number missed expectations. Additionally, jobs growth for the previous two months saw significant downward revisions. One thing, however, was made clear to some investors by this latest jobs report: The labor market — and by extension the economy — is cooling. The lower unemployment number versus the downward revisions presents a quandary given the pattern of downward revisions indicating more serious economic conditions becoming entrenched. On Friday, the S&P 500 and Nasdaq Composite registered losing weeks, down more than 4% and 5%, respectively. The Dow Jones Industrial Average ended the week with a more than 2% decline. Treasury yields fell Friday following the August jobs report, with the 10-year Treasury yield a little lower at 3.71%.

Now, it is likely the Fed will avoid a hard landing, but a cooling in the economy means that the landing might not be the softest. Mild recession either came and went, or is still likely. GDP rules suggested recession was back in 2022. SAHM rule suggests we are there now. Overall, we are not expecting catastrophe. There just is not a set up for that, but we do have a setup for an ongoing correction that approaches 10%. That is reasonable. If we get to the 200 day, it would be closer to an 8% correction. Now, instead of the market cap-weighted S&P 500, where a few high-flying tech stocks have been dominating for 8 quarters, we think you continue to see money move into other sectors like health care and financials, on top of real estate and utilities. Overall, sticking to quality companies that can weather any economic softness is always a good plan. This is why one of our latest names is a REIT (NNN) which had an up week when the markets were down 4-5%. So what type of economic damage might we see? Well I think we’re not going to get a hard landing, but we’re not going to get a no landing situation either, and it will be less than soft. That’s kind of what the equity market thinks. We may have a few sub 1.5% GDP quarters ahead, and that’s going to worry some people. Since market multiples are so high still, this could lead to ongoing pressure that keeps gains a bit more normalized. In the next year. What is clear is that the Fed will lower rates meaningfully from where they were over the coming months, a likelihood that has had us optimistic on Treasuries over the next six months, the first 2-3 of which have already come to pass when in chat we got behind bonds, back when the 10-year was near 4.5%. And you know, a lot of debate is going on about whether they cut 50 or 25 basis points, but it’s where we’re heading in the next year and a half in the bond market, and Fed funds is probably heading toward 3%. The end target is really what is more important. So that’s the more important number because that means rates are going down, and if you have more bonds you’re locking in higher yields now and you get to participate in that. This is why bonds have been bid up. Perhaps they have been bid up a bit too far too fast, but the move has been made. Bonds have been bought up ahead of cuts.

Next week lacks catalysts. There really is not much in the way of earnings. There is also a relatively light calendar outside some inflation reports. But unless those reports are drastically out of line, I do not think the market moves much. I expect a slower week this week in terms of daily market moves. Big tech has corrected hard. While I lean toward next week still being down, I think the degree of market moves will be more muted. As mentioned we have seen tech crushed. Chips and big dog mag7 names largely hit. Utilities and real estate have been in favor. I see no reason why next week is much different, but think we may get some mild relief in a session or two, but think we still see some uncertainty trading which could lead to a mildly down week. The Fed next week will head into the blackout period before their policy meeting on Sept. 17-18. That said, two key inflation reports next week could inform what the central bank’s next policy move will be. The August consumer and producer price reports — due out Wednesday and Thursday, respectively — are expected to show the trend of easing inflation remaining intact. However, any indication of a shift in the narrative has the potential to roil equities. But it would need to be a surprise. We just need to avoid any negative surprises. CPI is expected to have eased to 2.6% on a yearly basis last month. That would be down from a 2.9% increase in July. Core CPI, which strips out volatile food and energy prices, is expected to have remained unchanged at 3.2%. PPI is similarly anticipated to have fallen to 1.7% from 2.2%.

We have one other macro event to be aware of that has the potential to move sectors depending on what is said. Next week will also bring the first presidential debate between Vice President Kamala Harris and former President Donald Trump, an event traders will closely watch as the candidates potentially outline their economic policies in the debate. So you may see energy move on this, as well as financials. It all depends on what the candidates discuss.

One other event is notable. Apple (AAPL) will have its “It’s Glowtime” event where the tech giant is anticipated to launch its iPhone 16. Investors are also hoping for fresh details into Apple’s artificial intelligence endeavor, called “Apple Intelligence.”

In short, theres only a few events to watch, and I expect we see a day or so of relief, but think its is likely that we trickle a bit lower based on sentiment and technical. On the upside, if we do get relief, you would be looking for a test of the 50 day. On the down side, the 100 day is within 1% here.

Now those were the thoughts on the market we provided to members this weekend. Here is a sample trade, outlining the types of trades we have at BAD BEAT Investing. Williams-Sonoma, Inc. (NYSE:WSM) is a stock that we traded in 2021 and have been running a long-term house position in for years. There have been positives, including a recent stock split to attract new investors, ongoing strength in the business despite a very questionable housing market, and the loss of the former catalyst of everyone staying and working at home. Through all of this, management has continued to execute.

