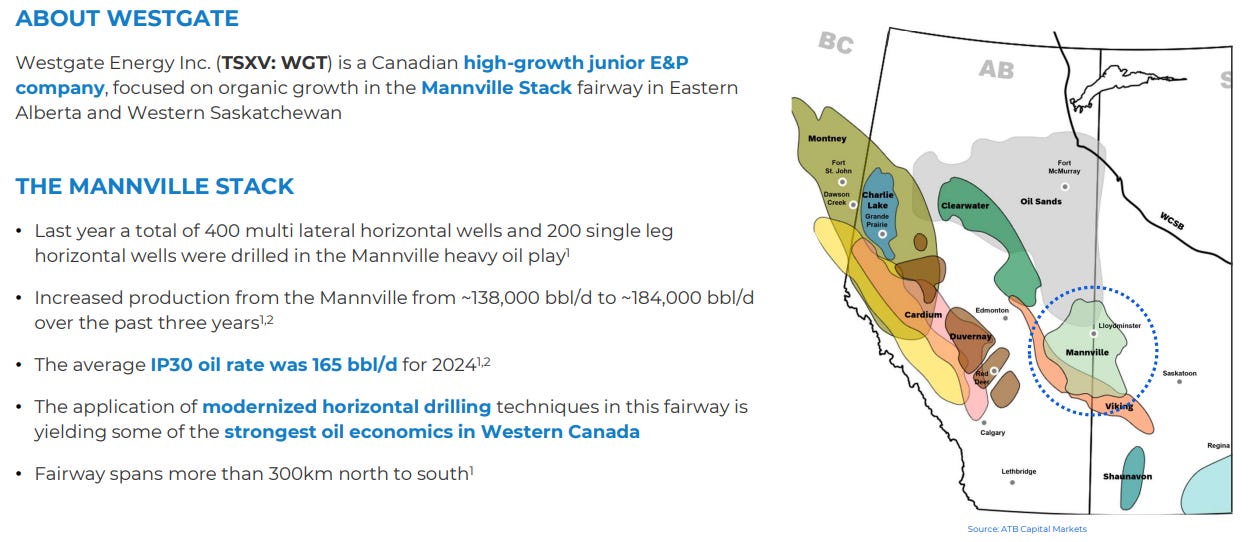

The vast majority of junior mining eyes are on #gold & #silver plays, with North American #oil producers being largely ignored. That’s understandable with precious metals up so much this year.

However, with the top quartile of gold junior up and average of +525% from their respective 52-week lows, taking some profits and shifting to other sectors might make sense.

If one believes that WTI oil will remain in the $60’s per barrel for years and years to come, then many producers are not that exciting.

However, small producers, fully-funded, growing very rapidly with robust economics offer compelling risk/reward propositions even with WTI in the $60’s.

Westgate Energy (TSX-v: WGT) / (OTCQB: WGTFF) is a prime example, one of the fastest growing in N. America, albeit from a small base. Westgate is fully-funded well into 2028 with a US$25M loan facility ($10M drawn).

Last month, management, led by founder / Exec. Chair Rick Grafton and CEO/Dir. Dan Brown, announced 7-day IP flow rates from three new wells averaging 156 barrels/day, +30% above expectations.

NOTE: in the new corporate presentation, those 3 wells are reportedly producing at “+500” barrels per day. All are above the type curve, but at different rates.

