Where Is Inflation Headed Now?

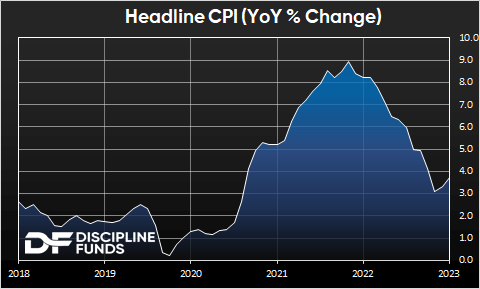

Inflation bumped modestly higher in the August reading of CPI to a rate of change of 3.7%, up from 3.3%.1 This is well off the high of 8.9% in June of 2022, but also well above the Fed’s 2% inflation target. Core inflation has been a bit stickier at 4.4%, but also well off the high of 6.6% from last September.

Core CPI has been stickier in large part because services inflation hasn’t come down while headline CPI has dropped sharply in response to much lower goods inflation. A big chunk of that is commodity prices which are down 25% year over year. Interestingly, if you exclude shelter the rate of inflation is just 2%, already at the Fed’s target rate. But shelter and other services have been sticky.

All of this is very mixed news for the Fed. It’s reassuring to see inflation coming down rapidly, but it’s also disheartening to see inflation this sticky after such an aggressive Fed move. And while the majority of the “easy” move lower has been made in inflation there is still a significant tailwind that will keep inflation from spiking significantly higher.

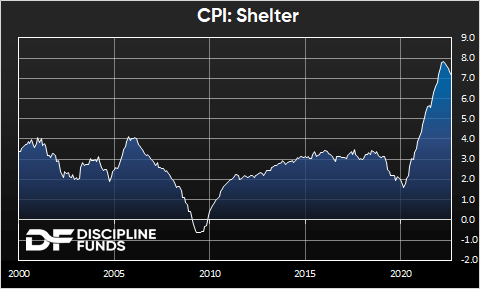

In the three years prior to the pandemic, shelter was contributing 1.3% to CPI on average. During the peak of shelter inflation last Summer shelter was contributing a whopping 3.5%. Shelter is 35% of CPI so it’s not just a driving component, it’s the most important contributing factor by a large margin. When we said inflation wouldn’t be “transitory” in 2021, the primary reason for that was the well-known lag in shelter inflation. In short, shelter lags because the BLS calculation for shelter inflation is conducted biannually and attempts to reflect the lagging nature of rental updates. So, if shelter prices surge you won’t see it in inflation data for 9-12 months. As a result, a big pop in inflation from the shelter will lag as it did into 2022. And it will also lag on the way down.

The good news here is that we’re very early in that shelter-lagging process. In fact, shelter inflation has only just started to slow. Shelter inflation peaked at 7.9% in March and has only come down to 7.1% as of August. This is going to drop to 2-3% minimum and could even deflate depending on how housing evolves. So far, housing has held up better than expected, but rents and prices are still stagnating. This means we’re likely to see at least a full year of disinflating shelter and that’s a 35% tailwind to the disinflation story.

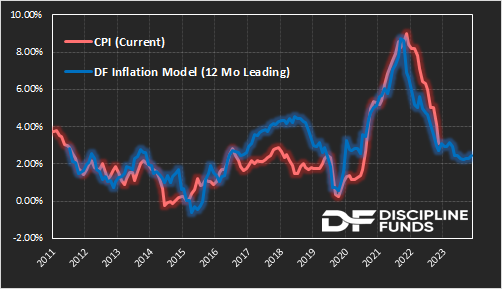

Discipline Funds Baseline Inflation Forecast

All of this leaves the Fed sitting tight. They’re comfortable with where inflation has come from, but also still worried about the double bump in inflation like we saw in the 70s and 40s. But this also increases the risk that the Fed is behind the curve and will remain tight until it’s too obvious that they are too tight.

Our inflation model is consistent with the view that the easy part of the disinflation is over. But the model is also still consistent with an entrenched disinflation trend. That is, shelter and goods disinflation are very likely to keep inflation near current levels or disinflating further. We expect the shelter to reinforce a more pronounced disinflationary trend in the coming year and should drive inflation closer to the Fed’s target over the course of 2024.

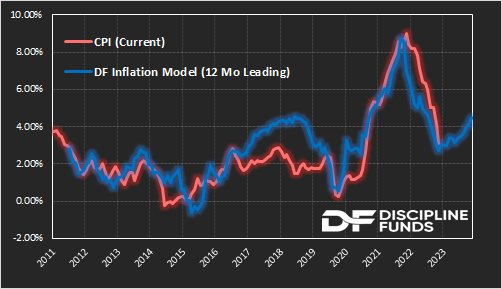

The big risk to the upside is a commodity spike. The chart below shows how inflation would likely evolve in the event of new highs in commodity prices in the coming 12 months. But even in this scenario the likelihood of seeing 9% inflation again is incredibly remote.

DF Inflation Model with New Highs in Commodities

The combination of shelter disinflation with a commodity boom will not result in new inflation highs. Based on our model a new high in commodity prices in the coming 12 months would drive CPI over 4%. While commodities are a real-time unknown shelter CPI is much more predictable because we can see what real-time rent indicators and housing price indicators look like and they’re flat at best and showing only modest signs of upside risk.

To be clear, this would be a very bad scenario because the Fed would likely get even more aggressive, but it’s not remotely close to a double bump inflation scare as we saw in the 40s and 70s. And this is essentially a worst-case scenario at this point given that new highs in commodity prices would require some sort of exogenous shock to prices.

All in all, it’s a mixed bag. Inflation is trending in the right direction, but it’s stickier than we’d prefer. That means the Fed is going to keep rates high and credit markets will continue to grind slower as a result. This is great news for the low-risk income earner who wants to clip T-Bills at 5.5%. It’s a much more mixed bag for anyone who wants to take longer duration equity and bond risk.

1 – These conversations sometimes frustrate people who don’t like the idea that inflation is a “rate of change”. Most of us see inflation as an ever increasing move in the level of prices higher, whereas economists and the Fed view inflation thru the lens of the rate of change. In short, economists view some modest level of inflation as inevitable so higher prices aren’t surprising. What’s more important to them is the rate of change. A modestly low rate of change is generally viewed as a natural byproduct of economic growth whereas a high rate of change is viewed as a problematic underlying issue that requires policy intervention.

More By This Author:

Why Are Consumers So Depressed?

The Labor Market – Goldilocks Or Golden Guillotine?

The Labor Market Is Not Tight

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more

Good summary of the current outlook.