Note: References to the historical resource are for 100% of that resource. Golden Independence is earning up to a 75% interest in the Independence project. It’s assumed for the purposes of this interview that the Company will achieve a 75% interest, which would entail US$4.3M in future payments to the vendor, plus US$3M in exploration expenditures — both requirements by 12/31/2021 — to earn a 51% interest. Golden Independence would then have four years to earn up to an additional 24% interest, (to reach 75%), by spending $10M more on exploration / development.

In north America there’s been a concerted effort by dozens of junior miners to re-establish / restart past-producing mines and/or explore / develop brownfields sites. The reasoning is sound — new mines can be fast-tracked with the help of historical workings, drill hole data, actual mining records, historical PEA, PFS, DFS reports, etc.

The ability to fast-track a project to production is largely tied to three things; jurisdiction, permitting regime and access to capital.

Some juniors pursuing brownfields exploration / development have been dealt a strong hand with respect to all three factors. One such company is Golden Independence (CSE: IGLD). It’s flagship project is in Nevada, it’s permitted for the next 160 drill holes and sits on property within Nevada Gold Mines’ (a JV between Barrick & Newmont) Environmental Impact Statement & Permitted Plan of Operations.

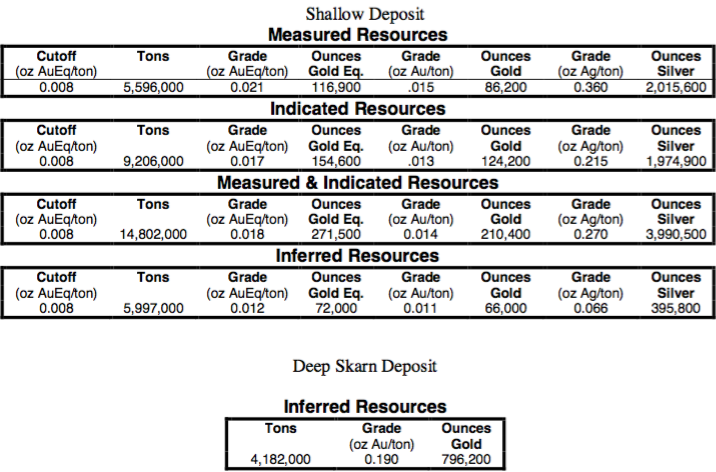

Even better, IGLD has an historical (non NI 43-101 compliant) Measured, Indicated + Inferred mineral resource estimate from 2010 of > 1.1 million ounces gold equivalent — 343.4k oz. in a shallow oxide zone, only measured to a depth of 400 ft. / 121.9 m. A low-cost, low technical risk heap leach operation is being studied.

The Company has C$4M in cash to fund a robust, Phase 1 drill program of 15 holes / ~3,660 meters (now underway). Drill results should start coming in late-November or early-December.

Management believes there’s a good chance that a new, NI 43-101 compliant, resource total of roughly 1.60-1.75M Au Eq. ounces — [at midpoint, ~1.25M oz. net to IGLD, assuming a 75% interest] — could be delivered in the next several months.

More than $33M has been invested, and > 210 drill holes (> 30,480 meters) logged, prior to IGLD starting work on the project two months ago. To learn more about Golden Independence, I spoke with CEO Tim Henneberry about near-term prospects and longer-term goals.

This is a Company that’s not well known. It has only 32M shares outstanding and a C$17M market cap. With zero debt & C$4M in cash, its EV is C$13M = US$10M.

The Company’s valuation seems very cheap compared to peers. On an Enterprise Value (“EV“) {market value + debt – cash) to oz. in the ground basis, IGLD is trading at C$15/oz. Peers trade at an average of C$70/oz. Pro forma for the upcoming resource estimate, IGLD could be trading an EV/oz. ratio of closer to C$10/oz.

Golden Independence is earning up to a 75%-Interest in the Independence Gold project that has had > 210 drill holes and > $33M invested in it, not to mention a 1.1M gold equivalent (Au Eq.) ounce (historical, non NI 43-101 compliant) mineral resource. Please provide readers with a history of this project.

The Independence gold-silver project is 0.5 km southwest of the Phoenix pit of Nevada Gold Mines (Newmont / Barrick JV), ~14 miles south of Battle Mountain in north central Nevada.

Three distinct deposit types are present; a near-surface epithermal system and a deeper high-grade, gold-rich skarn-hosted system, and a gold-copper porphyry system.

