What Should We Make Of Weak Investment In The US Economy?

Recession pundits have been continuously thwarted by the fact that the American economy is still growing quite robustly.

After all, the global economy has been slowing and the global outlook appears quite risky.

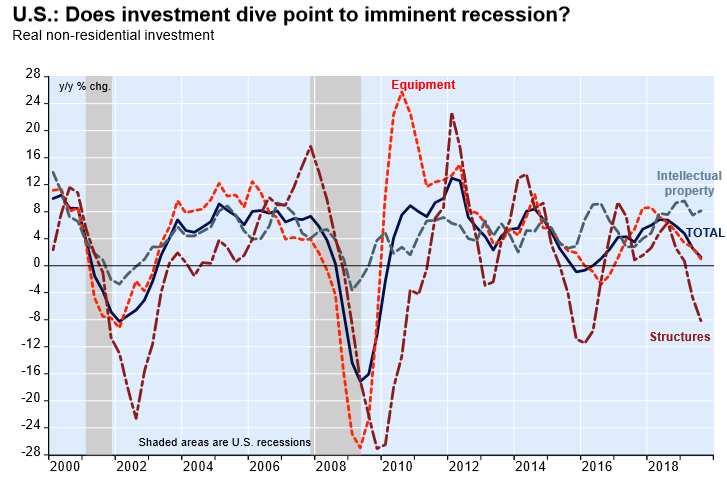

The US economy is also slowing to what is thought to be its trend rate of growth, business capital investment spending is in the doldrums, and manufacturing production has been shrinking in virtually all of the advanced economies. And of course, there is the never-ending threat of a global trade war.

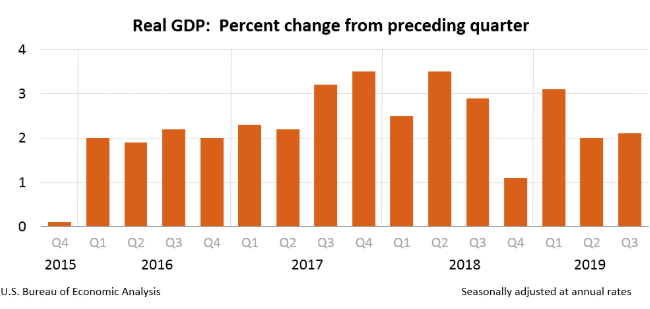

The American economy accelerated from 1.6% growth in 2016 to 2.4% in 2017 and 2.9% in 2018. Most economists who continue to predict a no recession scenario expect about 2.3% annual growth this year and only 1.9% growth in 2020 and 1.7% in 2021.

The US economy managed to expand at a 2.1% annual rate in the third quarter, similar to the 2% growth posted in the preceding quarter.

The increase in GDP in the third quarter reflected positive contributions from consumer spending, government spending, residential investment, inventory investment, exports, and state and local government spending. These positives were partly offset by a contraction of business investment.

The escalating conflict over tariffs, principally between the US and China, has curbed world trade and is undermining business investment and manufacturing production around the world. Yet in the American economy, strong consumer spending has held up as the job market continues to remain quite robust.

Indeed, those who continue to project a soft-landing for the US economy base it on the fact that the Federal Reserve and the ECB have already aggressively lowered interest rates.

The assumption is that easy money will continue to support American consumer spending and the job market and will offset to a large degree the business investment softness which is associated with a weak international trade outlook.

As the following National Bank chart shows, the US managed to stay out of recession in 2015 and 2016 despite significant declines in business investment. And in 2016, the support for the economy was largely due to strong consumer spending.

Will history repeat?

(Click on image to enlarge)

(Click on image to enlarge)

Arthur

Business investment and govt spending are slowing and together that accounts for 35% of GDP. Those segments are dragging down GDP and more importantly are reducing long term potential as the capital stock wears down and overall productivity falls---which is the most serious issue.