Note: On the morning of October 8th, Sassy Resources (CSE: SASY) announced a C$5M non-brokered private placement.

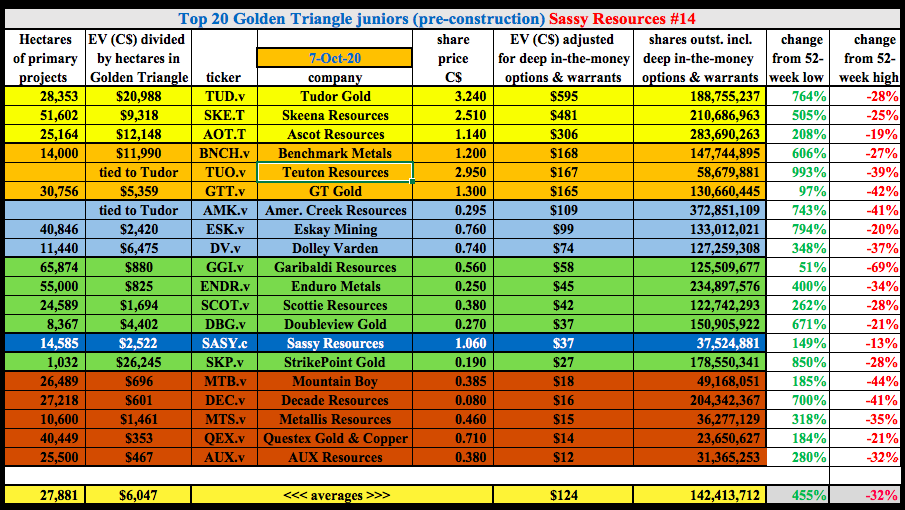

Few gold/silver jurisdictions on the planet share the high-grade, high excitement and high company valuations of the Golden Triangle (“GT“) in northwestern B.C., Canada. Over 40 companies have all, or substantially all, of their properties / projects there. Below is a chart showing the top 20 pre-construction stage juniors in the district.

Only four have current mineral resource estimates, one has a PEA and one a DFS. Yet, these 20 are trading at an average Enterprise Value (“EV“) (market cap + debt – cash) of $124M. On average, the top 20 are up +455% from their respective 52-week lows (range 51% to 993%).

Some of the names on the list might be overvalued, but many analysts and market pundits believe there will be a tsunami of precious metals M&A over the next few years. A rising tide will continue to lift all boats. Still, some boats have more lift potential than others.

To be safe, investors should be aware of relative valuation in the GT, and for that matter across the > 500 Canadian & U.S.-listed gold juniors. Perhaps readers should shy away from companies like Teuton Resources, up 993% from its 52-week low.