We think weakness should be bought into the fall, especially if we get another market-wide selloff. A selloff is certainly in the cards seasonally, and we do have mixed economic data, as well as the volatility surrounding the election in the U.S. All of this, of course, is short-term noise. Leverage any weakness and consider going long. A "sample trade" like we do it our service is outlined below as one way to consider going long.

The Play

Target entry 1: $127-$138 (25% of position)

Target entry 2: $120-$121 (30% of position)

Target entry 3: $113-$115 (45% of position)

Stop loss: $85

Target Exit: $170

Options consideration: We think there are a number of options approaches that work here; however, such guidance is reserved for BAD BEAT members ONLY.

Discussion

In the past, Williams-Sonoma had always been a bit of a niche retailer. It is not the highest of higher-end merchandise, but also isn't an affordable low-dollar big box store type name either. It falls in between a bit. That said, it is a great store for both the home and the office. The company just reported Q2 results, and the numbers were a bit mixed. However, the view going forward is still positive thanks to better-than-expected guidance on margins, despite a small revenue decline. Williams-Sonoma saw an income of $1.74 per diluted share. This was a strong beat of $0.13 versus consensus and rose from $1.56 a year ago.

Sales and Comps

The earnings beat actually came despite a very minor sales miss and sales that actually were down from last year (as expected). Sales in Q2 registered $1.79 billion and just missed consensus estimates by $20 million, and were down 3.8% from a year ago.

What about the all-important comps? Well, comparable sales were down 3.3%$ in total, but E-commerce remains strong. In fact, the digital strength of the company is underappreciated in our opinion. Now, looking at the segments, we saw declines in most except Pottery Barn Kids. We saw West Elm comps decline 4.8%, but better than the 20.8% decline a year ago. We saw Pottery Barn comps down 7.1%, but better than down 10.6% a year ago. And Pottery Barn Kids and Teens were strong, seeing 1.5% comp growth versus a decline of 9.0% a year ago. The flagship Williams-Sonoma brands were down marginally, slipping 0.8%. So, while comps are down, we actually think it is clouding the big story here, and that is tremendous margin expansion.

Gross margin came in at a whopping 46.2% which is outstanding in retail. This was up 550 basis points from last year. This solid margin improvement was driven by higher merchandise margins up 380 basis points as well as supply chain efficiencies that added 180 basis points. Further, occupancy costs were $197 million, down -3.0% versus a year ago. This led to a guidance increase, which we will touch on, but the balance sheet is also in great shape.

Balance Sheet in Great Shape

Williams-Sonoma still has a strong balance sheet. Williams-Sonoma had a strong liquidity position of $1.3 billion in cash, including approximately $246 million in operating cash flow resulting from strong performance. What is more, there is no long-term debt here. That is a win. The company is also very shareholder-friendly. In the quarter, the company was able to repurchase an additional $130 million in shares.

The company is also a serial dividend raiser. The dividend has been hiked once again, and now is $0.57 quarterly (or $1.04 before the split), up from the $0.71 it was paying (pre-split) when we first got involved. The yield is a moderate 1.6%, but this is a dividend growth name, and we love owning stocks like that for the long term. This is especially true for a house position that we own with profit for a lifetime.

Valuation and Final Thoughts

From a valuation standpoint, we mentioned enjoying a growing dividend with a 1.6% yield while waiting for shares to move higher. The dividend is secure and likely to see increases as we move year to year. The growth in profit power is impressive, but so is the valuation. Sales this year will be down 1-4%, but management has raised guidance on operating margin for fiscal 2024. Management now expects an operating margin between 18.0% to 18.4%.

Now, over the long term, we think that you can continue to expect mid-to-high single-digit annual net revenue growth from this company, with an operating margin in the mid-to-high teens. As for fiscal 2024 EPS, we see this metric coming in at $8.40 to $9.00 on this margin guide, depending on the degree of sales. This puts the stock at just 15X FWD EPS, which is incredibly attractive in our opinion. If Williams-Sonoma, Inc. shares decline further, consider building a position.

Looking for more of our winners like WSM?

Start WINNING TODAY! Grow your portfolio by embracing a blended trading and investing approach at our premier service!

Join Seeking Alpha's premier service while the last spot remains at the best price we have offered a new member! We want it FILLED!

Enjoy a money back guarantee if you aren't satisfied (you will be). Start WINNING today. Get in the game!

Analyst's Disclosure: I/we have a beneficial long position in the shares of MANY STOCKS either through stock ownership, options, or other derivatives.

DISCLAIMER : BAD BEAT Investing and Quad 7 Capital offers research and writes opinion columns. By using our service you understand and acknowledge that there is a very high degree of risk involved in trading securities and, in particular, in trading options, including the entire loss of principal. Use of the service, our research columns, the chat service, and any other tools and the information contained herein is not intended to be a source of advice with respect to the material presented, and the information and/or documents contained in this website do not constitute investment advice. All users of the site are encouraged to consult with a personal financial advisor. No personal investment advice is being made, nor will be given.