Hello everyone! In today’s article, we’ll examine the recent performance of Alphabet Inc. ($GOOGL) through the lens of Elliott Wave Theory. We’ll review how the rally from the May 07, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this stock.

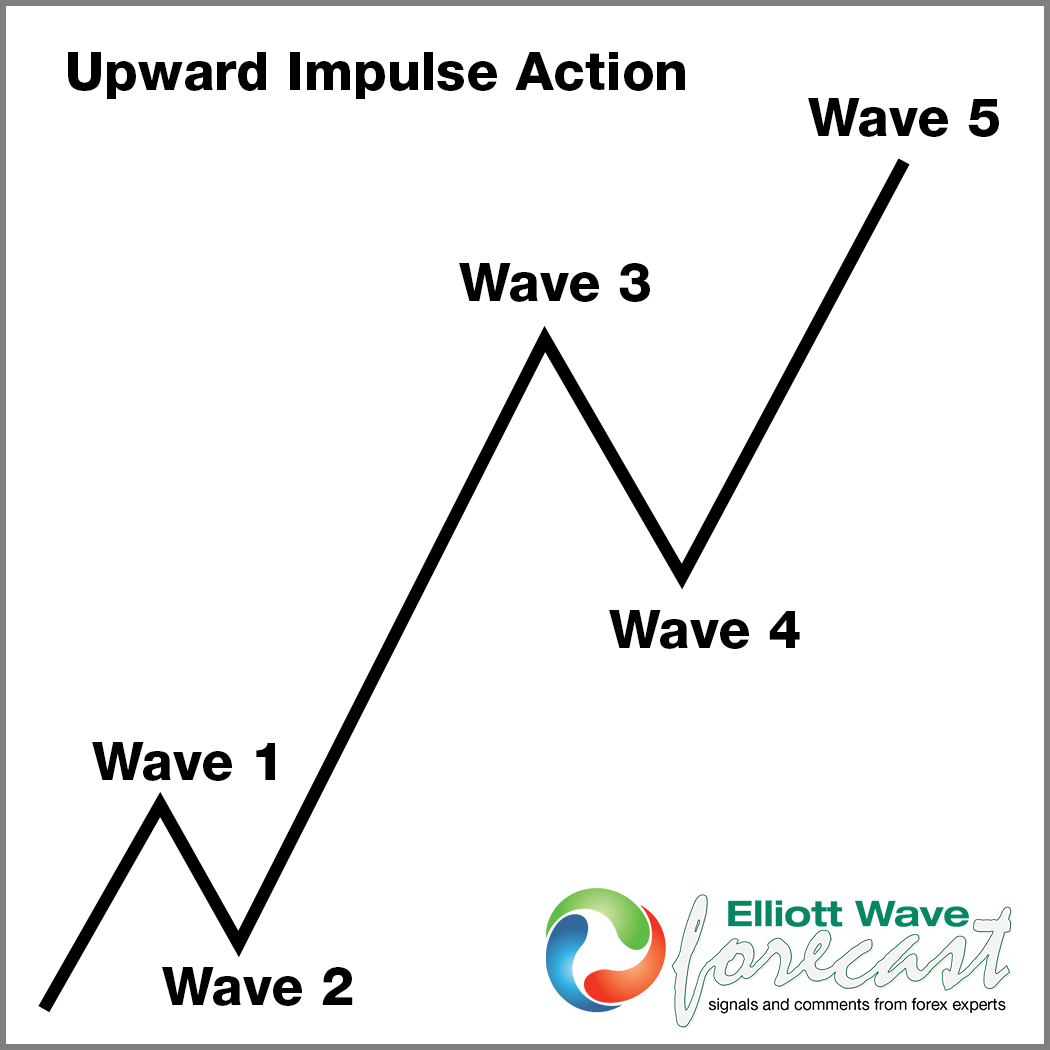

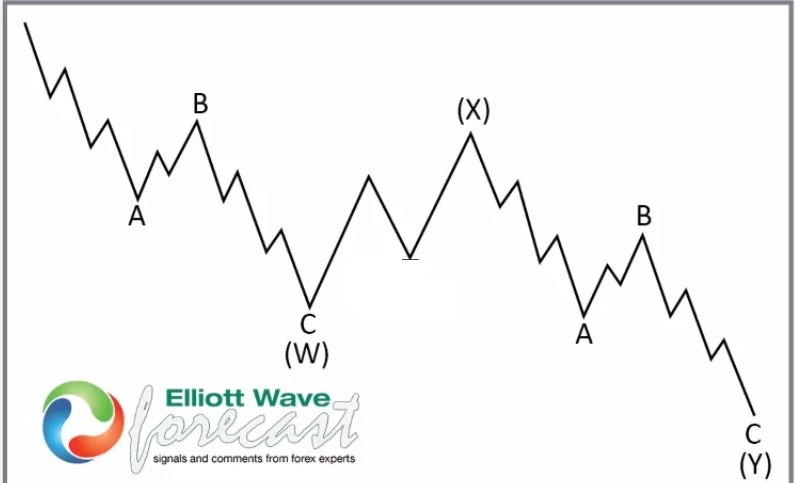

5 Wave Impulse + 7 Swing WXY correction

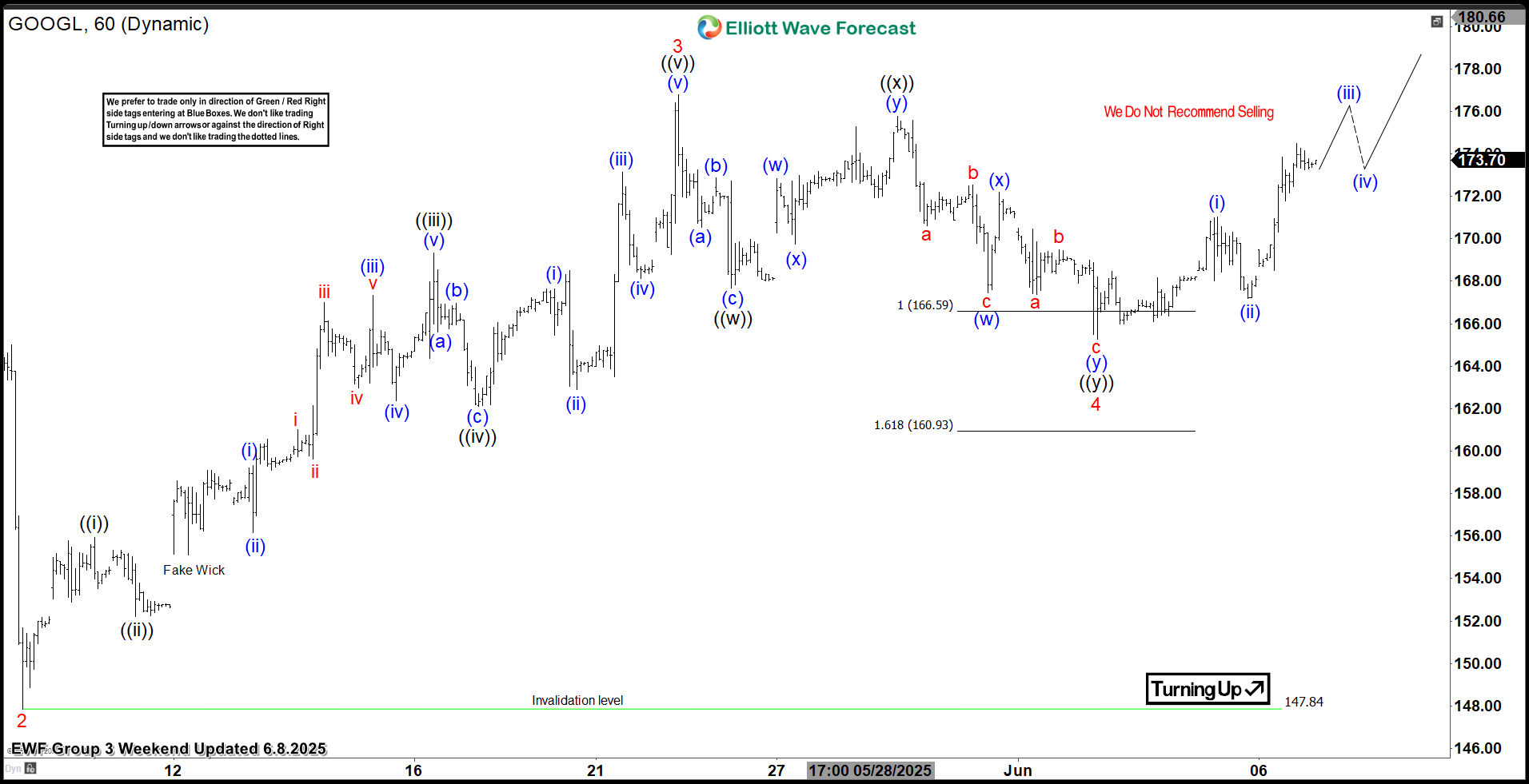

$GOOGL 1H Elliott Wave Chart 6.02.2025:

In the 1-hour Elliott Wave count from June 02, 2025, we saw that $GOOGL completed a 5-wave impulsive cycle at red 3. As expected, this initial wave prompted a pullback. We anticipated this pullback to unfold in 7 swings, likely finding buyers in the equal legs area between $166.59 and $160.93.This setup aligns with a typical Elliott Wave correction pattern (WXY), in which the market pauses briefly before resuming its primary trend.

$GOOGL 1H Elliott Wave Chart 6.08.2025:

The most recent update, from June 08, 2025, shows that the stock bounced as predicted. Currently, it is trading higher in wave 5 looking for continuation higher towards 180–184 area before another pullback can happen.

The most recent update, from June 08, 2025, shows that the stock bounced as predicted. Currently, it is trading higher in wave 5 looking for continuation higher towards 180–184 area before another pullback can happen.

Conclusion

In conclusion, our Elliott Wave analysis of Alphabet Inc. ($GOOGL) suggests that it remains supported against May 2025 lows. As a result, traders that bought the dip should monitor the $180–$184 zone as the next potential target. In the meantime, keep an eye out for any corrective pullbacks that may offer entry opportunities. By applying Elliott Wave Theory, traders can better anticipate the structure of upcoming moves and enhance risk management in volatile markets.