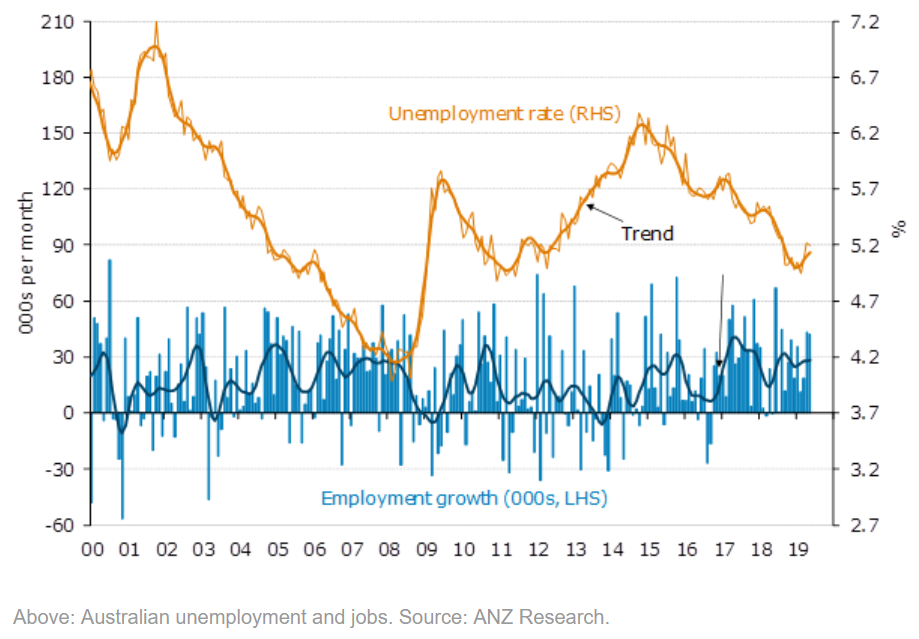

Australian Dollar dropped further last week as unemployment figure came out higher than expected at 5.2%. The consensus has been for a dip to 5.1%. Australian unemployment rate has now risen 0.3% since February. The official number has raised speculation that further interest rate cut will come.

RBA (Reserve Bank of Australia) has been fighting low inflation rate below 2-3% target range for several years now. In February, RBA has said that sustained increase in unemployment rate would require them to cut interest rates. On May, the central bank cut the rate by 25 basis point to a record low 1.25%. RBA provide little guidance on the direction of future cash rate. However, due to soft economic data and the fallout from China-US tariffs globally, investors bet on further aggressive rate cuts by RBA.

Futures suggest a 66% probability that RBA will further cut cash rate in July. The market also starts to price in another cut by the end of the year to 0.75% due to the mixed labour report.

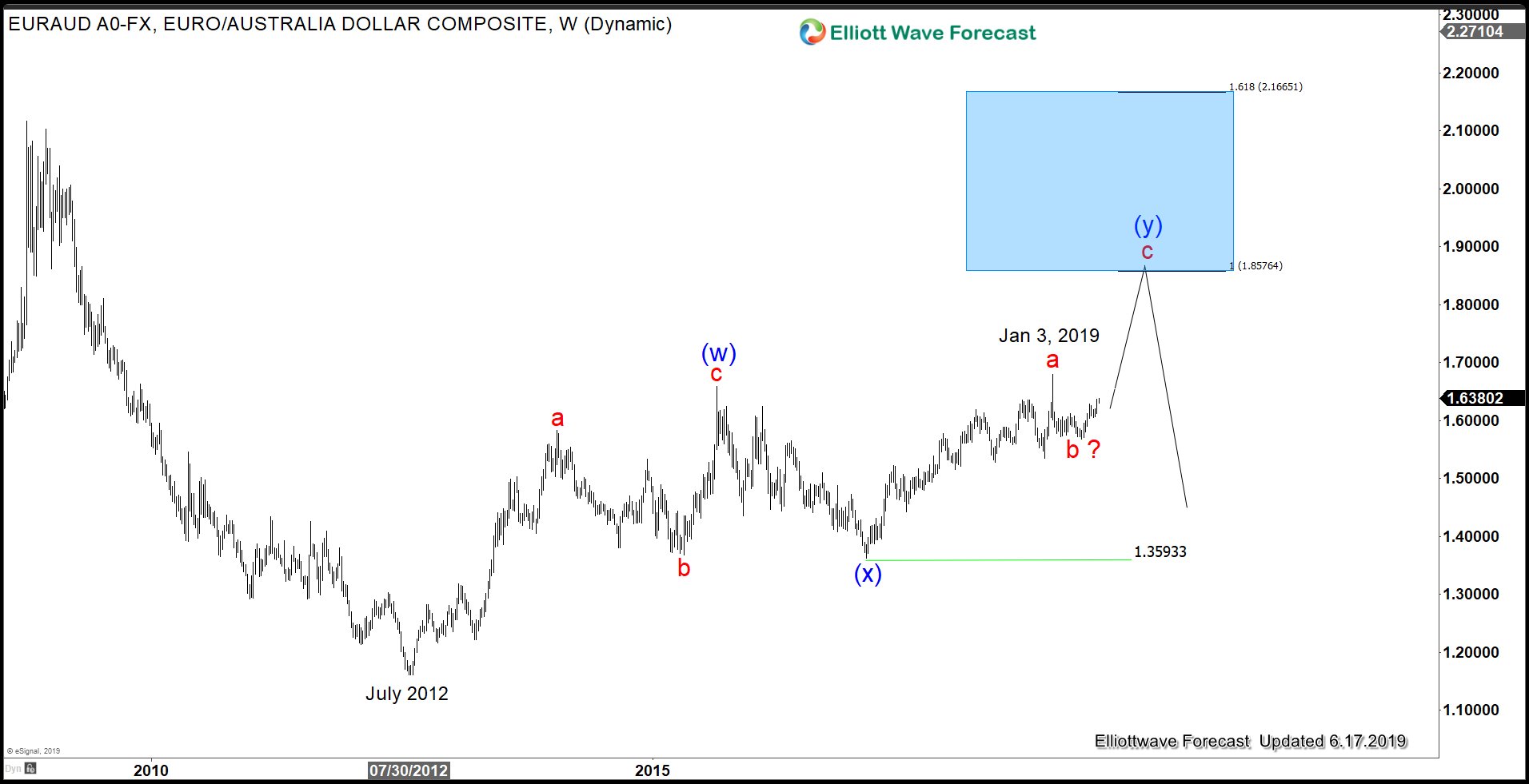

EURAUD Bullish Elliott Wave Sequence Points for more Australian Dollar Weakness

Elliott Wave outlook in $EURAUD shows a 5 swing bullish sequence from July 2012 low, favoring more upside. A 100% extension in 7 swing double three structure from July 2012 targets 1.857 - 2.166 area. If pair breaks above Jan 3, 2019 high (1.679), then the next move higher has started and we should see further Australian dollar weakness. Wave b of (y) can be complete already at 1.568, but pair still needs to break above wave a at 1.679 to confirm this view.

EURAUD 4 Hour Elliott Wave Chart

$EURAUD shows a higher high sequence from April 17, 2019 low. If this sequence can extend to 100%, then it should resume higher to at least 1.663 - 1.677 area. Short term dips likely find support in 3, 7, or 11 swing as far as pivot at 1.604 low stays intact. Both the long term and short term Elliott Wave sequence therefore favors continuation higher in the pair and further weakness in Australian Dollar.