Complaining about our presidents in the US of A is maybe second only to baseball as our national pass-time. So allow me to indulge in a rant. I want to take a somewhat spiteful look at the financial market history of our presidents since John Kennedy - an era that I think of as a Comedy of Errors, one of the Bard's great plays. But it isn't so funny. Then we will look at our upcoming election in the light of all this.

John Kennedy gave us a free market administration, with low taxes and a business friendly slant. He felt that the tax and regulation burden on business was an economy killer. His policies extended the great bull market from the late 1940s to 1966, the post depression recovery. Perhaps his most famous wisdom was "Ask not what your country can do for you. Ask what you can do for your country". This saying has a lot of significance in our present heated debate over what our government should be doing for our mess as opposed to removing over-taxing, over-regulation, and other short-term government fixes so that individual businesses can do their thing for our country. It would have been a good Tea Party slogan had it not already been used by Kennedy.

Unfortunately, Kennedy's VP didn't have his partner's key wisdom very near to his heart. Lyndon Johnson was probably best known for his Great Society programs, which were an overdone version of some of Kennedy's initiatives to help the poor. Under Johnson, they became big government helping hands in a War On Poverty, as if it were government's job to regulate the economic status of individuals. Some of these things survive to this day, like Medicare, and are a big help. But many were bureaucratic boondoggles - and all began to be a tax problem. By the time LBJ left office in 1968, the great secular bear market of 1966-1982 had begun. You can't blame that whole bear market on one president, but an age of asking what your country can do for you had begun.

Then came Nixon. A normal paper/hard asset cycle turn had begun away from paper investment and to hard assets (commodities). The turn away from the 20 year stock bull market to the 16 year commodity bull market that began in 1966 was perhaps triggered, or at least abetted, by the bad business policy that came after John Kennedy. Economy friendly government seems to have died with JFK's murder in 1963. The commodity bull market had inflation running at around 4% in Nixon's time. His reaction? - wage and price controls. Was he a student of the Soviet Union? This socialist intervention was a dismal failure. It was a government engineered fix to a government engineered problem. Sound familiar? The economy truly went into the ravine under his socialist guidance. And he took us off the gold standard in 1971 for good measure. This was to facilitate the government's "helping" hands and loosen up its wrist for the dollar's printing press to follow. By the time Nixon left office in 1974, the stock market had lost about 50%. He was bounced out of office for lying before he could do any more damage.

Then came Ford and Carter. Ford served only briefly and sadly, Carter was a damper on the economy. His forte was, and is to this day, international peace negotiation. He put together the Camp David Accords easing Mid-East problems for quite awhile. But on the economy, he seemed to want to continue the post Kennedy legacy of bigger government, bigger taxes, and more departments (he added two right off the bat) and was the first bail-out president when he bailed out Chrysler in 1979. Before Obama-care, there was "Carter-care", a government-run health-care system that went nowhere in Congress. He created the massive Superfund to clean up chemicals in the ground wherever they could be found. If there was a problem with the economy, government could fix it.

All of this string of socialist presidents, Johnson, Nixon, Ford, and Carter spanned the 15 years of the great secular bear market in stocks from 1966 to 1982, which saw the Dow unable to break 1000 and lose a lot of ground to stagflation. Then came the Reagan Revolution. And it was just that - a very fundamental change in government, the first real change since Kennedy died. Whereas LBJ declared war on poverty, Reagan declared war on big government. Many presidents' worth of government helping hands had the Reagan campaign's "misery index" at such an unbearable high that he was swept into office in one of the most one-sided elections in history. Reagan declared war on big government and big spending and was the first real business friendly president in 20 years. And the markets picked up on it, sending us roaring into a secular bull stock market and economic growth.

The next chain of presidencies, when you think about it, was five terms covering three men and 20 years. They all pretty much sought to continue the Revolution. The Clinton terms in the middle wound up being free market and business friendly, not to mention, with the help of a good economy, budget balancing. Clinton, either by the mandate of the mid-term elections or by a change of philosophy, or both, put together a pretty fair economic team by the time he left office.

But in the biggest socialism blight ever, we had a banana republic regime of central bankers imposing the greatest mountain of debt of all time on all of us. All four men occupying the White House from 1981 to 2008 turned a blind eye to this fifth column as "market stuff" that they didn't need to worry about. A new tyrant had taken over the bull/bear cycle, and the 1982-2000 secular bull was killed not by over-interventionist presidential socialism, but by financial weapons of mass destruction.

With Bush II and Obama, we have gone back to the post-Kennedy and pre-Reagan socialist world. Bush did not exactly have a revolutionary, business friendly congress, and Obama would confiscate every private business in the land if he could get away with it. A secular bear market in stocks and all non-debt fueled paper assets began in the 2000s. Robust economic growth now seems to be a thing of the past. Obama is responding to these problems with the socialism of Nixon, and the government helping hands of LBJ and Carter.