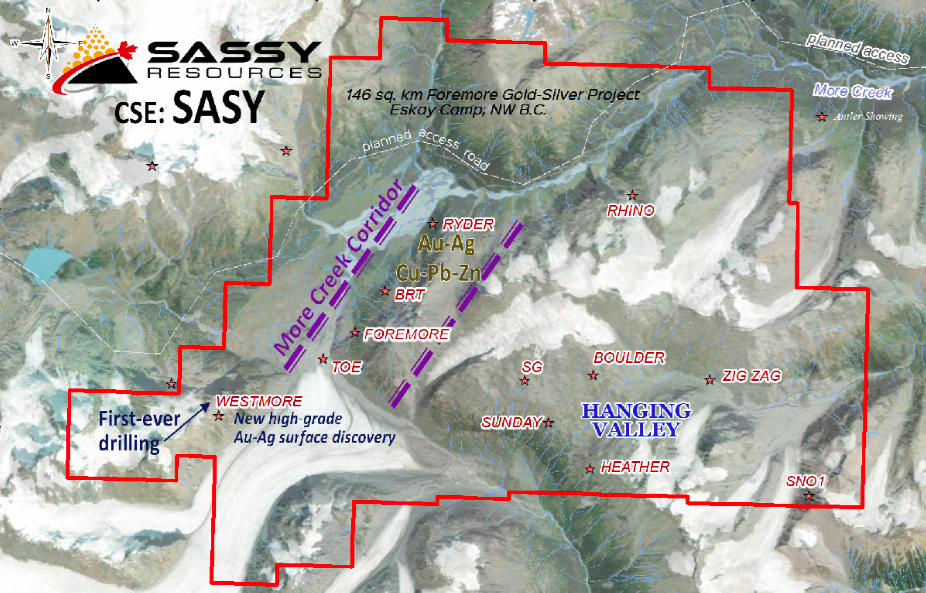

Sassy Resources — high-grade, high discovery potential on 14,585 hectares

This is my third article on recently listed Sassy Resources (CSE: SASY), a junior with a sizable project in the Eskay Camp, in the heart of the GT. Sassy is a relatively unknown spinout from Crystal Lake Mining (now called Enduro Metals). It may not remain unknown much longer as drill results and new strategic investors are announced later this year.

Sassy controls 100% of the very promising Foremore gold-silver project covering 14,585 contiguous hectares, hosting high-grade precious metal targets + non-trivial showings of zinc, lead & copper. This year management is laser-focused on high-grade gold & silver. Look a the map above to see how central this project is.

By way of comparison, Sassy’s 14,585 ha footprint is similar in size to other high-profile GT projects like; Skeena Resources’ Eskay Creek at 6,151 ha, or Ascot’s Red Mountain (17,125 ha) footprint. Tudor Gold owns 60% of the (17,913 ha) Treaty Creek, and Benchmark Minerals has the (14,000 ha) Lawyers project.

Pre-construction juniors in the GT have EVs as high as Tudor’s $595M. The top-10 average $222M. Sassy’s EV is $37M, the 14th largest on the chart. Note: {I count deep in-the-money shares & warrants in my share counts.}

However, if the Company has success on its ongoing drill program at the Westmore target, (currently drilling hole #5, results from initial holes should start coming back next month) its valuation could easily break onto the top-10 list!

Visible Gold in first 2 drill holes at Westmore target, this could be BIG…

To be clear, projects controlled by the top 10 companies are more advanced, roughly 2-4 drill seasons under their belts. Skeena’s Eskay Creek has a PEA on it, and Ascot’s project a DFS.

Sassy is just one season into drilling its property, but they already know they’re in the right zip code and have plenty of room for blockbuster, high-grade discoveries.

In Sassy’s most recent press release, management announced that vein sets recognized at surface at Westmore, (incl. visible gold in the first two drill holes), has been intersected to a depth of 270 m. These holes had core lengths of 211 & 304.5 meters.

Importantly, mineralized zones consisting of abundant quartz veins occur over widths of multiple meters. While visible gold is always nice, management points out the significant amounts of gold and silver in several other samples that did not have visible gold.

This is really big news, and mineralization remains open in all directions. Westmore is just one of a dozen targets on the Foremore property in Northwest B.C.’s Eskay Camp (in heart of Golden Triangle). Readers should note, management remains interested in the More Creek Corridor and Hanging Valleyareas, but the primary focus is Westmore.

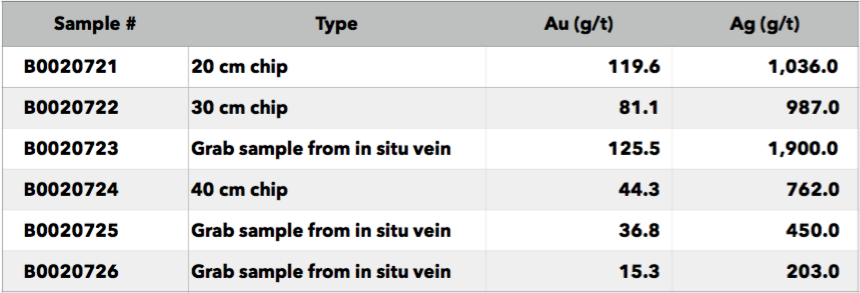

Impressively, over 800 chip, grab, and composite samples have been collected since July over an exposed surface area of 400 by 400 meters with initial assay results confirming high-grade gold values. Some samples had visible gold.