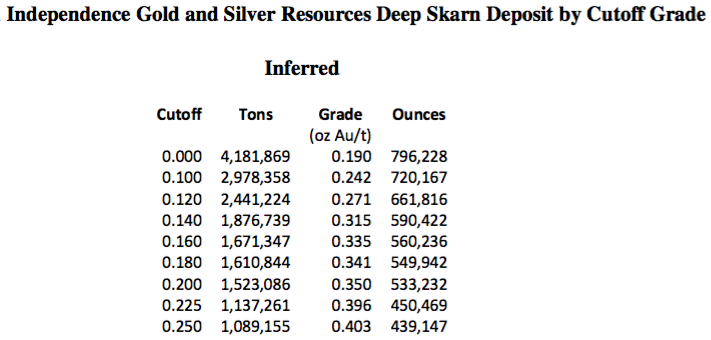

Over 210 drill holes were completed from 1973 to 2017. Gold mineralization in the deep skarn has been encountered in an area > 1,400 feet wide by 3,400 feet long. The majority of the skarn target is ~2,800 to 2,900 feet beneath the surface.

Note: Notice in the Inferred resource chart above for the deep skarn portion — the 796,228 ounces @ 0.19 opt = 6.5 g/t gold is associated with a zero cut-off grade. The Inferred resource is still 533,232 ounces at a 0.20 opt cut-off and an average grade of 0.35 opt = 12 g/t gold. That’s 33% fewer ounces, but contained in 64% fewer tons.

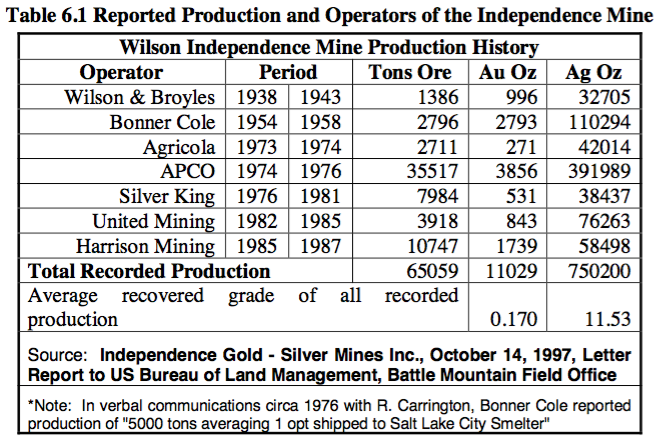

Shallow oxide drilling subsequent to the 2010 historic resource expanded mineralization to the north & south and the deposit remains open in both directions. The Independence mine produced intermittently from 1938 through 1987 from several miles of underground workings developed along a 1,500-foot (457-meter) strike length.

Note: {Reported production by prior operators [shown below] totaled 11,029 ounces gold + 750,200 ounces silver. The weighted average grade is 10.9 g/t gold equivalent (at spot prices). However, this production is not representative of what Golden Independence is pursing now. Old-timers only chased the veins}

Subsequent to the historical resource calculation, there have been 62 other historical holes, and your team has started a 12,000 ft. (~3,660 m) Phase 1 drill program. Do you have a conceptual target of how large your upcoming (1Q 2021) mineral resource estimate could be?

Good question. Based on what we’ve seen to date, from prior due diligence, the historical resource report and the subsequent historical drilling of those 62 holes, we think a total of 2.5-3.0M ounces (from both shallow oxide plus deeper sulfide mineralization) is possible. However, a figure of that size might not come to pass until 2022 (if at all).

In our upcoming mineral resource estimate — we hope to establish a shallow oxide only portion of 800-950k gold equiv. ounces, giving us a total of 1.60 to 1.75M ounces, including the much deeper, higher grade sulfide portion of 796,200 Inferred ounces.

What’s the significance of your project lying within Nevada Gold Mines’ (“NGM”) (a Newmont-Barrick JV) approved Environmental Impact Statement (“EIS”) & Permitted Plan of Operations (“POP”)?

I think the main point is that all of the environmental & socio-economic surveys / analyses have been completed for the area as part of NGM’s POP approval.

While we still have to do these surveys, the fact that drilling & mining has already been approved for the entire POP, indicates permitting for Independence’s project should be a straight-forward, lower-cost and (hopefully) expedited process.

Given its location, why isn’t NGM exploring / developing the Independence Gold project?

NGM is a JV between Newmont & Barrick that holds all of the two Major’s Nevada properties / projects / mines / mills. Our project is simply too small for NGM at this time.

However, if we can prove up (over time) 2.5 or 3.0M ounces, a substantial portion in the Measured & Indicated categories — and deliver a PEA — we think that NGM and other regional players would be very interested.