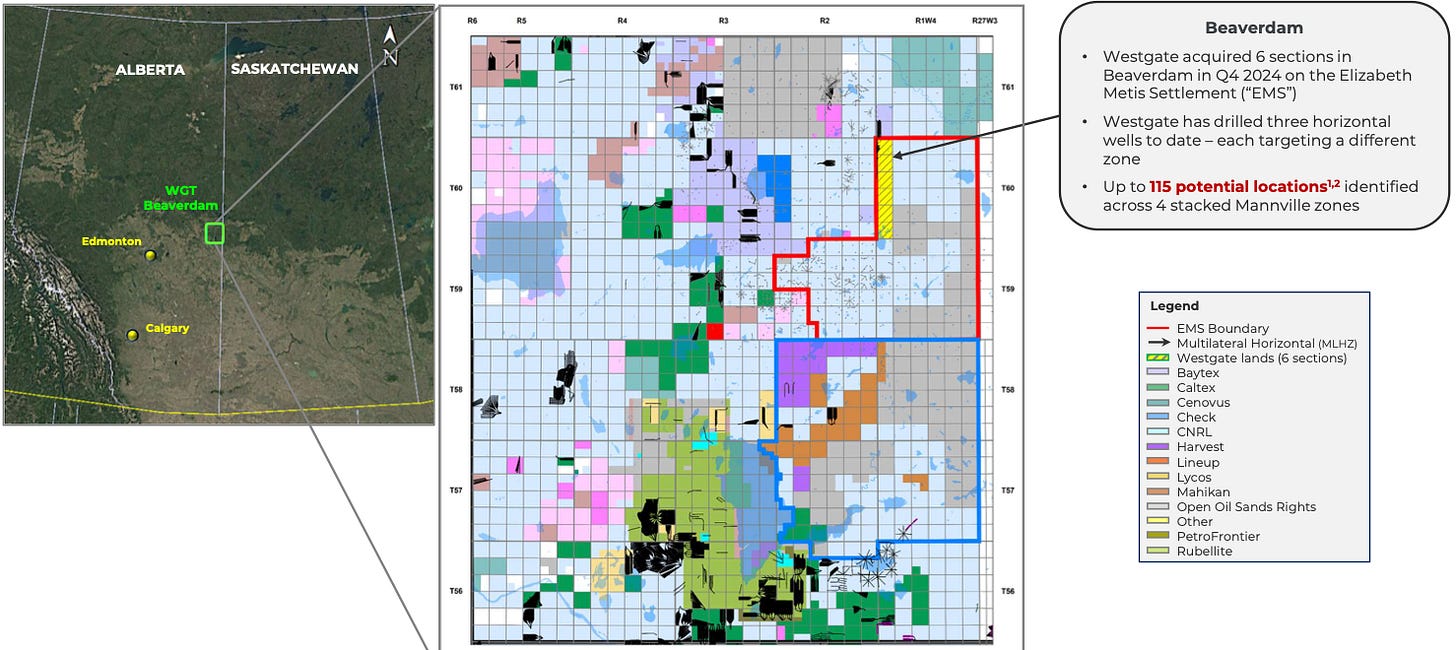

This is huge news as it expands the (potential) number of Tier 1, 2 & 3 well locations to 159, of which 72% are Tiers 1 & 2! That’s a very substantial amount of inventory if drilling just 3 wells/quarter.

This represents a > 70% increase in prospective drill locations from three months ago, begging the question, will Westgate drill more than 3 wells/qtr next year? I don’t know, but management has underpromised & overdelivered so far in 2025.

Imagine what Westgate’s valuation could be if/when WTI rises above $70 or $80/bbl, as it does from time to time. The following interview of CEO Brown is concise, timely & informative. Westgate has excellent, fully-funded operational runway to continue growing for several more years.

With just 68.7M shares outstanding (incl. 1.8M RSUs/DSUs) and no near-term private placements planned, open market purchases is the only way to build a position. Trading volume is up, (~385k shares/day in Canada alone in the past two weeks). 2026 should be a great year, and 2027 even better.

Although your team is still planning the drill program for Q4/25, can you say anything about the possible number and type of wells being planned?

We will do a 3-well program this quarter (4Q/25), plus two stratigraphic test wells to further delineate existing inventory, validate our geological mapping, and orientate future well pads to efficiently develop various geological horizons.

115 potential Tier 1 & 2 well locations, 159 incl. Tier 3’s, A LOT of INVENTORY!

These test wells will also further delineate “other” prospective zones that we discovered via the first stratigraphic test.

Can you provide a preliminary update on how valuable new knowledge from recent success might impact expected results on future wells?

Recent successes will help us with:

- Expanding our drilling inventory, both potential new zones, but also validating our Tier 1, 2 & 3 locations, and possibly high grading some tier 2’s into Tier 1’s and Tier 3’s into Tier 2’s

- Refining and potentially increasing our type curve. It’s too early to revise the type curves yet, but our initial three wells are a great start!

- Those three strong wells will help refine our EUR’s (Expected Ultimate Recovery) modeling

- Notable successes from each geological horizon (we drilled three zones) will help us prioritize which horizon(s) to put more focus on in the near-term

Will Westgate’s pace of drilling new wells depend in part on the WTI oil price?

Q4/25 drilling is going to proceed (as per the Oct. 1st press release). $60+ WTI is adequate for the next round of drilling. Q1/26 could be impacted in either direction… If WTI goes lower, we may slow or pause drilling, if higher, we could expedite drilling.

If WTI remains rangebound, we will likely drill a similar number of wells relative to Q3 & Q4/25.

Tuck-in acquisitions are probably next year’s business, yet any insights on opportunities that Westgate is being shown?

Yes, multiple opportunities are always being pursued, both “small tuck-ins” and “transformational” initiatives. No guidance is available on the timing or probability of either.

Importantly, with our six sections and the multiple (3+) zones we can drill, we don’t need to do acquisitions, but we’re always looking at accretive opportunities.

A recent press release described how more drilling locations could be developed than thought 3-4 months ago. Please elaborate.

Yes, recent drilling validated three zones on our land package. One of the zones was previously considered to be slightly exploratory (i.e. higher risk). However, results from that zone have significantly improved the potential number of locations there.

This gives us increased confidence in our internally generated well location count (inclusive of that zone). The completed stratigraphic test, plus two more planed stratigraphic tests, have the potential to further increase location count within our three proven primary zones, plus one or two other zones.

The drilling of three more horizontal producers will further contribute to validating / expanding our location count.

Westgate’s most recent three wells, and ones to follow for the foreseeable future, are almost all oil. Can you describe the significance of producing oil vs. natural gas?

Oil is our sole focus. Oil provides us with rapid spud to on-stream timelines (~40 days). We require no gas gathering infrastructure, compressors, pipelines, and have no gas processing fees.

This means no gas processing capacity issues that would impede production and the pace of our rapid development.

In addition to better than expected IP rates, were there other positive surprises of note?

The stratigraphic test well provided us with an indication of good potential in other Mannville stack oil bearing zones. We are building off of that with two additional stratigraphic tests.

Although you have a debt facility with excess capacity (subject to ongoing credit approval), might there be a reason to do an equity raise?

No, not in the near term. We plan to significantly improve production and cash flow per share first. An equity raise may be considered if our capital program is expanded, but would be next year’s business.

A meaningful acquisition could also be a catalyst for an equity raise, but would also probably be a 2026 event. Drilling Q4/25 wells and preparing for anticipated Q1/26 wells is our focus in the coming months.

Thank you Dan for your time and keen insights. I look forward to the re-start of drilling later this month!

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Westgate Energy, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Westgate Energy are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Westgate Energy was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.