The essence of modern AI is going through a large dataset with a specific task in mind, picking out the models and formulas that describe the patterns present in it, and running new data through these formulas, mainly to predict things or classify things. AI is used to accomplish a wide variety of tasks ranging from preventing credit card fraud to helping customers manage their income and spending. But perhaps the most exciting (and challenging) task for AI to take on is investment advice, with machine learning utilized to model the market dynamics and pick out the most lucrative investment options.

IKF Algorithm: How Do We Bet on the Winning Horse?

In order to take full advantage of the advanced AI technologies, we follow a few tips that allow us to correctly interpret the output of the AI algorithm and be confident in our investment.

First, in line with the idea of betting on the winners, we identify the most lucrative areas by using the sector forecast or the indices forecast to get an insight into the leading sectors. To help with this task I Know First provides the ETFs Forecast package and the World Indices Forecast package.

Second, by using the right packages. For example: if you see a strong signal that is pointing to the energy sector, the energy package is the more appropriate forecast to guide. Please visit our website for recent forecasts performances.

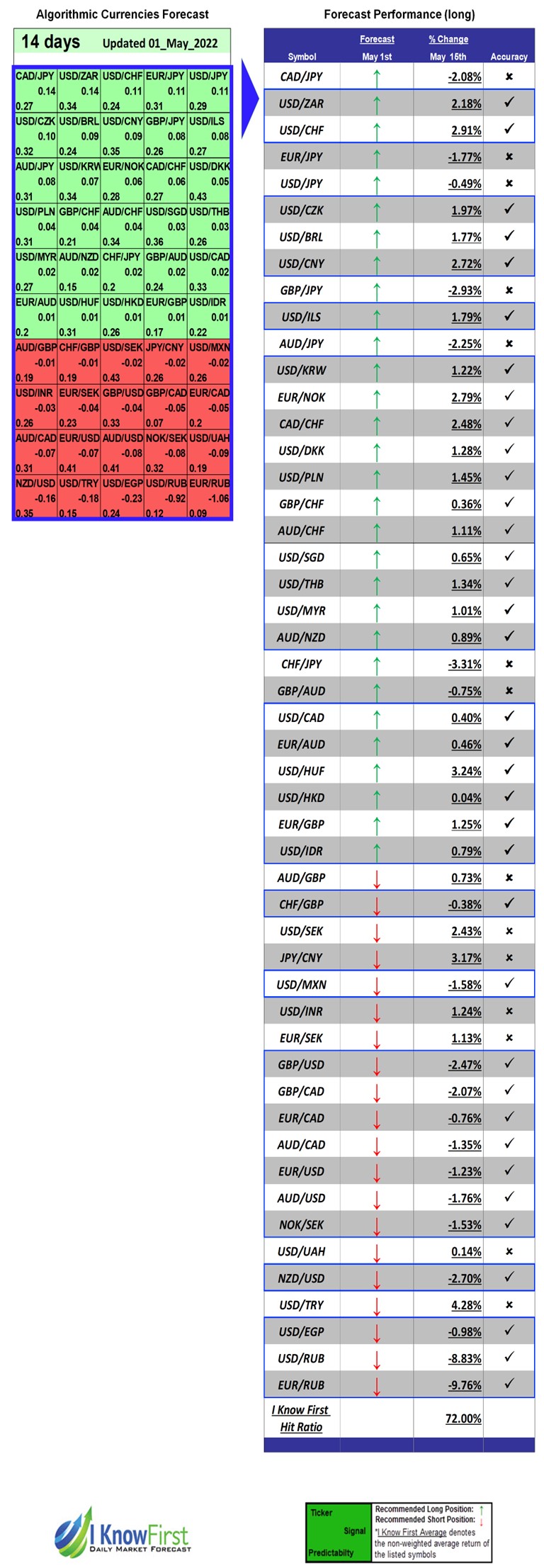

Third, by focusing on the strongest signals. The idea is to pick out the assets that have the highest signal and are predicted to move in the same direction as the sector itself. Among these, we will select the ones with the highest probability scores, to make sure our investment does not fall prey to the AI’s hiccup.

Fourth, by also using these opportunities to short sell. Our algorithm not only provides stocks to buy but also stocks to go short which allows us to find great investment opportunities not only in the bull market but also in the bear market.

Fifth, using predictions for different times. Among these, we will select the asset with the highest probability scores, to make sure our investment. Our artificial intelligence algorithm provides opportunities in the short term and also in the long term. We currently work with six different time horizons: 3 days, 7 days, 14 days, one month, 3 months, and one year. The idea is the short-term forecast should be supported by the long-term forecast.

Sixth, investing not only in stocks! You can diversify your portfolio by using different asset classes. We offer forecasts for ETFs, currencies, commodities, and even cryptocurrencies!

And last but not least, by analyzing your own portfolio. You can use our artificial intelligence algorithm services to receive custom forecasts, as well as to analyze your existing portfolio. You can have access to it by sending your existing portfolio to custom@iknowfirst.com. If you are interested in our packages, you can access them here.

At I Know First, we use computers, mathematics, and self-learning algorithms to pick stocks. Markets move in waves, and our algorithms are designed to detect and predict these waves. Each algorithmic forecast has many inputs from many different sources, with each input affecting the outcome. The output of each stock is an up or down signal, along with its predictability. The use of mathematics and algorithms eliminates a big problem that all of us share, being emotional. The I Know First algorithm is trained on a historical dataset covering 15 years of trading, it can model and predict the price dynamics for more than 10,500 financial instruments for time horizons ranging from 3 to 365 days. Its output is delivered as an easy-to-interpret heatmap with 2 numerical indicators: signal, demonstrating the asset’s performance relative to the other stocks on the forecast, and predictability, which demonstrates how well the algorithm has predicted the asset’s dynamics in its prior forecasts.

To subscribe today click here.

Please note-for trading decisions use the most recent forecast.