Mark Scott, President & CEO, commented,

“It is rare to have a grassroots target turn into an early-stage discovery like this after only a few months of field work followed by the first two drill holes, but this speaks to the energy and boldness of our team and the prolific nature of this district. We will push the drilling as far into the fall as possible as we have multiple high-quality targets to test thanks to extensive mapping and sampling.”

Select blockbuster surface samples, will drill results impress?

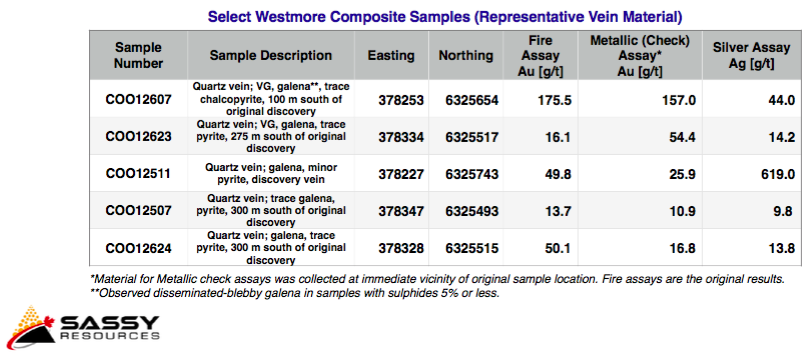

Results are being received for sampled quartz veins occurring 100 to 300 m south of the original surface discovery reported on September 4th. Needless to say, expansion of the prospective mineralization by hundreds of meters would be incredibly important.

Preliminary assay and check assay results at Westmore have highlighted widespread high-grade gold mineralization. These surface samples range up to a gold equiv. grade of ~157.5 g/t, (the second best grades ~150 g/t gold equiv.).

At least one full drill core has been submitted to a lab for assay, delivered about 10 days ago. Due to unprecedented delays in B.C labs, it’s hard to know when to expect results, but next month news should start to flow and continue flowing well into December.

As mentioned, the first two drill holes produced core with visible gold and demonstrated continuity from surface to (at least) 270 m. If visible inspections of drill cores continue to identify multiple meters of potentially high-grade mineralization, that would generate a great deal of attention.

Imagine having such substantial exploration success so soon — on the very first drill program — on 1 of 12 targets. That’s what were looking at here. That’s why management is so excited and why the Company just announced a private placement with “strategic investors” to raise cash to do a lot more drilling!

Perhaps less appreciated by investors is management’s ongoing quest to make acquisitions. Unlike most GT-focused juniors, Sassy plans to control high-grade projects in North America upon which they can drill year-round. Multiple discussions are underway, and I believe at least one deal will be announced before year-end.

CONCLUSION

Looking at the top-20 GT names again, 9 are up > +500%. Could some of those stocks double or triple from here? Sure. But if they did it would probably be in large part due to soaring M&A activity, a higher gold price and/or new investors entering the precious metals sector.

If some of the best performers were to rise by another 100%-200%, I feel confident that Sassy would increase by a lot more. Two more things in the Company’s favor are the tight share structure (under 40M shares) & modest EV, under $40M (pro forma for today’s announced equity raise).

In my opinion, it would be a lot harder for Tudor Gold to triple to an EV of nearly $1.8B than for Sassy’s valuation to triple. Make no mistake, Sassy Resources is an earlier-stage and riskier company than most of the top-10 names, but it offers a compelling risk/reward investment proposition.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Resources was an advertiser on [ER] and Peter Epstein owned zero shares, options & warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.