As the over arching socialism of central bankers puts debt and currency issues front and center, the old fashioned president/economy relationship is fading. The "socialist" Bernie Sanders is the only major US presidential candidate I know of to advocate reinstating Glass-Steagall. This was the safeguard necessitated by Depression banking collapses that barred banking fools from gambling with depositors' accounts in stocks or anything but the business forming loans they had been doing before the Roaring 1920's led them astray.

We had many decades of banking peace after this 1933 Act. Then came the banker inspired repeal of Glass-Steagall in the roaring 1999, and we have had one financial crisis after another ever since. Fully reinstating Glass-Steagall is an issue in the election as detailed in an article at NerdWallet "Glass-Steagall Act: 1933 Law Stirs 2016 Presidential Race". Sanders' reinstatement would take away the $20 + trillion of speculation toys (all our bank accounts) from big banking. But even this would perhaps be too little too late. The point to consider is this: the era of the power of the president over our financial cycles has ended. Getting it back may involve more radical upheaval than a US president can muster.

We would have to have a Reagan Revolution in every major country in the world, but even that would not solve the massive delevering cycle and global debt resolution problems we now must endure. This problem did not exist in 1982. So the unruly Trump/Sanders hoards are now a budding revolution not so much against big government, but against the new socialism of big "Wall Street" - the perversion of what free market capitalism used to be. Main Street is becoming incensed by it, and this election campaign is showing it.

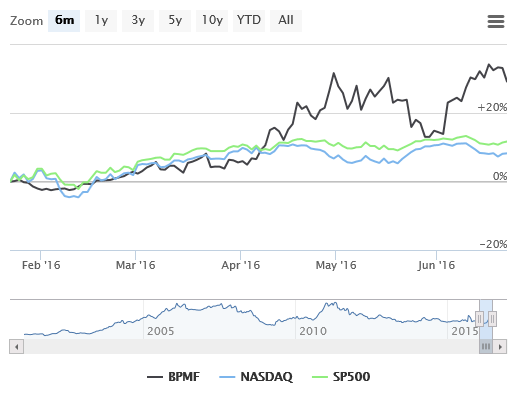

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this:

My fund methodology is high diversification, usually running around 40-60 stocks from many different sectors. I rarely weight any position much over 5%. I began at Marketocracy developing an analysis method I've labeled The Fractal Base Flow Model. I've been experimenting with variations of my basic methodology with 4 other funds and a 5th where I try new things. With my first and main model fund BPMF (Bruce Pile's Mutual Fund) I did my basic method for the first 7 years or so with an alpha over 30, then strayed a little into other analysis methods that did not work as well. The last couple years I have been making my model strictly a one method fund again as I am convinced I'm not going to find a better analysis method.

Marketocracy is a new way of investing that solves a lot of the problems in the industry today. When investors nowadays survey their options, they are perplexed by the mish mash of risk and fees.

In mutual funds, you have regulated safety where managers must diversify with less than 10% of your money in any one name in the top of your weightings scheme, making for at least around 20 stocks at any one time. The SEC also prohibits the risk of leverage and investing in dangerous derivatives, etc. But this safety is typically viewed as a tradeoff with performance vs hedge funds, where all the dangerous stuff is allowed. But the sad result of all this danger is that most hedge funds fail.

The average life of a hedge fund that makes it past the first year is just 5 years. More than two thirds of all hedge funds that ever existed are now dead. There is the fund of funds option, but the high turnover means that even they must select an all new portfolio of funds about every 5 years. This makes selecting proven long-term performers virtually impossible.

A fund of hedge funds will typically not only charge the high hedge fund fees of 1%-4% management fee plus 15%-25% of your returns, but will also charge fees for running the fund of funds. They pile complication upon complication and charge you for it. "Oh, and the hedge fund industry as a whole hasn’t produced alpha/added value to simple portfolios for years, since its assets under management ballooned." [FTalphaville]

With typical leverage, that has grown over 15 years from around 20% to over 40% now, you get 40%more risk than mutual fund rules with no significant added performance, just more costs. And because that added leverage risk is so often concentrated in the same areas by all the large funds, inducing systemic risk, when those bets go wrong they can go very wrong. With all the above, an investor must live with the risk of having just one fund manager, or picker of rotating funds in a fund of funds.

Imagine a place where you could go to sign up for an account where you could review track records and styles and risk levels of not just one guy, but up to 15 or so, and check on your account signup form how you want to spread your money among these guys. And imagine that all these managers have had to compile top ranked hedge fund performance levels for up to 15 years under the safety level of SEC rules for mutual funds. And imagine you could get all this at roughly cost of a mutual fund. It would be like opening an account and checking the names of Peter Lynch, Warren Buffett, and all your favorite hedge fund managers to gang tackle your investment objectives. And as in any team sport, if one guy hits a cold streak, the others will carry him. No dependence on one manager.

Well there is such a place - Marketocracy Capital Management. Here, thousands of people from all walks of life, from retired and active fund managers to ordinary individual investors, compete online with virtual funds. If your track record qualifies, you can open a GIPS account for real money tracking of your model fund and have client accounts track your model. My fund is one of those, ticker BPMF. FOLIOfn Institutional can open a client SMA where you can pick and choose from the best of the best long-term performers. To look into this: