To our valued readers,

We have a stock recommendation below that we think has very strong return potential. It was recently featured at our investing group, where 99% of the ideas will never see the light of day. That trade is below. Now, we hope you had a wonderful Labor Day week. We wanted to remind you that today is the last day of our Labor Day week annual sale for the premier trading service on Seeking Alpha. The only other sale of this nature will run black Friday special for 65% off at BAD BEAT Investing. As of now we have had dozens signup at a rapid pace, and have just 3 spots remaining before the sale will close. Get one before it is gone. Below you can see some of the conversations we have, and a shot of our summary table of trades.

We give you CRYSTAL CLEAR entry and exit targets.

We offer 1-2 written trade ideas a week that are focused on the short and medium-term.

Our active fund analysts are available all day during market hours to answer your investing questions

We have 4 different chat rooms with different themes.

Receive email alerts when we have a very timely idea that we post in the chat for quick trades.

CLICK HERE TO START WINNING

no thank you, I do not want to win, but I want to see the chat and trades below-----

Our high upside trade is below, but do check out our recent trading history. Note, open trades are redacted out of respect for members.

We actually have not taken a stop loss (reflected as STOPPED) in our summary tracker, since April. This year 90% of ideas have been closed for profit. So, we hope you will take up our offer for a discount.

If you are not satisfied, you have a 30-day money back guarantee if you cancel.

Thank you for hearing our pitch, here is the trade.

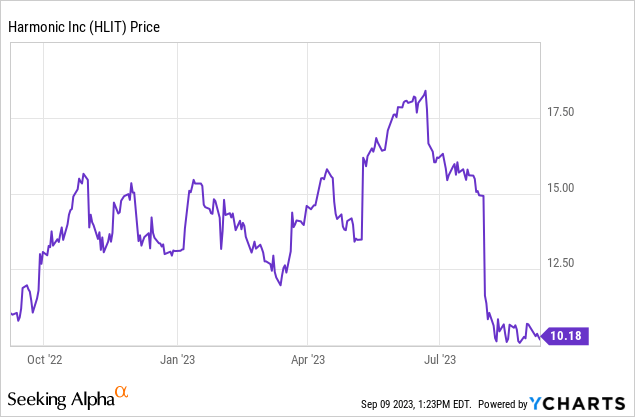

Today, I think I have found a stock that really looks good, selling for around $10, and is down 50% in a few weeks. No, this is not some biotech that missed a read out. This is an earnings positive, revenue growing company in the video content creation space. The stock in question is Harmonic Inc. (HLIT). This is not a household name, to be sure.

The stock has really suffered after a really strong run up in 2023. I think the selloff is WAY overdone here folks.

Data by YCharts

The play

Target entry 2: $10.20-$10.30 (33% of position)

Target entry 3: $9.90-$10.00 (67% of position)

Stop $8

Target exit $13.00 (recommend then running a house position by backing out initial investment plus 10% profit).

Option consideration. Little wide on the bid asks, but the January 12.50 calls go for about $0.80, add on at $0.50. You can also sell September $10 puts for about $0.30, not a bad premium for a month, with a killer entry point if assigned.

Discussion

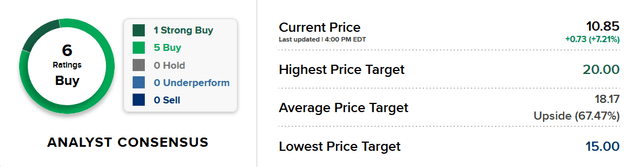

You know how I feel about analysts, that they are often reactionary, but there views do matter on the Street, for better or worse. There are 6 analysts following this company and all of them have a buy rating.

Here is the impressive thing. The stock is at $10-$11 here. The LOWEST price target is $15.00. Folks, I am not even looking to be that greedy here. But I am looking for 30%, at which point I want to convert to a house position. It may take some time to play out, but I think this stock is going to be a winner.

So what is this company all about? Harmonic, is a worldwide leader in virtualized broadband and video streaming solutions, and is guiding the transformation for video, broadband and media companies, with smarter, faster, and simpler solutions. Now, for the past 25 years, they have been at the forefront of industry innovations. Whether powering multi-gigabit broadband services or simplifying video streaming and broadcast delivery, Harmonic is shaping the future of the telecom, cable, and media and entertainment industries. Within the company, there are 2 main segments, the broadband, and the video segment. Here the video segment is the faster-growing one, much thanks to SaaS revenue being up 72% YoY. Harmonic is prioritizing getting strong multi-year contracts in order to stabilize and create predictable future revenues for the company. This also has the effect of creating more reliable cash flows which can be used for investment into new products. With the partnering with Charter Communications, Inc. (Charter Communications, Inc. (CHTR) Stock Price Today, Quote & News), HLIT is further solidifying its position in the market and creating an opportunity for its two segments to continue growing.

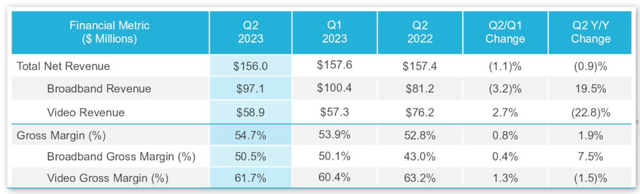

So what is performance like? Well that is kind of what triggered the massive selloff. It was not a good quarter. No need to reinvent the wheel here, these are the highlights from the presser for Q2. Revenue suffered in the video segment, but margins were up actually., but the operating income suffered.

- Revenue: $156.0 million, down 1% year over year

- Broadband segment revenue: $97.1 million, up 20% year over year

- Video segment revenue: $58.9 million, compared to $76.2 million in the prior year period

- Gross margin: GAAP 54.5% and non-GAAP 54.7%, compared to GAAP 52.3% and non-GAAP 52.8% in the year ago period

- Broadband segment gross margin: 50.5% compared to 43.0% in the year ago period

- Video segment gross margin: 61.7% compared to 63.2% in the year ago period

- Operating income: GAAP income $10.0 million and non-GAAP income $18.2 million, compared to GAAP income $15.1 million and non-GAAP income $21.4 million in the year ago period

- Net income: GAAP net income $1.6 million and non-GAAP net income of $14.0 million, compared to GAAP net income $14.8 million and non-GAAP net income $17.6 million in the year ago period

- Adjusted EBITDA: $21.1 million income compared to $24.3 million income in the year ago period

- EPS: GAAP net income per share of $0.01 and non-GAAP net income per share of $0.12, compared to GAAP net income per share of $0.14 and non-GAAP net income per share of $0.16 in the year ago period

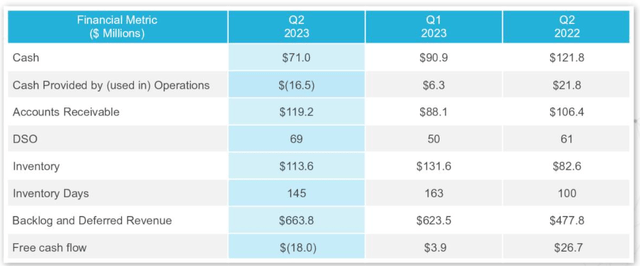

- Cash: $71.0 million, down $50.8 million year over year

So we saw cash burn, we saw weakening net income, we saw revenues down. Why be bullish? Seems contrarian for us doesnt it? Patrick Harshman, president and chief executive officer of Harmonic put it in perspective:

"While we achieved double digit year over year Broadband and Video SaaS revenue growth and strong gross margins for the second quarter, we experienced hardware sales delays across our business segments resulting in total revenue that was below our expectations. Despite these short-term headwinds, we have the largest backlog in our Company's history and our operating model continued to deliver solid profitability. The strength of our market position was reinforced by several new customer wins which further supports our multi-year growth plan."

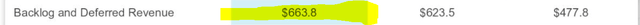

Now, it is the latter point, the multi year growth plan. I scoured the quarterly statements and 10-k filings. The backlog is for real.

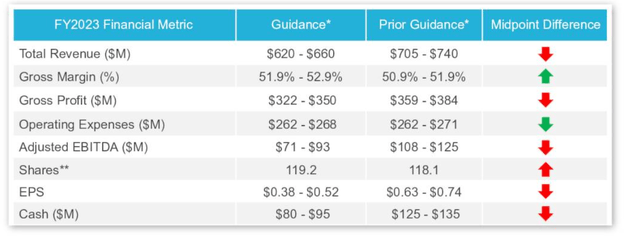

The backlog is a new record. A record backlog. Essentially what happened here, is that revenues are being pushed out to later in the year and into next year. This crushed the FY2023 outlook, but in our opinion, the selloff is overdone.

Make no mistake, these are tough numbers to swallow until you recognize that the sales are being delayed, they are not gone. Also, they are improving gross margin and starting to cut opex. This is a winning combo. Of course, shares are not cheap, about 25X FWD EPS now. 2024 is now having a very constructive view. Harmonic has reinvented itself after looking like it was heading out to pasture. Years ago they pivoted their products and business toward software-oriented architectures focused on video delivery and next-gen broadband. With key reference accounts secured and a lead over legacy platform competitors, we think Harmonic is a winner. The deal with Charter was a winner. That could lead to $100 million in revenue alone. Winning.

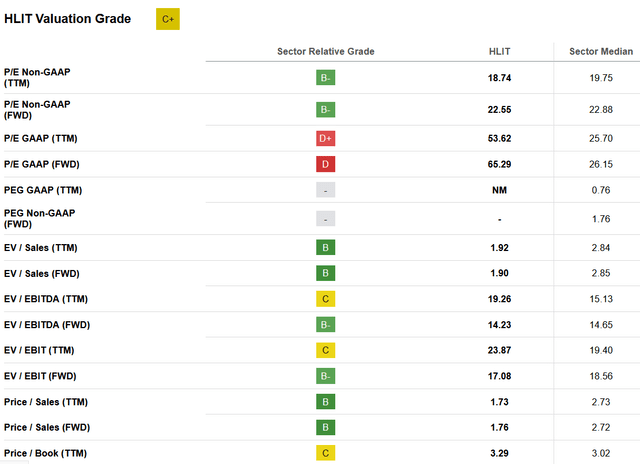

The value, as of now, is average of course. But this is about the future, and I see shares rallying into the fall and year end on a favorable 2024.

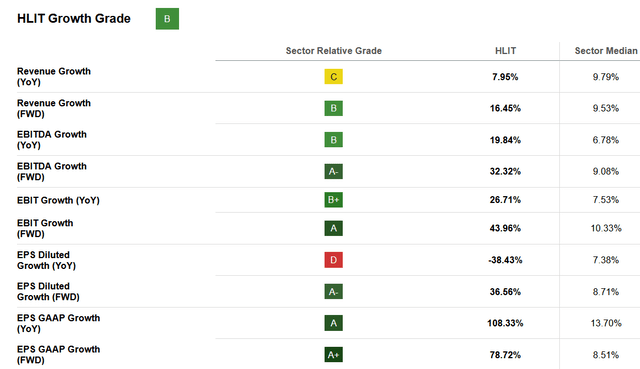

The growth is a bit above average, despite the immediate cut to the outlook. It is still a growth story and now it is on sale.

If the market takes this back lower toward $10, I think you buy up shares. I really like it here at $10 for some growth. It also is one that sets itself up for a house position.

Quite the pitch.