The Labor Market – Goldilocks Or Golden Guillotine?

I’ve previously referred to the current interest rate structure in the banking system as a “golden guillotine”. That is, while low interest rates are “golden handcuffs” for borrowers who locked in long duration short rates, the counterparty to this trade is sitting in a golden guillotine as they earn a very low rate of interest on a long duration loan that they now need to trade to someone else at a huge loss. This is a problem for the aggregate economy because the golden handcuffs mean that those borrowers won’t refinance at the higher rates that the lenders need to turnover their loan books. And new rates are so punitive that loan demand is low and so turning over those old loans becomes a slow process and perhaps an impossible process. So the handcuffs cause a stagnation in credit and lending and the guillotine chops heads as time goes on.

The labor market isn’t immune to the effect of higher interest rates and the slowing aggregate demand. In fact, the labor market continues to track exactly as one might expect it to in an environment of very tight monetary policy. But is this a Goldilocks slowdown or a Golden Guillotine over the labor market? Let’s look into the fresh data from this morning.

Total payrolls came in at a healthy 187K. But the previous two months were revised lower by 100K. The trend is a clear slowdown in labor markets, but it’s not something that’s alarming just yet. In fact, we’re basically back to trend growth in the pre-Covid period. The unemployment rate ticked up to 3.8%, but that mostly reflects more people looking for work. This could be a good thing or it could be the first signs of something bad. More people looking for work is good in that it gives capital more wage negotiating power and that’s a good sign for future wages and inflation. But more people looking for work could be bad in that it could reflect an economy where people are starting to feel strapped for cash and in need of income.

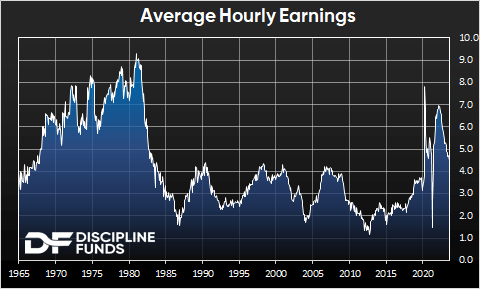

Speaking of wages – the clear downtrend in wages continued in this report with average hourly earnings coming in at 4.5%. This is still way too high for the Fed’s comfort, but this data tends to lag pretty substantially as wages are “sticky”. The recent data from the JOLTS report showed a large decline in quits and that tends to lead wages. We expect wages to continue their downtrend towards 3% over the coming year.

All of this looks more “Goldilocks” than anything else, but the Guillotine is still there. The three trends that are most worrisome in the labor market are:

- The clear downtrend in labor market growth.

- The sharp slowdown in temporary employment, which always precedes labor market contractions.

- The rise in hours worked and workers looking for employment.

None of these are alarming enough that markets are shifting towards a panic mode. And yes, it all looks more like Goldilocks than anything else at this point. But the Golden Guillotine of high interest rates is there and the Fed remains more concerned about having to lift the Guillotine higher as opposed to easing the Guillotine down. It’s all good unless something forces the Fed to drop the Guillotine quickly. And that’s what makes tight monetary policy environments so difficult to navigate.

More By This Author:

The Labor Market Is Not TightJackson Hole – The Future Of Inflation And Interest Rates

Chart Of The Week – Total U.S. Real Estate Prices

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more