Why Are Consumers So Depressed?

As I’ve previously discussed, this is an environment where there’s a narrative for everyone. The data over the last few years is so unclear and so politically polarizing that you can formulate whatever conclusion you want. But one thing that’s clear is that consumers remain depressed as evidenced in most consumer sentiment polls. But it’s worth asking – even with a mixed view on the economy and markets consumer sentiment appears excessively depressed relative to what’s really happening in the economy and the markets. Why is that?

Sentiment is a lagging indicator. The primary reason why sentiment might be low is because sentiment tends to lag. If you review past recessions sentiment will always decline during a recession. It then takes, on average, about 3 years for sentiment to return to its prior levels. Recessions are like getting punched in the face. You don’t just bounce right back unless you’re my 2 year old daughter.1 It takes time to recover. The Covid recession is no different and we’re not that far removed from it so sentiment could be lagging just because we’re still getting over being punched in the face by Covid.

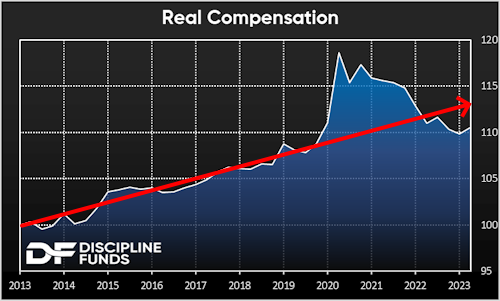

Real wages rope-a-doped us.2 Staying with our boxing analogies – real wages tricked us on the upside, then depressed us on the downside. Real wages surged in 2020 in large because inflation lagged. But then inflation punched us in the mouth in 2021/2022 and real wages dropped significantly. It’s unusual because real wages usually rise in the long-term.

Covid was frustrating for many people because the government stimulus caused a big surge in compensation, but then it was followed up with a big surge in inflation that offset most of the wage gains. So there was a brief respite in 2020 where it looked like the stimulus had no downside, but then the inflation came home to roost and we were reminded that there are no free lunches in the financial world.

In the end, a lot of people feel like they’ve been running in place for years. And in fact, that’s pretty much how the financial markets have reflected this as stocks and bonds have been flat to down for most of the last 2-3 years.

Inflation has been more acute in areas consumers notice. It’s well known that consumers tend to have inflation biases due to food and gas prices. That’s because these prices are in our face regularly. You probably don’t remember what you paid for a TV 3 years ago, but you see the price of gas every day. You also remember what your favorite cut of meat costs because you see it every week. So the price of things like gas and food are more memorable and will tend to stand out relative to many other price increases.

This is also why price indices like the CPI often infuriate many consumers – the prices we see don’t always correlate to the prices of a basket of goods like the CPI. And then this is doubly aggravating for consumers because they then see the Fed strip out food and energy and everyday consumers are like “sure, yeah, just remove the two things that most of us need, idiots!”

This has been especially bad in recent years as food and gas prices have surged. Gasoline prices are up 48% since the beginning of 2020 while food prices are up 24%. Meanwhile, CPI is up 18%. As a result of this consumers are being constantly reminded that prices are surging even though broader prices might not be as bad as many think. But this actually compounds the negative sentiment because then we’re told to ignore these items and that inflation isn’t that bad, but our biases tell us that inflation is actually worse than we’re being told.

All of this is a recipe for bad sentiment. It should (hopefully) change with time as we recover from being punched in the face, but for now, the negative sentiment is both understandable and explainable.

1 – For the record, I am not the one who punches her. That’s her 3-year-old sister. We lovingly call our two-year-old “Juggernaut” because she can fall off things, run through things and get slammed by things without reaction.

2 – This is your periodic reminder that this Muhammad Ali highlight is the greatest moment you will ever see in professional sports.

More By This Author:

The Labor Market – Goldilocks Or Golden Guillotine?

The Labor Market Is Not Tight

Jackson Hole – The Future Of Inflation And Interest Rates

Disclaimer Cipher Research Ltd. is not a licensed broker, broker dealer, market maker, investment banker, investment advisor, analyst, or underwriter and is not affiliated with any. There is no ...

more