Your company is, “fully-permitted for exploration & development drilling of > 160 drill holes.” That seems unusual, please explain.

It is unusual, I’ve been in the mining industry for 40 years and this approach of permitting well more than one’s current drill program needs is new to me. We think that it makes a lot of sense as it saves time and provides enhanced operational flexibility.

The $33M in historic exploration expenditures greatly assisted in the targeting of such a large number of holes as the zones of known mineralization have been more or less defined and we’re now just drilling them off.

In reading your corporate presentation, it seems that the Independence Gold project could potentially be fast-tracked. Please describe the steps that would get you into production sooner rather than later.

Yes, that’s certainly the goal, to have line of sight towards commercial production in 4-5 years. Many U.S. projects, especially in Nevada, are looking at 5-10 years before initial production. Why so long? They’re pre-maiden resource, are not working in a brownfields setting, do not have > 210 drill holes under their belts, and are not permitted for the next 160 holes.

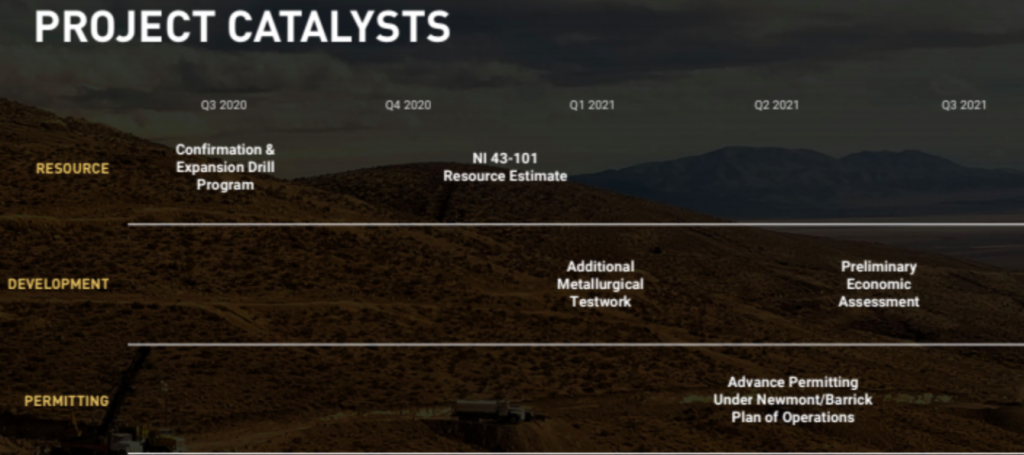

We are just 12-14 months from a PEA, most Nevada peers are years away from a PEA. Our project already has an historical resource of > 1M ounces gold, which we expect will hold up in our new resource estimate in 1Q 2021.

It will take many of our peers multiple rounds of drilling, substantial capital outlays and more than 1 resource estimate to top the 1M oz. threshold. That takes a lot of time, especially considering the permitting steps these companies have to take that we do not.

Can you discuss the preliminary metallurgy testwork that’s been done on the project.

Yes, preliminary metallurgical testing was completed on the shallow oxide material. The oxide material was crushed to minus 6 inches and yielded an 83% recovery for gold. We will be completing further metallurgical testing with material from the current drill program.

Why should readers consider buying shares of Golden Independence (CSE: IGLD) instead of the 50+ precious metal juniors with all or most of their properties in Nevada?

We’ve talked about the main investment catalysts; 1) potential for a fast-track scenario, 2) a great project in a great jurisdiction 3) new NI 43-101 compliant mineral resource estimate of ~1.6 to 1.75M ounces expected in 1q 2021, 4) a longer-term conceptual target of 2.5 to 3.0M gold equiv. ounces, 5) a PEA in about 12-14 months.

Peter, as you mentioned in your opening paragraphs, IGLD is trading at an inexpensive valuation relative to many of our peers. While some are more advanced, others are less (further from first production) advanced than we are. And, some have projects in far more remote locations, with limited regional infrastructure in place.

Bottom line, we feel that we have as much blue-sky upside potential as most peers, but with less risk due to the attributes we talked about — (a past producer, historical resource estimate, world-class jurisdiction, permitted drill holes, etc.).

Thank you Tim, that’s very helpful. Hopefully more investors will learn about your company and consider investing in IGLD’s future.

Disclosures / disclaimers: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Golden Independence Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Golden Independence Mining are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned no stock, options or warrants in Golden Independence Mining, and the Company was an advertiser on [ER].

While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.